Pay Montgomery County Property Tax

Montgomery County, located in the state of Texas, offers various methods for residents and property owners to pay their property taxes conveniently. Property taxes are an essential component of the local economy, contributing to the funding of essential services such as education, infrastructure, and public safety. In this comprehensive guide, we will delve into the different ways to pay Montgomery County property taxes, providing you with detailed instructions and insights to ensure a smooth and timely payment process.

Understanding Property Taxes in Montgomery County

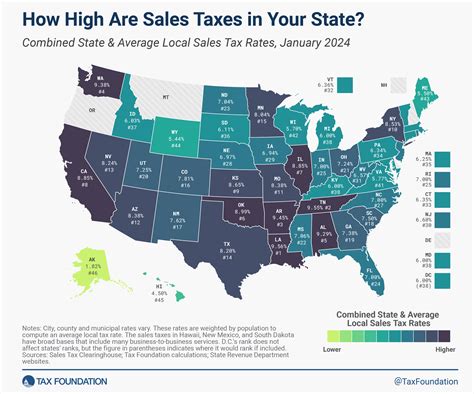

Property taxes in Montgomery County are determined by the appraised value of your property and the tax rates set by various taxing entities, including the county, school districts, and special districts. The tax rates can vary depending on the location and the services provided by these entities. Understanding your property's appraised value and the tax rates applicable to your area is crucial for budgeting and planning your tax payments.

The tax year in Montgomery County runs from January 1st to December 31st. The appraisal district is responsible for assessing the value of properties within the county, and the appraisal review board (ARB) handles any disputes or challenges to these appraisals. Once the values are finalized, the tax bills are generated and sent to property owners.

Online Payment Options

Montgomery County offers convenient online payment options for property taxes, providing flexibility and accessibility to taxpayers. Here are the detailed steps to pay your property taxes online:

Option 1: Montgomery County Tax Office Website

- Visit the official Montgomery County Tax Office website: https://www.mctx.org/964/Tax-Office.

- Navigate to the "Pay Taxes Online" section, which is usually located in the "Quick Links" or "Services" tab.

- You will be redirected to a secure payment portal. Select the "Property Tax Payment" option.

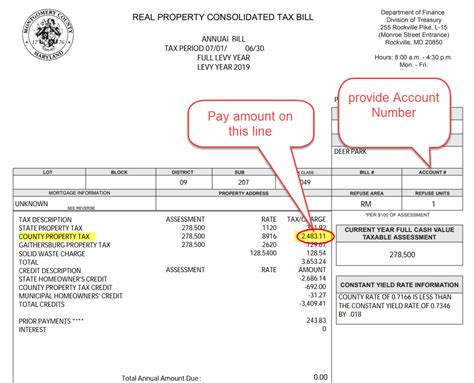

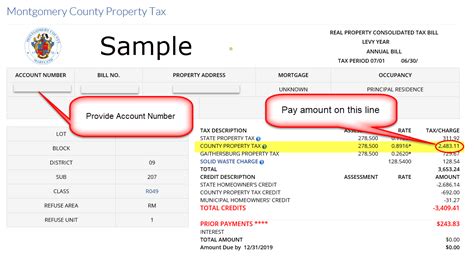

- Enter your Account Number or Property Address to access your tax information.

- Review your tax details, including the total amount due, penalties (if applicable), and any available discounts.

- Choose your preferred payment method, such as credit/debit card or electronic check (eCheck). Note that some payment methods may incur convenience fees.

- Enter your payment details and complete the transaction securely.

- You will receive a confirmation email or a printable receipt as proof of payment.

Option 2: Third-Party Payment Processors

In addition to the county's official website, Montgomery County also partners with third-party payment processors to offer alternative online payment options. These processors provide a user-friendly interface and additional payment methods, ensuring a seamless experience.

Here are the steps to pay your property taxes using a third-party processor:

- Visit the third-party payment processor's website, such as Official Payments or Pay.gov.

- Select "Property Taxes" or a similar option from the payment categories.

- Enter your Account Number, Property Address, or Taxpayer ID to locate your tax information.

- Review the payment details and choose your preferred payment method.

- Provide your payment information and complete the transaction securely.

- Save or print the confirmation or receipt provided by the payment processor.

Payment by Mail

If you prefer a traditional method, you can pay your Montgomery County property taxes by mailing a check or money order. Here's how to do it:

- Obtain the tax bill from the Montgomery County Tax Office or access it online.

- Make sure to include your Account Number or Property Address on the check or money order to ensure accurate processing.

