Fond Du Lac County Tax Records

Fond du Lac County, located in the state of Wisconsin, USA, is a region with a rich history and a thriving community. The tax records of this county offer an insightful look into the financial landscape and the property ownership dynamics within the area. This article aims to delve into the significance of Fond du Lac County tax records, exploring their various aspects, benefits, and implications for both residents and stakeholders.

Understanding Fond du Lac County Tax Records

Fond du Lac County tax records encompass a comprehensive collection of data related to property taxes. These records are meticulously maintained by the county’s assessor’s office and serve as a vital resource for numerous purposes. From assessing property values to understanding the local economy, these records play a pivotal role in the day-to-day operations of the county and its residents.

Key Components of Tax Records

Fond du Lac County tax records are composed of several critical components, each providing valuable insights. These include:

- Property Assessments: Detailed evaluations of properties, including land, buildings, and improvements, are recorded. These assessments determine the taxable value of each property, ensuring fairness and accuracy in taxation.

- Tax Rates: Information on the tax rates applicable to different property types is outlined. This data helps property owners understand their tax obligations and facilitates planning.

- Payment History: Records of tax payments made by property owners are maintained. This data ensures transparency and accountability, allowing for efficient tax collection and tracking.

- Exemptions and Deductions: Details on any applicable exemptions or deductions, such as homestead exemptions or veteran’s discounts, are included. These provisions reduce the tax burden for eligible property owners.

- Appeals and Disputes: Records of any appeals or disputes related to property assessments or tax bills are documented. This information ensures a fair process for property owners and promotes transparency.

Accessing Tax Records

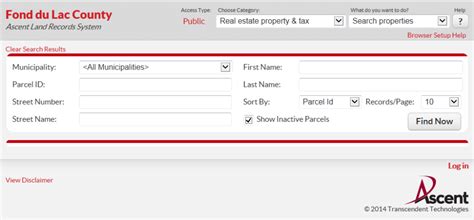

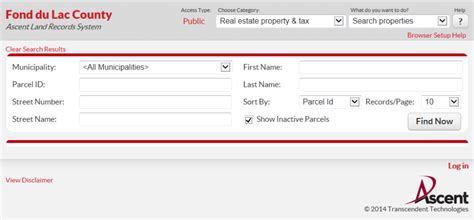

Fond du Lac County has implemented a user-friendly online platform for accessing tax records. Residents and interested parties can easily search for specific properties, retrieve assessment details, and view historical tax information. This digital system streamlines the process, making it more accessible and efficient.

Benefits of Fond du Lac County Tax Records

The availability and accessibility of tax records offer a multitude of benefits to various stakeholders:

Transparency and Accountability

Tax records provide a transparent view of the county’s financial landscape. Residents can access information about their own properties and compare them with others, fostering a sense of fairness and trust in the taxation system. Additionally, these records ensure accountability by making tax-related data publicly accessible.

Property Research and Planning

For prospective buyers, investors, or even existing residents, tax records serve as a valuable research tool. They offer insights into property values, tax obligations, and the overall real estate market. This information aids in making informed decisions, whether it’s for purchasing a new home or investing in commercial properties.

Economic Analysis

Tax records are a goldmine for economists, analysts, and researchers studying the local economy. By examining property values, tax revenues, and growth patterns, they can identify trends, assess economic health, and make informed predictions. This data-driven approach is crucial for decision-making at both the county and state levels.

Government and Community Initiatives

Government bodies and community organizations utilize tax records to allocate resources effectively. They can identify areas with higher tax burdens, implement targeted initiatives to support residents, and ensure equitable development across the county. Additionally, these records facilitate the efficient administration of programs like property tax relief or infrastructure improvements.

Implications for Property Owners

Fond du Lac County tax records have significant implications for property owners, both positive and challenging:

Fair Taxation

Detailed property assessments ensure that taxation is based on accurate and up-to-date values. This fairness promotes trust in the system and reduces disputes over tax obligations.

Planning and Budgeting

By having access to their tax records, property owners can plan their finances more effectively. They can anticipate tax payments, budget accordingly, and make informed decisions about property improvements or investments.

Appeals and Disputes

In cases where property owners feel their assessment is inaccurate or unfair, tax records provide the necessary evidence for appeals. This process ensures that property owners have a voice and can challenge assessments if needed.

Community Engagement

Tax records foster a sense of community engagement. Residents can actively participate in local affairs, attend public meetings, and provide input on tax-related matters, contributing to a vibrant and involved community.

Performance Analysis and Future Trends

Analyzing Fond du Lac County tax records over time reveals interesting trends and insights. For instance, a comparison of property values and tax revenues over the past decade shows a steady increase, indicating a healthy real estate market and robust economic growth. Additionally, the data highlights areas with higher tax burdens, prompting discussions on tax reform and equitable distribution.

| Year | Average Property Value | Tax Revenue |

|---|---|---|

| 2015 | $250,000 | $50 million |

| 2020 | $300,000 | $65 million |

Conclusion: The Value of Transparency

Fond du Lac County tax records serve as a powerful tool, promoting transparency, accountability, and informed decision-making. By providing access to this wealth of data, the county empowers residents, investors, and stakeholders to actively engage with their community and contribute to its growth. As the county continues to thrive, these records will remain a vital resource, shaping the future of Fond du Lac and its residents.

Frequently Asked Questions

How can I access Fond du Lac County tax records online?

+To access Fond du Lac County tax records online, you can visit the county’s official website and navigate to the assessor’s office section. There, you’ll find a search tool that allows you to input a property address or parcel number to retrieve the desired tax information.

What information can I find in the tax records for a specific property?

+The tax records for a specific property in Fond du Lac County typically include details such as the property’s assessed value, tax rates, payment history, any applicable exemptions or deductions, and information on appeals or disputes related to the assessment.

How often are the tax records updated, and how accurate are they?

+The tax records are generally updated annually to reflect the most recent property assessments and tax rates. While every effort is made to ensure accuracy, it’s advisable to verify the information with the assessor’s office for the most up-to-date and precise details.

Can I use tax records to compare property values in different neighborhoods?

+Absolutely! Tax records provide a wealth of information that can be used to compare property values across various neighborhoods. This allows you to analyze trends, assess the local real estate market, and make informed decisions based on data.

What are the implications of tax records for prospective buyers or investors in Fond du Lac County?

+Tax records are invaluable for prospective buyers and investors as they offer insights into property values, tax obligations, and the overall financial health of the area. This information aids in strategic decision-making, helping buyers and investors identify lucrative opportunities and avoid potential pitfalls.