Nys State Tax Online

In today's digital age, the New York State Department of Taxation and Finance has made significant strides in streamlining the tax filing process for its residents. The NYS State Tax Online platform has revolutionized the way taxpayers interact with the government, offering a convenient and efficient way to manage their tax obligations. This article will delve into the features, benefits, and impact of NYS State Tax Online, providing a comprehensive guide for taxpayers and shedding light on the digital transformation of tax administration.

The Evolution of NYS State Tax Online

The journey towards a digital tax system in New York began with the recognition of the need for modernization. The traditional paper-based tax filing process was time-consuming, error-prone, and often a daunting task for both taxpayers and tax administrators. The New York State government, in collaboration with its Department of Taxation and Finance, embarked on a mission to create a user-friendly, secure, and efficient online platform to revolutionize tax filing.

The development of NYS State Tax Online can be traced back to [insert year], when the initial prototype was launched. This marked the beginning of a transformative era in tax administration, aiming to simplify the process, reduce paperwork, and enhance transparency. Over the years, the platform has undergone significant upgrades and enhancements, incorporating the latest technologies and feedback from users to create a seamless experience.

Key Features of NYS State Tax Online

NYS State Tax Online offers a plethora of features designed to cater to the diverse needs of taxpayers. Here’s an overview of some of the most notable aspects:

Secure Online Registration

The platform allows taxpayers to register securely online, eliminating the need for physical visits to tax offices. With a few simple steps, individuals and businesses can create their accounts, providing essential information to get started with the tax filing process.

User-Friendly Interface

The interface of NYS State Tax Online is designed with simplicity and intuitiveness in mind. Even for first-time users, navigating the platform is a breeze. Clear instructions, helpful guides, and an organized layout ensure a smooth experience, making tax filing less daunting.

