Lane County Property Tax

Welcome to a comprehensive guide on Lane County's property tax system, a topic of interest for many homeowners, investors, and residents in the region. Lane County, nestled in the heart of Oregon, offers a unique blend of natural beauty, vibrant communities, and a thriving local economy. As property values rise and the real estate market evolves, understanding the intricacies of property taxation becomes increasingly important. This article aims to provide an in-depth analysis, offering clarity and insights to help you navigate the Lane County property tax landscape effectively.

The Basics of Lane County Property Taxation

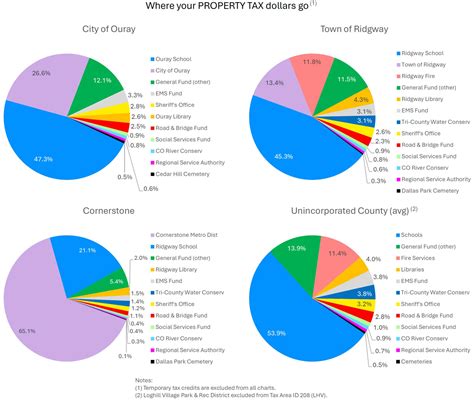

Lane County, like many other jurisdictions in the United States, relies on property taxes as a significant source of revenue to fund essential services such as education, public safety, infrastructure development, and social programs. This tax is levied on both real property (land and buildings) and personal property (tangible assets owned by individuals or businesses). The assessment and collection process is governed by a set of rules and regulations designed to ensure fairness and transparency.

Assessment Process: Unraveling the Methodology

At the core of Lane County's property tax system is the assessment process, where the county's tax assessor determines the value of each taxable property. This value, known as the assessed value, forms the basis for calculating the property tax owed. The assessment process involves a comprehensive evaluation of various factors, including:

- Market Value: The assessor considers the property's fair market value, which is the price it would likely sell for in an open market transaction.

- Property Characteristics: Factors such as size, location, age, condition, and any unique features or improvements are taken into account.

- Sales Data: Recent sales of comparable properties in the area provide valuable insights into the property's potential value.

- Tax Rate: Lane County, along with other taxing districts within the county, sets a tax rate, which is applied to the assessed value to determine the tax liability.

| Assessment Year | Assessed Value | Tax Rate | Estimated Taxes |

|---|---|---|---|

| 2023 | $350,000 | 1.85% | $6,475 |

| 2024 (Projected) | $365,000 | 1.9% | $6,935 |

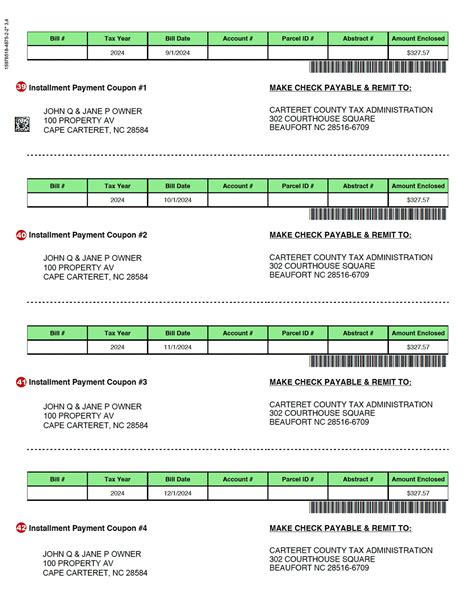

Tax Bills and Payment Options

Once the assessed value and tax rate are determined, the county issues tax bills to property owners. These bills outline the property's assessed value, applicable taxes, and due dates. Lane County provides various payment options, including online payment platforms, mail-in checks, and in-person payments at designated locations. Property owners are encouraged to review their tax bills carefully and take advantage of early payment discounts or installment plans if available.

Tax Relief Programs: Supporting Lane County Residents

Recognizing the financial impact of property taxes, Lane County offers several tax relief programs designed to assist eligible homeowners and businesses. These programs aim to ensure that property taxes remain manageable, especially for low-income individuals, seniors, and those facing financial hardship. Some of the notable tax relief initiatives include:

- Property Tax Deferral Program: This program allows eligible seniors and disabled individuals to defer their property taxes, with the deferred amount becoming a lien on the property and paid upon sale or transfer of ownership.

- Low-Income Senior/Disabled Citizen Property Tax Exemption: Qualifying seniors and disabled citizens can receive an exemption from a portion of their property taxes, reducing their overall tax burden.

