Minnesota Sales Tax On Automobiles

In the state of Minnesota, sales tax is an important aspect of any transaction, and when it comes to purchasing automobiles, understanding the tax implications is crucial for both buyers and sellers. The sales tax on automobiles in Minnesota is a key factor that influences the overall cost of a vehicle and can significantly impact the financial planning of individuals or businesses looking to acquire a new or used car. This comprehensive guide aims to shed light on the intricacies of Minnesota's sales tax laws as they pertain to automobiles, offering a detailed breakdown of the tax structure, calculation methods, and any applicable exemptions or special considerations.

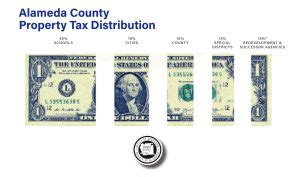

Understanding Minnesota’s Sales Tax Structure

Minnesota imposes a sales tax on the purchase of tangible personal property, including automobiles. The state sales tax rate is a flat 6.875% as of 2023. This state-wide rate is applied uniformly across all counties in Minnesota. However, it’s important to note that some counties may have additional local sales tax rates, which can vary. These local sales tax rates are typically added to the state rate, resulting in a combined sales tax rate that buyers must consider when purchasing an automobile.

Calculating Sales Tax on Automobiles

To calculate the sales tax on an automobile in Minnesota, the base tax rate (state and local) is applied to the purchase price of the vehicle. For instance, if a buyer is purchasing a car in a county with a combined sales tax rate of 7.875% (state rate + local rate), they would calculate the tax as follows: Purchase Price x Tax Rate. Let’s take an example where the purchase price of the vehicle is 30,000. The sales tax would be: <strong>30,000 x 0.07875 = 2,362.50</strong>. This means the buyer would pay an additional 2,362.50 in sales tax on top of the purchase price.

| County | Local Sales Tax Rate | Combined Sales Tax Rate |

|---|---|---|

| Hennepin County | 0.5% | 7.375% |

| Ramsey County | 0.5% | 7.375% |

| Dakota County | 0.5% | 7.375% |

| Washington County | 0.5% | 7.375% |

| Anoka County | 0.5% | 7.375% |

| Other Counties | Varies | Varies |

Exemptions and Special Considerations

While the standard sales tax rate applies to most automobile purchases in Minnesota, there are certain exemptions and special considerations that buyers and sellers should be aware of. These can significantly reduce the tax burden on specific transactions.

- Trade-Ins: When trading in an old vehicle as part of the purchase of a new one, the trade-in value is deducted from the purchase price of the new vehicle before sales tax is applied. This can result in a substantial savings on sales tax.

- Lease Vehicles: Leased vehicles are subject to a use tax rather than a sales tax. The use tax rate is the same as the sales tax rate (6.875%) and is calculated based on the total lease payments made during the lease term.

- Sales to Government Entities: Sales to federal, state, or local government entities are exempt from sales tax in Minnesota. This includes purchases by government agencies, schools, and certain nonprofit organizations.

- Disabled Individuals: Certain vehicles purchased by individuals with a permanent disability are exempt from sales tax. This exemption applies to vehicles specifically modified for the disabled individual's use.

- Military Personnel: Active-duty military personnel stationed in Minnesota can claim an exemption from sales tax on the purchase of a vehicle if they have lived in the state for less than 12 months.

Registration and Title Fees

In addition to sales tax, buyers of automobiles in Minnesota must also consider registration and title fees. These fees are separate from the sales tax and are charged by the Minnesota Department of Vehicle Services (DVS) to register and title the vehicle.

Registration Fees

Registration fees in Minnesota are based on the weight of the vehicle and the number of years for which the registration is valid. For passenger vehicles, the registration fee is 30 for a 1-year registration or 60 for a 2-year registration. For vehicles weighing more than 5,000 pounds, the registration fee is 35 for a 1-year registration or 70 for a 2-year registration. These fees are subject to change, so it’s advisable to check with the DVS for the most current rates.

Title Transfer Fees

When purchasing a used vehicle, a title transfer fee is required. This fee is 10 for a standard title and 20 for an expedited title. Additionally, there is a $2.50 fee for the registration certificate. If the buyer is also registering the vehicle, the title transfer fee is included in the registration fee.

Specialty Vehicles and Sales Tax

Minnesota’s sales tax laws also apply to specialty vehicles such as recreational vehicles (RVs), motorcycles, and boats. However, the tax calculation and applicable rates may differ based on the type of vehicle and its intended use.

Recreational Vehicles (RVs)

RVs are subject to the same sales tax rate as automobiles (6.875%) when purchased for personal use. However, if the RV is used for commercial purposes, such as rental or charter operations, the sales tax rate is higher at 9.375%. This commercial rate also applies to the sale of used RVs that were previously used for commercial purposes.

Motorcycles

Motorcycles are taxed at the standard sales tax rate of 6.875% when purchased for personal use. However, if the motorcycle is intended for commercial use, such as for a motorcycle rental business, the sales tax rate increases to 9.375%.

Boats

Sales tax on boats in Minnesota depends on the purchase price and the length of the boat. For boats with a purchase price under 10,000 and a length of less than 16 feet, there is no sales tax. For boats with a purchase price over 10,000 or a length of 16 feet or more, the sales tax rate is 6.875%. However, if the boat is used for commercial purposes, such as charter operations, the sales tax rate increases to 9.375%.

Future Implications and Tax Reform

While Minnesota’s sales tax structure on automobiles has remained relatively stable in recent years, there are ongoing discussions and proposals for tax reform. Some proposed changes include altering the sales tax rate, introducing new tax exemptions, or adjusting the tax calculation methods. These reforms could have significant implications for automobile buyers and sellers, impacting the overall cost of vehicle purchases in the state.

Staying informed about any potential changes to Minnesota's sales tax laws is crucial for both consumers and businesses. Regularly checking the Minnesota Department of Revenue's website or consulting with tax professionals can ensure that individuals and businesses remain compliant with the latest tax regulations and take advantage of any beneficial tax reforms.

Are there any online resources to help calculate sales tax on automobiles in Minnesota?

+Yes, there are several online sales tax calculators available that can assist in determining the sales tax on an automobile purchase in Minnesota. These calculators typically require the purchase price of the vehicle and the applicable sales tax rate (including any local rates) to provide an accurate tax calculation. It’s important to note that these calculators are tools and should be used as a guide, with the final tax liability confirmed with the Minnesota Department of Revenue or a tax professional.

How often do sales tax rates change in Minnesota, and how can I stay updated?

+Sales tax rates in Minnesota can change periodically, often as a result of legislative actions or budget decisions. To stay updated on any changes, it’s recommended to regularly check the Minnesota Department of Revenue’s website, which provides the most current tax rates and any applicable updates. Additionally, subscribing to tax-related newsletters or following reputable tax information sources can ensure timely awareness of any changes.

Are there any resources available to help understand the sales tax laws for businesses selling automobiles in Minnesota?

+Absolutely. The Minnesota Department of Revenue provides comprehensive resources and guidelines specifically for businesses engaged in the sale of automobiles. These resources cover topics such as tax registration, collection, and reporting requirements. Additionally, the department offers educational materials, webinars, and workshops to help businesses understand and comply with sales tax laws. Consulting with a tax professional or accountant who specializes in business taxes can also provide valuable insights and guidance.