Sales Tax In California

Sales tax in California is an important aspect of the state's economy and plays a significant role in funding various public services and infrastructure projects. It is a consumption tax levied on the sale of goods and services within the state, and it varies across different jurisdictions, impacting both residents and businesses. Understanding the nuances of California's sales tax system is crucial for individuals and businesses operating in the state.

The Complex Landscape of California Sales Tax

California’s sales tax system is known for its complexity, with rates varying not only at the state level but also at the county and city levels. This multifaceted structure results in a diverse range of sales tax rates across the state, making it a challenging yet intriguing topic for exploration.

Statewide Sales Tax

At the statewide level, California imposes a sales and use tax of 7.25%. This base rate is a fundamental component of the state’s revenue generation strategy, serving as a starting point for the more intricate local tax rates that follow.

| Statewide Sales Tax | Rate |

|---|---|

| California Base Rate | 7.25% |

However, it is essential to recognize that this base rate is just the beginning. Local jurisdictions have the authority to add their own sales taxes, leading to a more dynamic and nuanced tax landscape.

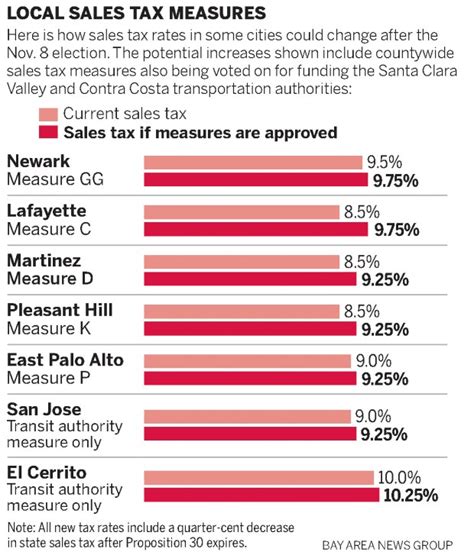

Local Sales Tax Variations

California’s local governments, including counties and cities, have the autonomy to impose additional sales taxes on top of the state rate. These local add-ons can significantly impact the total sales tax burden, resulting in a wide range of rates across the state.

For instance, Los Angeles County, one of the state's most populous regions, levies an additional 0.25% tax, bringing the total sales tax rate to 7.50%. In contrast, San Francisco has a more substantial add-on of 1.50%, pushing the total rate to 8.75%, one of the highest in the state.

| Local Jurisdictions | Additional Tax Rate | Total Sales Tax Rate |

|---|---|---|

| Los Angeles County | 0.25% | 7.50% |

| San Francisco | 1.50% | 8.75% |

These variations in local sales tax rates can have a significant impact on businesses and consumers, influencing purchasing decisions and overall economic activity.

Sales Tax Exemptions and Special Cases

While the general sales tax structure in California is relatively straightforward, it’s important to note that certain goods and services are exempt from sales tax. These exemptions can vary based on state laws and local ordinances, adding another layer of complexity to the sales tax landscape.

For instance, many states, including California, exempt groceries and certain essential items from sales tax to alleviate the tax burden on lower-income households. Additionally, certain services, such as medical and legal services, are often exempt from sales tax.

Furthermore, there are special cases where sales tax rates may differ. For example, certain cities or regions within California may offer sales tax incentives or rebates to promote economic development or tourism. These special tax rates can further complicate the sales tax picture for businesses and consumers alike.

The Impact of California Sales Tax on Businesses

California’s sales tax system has a significant influence on the state’s business landscape. For businesses, understanding and managing sales tax obligations is crucial for compliance and financial planning.

Compliance and Reporting

Businesses operating in California must navigate the complex web of sales tax rates and regulations to ensure compliance. This involves accurate record-keeping, timely reporting, and remittance of sales tax revenues to the appropriate tax authorities.

The California Department of Tax and Fee Administration provides resources and guidance to help businesses navigate the sales tax landscape, including registration processes, filing deadlines, and payment requirements. Non-compliance can result in penalties and legal consequences, underscoring the importance of staying informed and up-to-date with sales tax regulations.

Sales Tax Registration and Collection

Businesses engaged in taxable sales or providing taxable services in California are generally required to register with the state’s tax authority and obtain a seller’s permit. This permit allows businesses to collect and remit sales tax on behalf of the state.

The process of registering for a seller's permit involves providing detailed information about the business, including its legal structure, location(s) of operation, and the nature of its sales activities. Once registered, businesses must collect sales tax from customers at the applicable rate and remit these funds to the tax authority on a regular basis, typically monthly or quarterly.

Failure to register or accurately collect and remit sales tax can result in significant penalties and interest charges, making compliance a critical aspect of doing business in California.

Impact on Pricing and Competitiveness

California’s sales tax rates can influence a business’s pricing strategies and competitiveness in the market. Higher sales tax rates can make products or services less affordable for consumers, potentially impacting sales volumes and market share.

Businesses must carefully consider the impact of sales tax on their pricing structures, especially when operating in regions with high sales tax rates. Strategies such as bundling services or offering discounts to offset the tax burden can help maintain competitiveness and customer loyalty.

