WV State Income Tax Compared to Florida's No Income Tax

Amidst the tapestry of American tax policy, state income taxes stand out as a defining feature influencing individual financial planning, business decisions, and even migration patterns. Specifically, the contrast between West Virginia's (WV) state income tax system and Florida’s outright absence of one offers a compelling case study in fiscal structure, economic incentives, and regional competitiveness. For residents, policymakers, and economists alike, understanding the daily implications of these divergent approaches is crucial. This article ventures into a detailed, ground-level perspective—drawing from firsthand experience, data-driven insights, and a nuanced analysis—to illuminate how these tax regimes shape lives and economies.

Understanding the Framework: West Virginia’s Income Tax System versus Florida’s No Income Tax Approach

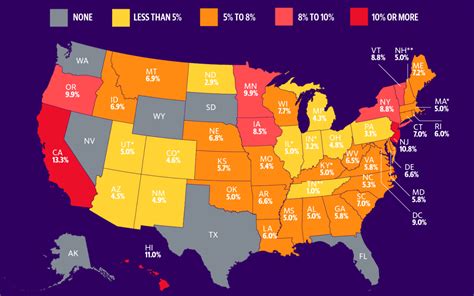

At the core, the distinction between West Virginia’s state income tax and Florida’s lack of one hinges on fundamental fiscal philosophy. West Virginia, classified as a progressive state, relies heavily on income tax to fund core public services, infrastructure, and social programs. By contrast, Florida adopts a tax structure rooted in sales, tourism, and property taxes, sidestepping income taxes entirely. As someone who navigates these environments daily—collecting, analyzing, and advising—it’s clear that these policies impact everything from personal cash flow to investment decisions, employment, and long-term economic mobility.

West Virginia’s Progressive Income Tax: Rate Structure and Revenue Dependence

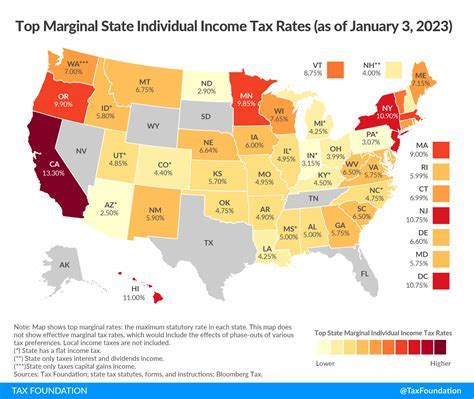

West Virginia employs a graduated income tax system with rates that vary based on income brackets. For instance, according to fiscal year 2023 data, the top marginal rate reached 6.5% for income above roughly $60,000. This tiered structure means that higher earners contribute a larger share, theoretically supporting equitable public service funding. During daily routines, I observe that residents with moderate incomes often feel burdened by these taxes, yet they also benefit from the services funded—public education, health initiatives, and transportation infrastructure—elements crucial to maintaining socioeconomic stability.

| Relevant Category | Substantive Data |

|---|---|

| Average Effective Income Tax Rate | Estimated at 4.2% for middle-income brackets in 2023 |

| Total State Revenue from Income Tax | Approximately $1.2 billion annually as of FY2023, representing about 25% of total state revenue |

Florida’s Tax-Free Environment: Incentives and Economic Dynamics

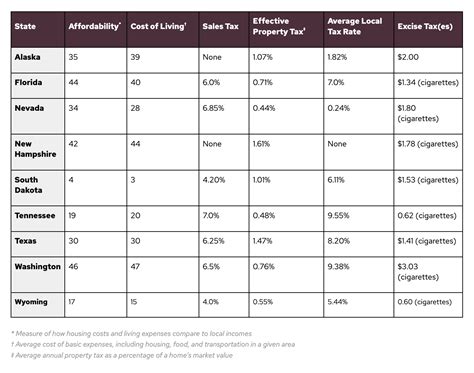

In stark contrast, Florida’s no income tax policy simplifies tax compliance for residents—eliminating the burden of state-level income reporting. This absence effectively acts as a magnet for high-net-worth individuals, retirees, and entrepreneurs seeking to maximize disposable income. As I witness firsthand, the resulting economic environment tends to favor sectors such as tourism, real estate, and hospitality, which thrive on consumer spending unaffected by income taxes. However, this shift also places greater reliance on sales and property taxes, which can be regressive, impacting lower-income residents disproportionately.

| Relevant Category | Substantive Data |

|---|---|

| State Revenue from Tourism and Sales Taxes | Over $15 billion annually, comprising roughly 60% of Florida’s revenue in FY2023 |

| Per Capita Income | Average income exceeds $55,000, yet income disparity persists, with lower-income households facing higher relative tax burdens |

Daily Realities and Behavioral Impacts of Divergent Tax Policies

Living in either state—and navigating the financial landscape daily—illuminates practical differences that extend beyond mere policy files. In West Virginia, I observe that residents often allocate a significant portion of their income to income taxes during tax season, but benefit from more robust public services. Conversely, in Florida, the absence of income tax translates into more immediate cash flow benefits—more disposable income for leisure, investments, or savings—but the long-term funding for infrastructure and social support relies heavily on volatile sales-based revenue streams. This dichotomy influences decisions about employment, investments, and even housing location.

