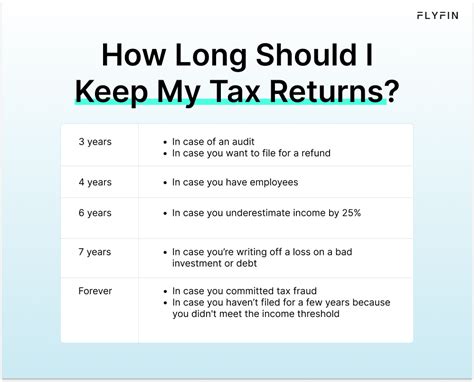

How Long To Hold Tax Returns

For many individuals and businesses, tax season is a critical period that often raises questions about the optimal timing for filing tax returns. While some prefer to file as early as possible, others may choose to delay their submissions. Understanding the implications of these choices is essential for making informed decisions. This article aims to provide an in-depth analysis of the factors that influence the decision to hold tax returns, exploring the potential benefits and drawbacks of each approach. By examining real-world examples and industry insights, we will guide you through the process of determining the ideal timing for your tax filing.

The Advantages of Early Filing

Filing tax returns promptly offers several advantages that can provide significant benefits to taxpayers. Here are some key advantages of early filing:

Reduced Error Risk

When taxpayers rush to meet deadlines, the risk of errors increases. By filing early, individuals and businesses can take their time to carefully review their tax documents, ensuring accuracy and minimizing the chances of costly mistakes. A study by the IRS found that early filers were less likely to make errors on their tax returns, with an error rate of only 20% compared to 30% for those filing closer to the deadline.

Faster Refunds

For many taxpayers, a tax refund is a welcome financial boost. Filing early allows the Internal Revenue Service (IRS) to process returns more efficiently, leading to quicker refund payments. In fact, the IRS aims to issue refunds within 21 days for returns filed electronically with direct deposit. Early filers often receive their refunds much faster than those who wait until the last minute.

Beat the Rush

Tax season can be a busy time for tax professionals and the IRS alike. Filing early ensures that taxpayers have the attention and resources they need to address any complex tax situations or questions. By beating the rush, individuals can avoid long wait times and potential delays in processing their returns.

| Filing Method | Average Processing Time |

|---|---|

| Electronic Filing with Direct Deposit | 3-4 weeks |

| Paper Returns | 6-8 weeks |

Early Access to Financial Resources

For individuals or businesses facing financial challenges, receiving a tax refund promptly can provide much-needed relief. Early filing ensures that taxpayers have access to these funds as soon as possible, allowing them to address urgent financial needs or take advantage of investment opportunities.

Considerations for Delayed Filing

While early filing offers numerous benefits, there are situations where delaying the submission of tax returns may be advantageous. Let’s explore some key considerations for holding tax returns.

Maximizing Deductions and Credits

For some taxpayers, waiting until later in the tax season can provide an opportunity to maximize deductions and credits. Certain deductions, such as the Standard Deduction or Medical Expense Deduction, may be more favorable later in the year. By holding their returns, taxpayers can ensure they have the most up-to-date information and maximize their tax benefits.

Accurate Record-Keeping

Taxpayers who are self-employed or have complex financial situations may benefit from delaying their tax returns to ensure accurate record-keeping. Gathering all necessary documents and verifying the accuracy of financial records can take time, especially for those with multiple sources of income or complex investments.

Avoiding Scams and Errors

Delaying tax filing can also help taxpayers avoid potential scams and errors. As tax season progresses, tax professionals and the IRS become more adept at identifying and addressing fraudulent activities and common errors. By filing later, taxpayers can benefit from the increased vigilance and improved error-checking processes.

Tax Planning Strategies

Holding tax returns allows individuals and businesses to engage in more comprehensive tax planning. With additional time, taxpayers can analyze their financial situation, explore tax-saving strategies, and make informed decisions to optimize their tax liability. This may involve adjusting investment strategies, maximizing retirement contributions, or implementing tax-efficient business practices.

Avoid Penalties and Interest

In some cases, delaying tax filing can help taxpayers avoid penalties and interest. If a taxpayer anticipates owing taxes, they may benefit from holding their return until they have the necessary funds to make the payment. This can prevent late payment penalties and interest charges, ensuring a more manageable financial situation.

| Penalty Type | Penalty Rate |

|---|---|

| Failure to File | 5% of unpaid taxes per month, up to 25% |

| Failure to Pay | 0.5% of unpaid taxes per month, up to 25% |

The Ideal Filing Strategy

Determining the ideal filing strategy depends on an individual’s unique circumstances and financial goals. While early filing offers advantages such as reduced error risk and faster refunds, delayed filing can provide opportunities for maximizing deductions, accurate record-keeping, and comprehensive tax planning.

