Pay Nys Income Tax Online

Paying your New York State (NYS) income tax online is a convenient and efficient way to fulfill your tax obligations. The NYS Department of Taxation and Finance offers a user-friendly online platform to facilitate this process, making it accessible and straightforward for taxpayers. In this article, we will guide you through the steps to pay your NYS income tax online, ensuring a seamless and timely transaction.

Step-by-Step Guide: Paying NYS Income Tax Online

Follow these comprehensive steps to pay your NYS income tax online:

Step 1: Access the NYS Department of Taxation and Finance Website

Begin by visiting the official NYS Department of Taxation and Finance website. This is the secure and official platform where you can access all the necessary tools and information to manage your tax obligations.

Step 2: Create or Login to Your Account

If you already have a My NY Tax account, simply log in using your credentials. If you're a new user, follow the instructions to create an account. This account will serve as your personalized portal for managing your tax-related activities.

Step 3: Navigate to the Online Payment Portal

Once logged in, locate the Online Payment option. This is usually found under the Taxpayer Services or Payments section. The portal will guide you through the payment process, ensuring a secure and user-friendly experience.

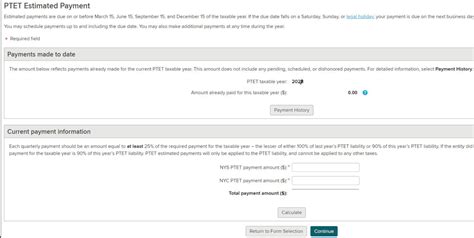

Step 4: Enter Your Tax Information

Provide the required tax information, including your tax year, tax type (e.g., individual income tax), and tax identification number (your Social Security Number or Employer Identification Number). Ensure that all details are accurate to avoid any delays or errors in processing your payment.

Step 5: Select Your Payment Method

Choose your preferred payment method. The NYS Department of Taxation and Finance offers several options, including credit/debit cards, e-checks (electronic checks), and online bill pay through your bank. Each method has its own set of advantages and potential fees, so choose the one that best suits your needs and preferences.

Step 6: Enter Payment Details and Review

Enter the necessary details for your chosen payment method. For example, if you opt for a credit/debit card, you'll need to provide the card number, expiration date, and security code. Carefully review all the information you've entered to ensure accuracy.

Step 7: Submit and Confirm Your Payment

Once you've verified all the details, submit your payment. The system will process your request, and you'll receive a confirmation. This confirmation serves as a record of your transaction and should be retained for your records.

Step 8: Receive Your Payment Confirmation

After successfully submitting your payment, you will receive a payment confirmation. This confirmation typically includes a unique transaction ID or reference number, the amount paid, the tax year, and the tax type. Save this confirmation for your records and future reference.

Step 9: Monitor Your Payment Status

You can track the status of your payment by logging back into your My NY Tax account. The system will update the status of your payment, indicating whether it has been received, processed, or applied to your tax obligation. This real-time update ensures transparency and allows you to stay informed about the progress of your payment.

Step 10: Keep Records and Stay Informed

It's essential to maintain records of your online tax payments. Save or print the payment confirmation and store it securely. Additionally, stay informed about any tax-related updates, deadlines, and changes by regularly checking the NYS Department of Taxation and Finance's website or subscribing to their email notifications.

| Tax Year | Payment Due Date |

|---|---|

| 2023 | April 15, 2024 |

| 2022 | April 18, 2023 |

| 2021 | April 15, 2022 |

Additional Tips for a Smooth Online Payment Process

- Ensure you have all the necessary information, such as your tax identification number and the correct tax year, before starting the online payment process.

- Consider using a secure browser and network connection to protect your personal and financial information during the transaction.

- If you encounter any issues or have questions during the payment process, the NYS Department of Taxation and Finance provides a Help or Contact Us section on their website. Reach out to their support team for assistance.

- For complex tax situations or if you need expert advice, consider consulting a qualified tax professional or accountant.

- Keep track of your payment history and stay organized by regularly reviewing your My NY Tax account. This will help you manage your tax obligations effectively.

Frequently Asked Questions (FAQ)

What happens if I miss the NYS income tax payment deadline?

+If you miss the payment deadline, you may be subject to late payment penalties and interest charges. It's important to pay your taxes on time to avoid additional fees and potential legal consequences. However, the NYS Department of Taxation and Finance may offer relief programs or payment plans for taxpayers facing financial difficulties. Contact them to explore your options.

<div class="faq-item">

<div class="faq-question">

<h3>Can I pay my NYS income tax in installments?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>Yes, the NYS Department of Taxation and Finance offers installment payment plans for taxpayers who cannot pay their taxes in full by the due date. These plans allow you to pay your tax liability in smaller, more manageable installments over a specified period. To apply for an installment plan, visit the <strong>Payment Plans</strong> section on their website or contact their customer service for assistance.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>Are there any fees associated with online tax payments in NYS?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>Yes, when paying your NYS income tax online, you may incur fees depending on the payment method you choose. Credit/debit card payments often carry processing fees, while e-check and online bill pay methods may have lower or no fees. It's advisable to review the fee structure for each payment method before proceeding to choose the most cost-effective option for your situation.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>Can I pay my NYS income tax with a credit card, and is it safe?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>Yes, you can pay your NYS income tax with a credit card. The NYS Department of Taxation and Finance offers this payment method for convenience. However, it's important to note that credit card payments typically incur processing fees, which can vary depending on the card type and issuer. Additionally, ensure that the website is secure (look for <strong>https</strong> and a padlock icon in the address bar) to protect your credit card information during the transaction.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>How long does it take for my online tax payment to be processed and reflected in my account?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>The processing time for online tax payments can vary depending on the payment method and the volume of transactions. Generally, credit/debit card payments and e-checks are processed within a few business days. However, during peak tax seasons, processing times may be longer. It's advisable to allow sufficient time for your payment to be processed and reflected in your tax account to avoid any potential penalties or late fees.</p>

</div>

</div>

</div>