How Many Years Keep Tax Returns

Tax records and returns are an essential part of financial management and compliance for individuals and businesses alike. However, determining how long to retain these records is crucial for efficient filing, organization, and legal purposes. This article delves into the intricacies of tax return retention, providing expert insights and practical guidance on the topic.

Understanding Tax Return Retention Periods

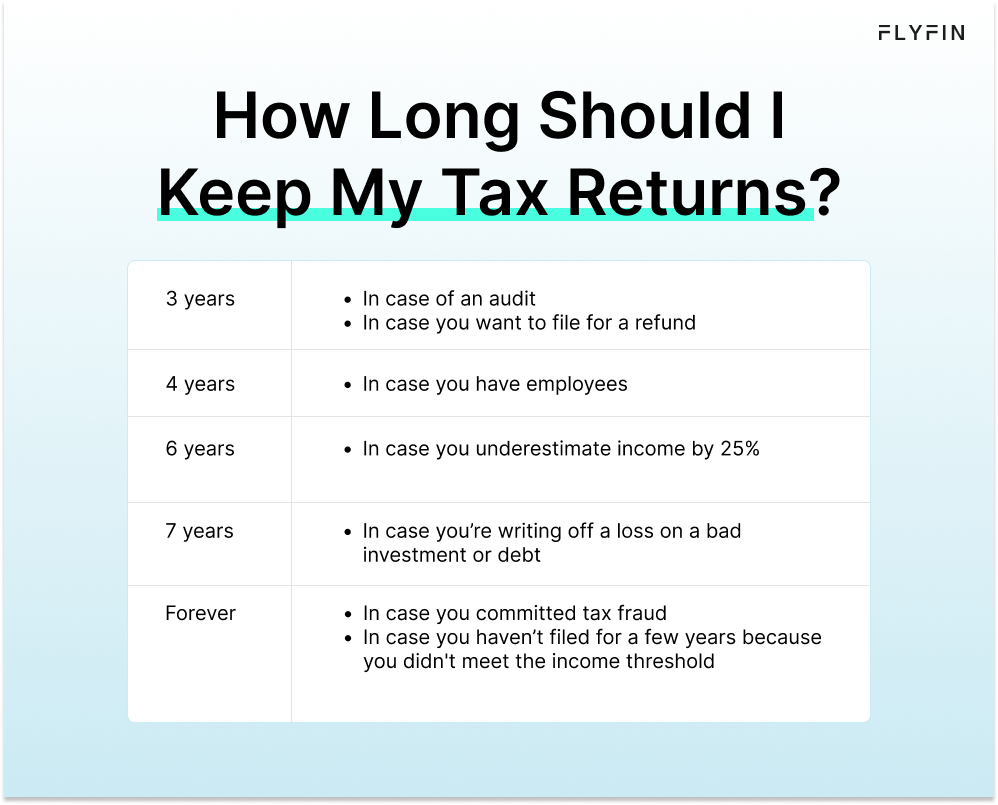

The duration for which tax returns and associated documents should be kept varies based on the nature of the tax filing, the type of taxpayer, and the specific tax authority’s guidelines. While some records can be safely discarded after a few years, others may need to be retained indefinitely. Understanding these nuances is key to effective record-keeping and compliance.

Legal and Regulatory Requirements

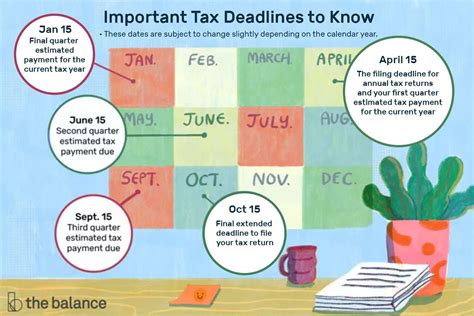

Most countries have legal frameworks that dictate the minimum period for which tax records must be retained. These requirements are typically outlined by the country’s tax authority, such as the Internal Revenue Service (IRS) in the United States or Her Majesty’s Revenue and Customs (HMRC) in the United Kingdom. Failure to adhere to these guidelines can result in penalties and legal repercussions.

For instance, the IRS generally recommends keeping records that support an item on a tax return for at least three years from the date the original return was filed. This includes documentation related to income, deductions, and credits claimed on the return. However, for certain situations, such as a substantial error or omission on a tax return, the IRS has the authority to audit a taxpayer's records up to six years after the return was filed.

| Record Type | Recommended Retention Period |

|---|---|

| Tax Returns and Supporting Documents | Minimum 3 years from filing date |

| Records of Income and Expenses | Minimum 3 years from filing date |

| Records of Property and Asset Ownership | Minimum 3 years from filing date |

| Business Records (for sole proprietors and partnerships) | Minimum 3 years from filing date |

Personal vs. Business Tax Returns

The retention period for tax returns can differ significantly between personal and business tax filings. For individuals, the focus is primarily on income tax returns and associated documents, such as pay stubs, bank statements, and receipts for deductions and credits. These records are generally kept for at least three years, as mentioned earlier.

