Alameda Property Taxes

Alameda, California, a charming city nestled in the San Francisco Bay Area, boasts a unique and vibrant character. While its picturesque waterfront, diverse neighborhoods, and thriving arts scene make it an attractive place to live, one aspect that often sparks curiosity and raises questions is the topic of property taxes. Understanding the property tax landscape in Alameda is crucial for both prospective homeowners and current residents alike. In this comprehensive guide, we will delve into the intricacies of Alameda property taxes, exploring rates, assessment processes, and the various factors that influence tax obligations.

Understanding Property Taxes in Alameda

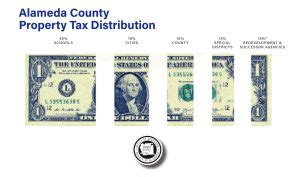

Property taxes are a significant source of revenue for local governments in the United States, and Alameda County is no exception. These taxes play a vital role in funding essential services such as public schools, infrastructure development, and community initiatives. As a homeowner in Alameda, it is essential to grasp the fundamentals of property taxation to ensure compliance and plan your financial obligations effectively.

Property Tax Rates in Alameda County

The property tax rate in Alameda County is determined by a combination of factors, including the assessed value of your property, local tax rates, and any applicable special assessments or district taxes. The county assesses property values annually, considering market trends and other relevant factors. This assessed value forms the basis for calculating your property tax liability.

| Assessment Year | Average Tax Rate |

|---|---|

| 2022 | 1.12% |

| 2021 | 1.10% |

| 2020 | 1.08% |

It's important to note that the tax rate can vary slightly depending on the specific city or unincorporated area within Alameda County. For instance, the city of Alameda may have a slightly different tax rate compared to other municipalities in the county.

Assessing Property Value

The assessment process in Alameda County is conducted by the Alameda County Assessor’s Office. They employ a team of trained professionals who analyze various factors to determine the assessed value of a property. These factors include:

- Recent sales of similar properties in the area

- Building improvements and renovations

- Location and neighborhood characteristics

- Market conditions and economic factors

The assessed value is typically based on the property's fair market value, which is the price it would likely sell for in an open market transaction. This value is then used to calculate your property taxes, with the tax rate applied to the assessed value to determine your annual tax obligation.

Tax Rate Calculation

To calculate your property taxes in Alameda County, the assessed value of your property is multiplied by the applicable tax rate. The tax rate comprises various components, including the general tax rate set by the county, city, or special districts, as well as any additional assessments or bonds approved by voters. These rates are subject to change annually, so it’s important to stay informed about any adjustments.

For example, if your property's assessed value is $500,000 and the combined tax rate is 1.2%, your annual property tax bill would be calculated as follows:

$500,000 (assessed value) x 0.012 (tax rate) = $6,000

So, in this scenario, your annual property tax obligation would be $6,000.

Factors Influencing Property Taxes

Several factors can impact your property tax liability in Alameda. Understanding these factors can help you anticipate potential changes and plan accordingly.

Property Value Increases

One of the primary factors influencing property taxes is the appreciation or increase in your property’s value. If the market value of your home rises, it can lead to higher assessed values, resulting in increased property taxes. Alameda County conducts annual assessments to ensure that property values remain accurate and up-to-date.

Special Assessments

Special assessments are additional charges levied on properties to fund specific improvements or services within a defined area. These assessments can be for infrastructure projects, such as road improvements, stormwater management, or the development of public parks. They are typically added to your property tax bill and are separate from the general tax rate.

District Taxes

Alameda County is home to various special districts, such as fire protection districts, water districts, and community services districts. These districts have the authority to levy taxes on properties within their jurisdiction to fund essential services. The tax rates for these districts are usually included in your overall property tax bill.

Voter-Approved Measures

Local governments and special districts may propose ballot measures to fund specific projects or initiatives. If these measures are approved by voters, they can result in additional taxes or assessments on properties. Staying informed about upcoming elections and proposed measures is crucial to understand potential impacts on your property taxes.

Managing Property Taxes

Navigating the world of property taxes can be complex, but there are strategies and resources available to help you manage your obligations effectively.

Tax Bills and Payment Options

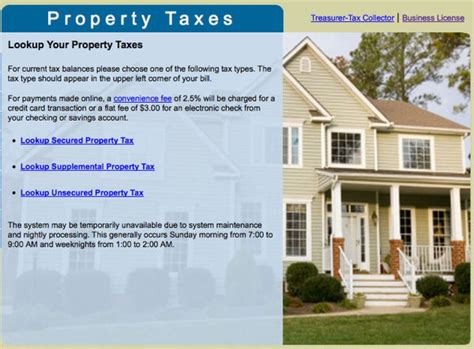

Property tax bills are typically mailed to homeowners twice a year, with payment due dates falling around February and November. It’s essential to review your tax bills carefully, ensuring that the assessed value and tax rates are accurate. If you have any concerns or disputes, you can contact the Alameda County Assessor’s Office to address them.

