Mo State Income Tax

In the United States, state income taxes are an essential component of the overall tax system. These taxes contribute significantly to state revenues and play a crucial role in funding various public services and infrastructure projects. Among the states, Missouri stands out with its unique approach to income taxation, offering a range of features and benefits that are worth exploring.

Understanding Missouri’s Income Tax Structure

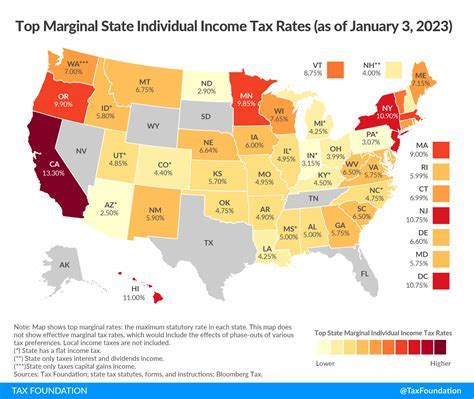

Missouri operates on a progressive income tax system, which means that the state income tax rates increase as your taxable income rises. This system aims to ensure that higher-income earners contribute a larger proportion of their income towards state revenues. As of 2023, Missouri has six income tax brackets, each with its own tax rate, ranging from 1.5% to 6.0%.

| Tax Bracket | Tax Rate |

|---|---|

| First $1,500 | 1.5% |

| Next $2,500 | 2.5% |

| Next $3,500 | 3.0% |

| Next $4,500 | 4.0% |

| Next $7,500 | 5.0% |

| Income over $23,500 | 6.0% |

This progressive structure ensures that individuals with lower incomes are taxed at a lower rate, while those with higher incomes contribute more to the state's revenue. The tax brackets are designed to be flexible and adapt to the changing economic landscape, allowing for fair and equitable taxation.

Key Features of Missouri’s Income Tax System

Missouri’s income tax system offers several notable features that set it apart from other states. One significant aspect is the state’s tax credits and deductions, which can help reduce the overall tax burden for individuals and businesses. These credits and deductions include options for education, retirement savings, and certain business-related expenses.

For instance, Missouri offers a Low-Income Housing Tax Credit, which encourages the development of affordable housing options across the state. Additionally, the state provides a Research and Development Tax Credit, promoting innovation and technological advancements within the state's industries.

Missouri also has a sales tax holiday each year, typically held in August. During this period, certain items like school supplies, clothing, and computers are exempt from sales tax, providing a significant savings opportunity for families and businesses alike. This initiative not only stimulates the economy but also eases the financial burden on residents during the back-to-school season.

Impact of Missouri’s Income Tax on Residents and Businesses

Missouri’s income tax system has a profound impact on both its residents and businesses. For individuals, the progressive nature of the tax structure ensures that higher earners contribute more, which can lead to a more equitable distribution of tax burdens. This approach also encourages economic growth by providing tax relief to those with lower incomes, who are more likely to spend a higher proportion of their income.

From a business perspective, Missouri's income tax system offers a competitive advantage compared to some neighboring states with higher tax rates. This can attract businesses to establish operations within the state, leading to job creation and economic growth. Additionally, the state's tax credits and deductions provide incentives for businesses to invest in research, development, and community initiatives.

However, it's important to note that the impact of income taxes on businesses can vary significantly depending on their industry and specific circumstances. While some businesses may benefit from Missouri's tax structure, others may face challenges, especially if they operate in sectors with high labor costs or complex supply chains.

Comparative Analysis with Other States

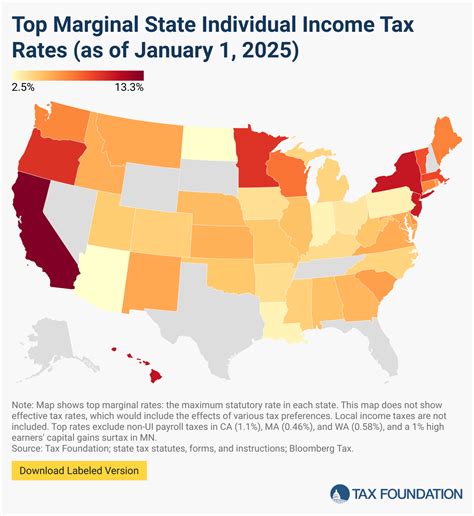

When compared to other states, Missouri’s income tax system stands out for its moderately progressive nature and competitive tax rates. For instance, neighboring states like Kansas and Illinois have higher income tax rates, which can make Missouri a more attractive option for individuals and businesses seeking to minimize their tax liabilities.

Furthermore, Missouri's tax system offers a balance between revenue generation and taxpayer relief. The state's approach to tax credits and deductions, as well as the sales tax holiday, demonstrates a commitment to supporting its residents and businesses while still maintaining a stable revenue stream for essential public services.

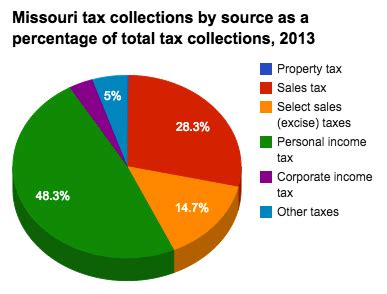

However, it's worth noting that income tax is just one aspect of a state's overall tax system. Other factors, such as property taxes, sales taxes, and business taxes, also play a significant role in the overall tax burden. Therefore, a comprehensive analysis of a state's tax system is necessary to understand its true impact on residents and businesses.

The Future of Missouri’s Income Tax: Challenges and Opportunities

As with any tax system, Missouri’s income tax structure faces both challenges and opportunities for improvement. One of the key challenges is keeping up with the changing economic landscape, particularly in the face of technological advancements and evolving business models. The state must ensure that its tax system remains flexible and adaptable to these changes, maintaining its competitiveness in attracting businesses and residents.

Additionally, Missouri's income tax system must navigate the delicate balance between fiscal responsibility and social welfare. The state needs to allocate its tax revenues effectively to fund essential services, such as education, healthcare, and infrastructure, while also providing support to those in need. This balance is crucial for ensuring the long-term sustainability and prosperity of the state.

Potential Reforms and Their Impact

Looking ahead, there are several potential reforms that could enhance Missouri’s income tax system. One option is to expand the tax base by including more income sources, such as capital gains and certain types of investments, which could generate additional revenue without increasing tax rates. This approach could provide a more stable and reliable source of funding for the state.

Another potential reform is to simplify the tax code by reducing the number of tax brackets and making the system more straightforward. A simpler tax code could make it easier for taxpayers to understand and comply with their tax obligations, reducing administrative burdens and potential errors.

Furthermore, Missouri could explore implementing a state-level Earned Income Tax Credit (EITC) to provide additional support to low- and moderate-income households. The EITC is a proven tool for reducing poverty and encouraging workforce participation, and its implementation at the state level could have a significant positive impact on Missouri's most vulnerable residents.

What is the average effective tax rate in Missouri for individuals?

+The average effective tax rate in Missouri for individuals varies depending on income levels. As of 2022, the average effective tax rate for Missouri taxpayers was approximately 4.5%.

Does Missouri have a state-level Earned Income Tax Credit (EITC)?

+No, Missouri does not currently have a state-level EITC. However, there have been ongoing discussions and proposals to implement one, which could provide significant benefits to low-income households.

Are there any plans to simplify Missouri’s tax code in the near future?

+While there is no specific timeline for tax code simplification, there have been ongoing efforts by policymakers to make the tax system more straightforward and user-friendly. These efforts aim to reduce complexity and improve taxpayer compliance.