What Is Schedule C Tax Form

Schedule C, also known as the "Profit or Loss From Business" form, is a crucial component of the U.S. tax system, particularly for sole proprietors and owners of small businesses. It plays a vital role in determining a business's tax liability and is often a key element in the financial planning and strategy of self-employed individuals and small business owners. This form is a comprehensive tool that captures various aspects of a business's financial health and performance, offering valuable insights into its profitability and tax obligations.

Understanding Schedule C: The Basics

Schedule C is a crucial form within the Internal Revenue Service’s (IRS) tax filing system. It is specifically designed for individuals who operate a business or profession as a sole proprietorship, which is the simplest and most common form of business organization. Under this structure, the business and its owner are considered a single entity for tax purposes, and all business profits and losses are reported on the owner’s personal tax return.

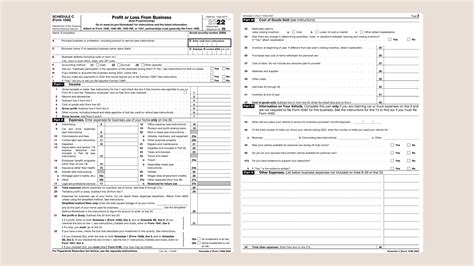

The form itself is relatively straightforward, guiding taxpayers through a series of sections that cover various aspects of their business. These sections typically include details on income, expenses, and other financial activities related to the business. By filling out Schedule C accurately, business owners can calculate their net profit or loss for the tax year, which is then transferred to their personal tax return (Form 1040) to determine their overall tax liability.

Key Sections of Schedule C

- Income: This section requires taxpayers to report all income received from their business, including sales, services rendered, and any other sources of business revenue. It’s essential to include all income, regardless of whether it was received in cash, check, or another form of payment.

- Expenses: Schedule C allows business owners to deduct various expenses incurred in the operation of their business. These can include advertising costs, supplies, rent, utilities, insurance, vehicle expenses, travel, and many other business-related expenditures. By deducting these expenses, business owners can reduce their taxable income and lower their overall tax liability.

- Cost of Goods Sold (COGS): For businesses that sell products, the COGS section is vital. It helps calculate the cost of the products sold during the tax year, which is then subtracted from the business’s gross receipts to determine its gross income. This calculation is crucial for businesses that produce or sell goods, as it directly impacts their net profit and tax obligations.

- Depreciation and Section 179 Deduction: Schedule C also provides a space for taxpayers to claim depreciation expenses for business assets. This includes vehicles, machinery, equipment, and other property used in the business. Additionally, business owners can take advantage of the Section 179 deduction, which allows them to deduct the full purchase price of qualifying assets in the year they were placed in service, up to a certain limit.

- Other Deductions and Credits: The form also accommodates other deductions and credits that business owners may be eligible for, such as the home office deduction, business start-up costs, and certain tax credits. These deductions can further reduce a business’s taxable income, potentially resulting in significant tax savings.

| Section | Description |

|---|---|

| Income | Reports all business revenue, including sales and services. |

| Expenses | Deducts business expenses, such as rent, utilities, and supplies. |

| Cost of Goods Sold (COGS) | Calculates the cost of products sold for businesses that sell goods. |

| Depreciation and Section 179 Deduction | Allows for depreciation of business assets and immediate deduction of asset costs under Section 179. |

| Other Deductions and Credits | Includes additional deductions and credits like the home office deduction and business start-up costs. |

The Impact of Schedule C on Tax Strategy

Schedule C has a significant impact on the tax strategies of sole proprietors and small business owners. By carefully tracking and reporting income and expenses, business owners can optimize their tax position. For instance, they can time certain purchases or investments to maximize deductions and credits, thereby reducing their taxable income and potential tax liability.

Additionally, Schedule C allows business owners to take advantage of various tax benefits specifically designed for small businesses. These can include deductions for health insurance premiums, retirement plan contributions, and certain business start-up costs. By understanding these benefits and how they interact with Schedule C, business owners can structure their operations to maximize their tax advantages.

Real-World Example: Sarah’s Catering Business

Consider Sarah, a sole proprietor who runs a small catering business. She uses Schedule C to report her business income and expenses. During the year, Sarah incurred various expenses, including the cost of food and supplies, rent for her commercial kitchen space, advertising costs, and vehicle expenses for delivering catering services. By deducting these expenses on Schedule C, Sarah is able to reduce her taxable income and, consequently, her tax liability.

Additionally, Sarah took advantage of the Section 179 deduction to immediately deduct the cost of a new commercial oven she purchased for her business. This allowed her to reduce her taxable income further, resulting in significant tax savings. By carefully managing her expenses and taking advantage of available tax benefits, Sarah was able to optimize her tax strategy and ensure her business remained financially healthy.

Future Implications and Tax Planning

Schedule C’s importance extends beyond the current tax year. It provides a foundation for future tax planning and financial forecasting. By analyzing past Schedule C filings, business owners can identify trends in their income and expenses, helping them make informed decisions about their business’s financial future. For instance, they can forecast their tax obligations, plan for potential growth, and make strategic investments to maximize their tax benefits.

Furthermore, Schedule C plays a crucial role in business valuation and financial planning. It provides a clear picture of a business's profitability and financial health, which is essential for securing loans, attracting investors, or even selling the business. Lenders and investors often review Schedule C to assess the financial viability and potential of a business.

Expert Insights

As a tax professional, I often emphasize the importance of accurate and detailed record-keeping for Schedule C. By maintaining comprehensive records of income and expenses, business owners can ensure they capture all eligible deductions and credits, maximizing their tax savings. Additionally, keeping accurate records simplifies the tax filing process and reduces the risk of audits.

Furthermore, it's crucial for business owners to stay updated on tax laws and regulations that may impact their Schedule C filings. Tax laws can change frequently, and staying informed can help business owners take advantage of new tax benefits or navigate potential pitfalls. Consulting with a tax professional or accountant can provide valuable guidance in this regard.

What is the difference between Schedule C and Schedule C-EZ?

+

Schedule C-EZ is a simplified version of Schedule C, designed for eligible taxpayers with relatively simple business operations. It allows for a shorter and more straightforward filing process. However, it has certain limitations and may not accommodate all types of business income and expenses. Schedule C, on the other hand, is more comprehensive and can accommodate a wider range of business activities and expenses.

How often should I update my records for Schedule C?

+

It’s recommended to update your records regularly, ideally on a monthly or quarterly basis. This ensures that your financial information is up-to-date and accurate. Regular updates also make the tax filing process smoother and provide a clear view of your business’s financial health throughout the year.

Can I deduct personal expenses on Schedule C?

+

No, Schedule C is specifically for business-related expenses. Personal expenses should not be included on this form. However, there are situations where certain personal expenses can be deducted if they are directly related to your business, such as the home office deduction. It’s important to understand the specific rules and guidelines for deducting personal expenses in a business context.