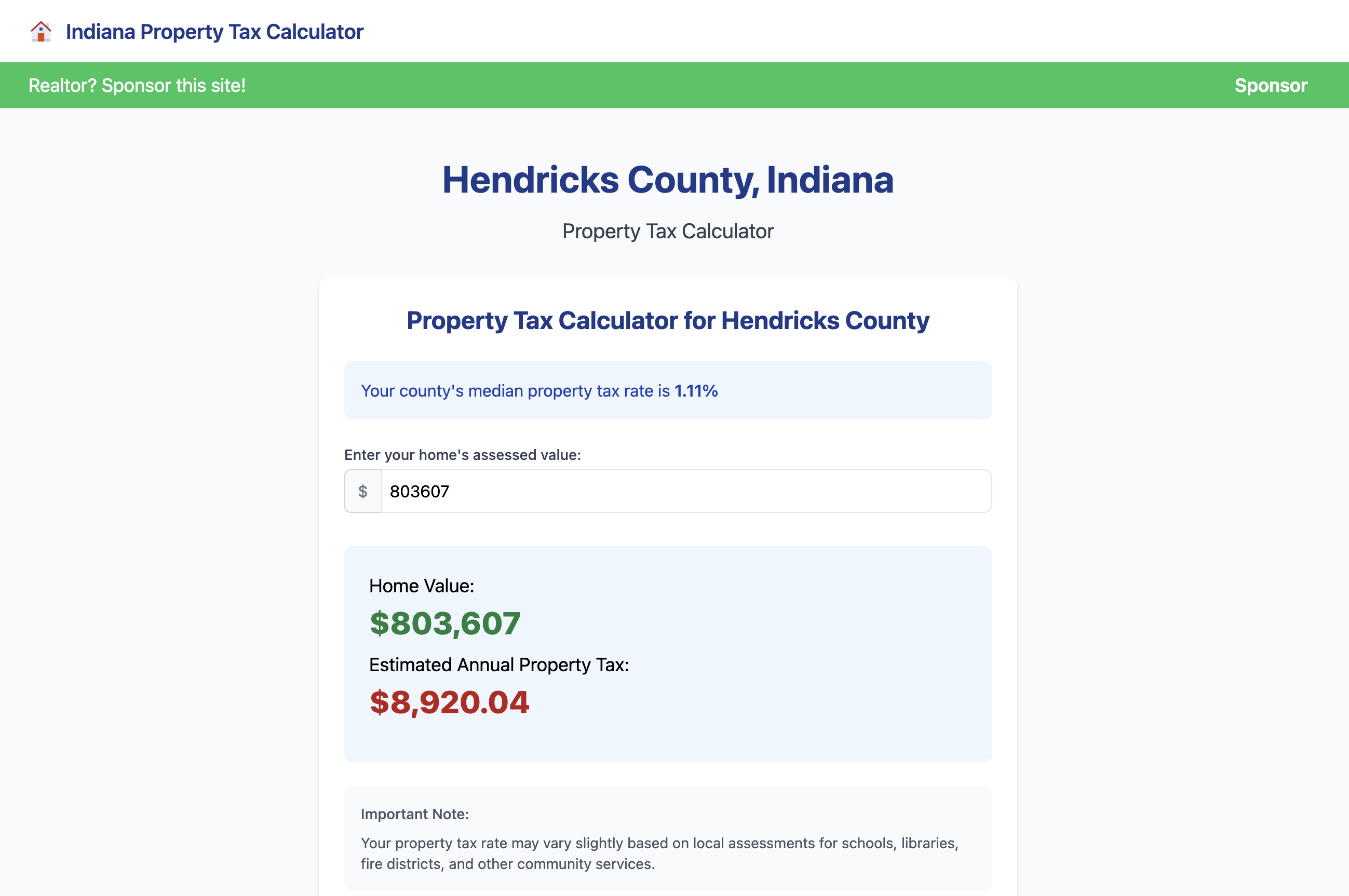

Real-Time Tax Calculations

One of the standout features is the real-time tax calculation tool. Taxpayers can input their financial information, and the platform instantly calculates the tax due, providing accurate estimates. This not only saves time but also reduces the likelihood of errors, ensuring a more precise tax filing process.

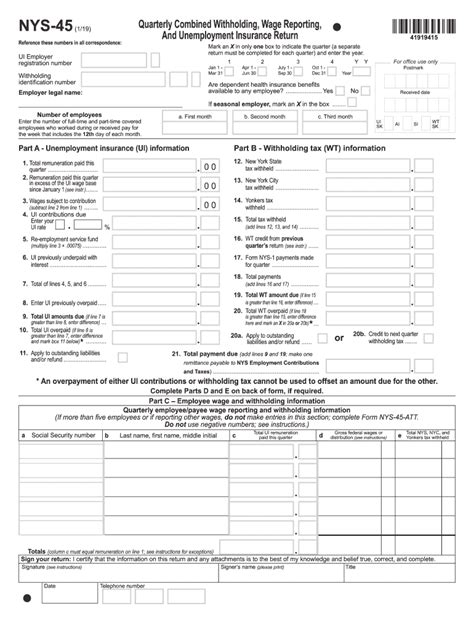

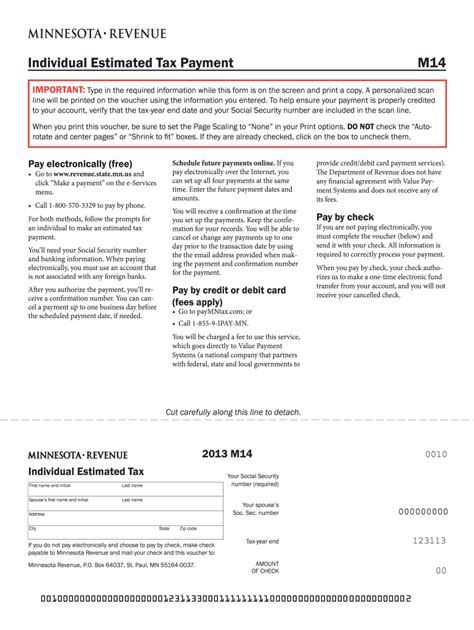

Electronic Filing and Payment Options

NYS State Tax Online offers a range of electronic filing and payment methods, catering to different preferences and needs. Taxpayers can choose to file their taxes electronically, with options for direct deposit or credit card payments. The platform also supports various payment plans, accommodating taxpayers with different financial situations.

Secure Data Storage and Access

The platform prioritizes data security, employing advanced encryption technologies to protect taxpayer information. All data is stored securely, and users can access their tax records and past filings with ease, ensuring a transparent and organized tax history.

