Does Wyoming Have State Tax

Wyoming, a state known for its breathtaking landscapes and diverse economy, has a unique tax system that significantly impacts its residents and businesses. Unlike many other states in the U.S., Wyoming boasts a tax structure that is notably favorable to its taxpayers. Let's delve into the specifics of Wyoming's tax system and explore the implications for individuals and businesses within this dynamic state.

Wyoming’s State Tax: A Low-Tax Haven

Wyoming’s tax policy is characterized by its emphasis on low taxation, which has become a cornerstone of its economic strategy. The state operates without imposing a personal income tax, a key differentiator that makes it an attractive destination for individuals and businesses alike. This lack of income tax extends to all forms of income, including wages, salaries, and investment earnings, providing residents with a significant financial advantage.

In addition to the absence of an income tax, Wyoming also forgoes levying a corporate income tax. This means that businesses, whether established or newly formed, are not subjected to state-level corporate income taxes, creating an environment that fosters economic growth and attracts a diverse range of industries. Wyoming's tax structure is designed to encourage entrepreneurship and business expansion, contributing to its thriving business climate.

Sales and Use Tax in Wyoming

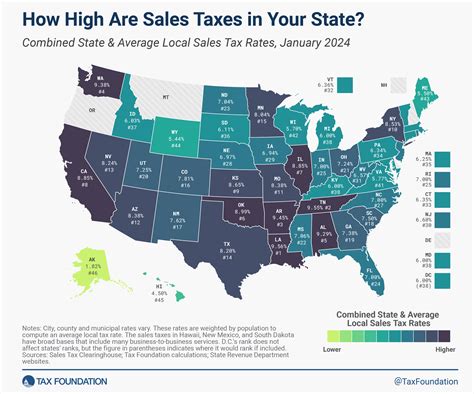

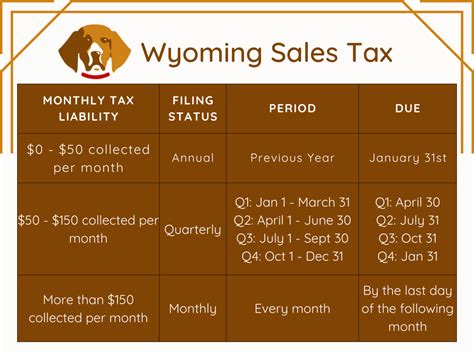

While Wyoming maintains a low-tax approach, it does impose a sales and use tax, which is a common revenue generator for many states. As of my last update in January 2023, the state’s sales and use tax rate stood at 4%, a relatively moderate rate compared to other states. This tax applies to various goods and services sold within the state, providing a steady stream of revenue for essential state services and infrastructure projects.

Wyoming's sales and use tax is administered by the Wyoming Department of Revenue, which ensures compliance and oversees the collection process. The tax is applied to retail sales, leases, and rentals of tangible personal property, as well as certain services. However, it's important to note that there are exemptions and special provisions within the sales tax laws, such as those related to food, prescription drugs, and certain agricultural equipment, which provide relief to specific sectors and individuals.

| Sales and Use Tax Rate | As of January 2023 |

|---|---|

| Wyoming | 4% |

The sales and use tax is an essential component of Wyoming's tax revenue, contributing to the state's ability to fund public services, education, and infrastructure development. Despite the low rate, Wyoming has successfully maintained a balanced budget and invested in critical areas, demonstrating the effectiveness of its tax strategy.

Property Tax in Wyoming

Property tax is another significant component of Wyoming’s tax system. The state relies on property taxes to fund local government services, including schools, fire protection, and other essential community functions. The property tax rates in Wyoming vary depending on the county and the specific tax district within each county.

The assessment and collection of property taxes are handled by the County Assessor's Office in each of Wyoming's 23 counties. These offices are responsible for determining the value of properties, which forms the basis for calculating the tax liability. Property owners in Wyoming can expect to pay taxes based on the assessed value of their real estate, including land and improvements such as buildings and structures.

