Real Estate Vs Property Tax

When it comes to navigating the complex world of property ownership, two crucial aspects that often intertwine are real estate and property tax. These two elements play significant roles in the lifecycle of owning and managing property, and understanding their intricacies is essential for any prospective or current homeowner. This article aims to delve deep into the nuances of real estate and property tax, shedding light on their differences, impacts, and the strategies one can employ to navigate them effectively.

Unraveling the Concept of Real Estate

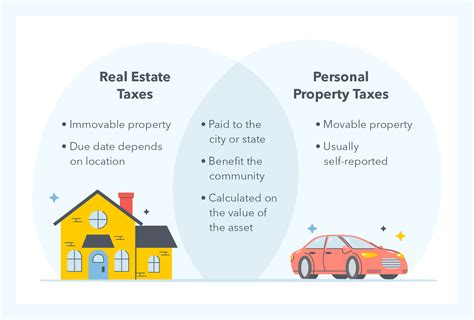

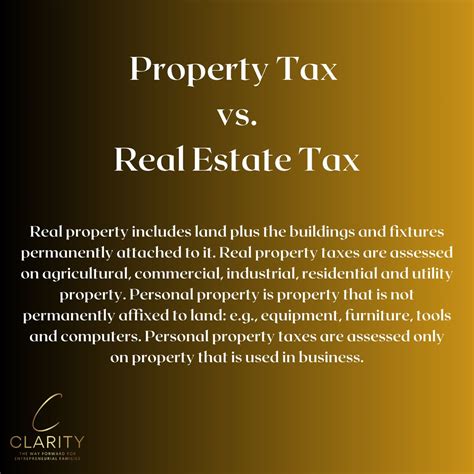

Real estate, a term often synonymous with property, encompasses a vast landscape of physical assets, including land, buildings, natural resources, and improvements made to these assets. It is a multifaceted industry that caters to various sectors, from residential and commercial to industrial and agricultural.

At its core, real estate involves the buying, selling, renting, and development of these properties. The industry is characterized by a diverse range of professionals, from real estate agents and brokers to developers and investors, each playing a unique role in the intricate dance of property transactions.

For instance, a real estate agent acts as a mediator between buyers and sellers, guiding them through the complex process of negotiations and legalities. On the other hand, a developer might focus on acquiring raw land, obtaining the necessary permits, and constructing buildings to meet the demands of a growing population.

Key Factors in Real Estate

- Location: The age-old adage, “location, location, location,” rings true in real estate. The value and appeal of a property are significantly influenced by its geographic location. Whether it’s proximity to urban centers, schools, or natural amenities, location plays a pivotal role in determining a property’s desirability and potential for appreciation.

- Market Dynamics: Real estate is subject to the ebbs and flows of market trends. Factors such as supply and demand, interest rates, and economic conditions can impact property values and the overall real estate market. Understanding these dynamics is crucial for making informed investment decisions.

- Property Types: Real estate encompasses a broad spectrum of property types, each with its own set of characteristics and investment potential. From single-family homes and condominiums to multi-family residences, commercial offices, and industrial warehouses, each type presents unique opportunities and considerations.

Furthermore, the real estate industry is often influenced by government policies and regulations, which can shape the development and ownership landscape. Zoning laws, building codes, and environmental regulations are just a few examples of how external factors can impact the real estate market.

The Complexity of Property Tax

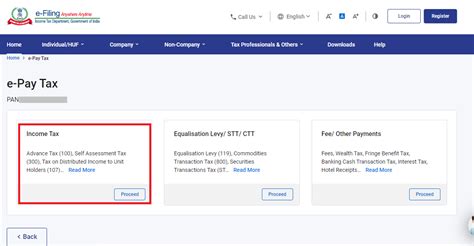

Property tax, often referred to as real estate tax or ad valorem tax, is a levy imposed on property owners by local governments. This tax is a significant source of revenue for municipalities and is used to fund various public services, including education, infrastructure, and public safety.

The assessment of property tax involves a comprehensive evaluation of the property's value, taking into account factors such as its location, size, condition, and potential use. This assessment is typically conducted by a professional assessor, who considers market trends, comparable sales, and other relevant data to determine the property's fair market value.

Understanding Property Tax Assessments

Property tax assessments are conducted periodically, with the frequency varying depending on the jurisdiction. In some areas, assessments are done annually, while in others, they may occur less frequently. The assessment process involves an inspection of the property, a review of relevant documents, and an analysis of market data to ensure accuracy.

