City Of Denver Co Sales Tax

Welcome to a comprehensive exploration of the sales tax landscape in Denver, Colorado. In this expert guide, we will delve into the intricacies of the city's sales tax structure, providing you with a deep understanding of the rates, rules, and regulations that govern this critical aspect of local commerce. Whether you're a business owner navigating the complexities of tax compliance or a resident curious about the economic dynamics of your city, this article aims to be your trusted resource.

Unraveling the Denver Sales Tax: A Comprehensive Overview

Denver, the vibrant capital of Colorado, boasts a unique sales tax system that reflects its position as a thriving urban center. With a rich history and a diverse economy, the city has crafted a tax structure that supports its growth and development while adhering to state and local regulations. This section aims to provide an in-depth analysis of Denver’s sales tax, covering everything from rates to exemptions, to ensure you have a comprehensive understanding of this crucial aspect of the city’s economy.

Sales Tax Rates: Breaking Down the Numbers

The sales tax in Denver is a combination of state, city, and potentially district or special purpose taxes, each with its own rate. As of my last update, the state sales tax rate in Colorado stands at 2.9%, a figure that forms the foundation of the city’s overall tax structure. On top of this, Denver imposes its own city sales tax, currently set at 3.62%, bringing the total tax rate to 6.52% for most purchases within city limits. However, it’s important to note that certain jurisdictions within Denver may have additional taxes, such as the Scientific and Cultural Facilities District (SCFD) tax, which is 0.1%, and the Regional Transportation District (RTD) tax, which varies but can be as high as 1.00% in some areas.

To illustrate the impact of these taxes, consider the following table, which breaks down the total sales tax rates for different areas of Denver:

| Jurisdiction | State Tax | City Tax | SCFD Tax | RTD Tax | Total Tax |

|---|---|---|---|---|---|

| Denver City | 2.9% | 3.62% | 0.1% | 1.00% | 7.62% |

| Denver County (Unincorporated) | 2.9% | 0.0% | 0.1% | 0.0% | 3.0% |

| Denver Metro Area | 2.9% | 0.0% | 0.1% | 0.5% | 3.5% |

Exemptions and Special Cases: Navigating the Nuances

While the basic sales tax rates are a crucial aspect, it’s important to understand that certain goods and services are exempt from sales tax in Denver. These exemptions can significantly impact businesses and consumers alike. For instance, most groceries are exempt from sales tax, a measure designed to alleviate the tax burden on essential items. Similarly, prescription drugs and certain medical devices are also tax-exempt, reflecting the city’s commitment to healthcare accessibility.

Additionally, Denver offers a Sales Tax Exemption for Manufacturing Machinery, which is a significant incentive for businesses in the manufacturing sector. This exemption applies to the purchase of machinery and equipment used directly in manufacturing processes, fostering an environment conducive to industrial growth. It's important for businesses to stay updated on these exemptions to ensure they're taking advantage of all applicable tax breaks.

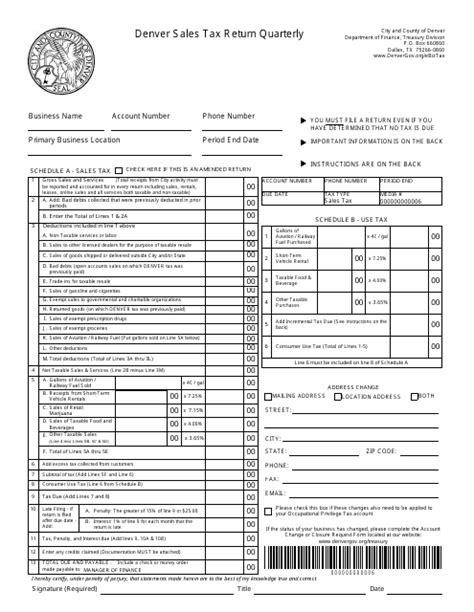

Compliance and Enforcement: A Balancing Act

Ensuring compliance with Denver’s sales tax regulations is a critical responsibility for businesses operating within the city. The Denver Department of Finance is responsible for enforcing sales tax laws, and non-compliance can result in significant penalties. Businesses are required to register for a sales tax license, collect the appropriate taxes from customers, and remit these taxes to the city on a regular basis.

