Indiana Property Tax Records

Indiana, known as the Hoosier State, has a unique property tax system that is a key component of its local government finances. This system plays a vital role in funding essential services such as education, infrastructure, and public safety. Understanding Indiana's property tax records is crucial for homeowners, investors, and those interested in the state's real estate market. In this comprehensive guide, we will delve into the intricacies of Indiana property tax records, providing an in-depth analysis and practical insights.

Understanding Indiana’s Property Tax System

Indiana’s property tax system is a complex yet essential part of its economic landscape. The state’s property taxes are primarily used to fund local government operations, with a significant portion dedicated to supporting public schools. This system is designed to ensure that local governments have a stable and reliable source of revenue to provide necessary services to their communities.

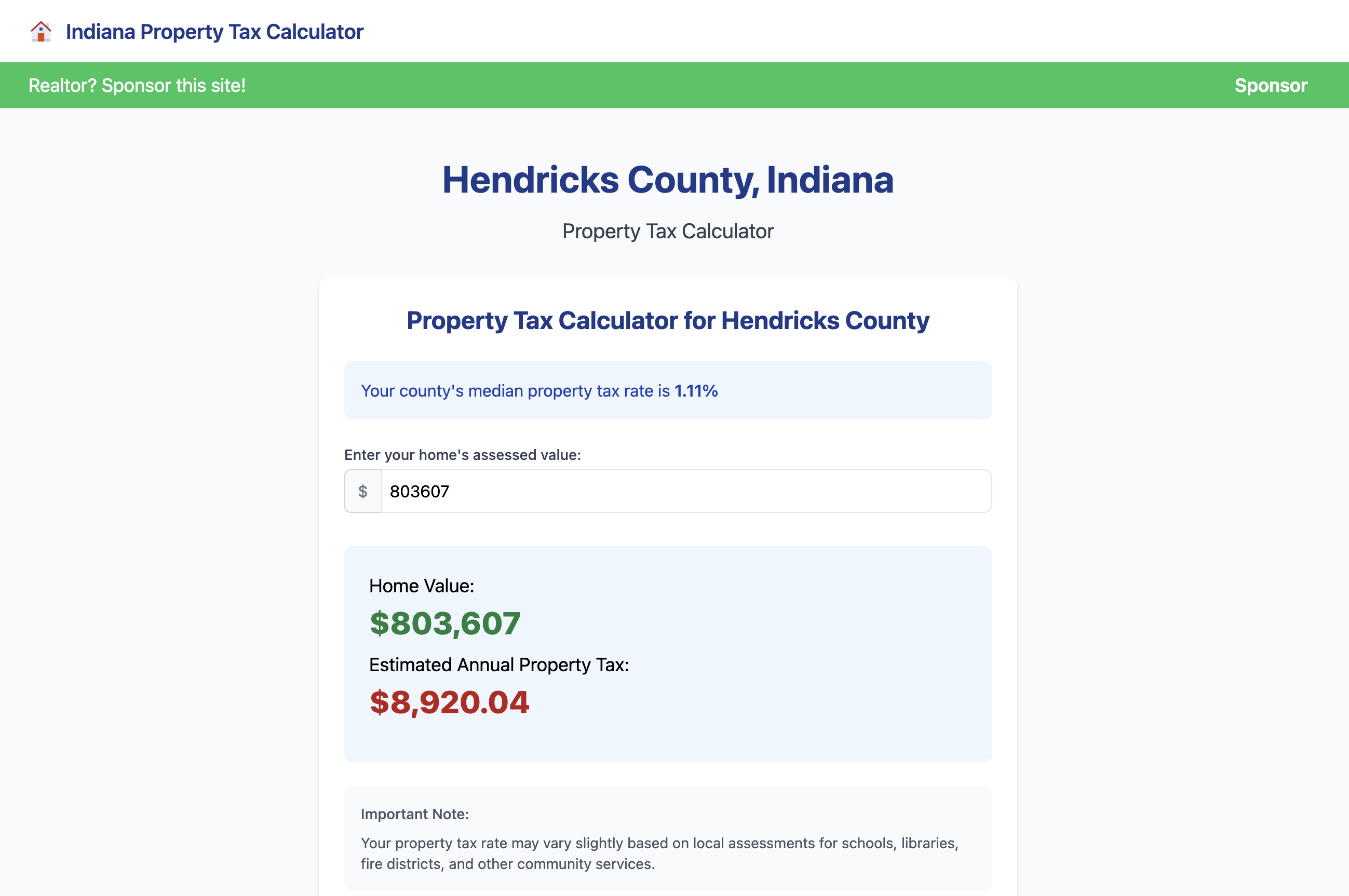

Property taxes in Indiana are based on the assessed value of a property, which is determined by the county assessor's office. The assessed value is then multiplied by the tax rate, which varies depending on the location and the type of property. This tax rate is often referred to as the "tax rate multiplier" or "mill rate," where one mill represents $1 of tax for every $1,000 of assessed value.

One unique aspect of Indiana's property tax system is the "Circuit Breaker" program, which provides tax relief for low-income homeowners. This program offers a credit to eligible homeowners, helping them manage their property tax burden. Additionally, Indiana has a "Tax Shift" program, which aims to distribute the tax burden more evenly among different types of properties, ensuring fairness in the system.

