Is Medical Insurance Pre Tax

Medical insurance is an essential aspect of healthcare coverage, offering financial protection and peace of mind to individuals and families. Understanding the tax implications of medical insurance is crucial for making informed decisions about your health coverage and optimizing your financial planning. In this comprehensive guide, we will delve into the world of medical insurance and explore whether it is considered a pre-tax benefit, examining the tax treatment, potential advantages, and its impact on your overall financial well-being.

The Pre-Tax Advantage: Unraveling the Concept

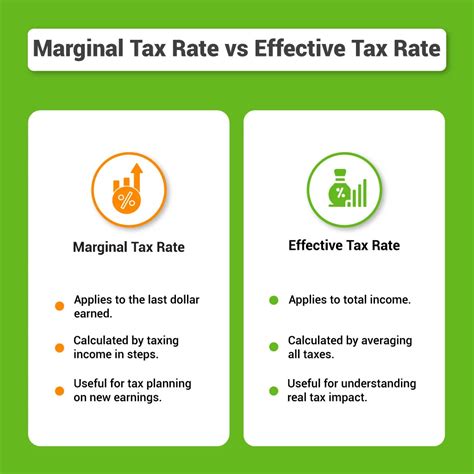

When discussing medical insurance in the context of taxes, the term “pre-tax” refers to the ability to pay for certain expenses or contributions before taxes are calculated and deducted from your income. This pre-tax treatment can have significant implications for your financial obligations and overall tax liability.

Understanding Pre-Tax Benefits

Pre-tax benefits are a strategic way for employers to offer additional perks to their employees, often with tax advantages for both the employer and the employee. By designating certain benefits as pre-tax, employers can provide enhanced compensation packages while reducing the overall tax burden for their workforce. These benefits typically include contributions to health insurance plans, flexible spending accounts (FSAs), and other health-related expenses.

For employees, pre-tax benefits translate to increased purchasing power and the ability to allocate more of their income towards essential healthcare expenses. By contributing to these pre-tax benefits, employees can reduce their taxable income, resulting in lower tax obligations and potentially significant savings.

The Impact on Medical Insurance

Medical insurance is a prime example of a pre-tax benefit, as it is often included in employer-sponsored health plans. When an employer offers medical insurance as a pre-tax benefit, employees can elect to have a portion of their salary contributed towards their health insurance premiums on a pre-tax basis. This means that the premiums are deducted from their gross income before calculating taxes.

The tax savings associated with pre-tax medical insurance can be substantial. By reducing taxable income, employees can lower their tax liability, which results in more disposable income. This not only provides financial relief but also ensures that a larger portion of an employee's earnings is dedicated to crucial healthcare coverage.

Tax Treatment of Medical Insurance

The tax treatment of medical insurance varies depending on the specific circumstances and the country or region in which you reside. Understanding the tax implications is essential for optimizing your financial strategy and ensuring compliance with tax regulations.

Employer-Sponsored Health Plans

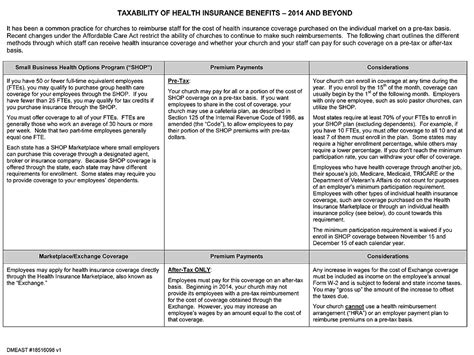

In many cases, employer-sponsored health plans are treated as pre-tax benefits. When an employer offers medical insurance as part of its benefits package, the premiums are typically paid with pre-tax dollars. This means that the employer deducts the insurance premium from the employee’s gross income before calculating taxes.

For employees, this pre-tax treatment can lead to significant tax savings. By reducing their taxable income, employees can lower their tax liability, resulting in a higher net pay. Additionally, the pre-tax nature of employer-sponsored health plans encourages employees to enroll in insurance plans, promoting better healthcare access and financial protection.