- Homeowner's Exemption: Lane County offers a homeowner's exemption, which provides a reduction in the assessed value of the property, resulting in lower taxes for eligible homeowners.

Navigating the Lane County Property Tax Landscape

Understanding the intricacies of Lane County's property tax system is crucial for property owners and investors alike. Here's a step-by-step guide to help you navigate this landscape effectively:

Step 1: Property Assessment Review

Upon receiving your property tax assessment, carefully review the details. Ensure that the assessed value accurately reflects your property's current market value. If you disagree with the assessment, you have the right to appeal, and Lane County provides a detailed process for dispute resolution.

Step 2: Explore Tax Relief Options

Familiarize yourself with the various tax relief programs offered by Lane County. Determine if you are eligible for any of these programs and take advantage of the benefits they provide. Remember, these programs can significantly reduce your tax liability, making property ownership more affordable.

Step 3: Payment Planning

Create a strategic payment plan to manage your property taxes effectively. Consider setting aside funds specifically for tax payments, taking advantage of early payment discounts, and exploring installment options if available. Proper financial planning can help ensure timely payments and avoid penalties or late fees.

Step 4: Stay Informed

Keep yourself updated on any changes or developments in Lane County's property tax policies and regulations. Attend local government meetings, follow relevant news outlets, and engage with community organizations to stay informed about potential tax reforms or initiatives that may impact your property.

The Future of Lane County Property Taxation

As Lane County continues to grow and evolve, its property tax system is likely to undergo adjustments and reforms to accommodate changing needs and circumstances. Here are some key trends and potential developments to watch out for:

Potential Tax Rate Adjustments

Lane County's tax rates are subject to change based on budgetary requirements and community needs. While the county aims to maintain a balanced approach, it's essential to stay informed about any proposed rate changes that could impact your tax liability.

Technological Advancements in Assessment

The assessment process is increasingly benefiting from technological advancements. Lane County may adopt more sophisticated assessment tools and data analytics to enhance accuracy and efficiency. These advancements could lead to more precise valuations, ensuring fair taxation for all property owners.

Community Engagement and Transparency

Lane County recognizes the importance of community involvement and transparency in the property tax system. Efforts to engage with residents, hold public hearings, and provide accessible information are likely to continue, fostering a sense of trust and understanding among property owners.

Green Initiatives and Property Taxation

With a growing focus on sustainability and environmental stewardship, Lane County may explore initiatives that incentivize eco-friendly practices. This could include tax benefits for properties with energy-efficient features or incentives for homeowners adopting sustainable living practices.

Economic Development and Tax Incentives

To attract businesses and foster economic growth, Lane County may consider offering tax incentives for commercial property owners. These incentives could include reduced tax rates or exemptions for specific industries, promoting job creation and economic prosperity within the county.

Frequently Asked Questions (FAQ)

How often are property taxes assessed in Lane County?

+Property taxes in Lane County are assessed annually. The assessment process takes into account various factors, including market value, property characteristics, and recent sales data, to determine the assessed value for the upcoming tax year.

Can I appeal my property tax assessment if I believe it is inaccurate?

+Yes, Lane County provides a formal appeals process for property owners who wish to challenge their assessment. You can contact the county assessor's office to initiate the appeal, and they will guide you through the necessary steps and deadlines.

Are there any tax breaks or exemptions available for seniors in Lane County?

+Absolutely! Lane County offers a range of tax relief programs for eligible seniors, including the Low-Income Senior/Disabled Citizen Property Tax Exemption and the Property Tax Deferral Program. These programs aim to reduce the tax burden for seniors, making property ownership more affordable.

Can I pay my property taxes online in Lane County?

+Yes, Lane County provides an online payment platform for property owners to make tax payments conveniently. You can access the platform through the county's official website, where you'll find detailed instructions and payment options.

What happens if I fail to pay my property taxes on time in Lane County?

+Unpaid property taxes can result in penalties, interest, and potential enforcement actions. It's crucial to stay informed about payment deadlines and take advantage of any available payment plans or extensions to avoid late fees and further complications.

In conclusion, understanding Lane County’s property tax system is essential for anyone with a stake in the local real estate market. By staying informed, actively participating in the assessment process, and taking advantage of available tax relief programs, property owners can navigate this landscape with confidence. As Lane County continues to evolve, its property tax system will adapt to meet the changing needs of its residents, ensuring a fair and sustainable approach to funding essential services.