What Is A Tax Shelter

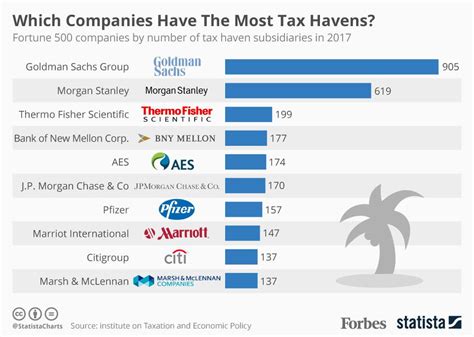

In the intricate world of finance and taxation, understanding the concept of a tax shelter is crucial for both individuals and businesses seeking to optimize their financial strategies. Tax shelters, often referred to as tax havens or tax avoidance mechanisms, are legal tools designed to minimize an entity's tax liability by utilizing specific provisions in tax laws. These shelters can take various forms and are employed strategically to reduce the overall tax burden, offering a complex yet fascinating aspect of financial management.

Unveiling the Nature of Tax Shelters

Tax shelters encompass a range of strategies and financial instruments that aim to reduce or defer taxable income. These mechanisms are rooted in the intricacies of tax laws, taking advantage of legal loopholes and specific provisions to minimize the tax owed. For instance, certain investments, like those in renewable energy or low-income housing, may qualify for tax credits or deductions, effectively reducing the overall tax liability.

The primary objective of tax shelters is to provide individuals and businesses with opportunities to maximize their financial returns by minimizing the tax impact. This can be particularly beneficial for high-net-worth individuals and corporations, who often have more complex financial structures and a greater need to optimize their tax strategies.

Key Types of Tax Shelters

Tax shelters come in various forms, each tailored to specific financial situations and tax laws. Here’s an overview of some common types:

- Investment Tax Shelters: These involve investing in specific assets or industries that offer tax benefits. For example, investing in small businesses or start-ups through angel investing may provide tax incentives.

- Retirement Accounts: Retirement plans like 401(k)s or IRAs are popular tax shelters, allowing individuals to defer taxes on their contributions until retirement.

- Charitable Contributions: Donating to qualified charitable organizations can result in tax deductions, effectively reducing taxable income.

- Real Estate Investments: Investing in real estate, particularly rental properties, can offer tax advantages through depreciation and other deductions.

- Life Insurance Policies: Certain types of life insurance, like whole life insurance, can provide tax-free growth and access to funds for investment purposes.

| Tax Shelter Type | Key Benefits |

|---|---|

| Investment Shelters | Tax credits, deductions, and incentives for specific investments. |

| Retirement Accounts | Tax-deferred growth and potential tax-free withdrawals in retirement. |

| Charitable Giving | Tax deductions for donations to qualified charities. |

| Real Estate | Depreciation benefits and tax deductions for rental properties. |

| Life Insurance | Tax-free growth and access to funds for investment. |

The Impact and Ethical Considerations

While tax shelters are legal and can provide significant financial benefits, they have also been a subject of controversy and scrutiny. Critics argue that tax shelters contribute to a perceived unfair distribution of tax burdens, where certain entities or individuals pay significantly less tax compared to others. This perception has led to increased regulatory oversight and even changes in tax laws to curb aggressive tax avoidance strategies.

Furthermore, the use of tax shelters can impact government revenue, potentially reducing the funds available for public services and infrastructure. This has prompted many governments to introduce measures to ensure fair tax contributions from all sectors of the economy.

Regulation and Compliance

In response to concerns about tax avoidance, many governments have implemented stricter regulations and compliance measures. These include:

- Closing tax loopholes and clarifying tax laws to minimize interpretation gaps.

- Introducing transparency measures, such as country-by-country reporting, to ensure corporations disclose their financial activities across jurisdictions.

- Implementing penalties and sanctions for non-compliance with tax laws.

- Enhancing international cooperation to combat tax evasion and sheltering practices.

Future Trends and Implications

The landscape of tax shelters is constantly evolving, influenced by changing economic conditions, political priorities, and technological advancements. Here are some key trends and potential implications for the future:

Digitalization and Tax Shelters

The digital revolution has brought about new opportunities and challenges in the realm of tax shelters. With the rise of cryptocurrencies and digital assets, tax authorities face the task of regulating and taxing these novel financial instruments. This has led to the development of specific guidelines and regulations for digital assets, which are expected to evolve further as the technology matures.

Sustainability and Tax Incentives

As sustainability and environmental concerns take center stage, tax shelters are increasingly being aligned with green initiatives. Governments and organizations are offering tax incentives for investments in renewable energy, energy efficiency, and sustainable practices. This trend is likely to continue and expand, shaping the future of tax shelters.

International Cooperation

To combat tax evasion and aggressive tax planning, international cooperation has become a priority. Initiatives like the Base Erosion and Profit Shifting (BEPS) project by the OECD aim to ensure that profits are taxed where economic activities occur and where value is created. Continued international collaboration is expected to play a significant role in shaping future tax policies and regulations.

Conclusion

Tax shelters remain a complex and dynamic aspect of financial management, offering both opportunities and challenges. While they provide legal means to optimize tax strategies, the evolving regulatory landscape and ethical considerations demand a careful and informed approach. Understanding the intricacies of tax shelters and staying updated with the latest trends and regulations is essential for individuals and businesses seeking to navigate this complex financial terrain.

What are the potential risks of using tax shelters?

+While tax shelters are legal, they can carry risks. Some strategies may be deemed aggressive by tax authorities, leading to audits and potential penalties. Additionally, changes in tax laws can make previously beneficial shelters obsolete or even detrimental. It’s crucial to seek professional advice and stay informed about tax regulations to mitigate these risks.

Are tax shelters suitable for everyone?

+Tax shelters are typically more beneficial for high-net-worth individuals and corporations with complex financial structures. For most individuals, basic tax planning strategies and utilizing standard deductions and credits can be sufficient. It’s important to assess one’s financial situation and goals before considering tax shelters.

How can I stay updated with tax shelter regulations and changes?

+Keeping abreast of tax regulations can be challenging. It’s advisable to consult tax professionals and subscribe to reputable financial news sources that cover tax-related topics. Additionally, government websites often provide updates on tax laws and regulations, ensuring you have the latest information.