Individual Market Plans

For individuals purchasing health insurance on the open market, the tax treatment may differ. In some regions, there are tax incentives or credits available to offset the cost of individual health insurance plans. These incentives can take various forms, such as tax deductions, tax credits, or subsidies, depending on the specific tax regulations in place.

Tax deductions allow individuals to reduce their taxable income by a certain amount based on their insurance premiums. Tax credits, on the other hand, provide a direct reduction in the taxes owed, making them particularly beneficial for those with lower incomes. Subsidies are another form of financial assistance, where individuals receive a reduction in their insurance premiums based on their income level.

It's important to note that the availability and specifics of these tax incentives can vary widely across different countries and regions. Consulting with a tax professional or staying updated on the latest tax regulations in your area is essential to maximize the tax benefits associated with individual health insurance plans.

Advantages of Pre-Tax Medical Insurance

Pre-tax medical insurance offers a range of advantages that can significantly impact your financial well-being and healthcare coverage. Let’s explore some of the key benefits associated with this tax-efficient approach to healthcare.

Lower Taxable Income

One of the most significant advantages of pre-tax medical insurance is the reduction in taxable income. By contributing to your health insurance premiums on a pre-tax basis, you effectively lower your taxable income, resulting in a lower tax liability. This means that a larger portion of your income is tax-free, providing you with more disposable income to allocate towards other financial goals or expenses.

Enhanced Purchasing Power

The pre-tax treatment of medical insurance allows you to allocate more of your income towards essential healthcare coverage. With pre-tax contributions, you have increased purchasing power when it comes to selecting your insurance plan. This can be particularly beneficial if you require comprehensive coverage or have specific healthcare needs.

Financial Protection and Peace of Mind

Medical insurance, when treated as a pre-tax benefit, provides a crucial layer of financial protection. By paying for your insurance premiums with pre-tax dollars, you reduce the financial burden associated with unexpected medical expenses. This peace of mind is invaluable, as it ensures that you have access to the healthcare services you need without the added stress of high out-of-pocket costs.

Employee Retention and Satisfaction

From an employer’s perspective, offering medical insurance as a pre-tax benefit can be a powerful tool for attracting and retaining top talent. Employees highly value comprehensive healthcare coverage, and the pre-tax nature of these benefits makes them even more appealing. By providing pre-tax medical insurance, employers can boost employee satisfaction, loyalty, and overall morale, leading to a more productive and engaged workforce.

Performance Analysis and Comparison

When evaluating the effectiveness of pre-tax medical insurance, it’s essential to consider real-world examples and compare it with other healthcare financing options. Let’s delve into a performance analysis and explore how pre-tax medical insurance stacks up against alternative approaches.

Case Study: John’s Financial Journey

Consider John, a hypothetical individual with an annual income of 60,000. John is enrolled in an employer-sponsored health plan with a monthly premium of 500. Without the pre-tax benefit, John’s taxable income would be $60,000, and he would owe taxes on this amount. However, with the pre-tax treatment of medical insurance, John’s taxable income is reduced by the amount of his insurance premiums.

In this case, John's taxable income is reduced by $6,000 (12 months x $500 premium), resulting in a taxable income of $54,000. This reduction in taxable income translates to lower tax obligations and increased disposable income for John. The pre-tax benefit allows him to save on taxes and have more funds available for other financial commitments or personal goals.

Comparison with Post-Tax Options

To better understand the advantages of pre-tax medical insurance, let’s compare it with a post-tax alternative. Imagine a scenario where an individual, let’s call her Sarah, has the same annual income of $60,000 but chooses to purchase health insurance on the open market with post-tax dollars.

In this case, Sarah's taxable income remains at $60,000, and she must pay taxes on this amount. Any insurance premiums she pays are deducted from her post-tax income, reducing her disposable income. The post-tax approach means that Sarah has less purchasing power for her insurance coverage and may face higher out-of-pocket expenses.

