How Much Is Sales Tax In New Jersey

Welcome to the ultimate guide on understanding and navigating the sales tax landscape in New Jersey. Sales tax is an essential aspect of doing business and making purchases in any state, and it can often be a complex topic to grasp. This comprehensive article aims to shed light on the intricacies of sales tax in New Jersey, providing you with a deep understanding of the rates, regulations, and best practices to ensure compliance and avoid any unexpected surprises.

The Complex Web of Sales Tax in New Jersey

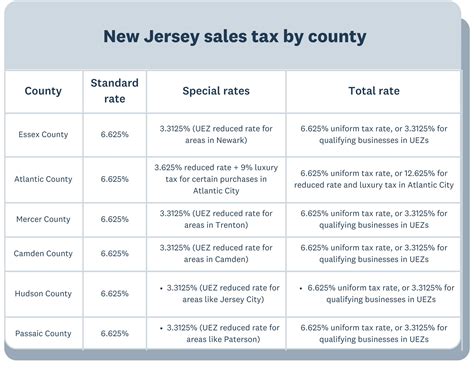

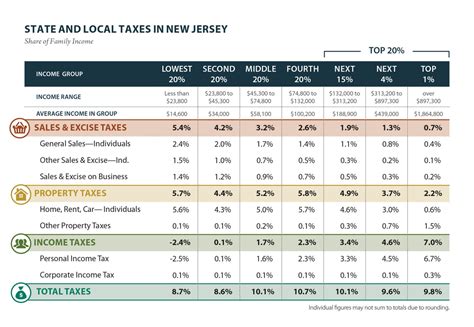

Sales tax in New Jersey is a multifaceted system that varies based on numerous factors. While the state of New Jersey imposes a uniform sales and use tax rate of 6.625% on most tangible personal property and certain services, it's important to note that this is just the starting point. Various jurisdictions within the state have the authority to levy additional taxes, often referred to as "local option taxes," resulting in a wide range of sales tax rates across the state.

To illustrate the diversity, here's a snapshot of the sales tax rates in some major cities in New Jersey as of January 2024:

| City | Sales Tax Rate |

|---|---|

| Atlantic City | 9.125% |

| Camden | 7.875% |

| Hoboken | 8.125% |

| Jersey City | 7.875% |

| Newark | 7.875% |

As you can see, the sales tax rates vary significantly, even within a single state. These variations can have a substantial impact on businesses and consumers, making it crucial to stay informed about the applicable rates in each jurisdiction.

Diving Deeper: Understanding Local Option Taxes

Local option taxes are a key component of the sales tax landscape in New Jersey. These taxes are authorized by the state but administered at the local level, typically by counties and municipalities. The purpose of local option taxes is to provide additional revenue for specific purposes, such as funding local infrastructure projects or supporting education.

The local option tax rate can range from 0% to 2.5%, and it is added on top of the state's base rate of 6.625%. This means that in some areas, the combined state and local sales tax rate can exceed 9%, as seen in the case of Atlantic City.

Impact on Businesses and Consumers

The varying sales tax rates across New Jersey can present both opportunities and challenges for businesses. For instance, a business located in a jurisdiction with a lower sales tax rate may attract more customers seeking to save on taxes. On the other hand, businesses operating in areas with higher tax rates might need to adopt strategic pricing strategies to remain competitive.

Consumers, too, are impacted by these variations. Those residing in areas with higher sales tax rates may choose to shop online or travel to neighboring jurisdictions with lower rates to make significant purchases. Understanding these dynamics is crucial for both businesses and consumers to make informed decisions and optimize their financial strategies.

Exemptions and Special Considerations

While sales tax is generally applicable to most goods and services, New Jersey, like many other states, provides exemptions for certain items. These exemptions can significantly impact the overall sales tax burden for both businesses and consumers.

Common Exemptions

- Food and beverages sold for consumption off the premises

- Clothing and footwear items priced under $100

- Prescription drugs and certain medical devices

- Residential utilities, such as electricity and gas

- Educational and instructional materials

It's worth noting that the state of New Jersey also offers specific tax incentives and programs aimed at promoting economic development and supporting certain industries. These incentives can include sales tax holidays, tax credits, and exemptions for qualifying businesses and industries.

Compliance and Reporting Requirements

Ensuring compliance with sales tax regulations is a critical aspect of doing business in New Jersey. Businesses are responsible for collecting, remitting, and reporting sales tax accurately and timely. Failure to comply can result in penalties, interest charges, and even legal consequences.

Registration and Permits

Businesses engaged in taxable sales in New Jersey must register with the New Jersey Division of Taxation and obtain a Sales and Use Tax Permit. This permit authorizes the business to collect and remit sales tax on behalf of the state.

The registration process typically involves completing an application form, providing business information, and obtaining a unique permit number. This permit must be displayed prominently at the place of business and referenced on all sales tax returns and correspondence.

Sales Tax Returns and Payment

Businesses are required to file sales tax returns periodically, usually on a monthly or quarterly basis, depending on their sales volume. These returns must be filed electronically through the New Jersey Online Tax Center or via paper forms for those with limited internet access.

Along with the return, businesses must remit the collected sales tax to the state. The payment can be made electronically, by check, or through other approved methods. Late payments and non-compliance can result in penalties and interest, so it's crucial to stay on top of the filing and payment deadlines.

Future Trends and Considerations

The sales tax landscape in New Jersey, like in many other states, is subject to ongoing changes and developments. Here are some key considerations for businesses and consumers looking ahead:

Sales Tax Automation

With the increasing complexity of sales tax regulations, many businesses are turning to sales tax automation software to streamline their compliance processes. These tools can automate sales tax calculation, filing, and reporting, reducing the risk of errors and ensuring timely compliance.

Online Sales and E-Commerce

The rise of e-commerce has presented unique challenges for sales tax collection. New Jersey, like other states, has implemented laws and regulations to ensure that online retailers collect and remit sales tax on transactions made within the state. Businesses engaged in online sales must stay updated on these regulations to avoid potential compliance issues.

Economic Development Initiatives

New Jersey continues to explore and implement economic development initiatives that may impact sales tax rates and incentives. Staying informed about these initiatives can help businesses and consumers understand the potential future changes and plan their financial strategies accordingly.

Conclusion: Navigating the Complexities

Understanding and navigating the sales tax landscape in New Jersey is a crucial aspect of doing business in the state. With its diverse sales tax rates, exemptions, and compliance requirements, staying informed and compliant is essential. By staying up-to-date with the latest regulations and utilizing tools like sales tax automation software, businesses can ensure they are meeting their sales tax obligations while optimizing their financial strategies.

FAQ

What is the sales tax rate in New Jersey for online purchases?

+

The sales tax rate for online purchases in New Jersey is the same as the rate in the jurisdiction where the goods are delivered or the services are provided. So, if you make an online purchase and have it delivered to an address in Atlantic City, you would pay the 9.125% sales tax rate, which includes both the state and local option tax.

Are there any special sales tax holidays in New Jersey?

+

Yes, New Jersey does have specific sales tax holidays. These holidays typically offer exemptions or reduced tax rates for certain items, such as clothing and school supplies. It’s important to stay updated on the specific dates and eligible items, as these holidays can provide significant savings for consumers.

How often do sales tax rates change in New Jersey?

+

Sales tax rates in New Jersey can change periodically, often as a result of legislative actions or local initiatives. While the state’s base rate of 6.625% has remained consistent for several years, local option tax rates can fluctuate more frequently. It’s advisable to periodically check the sales tax rates in your specific jurisdiction to stay informed.