Alameda County offers various payment options, including online payments, mail-in payments, and in-person payments at designated locations. You can also set up automatic payments to ensure timely payment and avoid late fees.

Appealing Your Assessment

If you believe that your property’s assessed value is inaccurate or excessive, you have the right to appeal the assessment. The Alameda County Assessor’s Office provides a formal appeals process, allowing you to present evidence and arguments to support your case. It’s important to act promptly, as there are specific deadlines for filing an appeal.

Property Tax Relief Programs

Alameda County offers several property tax relief programs designed to assist eligible homeowners. These programs can provide exemptions, deferrals, or reduced tax rates for qualifying individuals. Some common relief programs include the Homeowners’ Exemption, the Disabled Veterans’ Exemption, and the Senior Citizens’ Property Tax Deferral Program.

To determine your eligibility and apply for these programs, you can visit the Alameda County Assessor's Office website or contact their office directly. They will guide you through the application process and provide the necessary forms and instructions.

Future Implications and Trends

Understanding the current state of property taxes in Alameda is just the beginning. It’s essential to stay informed about future trends and potential changes that may impact your financial obligations.

Proposition 13 and Its Impact

California’s Proposition 13, passed in 1978, introduced significant changes to property taxation in the state. It limits the annual increase in the assessed value of real property to a maximum of 2% or the inflation rate, whichever is lower. This measure has had a profound impact on property taxes across California, including Alameda County.

Proposition 13 provides stability and predictability for homeowners, as it prevents drastic increases in property taxes. However, it also means that the assessed value of a property may not accurately reflect its current market value, potentially leading to lower tax obligations than what one might expect based on recent sales.

Market Fluctuations and Economic Factors

The real estate market in Alameda, like any other market, is subject to fluctuations and economic influences. Economic downturns or recessions can impact property values and, subsequently, property taxes. During such periods, homeowners may experience reduced property tax obligations as assessed values decrease.

Conversely, a robust real estate market with increasing property values can lead to higher assessed values and, consequently, higher property taxes. Staying informed about local market trends and economic indicators can help you anticipate potential changes and plan your financial strategies accordingly.

Proposed Changes and Reforms

The world of property taxation is not static, and proposals for reforms and changes are always on the horizon. In recent years, there have been discussions and proposals at both the state and local levels to modify the property tax system in California. These proposals aim to address concerns such as affordability, fairness, and revenue generation.

While it's challenging to predict the outcome of these proposals, staying engaged and informed about the legislative process can help you understand potential future changes. Monitoring local news, attending community meetings, and staying in touch with your local representatives can provide valuable insights into the direction of property tax policies.

Conclusion

Navigating the intricacies of property taxes in Alameda County requires a thorough understanding of the assessment process, tax rates, and the various factors that influence your obligations. From annual assessments to special district taxes, each aspect plays a role in determining your property tax liability.

By staying informed, exploring relief programs, and staying engaged with local government initiatives, you can effectively manage your property taxes and plan your financial strategies. Remember, property taxes are a crucial aspect of homeownership, and understanding them is essential for a smooth and stress-free experience.

How often are property values reassessed in Alameda County?

+Property values in Alameda County are reassessed annually to ensure they reflect current market conditions. This process helps maintain fairness and accuracy in property tax assessments.

Can I dispute my property’s assessed value?

+Yes, you have the right to appeal your property’s assessed value if you believe it is inaccurate. The Alameda County Assessor’s Office provides an appeals process, allowing you to present evidence and argue your case.

Are there any property tax relief programs available in Alameda County?

+Absolutely! Alameda County offers a range of property tax relief programs, including exemptions and deferrals for eligible homeowners. These programs aim to provide financial assistance and reduce tax burdens for qualifying individuals.

What happens if I miss the deadline for property tax payments?

+Missing the deadline for property tax payments can result in late fees and penalties. It’s important to stay informed about payment due dates and explore options for timely payment to avoid additional costs.

How can I stay updated on proposed changes to property tax policies in Alameda County?

+To stay informed about proposed changes and reforms, monitor local news sources, attend community meetings, and engage with your local representatives. These avenues will provide valuable insights into potential future developments in property taxation.