Once the assessment is complete, the property owner receives a tax bill, detailing the assessed value of the property and the corresponding tax amount. It's important to note that property tax rates can vary significantly between different jurisdictions, and even within the same region, based on the local government's budgetary needs and the level of services provided.

Strategies for Managing Property Tax

- Appeals and Challenges: If a property owner believes the assessed value of their property is inaccurate or unfair, they have the right to appeal. This process typically involves submitting evidence and arguments to support a lower valuation. Successful appeals can lead to reduced property tax liabilities.

- Homestead Exemptions: Many jurisdictions offer homestead exemptions, which provide tax relief to homeowners who use their property as their primary residence. These exemptions can significantly reduce the taxable value of the property, resulting in lower tax bills.

- Property Tax Deductions: In some regions, property owners can take advantage of tax deductions for certain improvements or expenses related to their property. These deductions can include energy-efficient upgrades, mortgage interest, or property taxes paid in the current or previous years.

Managing property tax effectively requires a thorough understanding of the assessment process, local regulations, and available exemptions and deductions. It's crucial for property owners to stay informed and proactive to ensure they are not overpaying on their property taxes.

The Intersection of Real Estate and Property Tax

While real estate and property tax are distinct concepts, they are intricately linked in the world of property ownership. The value of a real estate property is a key determinant in the calculation of property tax, making it essential for property owners to understand the relationship between these two aspects.

When a property is purchased or sold, the transaction value is often a significant factor in determining the property's assessed value for tax purposes. This means that changes in the real estate market can directly impact property tax assessments, leading to potential increases or decreases in tax liabilities.

For instance, if a property is sold at a higher price than its previous assessment, the new owner may face a higher property tax bill. On the other hand, if the property market experiences a downturn, property values may decline, resulting in reduced tax assessments and potentially lower tax bills.

Navigating Real Estate Transactions and Property Tax

- Due Diligence: When buying or selling real estate, it’s crucial to conduct thorough due diligence. This includes understanding the current property tax assessments, any potential tax liabilities, and the impact of the transaction on future tax obligations. Working with a real estate professional who specializes in tax considerations can be invaluable in this process.

- Timing of Transactions: The timing of a real estate transaction can have tax implications. Selling a property during a period of high market demand may result in a higher sale price, which could lead to a higher property tax assessment. Similarly, purchasing a property during a market downturn may present an opportunity to acquire a property at a lower assessment, potentially reducing tax liabilities.

- Tax Strategies for Real Estate Investors: For real estate investors, property tax considerations are a critical component of their investment strategy. Strategies such as holding properties for long periods to benefit from tax-efficient capital gains, utilizing tax-deferred exchanges, or taking advantage of tax incentives for certain types of properties can significantly impact the overall profitability of an investment.

The relationship between real estate and property tax is complex and ever-evolving. Staying informed about local tax policies, market trends, and available strategies is essential for property owners and investors to make informed decisions and optimize their financial positions.

Conclusion: Navigating the Complexities

Real estate and property tax are two pillars of property ownership, each with its own set of complexities and implications. Understanding the intricacies of these concepts is vital for anyone involved in the real estate market, whether as an owner, investor, or professional.

From the diverse landscape of real estate, encompassing various property types and market dynamics, to the intricate assessment and management of property tax, the journey of property ownership is a multifaceted one. Navigating these complexities requires a blend of knowledge, strategy, and a keen eye for detail.

As the real estate market continues to evolve, staying abreast of the latest trends, regulations, and tax strategies is essential. By doing so, property owners and investors can make informed decisions, optimize their financial positions, and navigate the intricate world of real estate and property tax with confidence and success.

What is the primary difference between real estate and property tax?

+Real estate refers to the physical assets and transactions involving land, buildings, and natural resources, while property tax is a levy imposed on these assets by local governments to fund public services. Real estate is a dynamic industry with various sectors and professionals, while property tax is a revenue source for municipalities.

How are property tax assessments determined?

+Property tax assessments are based on the property’s fair market value, considering factors like location, size, condition, and potential use. Professional assessors conduct inspections, review documents, and analyze market data to determine the assessed value.

What strategies can property owners employ to manage their property tax liabilities effectively?

+Property owners can appeal assessments if they believe the value is inaccurate, take advantage of homestead exemptions for primary residences, and explore property tax deductions for certain improvements or expenses. Staying informed about local regulations and available strategies is key.