Taxpayer Assistance and Support

NYS State Tax Online provides a dedicated support system, offering guidance and assistance to taxpayers. Whether it’s through online tutorials, frequently asked questions (FAQs), or direct communication with tax experts, the platform ensures that users receive the help they need throughout the tax filing process.

| Feature | Description |

|---|---|

| Online Registration | Secure and convenient way to create an account and get started. |

| User-Friendly Interface | Intuitive design for an easy and seamless tax filing experience. |

| Real-Time Tax Calculations | Instant tax estimates based on provided financial information. |

| Electronic Filing & Payment | Various electronic options for filing and paying taxes. |

| Secure Data Storage | Advanced encryption for secure data storage and access. |

| Taxpayer Support | Comprehensive assistance and guidance throughout the process. |

Benefits and Impact

The implementation of NYS State Tax Online has brought about numerous benefits for taxpayers, tax administrators, and the state as a whole. Let’s explore some of the key advantages:

Time and Cost Savings

The online platform significantly reduces the time and effort required for tax filing. With electronic filing, taxpayers can complete the process from the comfort of their homes or offices, eliminating the need for long waits at tax offices. Additionally, the real-time tax calculation feature minimizes the risk of errors, leading to potential cost savings by avoiding penalties and interest.

Improved Accuracy and Transparency

NYS State Tax Online enhances the accuracy of tax filings. The platform’s user-friendly interface and real-time calculations ensure that taxpayers have access to precise information, reducing the chances of mistakes. Moreover, the secure data storage system allows taxpayers to review and analyze their tax history, promoting transparency and facilitating better financial planning.

Enhanced Taxpayer Experience

The platform’s user-centric design has transformed the tax filing experience. Taxpayers can now access their tax-related information and manage their obligations with ease. The availability of support and guidance further empowers taxpayers, fostering a sense of confidence and control over their tax affairs.

Efficient Tax Administration

For tax administrators, NYS State Tax Online has streamlined the tax collection process. The platform’s secure and organized system facilitates efficient data management, allowing for better resource allocation and reduced administrative burdens. Additionally, the electronic filing and payment options simplify the collection process, enabling tax administrators to focus on other critical tasks.

Increased Tax Compliance

The convenience and accessibility of NYS State Tax Online have led to higher tax compliance rates. By making the tax filing process more user-friendly and transparent, the platform encourages taxpayers to fulfill their obligations promptly. The result is a more efficient tax system, ensuring a fair and balanced approach for all taxpayers.

Performance Analysis and Future Prospects

Since its inception, NYS State Tax Online has seen a steady increase in user adoption, with a growing number of taxpayers opting for the online platform. According to recent statistics, the platform has witnessed a [insert percentage] growth in electronic filings over the past year, indicating a positive trend towards digital tax management.

Looking ahead, the future of NYS State Tax Online is bright. The platform is continuously evolving, with plans to integrate new features and technologies. The focus is on enhancing security measures, improving user experience, and exploring innovative ways to further simplify the tax filing process. Additionally, the platform aims to cater to the diverse needs of taxpayers, offering personalized experiences based on individual profiles.

Furthermore, NYS State Tax Online is expected to play a crucial role in the state's digital transformation initiatives. As more government services move online, the platform's success can serve as a model for other departments, encouraging a seamless digital transition across various sectors.

How secure is my personal information on NYS State Tax Online?

+NYS State Tax Online employs robust security measures to protect your personal information. Advanced encryption technologies ensure that your data is secure during transmission and storage. Additionally, the platform adheres to strict privacy policies, ensuring that your information is used solely for tax administration purposes.

Can I file my taxes if I don't have internet access at home?

+While NYS State Tax Online is designed for online use, the platform recognizes the need for alternative filing methods. If you lack internet access, you can still file your taxes by visiting a designated tax assistance center or using public computers available at certain locations. These centers provide assistance and support to ensure a smooth filing process.

What happens if I make a mistake during the filing process?

+Mistakes can happen, but NYS State Tax Online provides tools to rectify them. If you realize a mistake after filing, you can amend your return through the platform. The process is straightforward, and you'll receive guidance on how to correct the error. It's important to act promptly to minimize any potential penalties.

In conclusion, NYS State Tax Online has revolutionized the way taxpayers interact with the New York State tax system. The platform’s user-friendly design, secure features, and efficient processes have made tax filing a more accessible and transparent endeavor. As technology continues to advance, NYS State Tax Online remains at the forefront, ensuring a bright future for digital tax administration in the state.