Key Components of Indiana Property Tax Records

Indiana property tax records provide a wealth of information, including:

- Assessed Value: The estimated market value of a property as determined by the county assessor. This value is used to calculate the property tax owed.

- Tax Rate: The rate at which the assessed value is taxed. This rate can vary by location and property type.

- Tax Amount: The actual dollar amount of property tax owed for a given year.

- Exemptions and Deductions: Records may indicate any applicable exemptions or deductions that reduce the taxable value of the property.

- Payment History: A record of tax payments made, including the dates and amounts.

These records are publicly available and can be accessed through various online platforms and county offices. They are a valuable resource for understanding the financial obligations associated with owning property in Indiana.

Analyzing Property Tax Records: A Case Study

To illustrate the practical application of Indiana property tax records, let’s consider a case study of a residential property in Marion County, Indianapolis.

Property Details

The property in question is a single-family home located in a desirable neighborhood. It has an assessed value of $250,000, which is based on recent market trends and comparable sales in the area.

Tax Calculation

The tax rate for this property is 1.8 mills, which means that for every 1,000 of assessed value, the owner owes 1.80 in property tax. Using this rate, the annual property tax for this home would be calculated as follows:

| Assessed Value | $250,000 |

|---|---|

| Tax Rate (Mills) | 1.8 |

| Annual Tax Amount | $4,500 |

This calculation demonstrates how the assessed value and tax rate directly impact the property tax obligation. It's important to note that tax rates can change annually, and adjustments to assessed values may occur due to reappraisals or other factors.

Exemptions and Relief Programs

In this case, the homeowner is eligible for the Circuit Breaker program, which provides a credit of 200. This credit reduces the overall tax burden, bringing the final tax amount to 4,300. Additionally, the homeowner has claimed a standard deduction of $300, further reducing the taxable value of the property.

Payment Options and Due Dates

Marion County offers several payment options, including online payments, mail-in payments, and in-person payments at the county treasurer’s office. The due dates for property taxes are typically in two installments: one due in May and the other in November. Late payments may incur penalties and interest.

The Impact of Property Taxes on Real Estate Decisions

Property taxes are a significant consideration for both homeowners and investors in Indiana. They can influence buying decisions, rental rates, and the overall financial health of a property.

Homeownership

For homeowners, property taxes are a fixed cost that must be budgeted for annually. Understanding the tax obligations associated with a property is essential when considering the overall affordability of a home. High property taxes can impact a homeowner’s ability to maintain their property or even lead to financial hardship if not properly managed.

Real Estate Investing

Investors in Indiana’s real estate market must also factor in property taxes when evaluating potential investments. A property with high taxes may have a lower cash flow, affecting the overall return on investment. Additionally, property taxes can influence the decision to buy or sell a property, as they are a significant expense that must be accounted for in investment strategies.

Comparative Analysis

Comparing property tax records across different counties in Indiana can provide valuable insights. For instance, a property in a rural county may have a lower tax rate compared to an urban county, even though the assessed values might be similar. This analysis can help investors and homeowners make informed decisions about where to buy or invest.

Future Implications and Trends

The future of Indiana’s property tax system is influenced by various factors, including economic trends, legislative changes, and shifts in the real estate market.

Economic Factors

Economic downturns can impact property values, which in turn affect tax assessments. During economic recessions, property values may decrease, leading to lower tax assessments and potentially reducing the tax burden for property owners. Conversely, economic booms can drive up property values, resulting in higher assessments and increased tax obligations.

Legislative Changes

Changes in state legislation can have a significant impact on Indiana’s property tax system. For instance, modifications to the Circuit Breaker program or the introduction of new tax relief initiatives can directly affect the tax obligations of homeowners. Additionally, changes in tax rates or assessment methodologies can influence the overall tax landscape in the state.

Real Estate Market Trends

Shifts in the real estate market, such as a surge in demand or a decline in housing prices, can also influence property tax records. Increased demand may lead to higher property values and, consequently, higher tax assessments. On the other hand, a decline in housing prices could result in lower assessments and potentially lower tax obligations.

Conclusion

Indiana’s property tax records are a vital resource for understanding the financial obligations associated with owning property in the state. They provide insights into assessed values, tax rates, and the various programs and deductions that impact the overall tax burden. By analyzing these records, homeowners and investors can make informed decisions, manage their finances effectively, and navigate the complexities of Indiana’s property tax system.

How often are property tax assessments conducted in Indiana?

+Property tax assessments in Indiana are typically conducted every few years, with the exact frequency varying by county. This reassessment process ensures that property values remain accurate and up-to-date.

Can property owners appeal their assessed value?

+Yes, property owners have the right to appeal their assessed value if they believe it is inaccurate or unfair. The appeal process involves submitting evidence and supporting documentation to the county assessor’s office.

Are there any tax relief programs for seniors in Indiana?

+Yes, Indiana offers the “Senior Citizen Property Tax Deduction,” which provides a deduction for eligible seniors based on their income and property value. This program helps reduce the tax burden for older homeowners.