County Of Santa Clara Property Tax

Welcome to a comprehensive guide on the property tax system in the vibrant County of Santa Clara, California. This article aims to provide an in-depth understanding of how property taxes work in this diverse region, shedding light on the processes, rates, and their impact on residents and businesses. By delving into specific examples and real-world scenarios, we will explore the intricate details of Santa Clara County's property tax landscape, offering valuable insights for property owners and those considering investing in this thriving county.

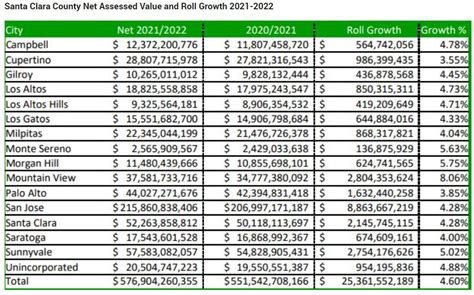

Understanding the Property Tax Landscape in Santa Clara County

Property taxes in Santa Clara County play a pivotal role in funding essential services and infrastructure development. These taxes are a crucial source of revenue for the county, contributing to the maintenance of schools, roads, emergency services, and other public amenities. The system is designed to ensure a fair and equitable distribution of financial responsibilities among property owners, with rates varying based on property value and location.

The county's Assessor's Office is responsible for appraising all taxable properties within its boundaries. This involves determining the assessed value of each property, which forms the basis for calculating the annual property tax bill. The assessed value is not necessarily the market value of the property but rather a value derived from a complex formula that considers factors such as the property's purchase price, improvements, and comparable sales in the area.

Tax Rates and Assessments

Santa Clara County’s property tax rates are determined by a combination of state and local factors. The state of California sets a base rate, known as the 1% tax rate, which applies to most properties. However, additional rates may be added by local governments and special districts to fund specific services or projects.

The county's property tax rate is typically expressed as a percentage of the assessed value. For instance, if the tax rate is set at 1.2%, a property with an assessed value of $500,000 would have an annual property tax bill of $6,000. These rates are subject to change annually, influenced by factors such as budget requirements, inflation, and voter-approved measures.

| Tax Rate Type | Rate | Description |

|---|---|---|

| State Base Rate | 1% | California's base property tax rate. |

| Local Rate | Varies | Additional rate set by Santa Clara County. |

| Special District Rates | Varies | Rates for specific services or projects. |

It's important to note that not all properties are taxed at the same rate. Certain properties, such as those owned by nonprofit organizations or used for specific agricultural purposes, may be eligible for reduced tax rates or exemptions. Additionally, Proposition 13, a landmark California law, limits the annual increase in assessed value for most properties to 2% or the inflation rate, whichever is lower.

Payment Options and Deadlines

Property tax payments in Santa Clara County are typically due in two installments, with the first installment deadline falling on December 10th and the second on April 10th of the following year. Property owners can choose to pay their taxes online, by mail, or in person at designated locations. Late payments are subject to penalties and additional fees.

For those facing financial hardships, the county offers various assistance programs. These include the Senior Citizens' Property Tax Postponement Program, which allows eligible seniors to defer their property tax payments until their property is sold, and the Disabled Veterans' Property Tax Exemption Program, which provides eligible veterans with a partial or full exemption from property taxes.

Real-World Examples and Case Studies

Let’s explore some specific scenarios to better understand how property taxes work in Santa Clara County. Consider the case of a homeowner, Ms. Johnson, who owns a single-family residence in the city of San Jose. Her property has an assessed value of $800,000, and the county’s tax rate is set at 1.15% for the current fiscal year.

Based on this information, Ms. Johnson's annual property tax bill would be calculated as follows: $800,000 x 0.0115 = $9,200. This amount would be due in two installments, with the first half due on December 10th and the second half on April 10th.

Commercial Property Taxes

Now, let’s examine the scenario of a business owner, Mr. Smith, who operates a retail store in downtown Palo Alto. His commercial property has an assessed value of $2.5 million, and the tax rate for commercial properties in the county is slightly higher at 1.25%.

Mr. Smith's annual property tax bill would be calculated as: $2,500,000 x 0.0125 = $31,250. This amount, like residential properties, is also due in two installments. However, commercial property owners often face additional complexities, such as supplemental tax bills for improvements made to the property during the year.

Impact of Property Tax on Investment Decisions

Property taxes are a significant consideration for investors looking to acquire real estate in Santa Clara County. For instance, let’s consider a real estate developer planning to purchase a vacant lot with the intention of constructing a multi-family housing complex. The developer must factor in not only the purchase price and construction costs but also the anticipated property taxes.

In this scenario, the developer's financial projections would include an estimation of the property taxes based on the assessed value of the vacant lot and the projected value of the completed development. This analysis is crucial to determine the feasibility and profitability of the investment.

The Future of Property Taxes in Santa Clara County

As Santa Clara County continues to thrive and evolve, the property tax landscape is likely to undergo changes and adaptations. One key factor influencing future tax rates is the county’s commitment to maintaining a balanced budget while providing essential services to its growing population.

With the county's reputation as a hub for technological innovation and a magnet for talented professionals, property values are expected to remain high or even increase. This trend may lead to higher property tax revenues, which could, in turn, impact the county's tax rates and assessments.

Potential Policy Changes

In recent years, there have been discussions and proposals for reforming the property tax system in California, including in Santa Clara County. These reforms aim to address concerns about rising property values and their impact on long-term residents and businesses. Some proposed changes include modifying Proposition 13 to allow for reassessments of commercial properties more frequently or introducing split-roll tax systems that treat commercial and residential properties differently.

Additionally, the county may explore alternative revenue sources to supplement property taxes, such as sales taxes or development fees. These measures could help alleviate the burden on property owners while ensuring the county can continue to fund critical services and infrastructure projects.

Conclusion

Understanding the property tax system in Santa Clara County is essential for both residents and investors. The intricate interplay of assessed values, tax rates, and special considerations for various property types showcases the complexity of this system. As the county continues to prosper, staying informed about property taxes and their potential future developments is crucial for making informed financial decisions.

How often are property values reassessed in Santa Clara County?

+Property values are typically reassessed every three years in Santa Clara County. However, significant changes to the property, such as additions or improvements, may trigger a reassessment before the scheduled three-year cycle.

Are there any tax breaks or exemptions available for homeowners in the county?

+Yes, Santa Clara County offers several tax relief programs for eligible homeowners. These include the Senior Citizens’ Property Tax Postponement Program and the Disabled Veterans’ Property Tax Exemption Program. Additionally, certain income-restricted homeowners may qualify for the California Property Tax Postponement (CPP) program.

What happens if I miss the property tax payment deadline?

+If you miss the property tax payment deadline, a penalty of 10% of the unpaid balance will be added to your bill. Failure to pay within a specified grace period may result in further penalties and the possibility of a tax default.

How can I appeal my property’s assessed value if I believe it is inaccurate?

+If you believe your property’s assessed value is inaccurate, you have the right to file an appeal with the Santa Clara County Assessment Appeals Board. The process involves submitting an application, providing supporting evidence, and attending a hearing to present your case.