To assist businesses in navigating these complexities, the Department of Finance offers a range of resources, including online guides, workshops, and one-on-one consultations. These services aim to ensure that businesses understand their obligations and can operate within the bounds of the law. For instance, the Department provides a Sales and Use Tax Guide for Businesses, which offers a comprehensive overview of tax obligations, exemptions, and registration processes.

The Impact on Local Economy: A Case Study

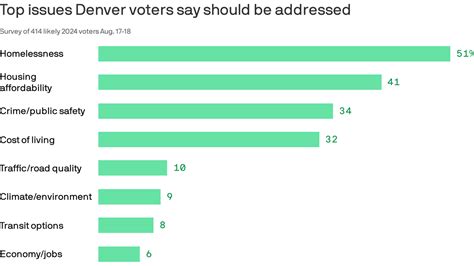

The sales tax in Denver plays a pivotal role in the city’s economic health. By generating revenue through sales tax, the city is able to fund essential services and infrastructure projects that benefit residents and businesses alike. For instance, sales tax revenue contributes to the maintenance and improvement of Denver’s renowned public transportation system, ensuring efficient mobility across the city.

Moreover, the sales tax structure can also influence consumer behavior and business strategies. For consumers, the tax rate can impact purchasing decisions, with higher rates potentially discouraging large purchases. For businesses, understanding the tax landscape is crucial for pricing strategies and cost management. For instance, businesses may choose to absorb a portion of the sales tax to offer competitive pricing or pass the tax directly to consumers, impacting their overall price perception.

Looking Ahead: Future Trends and Potential Changes

As Denver continues to evolve and adapt to changing economic landscapes, its sales tax structure may also undergo transformations. Potential future changes could include adjustments to tax rates to meet revenue needs or policy shifts to encourage economic growth in specific sectors. For instance, there have been discussions about introducing tax incentives for renewable energy industries, a move that could attract sustainable businesses to the city.

Additionally, with the rise of e-commerce and online sales, the city may need to adapt its sales tax policies to ensure fair taxation of online transactions. This could involve implementing measures to collect sales tax on remote sales, a complex but necessary step to ensure equitable taxation in the digital age. Staying informed about these potential changes is crucial for businesses and consumers alike to stay compliant and adapt their strategies accordingly.

What is the current sales tax rate in Denver, Colorado?

+

As of my last update, the total sales tax rate in Denver, Colorado, is 6.52%. This includes the state sales tax rate of 2.9%, the city sales tax rate of 3.62%, and additional taxes like the Scientific and Cultural Facilities District (SCFD) tax of 0.1% and the Regional Transportation District (RTD) tax, which varies but can be as high as 1.00% in some areas.

Are there any sales tax exemptions in Denver?

+

Yes, Denver offers several sales tax exemptions. These include exemptions for groceries, prescription drugs, certain medical devices, and manufacturing machinery used directly in manufacturing processes. These exemptions are designed to alleviate the tax burden on essential items and encourage economic growth in specific sectors.

How can businesses ensure compliance with Denver’s sales tax regulations?

+

Businesses can ensure compliance by registering for a sales tax license, collecting the appropriate taxes from customers, and remitting these taxes to the city on a regular basis. The Denver Department of Finance provides resources such as online guides, workshops, and consultations to assist businesses in understanding their obligations and staying compliant.

What impact does the sales tax have on Denver’s local economy?

+

The sales tax in Denver plays a crucial role in funding essential services and infrastructure projects that benefit residents and businesses. It also influences consumer behavior and business strategies, with higher rates potentially impacting purchasing decisions and pricing strategies.

What potential changes might Denver’s sales tax structure undergo in the future?

+

Denver’s sales tax structure may undergo changes to meet revenue needs or encourage economic growth in specific sectors. This could include adjustments to tax rates or the introduction of tax incentives for industries like renewable energy. Additionally, with the rise of e-commerce, the city may need to adapt its policies to collect sales tax on remote sales.