By contrast, with pre-tax medical insurance, individuals like John can reduce their taxable income, leading to lower tax obligations and increased disposable income. This tax-efficient approach provides a more financially advantageous position, especially when considering the potential for unexpected medical expenses.

| Comparison | Pre-Tax Medical Insurance | Post-Tax Insurance |

|---|---|---|

| Taxable Income | Reduced by insurance premiums | No reduction |

| Tax Obligations | Lowered due to reduced taxable income | Based on full taxable income |

| Disposable Income | Increased, providing more financial flexibility | Reduced, limiting purchasing power |

Financial Implications and Savings

The financial implications of pre-tax medical insurance are significant. By reducing taxable income, individuals can save a substantial amount on taxes, especially when considering the progressive nature of tax brackets. This saved money can be allocated towards other financial goals, such as savings, investments, or debt repayment.

Additionally, the pre-tax treatment of medical insurance provides a sense of financial security. With lower tax obligations, individuals have more funds available to cover potential medical expenses, reducing the financial strain associated with healthcare costs. This peace of mind is invaluable and can significantly impact overall financial well-being.

Future Implications and Industry Insights

As the healthcare landscape continues to evolve, the future implications of pre-tax medical insurance are worth exploring. Let’s delve into some industry insights and predictions regarding this tax-efficient approach to healthcare coverage.

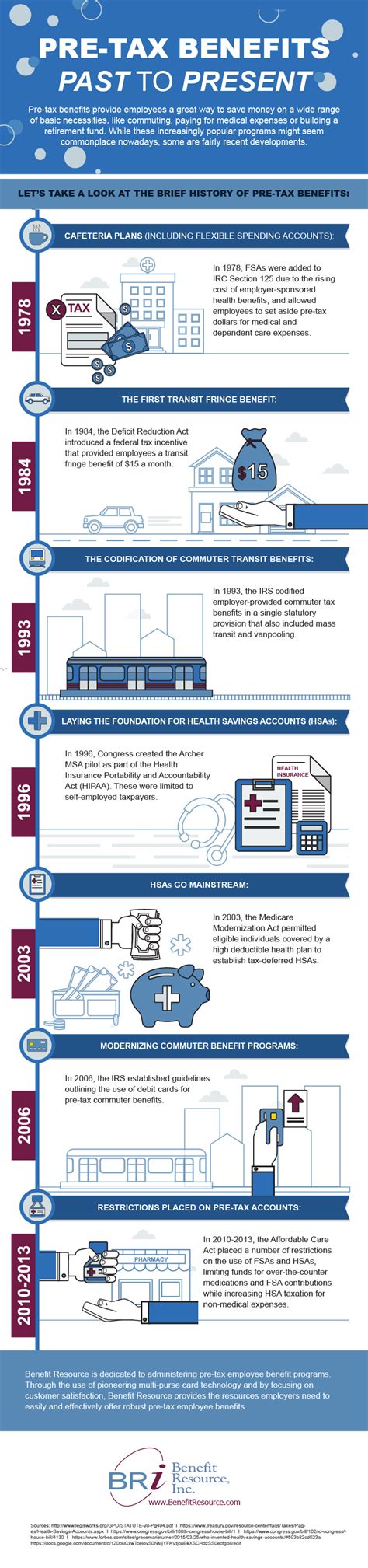

Industry Trends and Developments

The healthcare industry is witnessing several trends that are shaping the future of medical insurance and its tax treatment. One notable trend is the increasing focus on value-based care, where healthcare providers are incentivized to deliver high-quality, cost-effective care. This shift towards value-based care is expected to impact the design and pricing of insurance plans, potentially leading to more affordable and accessible healthcare options.

Additionally, the growing popularity of high-deductible health plans (HDHPs) is influencing the tax landscape. HDHPs often come with tax advantages, such as the ability to contribute to Health Savings Accounts (HSAs), which provide tax-free savings for medical expenses. As more individuals opt for HDHPs, the demand for tax-efficient healthcare financing options, including pre-tax medical insurance, is likely to increase.