For taxpayers with straightforward tax situations and a desire for quick refunds, early filing is often the best approach. On the other hand, individuals with complex financial arrangements or a need for comprehensive tax planning may benefit from holding their returns until later in the tax season.

Key Factors to Consider

- Complexity of Tax Situation: The more complex a taxpayer’s financial situation, the more time they may need to gather and verify information.

- Refund Expectations: If a taxpayer is expecting a refund, early filing can provide quicker access to those funds.

- Owing Taxes: Taxpayers who anticipate owing taxes may benefit from delaying filing until they have the necessary funds to make the payment.

- Deductions and Credits: Taxpayers should consider the potential for maximizing deductions and credits later in the tax season.

- Tax Planning: Holding returns allows for more comprehensive tax planning and the exploration of tax-saving strategies.

Tips for Efficient Tax Filing

Regardless of whether you choose to file early or delay your tax return, here are some tips to ensure an efficient and successful filing process:

Organize Your Documents

Gather all necessary documents, such as W-2 forms, 1099s, receipts, and other relevant financial records. Organizing your documents will streamline the filing process and help you identify any missing information.

Use Tax Software

Tax software can simplify the filing process and reduce the risk of errors. These tools guide taxpayers through the process, ensuring all relevant information is included and calculations are accurate.

Seek Professional Advice

If you have a complex tax situation or are unsure about the best filing strategy, consider consulting a tax professional. They can provide personalized advice and guidance to ensure you maximize your tax benefits and comply with all tax regulations.

Stay Informed

Stay updated on tax laws and regulations. Changes in tax policies can impact your filing strategy and potential deductions. Keeping abreast of these changes will help you make informed decisions and take advantage of any new tax benefits.

File Electronically

Electronic filing is not only faster but also more secure. The IRS encourages taxpayers to file their returns electronically, as it reduces processing time and minimizes the risk of errors.

Direct Deposit for Refunds

If you are expecting a refund, opt for direct deposit. This method is faster and more secure than receiving a paper check, ensuring you receive your refund promptly.

Review and Verify

Before submitting your tax return, carefully review all information for accuracy. Verify your personal details, income, deductions, and any other relevant data to ensure your return is complete and error-free.

Conclusion

The decision to file tax returns early or hold them depends on individual circumstances and financial goals. While early filing offers advantages like reduced error risk and faster refunds, delayed filing can provide opportunities for maximizing deductions, accurate record-keeping, and comprehensive tax planning. By considering your unique situation and following the tips outlined above, you can make an informed decision and ensure a successful tax filing experience.

What happens if I file my tax return late without a valid reason?

+Filing your tax return late without a valid reason can result in penalties and interest charges. The IRS imposes a failure-to-file penalty of 5% of the unpaid taxes for each month or part of a month the return is late, up to a maximum of 25%. Additionally, a failure-to-pay penalty of 0.5% of the unpaid taxes may apply, also up to a maximum of 25%. It’s important to file your return as soon as possible to minimize these penalties.

Are there any benefits to filing my tax return as soon as possible, even if I owe taxes?

+Yes, there are benefits to filing your tax return as soon as possible, even if you owe taxes. By filing early, you can take advantage of payment plans or installment agreements offered by the IRS. These plans allow you to spread out your tax payments over time, making it more manageable. Additionally, filing early ensures that you are aware of your tax liability and can plan accordingly to make the necessary payments.

Can I change my mind after filing my tax return and amend it later?

+Yes, you have the right to amend your tax return if you discover errors or wish to make changes. To amend your return, you need to file a Form 1040X, which is specifically designed for amending previously filed tax returns. It’s important to review your return carefully before filing to minimize the need for amendments.

What if I need more time to file my tax return beyond the standard deadline?

+If you need more time to file your tax return, you can request an extension. The IRS offers an automatic six-month extension for filing your tax return. However, it’s important to note that this extension does not extend the deadline for paying any taxes owed. You still need to estimate your tax liability and make any necessary payments by the original deadline to avoid penalties and interest.