Furthermore, businesses should be mindful of the impact of sales tax on their bottom line. While sales tax is a significant revenue source for the state, it can also represent a substantial expense for businesses, especially those with high sales volumes or operating in multiple jurisdictions with varying tax rates.

The Role of Sales Tax in California’s Economy

California’s sales tax system is a critical component of the state’s overall revenue generation strategy, playing a significant role in funding essential public services and infrastructure projects.

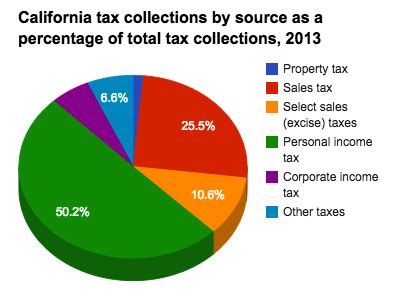

Revenue Generation and Allocation

Sales tax revenues in California contribute substantially to the state’s general fund, which supports a wide range of public services, including education, healthcare, transportation, and public safety. The funds collected from sales tax help maintain and improve the state’s infrastructure, making it an essential component of California’s economic development.

The allocation of sales tax revenues is a complex process, with a portion of the funds going to the state's general fund and another portion allocated to local governments based on population and other factors. This distribution ensures that sales tax revenues benefit both state-wide initiatives and local community needs.

Economic Impact and Consumer Behavior

The sales tax system in California can have a notable impact on consumer behavior and economic activity. Higher sales tax rates can discourage consumer spending, especially on discretionary items, potentially leading to a slowdown in economic growth.

Conversely, lower sales tax rates can stimulate consumer spending and boost economic activity. This dynamic is particularly relevant in border regions where consumers may cross state lines to take advantage of lower sales tax rates, impacting local businesses and tax revenues.

Understanding these economic implications is crucial for policymakers and businesses alike, as it can influence tax policy decisions and business strategies.

Sales Tax Holidays and Incentives

To encourage consumer spending and support certain industries, California, like many other states, occasionally offers sales tax holidays or incentives. During these periods, specific items or categories of goods are exempt from sales tax, providing consumers with an opportunity to save money and businesses with a potential boost in sales.

Sales tax holidays are typically targeted towards essential items such as clothing, school supplies, or energy-efficient appliances, offering relief to consumers and promoting the use of these products. These initiatives can have a positive impact on consumer spending and provide a short-term boost to the economy.

The Future of Sales Tax in California

The landscape of sales tax in California is dynamic and subject to ongoing changes and debates. As the state’s economy and population continue to evolve, so too will the sales tax system, reflecting the needs and priorities of its residents and businesses.

Proposed Reforms and Modernization

There are ongoing discussions and proposals for reforming and modernizing California’s sales tax system to address evolving economic realities and technological advancements. One key area of focus is the impact of e-commerce and online sales on the traditional sales tax model.

With the rise of online shopping, there is a growing concern that certain online transactions may not be subject to the same sales tax rates as in-store purchases, potentially creating an uneven playing field for brick-and-mortar businesses. Proposals to address this issue include expanding sales tax collection requirements for online retailers and implementing a uniform sales tax rate for online and in-store purchases.

Impact of Technological Advancements

Technological advancements, such as automation and data analytics, are transforming the way sales tax is administered and enforced. These innovations can streamline the sales tax collection and reporting process, reducing the administrative burden on businesses and improving compliance.

For example, cloud-based accounting software and sales tax automation tools can help businesses accurately calculate and remit sales tax, ensuring compliance with the complex web of sales tax rates and regulations. Additionally, data analytics can provide valuable insights into sales tax trends and patterns, helping businesses and tax authorities make more informed decisions.

Future Trends and Implications

Looking ahead, the future of sales tax in California is likely to be shaped by a combination of economic, technological, and political factors. As the state’s economy continues to evolve, so too will the sales tax system, adapting to meet the changing needs of its residents and businesses.

One key trend to watch is the potential shift towards a more streamlined and uniform sales tax rate, particularly in the context of e-commerce and online sales. This could involve a simplification of the current multi-layered tax system, making it easier for businesses and consumers to navigate.

Additionally, the increasing use of data analytics and automation in sales tax administration is likely to continue, further enhancing compliance and efficiency. These technological advancements can help businesses and tax authorities stay ahead of evolving tax landscapes and ensure accurate and timely reporting.

Overall, the future of sales tax in California promises to be an intriguing journey, marked by ongoing reforms, technological innovations, and a continued focus on funding essential public services and infrastructure projects.

What is the sales tax rate in California?

+

The statewide sales tax rate in California is 7.25%, but local jurisdictions can add their own taxes, resulting in varying rates across the state.

How often do sales tax rates change in California?

+

Sales tax rates can change annually, typically in April, based on legislative actions and local ballot measures.

Are there any sales tax holidays in California?

+

Yes, California occasionally offers sales tax holidays, exempting specific items like clothing or electronics from sales tax for a limited time.

How do I calculate sales tax in California for my business?

+

Use the statewide rate of 7.25% as a base and add the local rate specific to your business location. Consult with tax professionals for accurate calculations.