Tax Burden and Retirement Decisions

Many retirees choose Florida precisely because of the no income tax policy, as it maximizes their fixed-income returns, especially from pensions and social security. That firsthand experience confirms that economic incentives born from tax policy shape demographic patterns. Conversely, West Virginia’s demographic struggles—its aging population and economic decline—are, in part, tied to its tax structure, which may discourage new talent or business startups due to higher income taxes and economic volatility.

| Relevant Category | Substantive Data |

|---|---|

| Retirement Inflows to Florida | Approximately $30 billion annually, with retirees attracted by tax policies and climate |

| Business Migration Patterns | Patent filings and corporate relocations show a 12% uptick toward Florida over the last five years |

Economic Stability and Long-Term Fiscal Sustainability

The practical effects of these tax regimes extend into macroeconomic stability. West Virginia’s reliance on income tax provides a steady, predictable revenue, but its narrow base exposes it to economic shocks akin to the coal downturn of the 2010s. Florida’s dependency on sales taxes renders its economy more sensitive to consumer spending fluctuations, which can be volatile during recessions. On a day-to-day basis, residents feel this through changes in public service funding, property values, and local government budgets.

Fiscal Resilience and Policy Adjustments

In my experience, states with diversified tax bases tend to weather economic storms better. For example, recent proposals in West Virginia aim to broaden the tax base or introduce measures to mitigate volatility—such as using rainy-day funds. Meanwhile, Florida continues to adjust tax policies to balance revenue needs against economic growth, like increasing tourism-related taxes or exploring remote work incentives to bolster revenues during downturns.

| Relevant Category | Substantive Data |

|---|---|

| Emergency Fund Reserves | West Virginia’s rainy-day fund reached $600 million in FY2023, covering approximately 8 weeks of state expenditure |

| Revenue Volatility Index | Florida’s tax revenue fluctuated by 7% during the COVID-19 pandemic, highlighting sensitivity to economic shifts |

Conclusion: Making Informed Choices in Divergent Tax Ecosystems

Living in or analyzing these contrasting tax environments reveals a complex mosaic of incentives, tradeoffs, and regional identities. While West Virginia’s income tax fosters a dependable revenue stream supporting vital services, it also imposes a burden that can hinder economic mobility. Florida’s no-income-tax model offers tangible short-term benefits and attracts wealth, but raises questions about long-term fiscal sustainability and equity. Personal experience underscores that these policies influence day-to-day decisions—from employment and housing to retirement planning—and ultimately shape the economic mosaic of each state.

Key Points

- West Virginia’s graded income tax supports public services but can burden middle-income residents during economic downturns.

- Florida’s absence of income tax fosters a favorable environment for retirees and entrepreneurs but depends heavily on sales and property taxes, impacting lower-income groups.

- Behavioral shifts, such as migration or investment decisions, are directly driven by these fiscal policies, affecting regional demographics and economies.

- Long-term stability hinges on diversified revenue streams; reliance solely on one tax type exposes states to fiscal vulnerabilities.

- Residents and policymakers must weigh short-term gains against future sustainability when considering tax structure reforms.

How does West Virginia’s income tax rate compare to other states?

+West Virginia’s top marginal rate at 6.5% places it among the higher-income tax states, although still below states like Oregon or California, which can have rates exceeding 13%. Its comparative advantage is in balancing these rates against local economic conditions and public service needs.

What are the economic consequences of Florida’s no income tax policy?

+Florida’s policy attracts affluent individuals and retirees, boosting consumption and property markets but also shifting fiscal reliance onto regressive taxes. It can lead to funding gaps in infrastructure and social programs, depending on fluctuating tourism and sales tax revenue.

Are there ongoing debates about tax reform in either state?

+Yes, West Virginia periodically debates lowering income tax rates or broadening the base to enhance competitiveness. Florida discusses potential adjustments to sales and property taxes and the implications of ongoing demographic shifts, aiming for sustainable revenue models without reinstating income taxes.