On the other hand, businesses often have a more complex tax landscape, with a variety of tax obligations beyond income tax. This includes payroll taxes, sales taxes, and various business-specific taxes, each with its own set of record-keeping requirements. For example, payroll tax records often need to be retained for at least four years, while sales tax records may need to be kept for up to six years, depending on the jurisdiction.

Record-Keeping for Specific Tax Situations

There are certain tax situations that warrant longer record retention periods. For instance, if a taxpayer files a claim for a loss from worthless securities or a bad debt, the IRS recommends keeping the records until the period of limitations expires for the year in which the loss is claimed. Similarly, records related to the sale of property may need to be retained until the period of limitations expires for the year in which the property was sold.

Best Practices for Tax Return Retention

While the legal requirements provide a baseline for tax return retention, adopting best practices can ensure efficient record-keeping and ease of access when needed. Here are some strategies to consider:

Organized Filing System

Develop a systematic approach to storing tax records. This could involve using physical file folders or digital storage systems. Label each folder or digital file with the tax year and type of document, making it easy to retrieve information when needed. Consider using a color-coding system or a digital indexing system for quick reference.

Secure Digital Storage

With the increasing use of digital records, it’s crucial to have a secure digital storage system. This could be an external hard drive, cloud storage, or a combination of both. Ensure that these storage methods are password-protected and backed up regularly. Additionally, consider encrypting sensitive tax documents to add an extra layer of security.

Regular Review and Pruning

Periodically review your tax records to ensure they are up-to-date and accurate. This practice also helps in identifying records that can be safely discarded once they have exceeded the recommended retention period. Develop a schedule for this review, such as once a year or every tax season, to keep your records organized and compliant.

Utilize Tax Preparation Software

Many tax preparation software platforms offer built-in document storage and organization features. These tools can help automate the process of storing and retrieving tax records, making it easier to stay organized and compliant. Some software even integrates with cloud storage systems, providing a seamless digital filing experience.

Maintain Hard Copies for Critical Documents

While digital storage is efficient and secure, it’s also wise to maintain hard copies of critical tax documents. This provides a backup in case of digital storage failure or cybersecurity incidents. Store these physical records in a fireproof and waterproof safe to ensure their longevity and accessibility.

Future Implications and Trends

As technology advances and digital record-keeping becomes more prevalent, the tax landscape is likely to evolve. Here are some future implications and trends to consider:

Digital Tax Records and Blockchain Technology

The use of blockchain technology in tax record-keeping is an emerging trend. Blockchain offers a secure, transparent, and tamper-proof way to store and verify tax records. This technology could revolutionize tax record retention, providing an immutable record of tax transactions and reducing the need for extensive physical or digital storage.

Enhanced Data Security Measures

With increasing concerns over data privacy and cybersecurity, tax authorities and taxpayers alike will need to enhance their data security measures. This includes the use of encryption, multi-factor authentication, and regular security audits to protect sensitive tax information from unauthorized access or breaches.

Cloud-Based Tax Record Storage

The cloud is already a popular choice for digital storage, and its use is only expected to grow. Cloud-based storage offers scalability, accessibility, and cost-effectiveness, making it an attractive option for tax record retention. However, it’s essential to choose a reputable cloud service provider that adheres to strict security and privacy standards.

Artificial Intelligence in Tax Record Analysis

Artificial Intelligence (AI) is poised to play a significant role in tax record analysis. AI algorithms can quickly scan and analyze vast amounts of data, identifying patterns, anomalies, and potential errors in tax records. This technology can enhance tax compliance, streamline audits, and improve the efficiency of tax return retention processes.

Conclusion

Understanding the intricacies of tax return retention is crucial for effective financial management and compliance. By adhering to legal requirements, adopting best practices, and staying abreast of emerging trends, taxpayers can ensure they are prepared for any tax-related eventuality. As the tax landscape continues to evolve, staying informed and adaptable will be key to successful tax record-keeping.

How long should I keep my tax returns and supporting documents?

+Generally, it is recommended to keep tax returns and supporting documents for at least three years from the date the original return was filed. However, certain situations, such as audits or legal proceedings, may require longer retention periods.

Are there any exceptions to the three-year rule for tax return retention?

+Yes, there are exceptions. If you fail to report income that should have been shown on a return, the IRS has six years to assess tax on that return. Additionally, if you file a fraudulent return or don’t file a return at all, there is no statute of limitations, meaning records could be required indefinitely.

How should I store my tax records securely?

+To ensure secure storage, consider using a combination of physical and digital methods. Store hard copies in a fireproof safe, and use password-protected digital storage systems, such as external hard drives or cloud storage. Ensure that all digital records are encrypted for added security.