- Send your payment, along with the remittance stub from your tax bill, to the following address:

Montgomery County Tax Office

P.O. Box 9007

Conroe, TX 77305

Payment in Person

For those who prefer face-to-face transactions, Montgomery County Tax Office provides in-person payment options at its main office and satellite locations. Here are the details:

Main Office

Location: 301 North Thompson Street, Conroe, TX 77301

Business Hours: Monday to Friday, 8:00 AM to 5:00 PM

Accepted Payment Methods: Cash, Check, Money Order, Debit Card, and Credit Card (Visa, MasterCard, Discover, and American Express)

Satellite Locations

Montgomery County Tax Office operates satellite offices in various locations to serve taxpayers conveniently. Here are the details for some of the satellite locations:

- Lake Conroe Office

Location: 20153 SH 105 West, Suite 100, Montgomery, TX 77356

Business Hours: Monday to Friday, 8:00 AM to 4:30 PM - South County Office

Location: 14206 W. State Highway 249, Suite 200, Tomball, TX 77375

Business Hours: Monday to Friday, 8:00 AM to 4:30 PM - Magnolia Office

Location: 18219 FM 1488, Suite 200, Magnolia, TX 77354

Business Hours: Monday to Friday, 8:00 AM to 4:30 PM

Important Dates and Deadlines

Understanding the key dates and deadlines for property tax payments is crucial to avoid penalties and late fees. Here are the important dates to keep in mind:

| Event | Date |

|---|---|

| Tax Year Begins | January 1st |

| Appraisal Notices Mailed | April 15th |

| Protest Deadline | May 15th |

| Tax Bills Mailed | October 1st |

| First Installment Due | January 31st |

| Second Installment Due | July 31st |

| Penalty Begins | February 1st |

| Late Payment Penalty | 1% per month or portion of a month, up to 12% |

Payment Discounts and Penalties

Montgomery County offers a 1% discount for early payments of the first installment of property taxes. This discount applies if the payment is received by the last business day in January. Additionally, a 3% discount is available if the entire year's taxes are paid in full by the last business day in February.

If you miss the payment deadlines, penalties will start accruing from February 1st onwards. The late payment penalty is 1% per month or portion of a month, up to a maximum of 12%. It's crucial to stay updated on these deadlines to avoid unnecessary penalties.

Payment Plans and Options

Montgomery County understands that paying property taxes in full can be a financial burden for some taxpayers. To provide flexibility, the county offers various payment plans and options:

Installment Payment Plans

Property owners can opt for an installment payment plan, which allows them to divide their tax payments into two installments. The first installment is due on January 31st, and the second installment is due on July 31st. This option helps taxpayers manage their finances more effectively.

Deferred Payment Agreements

For qualifying taxpayers who are experiencing financial hardship, Montgomery County offers deferred payment agreements. These agreements allow taxpayers to defer their property tax payments until a later date, providing temporary relief during challenging financial circumstances.

Payment by Credit Card

Montgomery County accepts credit card payments for property taxes. However, it's important to note that credit card payments may incur additional fees, which vary depending on the card type and the payment processor. Check the fee schedule provided by the tax office or the payment processor for accurate information.

Conclusion: Paying Montgomery County Property Taxes

Paying Montgomery County property taxes is a responsibility that contributes to the well-being of the community. With the various payment options available, taxpayers can choose the method that best suits their preferences and financial situation. Whether it's online, by mail, or in person, the process is designed to be efficient and user-friendly.

Remember to stay updated on important dates, take advantage of early payment discounts, and be mindful of potential penalties for late payments. By understanding the property tax system and utilizing the resources provided by the Montgomery County Tax Office, you can ensure a seamless and timely payment process.

Frequently Asked Questions

What happens if I don’t receive my tax bill by the due date?

+

If you do not receive your tax bill by the due date, you should contact the Montgomery County Tax Office immediately. They can provide you with a duplicate bill or assist you in making the necessary arrangements to avoid late payment penalties.

Can I pay my property taxes in installments without a formal plan?

+

Yes, you can pay your property taxes in two installments without a formal plan. The first installment is due on January 31st, and the second installment is due on July 31st. However, keep in mind that you may not be eligible for the early payment discounts if you choose this option.

Are there any alternatives to paying by check or money order in person?

+

Yes, if you prefer not to pay by check or money order in person, you can utilize the online payment options or third-party payment processors. These methods provide a secure and convenient way to pay your property taxes without physically visiting the tax office.

Can I make a partial payment for my property taxes?

+

Yes, you can make a partial payment for your property taxes. However, it’s important to note that partial payments are considered late payments and may be subject to penalties. It’s recommended to pay the full amount to avoid any additional fees.

How can I verify that my property tax payment has been received and processed?

+

You can verify your property tax payment by contacting the Montgomery County Tax Office. They can provide you with the payment status and confirm if your payment has been successfully received and processed. Additionally, if you paid online, you should receive a confirmation email or have access to a printable receipt.