Potential Changes in Tax Regulations

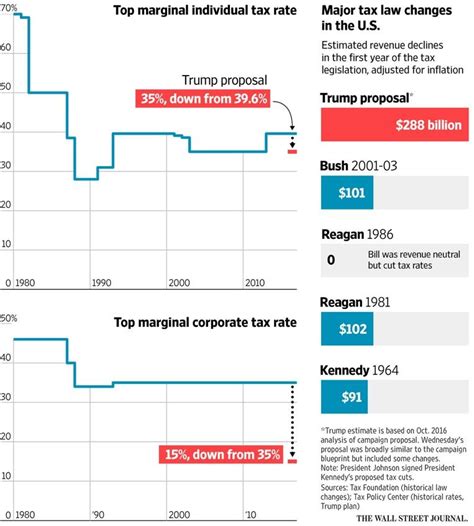

Tax regulations are subject to change, and it’s essential to stay updated on any potential modifications that may impact the tax treatment of medical insurance. While it’s challenging to predict specific changes, certain trends and proposals can provide insights into the future direction of tax policies.

One potential area of change is the expansion of tax incentives for healthcare coverage. Governments may explore ways to encourage individuals to enroll in health insurance plans by offering enhanced tax benefits or credits. These incentives could further promote the adoption of pre-tax medical insurance, making it an even more attractive option for both employers and employees.

Additionally, there may be discussions around simplifying the tax treatment of medical insurance, making it more accessible and understandable for individuals. Streamlining the tax regulations surrounding healthcare coverage could enhance the overall efficiency and effectiveness of the system, benefiting both taxpayers and healthcare providers.

Embracing Technological Advancements

The healthcare industry is embracing technological advancements to improve efficiency and patient outcomes. In the context of medical insurance, the integration of technology can streamline the enrollment and administration processes, making pre-tax benefits more accessible and user-friendly.

Online portals and mobile applications can provide employees with easy access to their insurance plans and pre-tax benefit information. These digital platforms can offer real-time updates, personalized recommendations, and seamless interactions, enhancing the overall experience of managing healthcare coverage.

Furthermore, technological advancements can facilitate better data analysis and insights, allowing employers and insurance providers to tailor their offerings to meet the specific needs of their workforce. This data-driven approach can lead to more effective and cost-efficient healthcare solutions, benefiting both employers and employees.

Expanding Access to Healthcare

The ultimate goal of healthcare coverage is to ensure that individuals have access to quality healthcare services when they need them. Pre-tax medical insurance plays a crucial role in expanding access by making healthcare more affordable and financially manageable.

As the healthcare industry continues to evolve, efforts to improve access will remain a priority. Pre-tax medical insurance, with its tax advantages and reduced financial burden, can be a powerful tool in achieving this goal. By encouraging enrollment and providing financial relief, pre-tax benefits contribute to a healthier and more resilient society.

How do I know if my medical insurance is considered pre-tax?

+To determine if your medical insurance is considered pre-tax, you can check your payroll deductions or contact your employer’s human resources department. Pre-tax benefits are typically reflected in your gross income, and the insurance premiums are deducted before calculating taxes.

Are there any limitations or restrictions on pre-tax medical insurance contributions?

+Yes, there may be certain limitations or restrictions on pre-tax medical insurance contributions. These limitations often depend on the specific plan and the tax regulations in your region. It’s advisable to consult with your employer or a tax professional to understand any applicable limits or guidelines.

Can I claim tax deductions for medical insurance if I purchase it individually?

+The tax treatment of individually purchased medical insurance can vary. In some regions, there may be tax deductions or credits available to offset the cost of insurance premiums. It’s essential to check the specific tax regulations in your area and consult with a tax professional to understand your eligibility for any tax benefits.

What are the potential disadvantages of pre-tax medical insurance?

+One potential disadvantage of pre-tax medical insurance is the lack of flexibility in using the funds for non-medical expenses. Since the contributions are designated for healthcare, they cannot be used for other purposes. Additionally, there may be restrictions on withdrawing funds from certain types of pre-tax accounts, such as Health Savings Accounts (HSAs), without incurring penalties.

How can I maximize the benefits of pre-tax medical insurance?

+To maximize the benefits of pre-tax medical insurance, it’s crucial to understand your specific plan and the associated tax advantages. Take advantage of any employer-provided resources or guidance to make informed decisions about your insurance coverage. Additionally, stay updated on tax regulations and consult with tax professionals to ensure you’re optimizing your financial strategy.