While property tax rates can vary, Wyoming generally maintains lower property tax rates compared to many other states. This is partly due to the state's commitment to keeping taxes low and its efforts to attract residents and businesses. The combination of no personal or corporate income tax and relatively moderate property tax rates creates a favorable tax climate for property owners in Wyoming.

Wyoming’s Tax Incentives and Business Advantages

Wyoming’s tax structure is not only characterized by its low rates but also by its range of tax incentives and business advantages. These incentives are designed to promote economic development, encourage entrepreneurship, and attract new businesses to the state.

Business Tax Incentives

One of the key business tax incentives in Wyoming is the Enterprise Zone Program. This program offers reduced sales tax rates and property tax abatements to businesses that locate or expand within designated enterprise zones. These zones are typically in areas where economic development is a priority, and the incentives aim to stimulate job creation and investment.

Wyoming also offers tax incentives for specific industries, such as the Mineral Processing Tax Incentive, which provides a reduced sales tax rate for the processing of minerals within the state. This incentive aims to boost the state's mining industry and attract mineral processing businesses to Wyoming.

Additionally, the Wyoming Business Council provides various business development programs and grants, offering financial assistance and support to businesses that meet certain criteria. These programs further enhance Wyoming's appeal as a business-friendly state.

Individual Tax Incentives

Wyoming extends tax incentives to individuals as well. The Wyoming Saver’s Credit, for instance, provides a tax credit for contributions made to certain retirement plans, encouraging residents to save for their future. This credit applies to traditional IRAs, Roth IRAs, and certain employer-sponsored retirement plans.

Furthermore, Wyoming offers tax deductions for various expenses, including medical expenses, educational expenses, and certain charitable contributions. These deductions provide residents with opportunities to reduce their tax liabilities, making Wyoming an even more attractive place to live and work.

The Impact of Wyoming’s Tax Structure

Wyoming’s unique tax structure has had a profound impact on the state’s economy and its residents. By eliminating personal and corporate income taxes, Wyoming has created a highly competitive business environment that has attracted a diverse range of industries. This, in turn, has led to job creation, economic growth, and a thriving business climate.

For individuals, Wyoming's tax system offers significant financial benefits. The absence of income tax means residents can keep more of their earnings, providing them with greater financial flexibility and the opportunity to invest in their future. Additionally, the state's moderate sales and property tax rates ensure that the cost of living remains relatively affordable.

Wyoming's low-tax approach has also contributed to its reputation as a desirable place to retire. The state's tax-friendly environment, coupled with its natural beauty and outdoor recreational opportunities, makes it an attractive destination for retirees seeking a comfortable and financially advantageous lifestyle.

Conclusion

Wyoming’s tax system, characterized by its absence of personal and corporate income taxes, has positioned the state as a low-tax haven in the U.S. This strategy has proven effective in attracting businesses and individuals, contributing to economic growth and a thriving business climate. While Wyoming maintains a relatively low sales and use tax rate and moderate property taxes, its emphasis on tax incentives and a business-friendly environment further solidifies its appeal.

As Wyoming continues to leverage its tax advantages and strategic location, it is poised to remain a leader in economic development and a destination of choice for those seeking a favorable tax environment.

What is the primary source of tax revenue for Wyoming if it doesn’t have personal or corporate income taxes?

+Wyoming primarily relies on sales and use taxes, as well as property taxes, to generate tax revenue. The state’s low tax rates and strategic tax incentives contribute to a balanced budget and fund essential public services.

Are there any special tax provisions for certain industries in Wyoming?

+Yes, Wyoming offers specific tax incentives for industries such as mineral processing. The Mineral Processing Tax Incentive provides a reduced sales tax rate, making Wyoming an attractive location for mineral-related businesses.

How does Wyoming’s tax structure impact its reputation as a retirement destination?

+Wyoming’s tax-friendly environment, which includes the absence of income tax and moderate sales and property taxes, makes it an appealing retirement destination. Retirees can enjoy a comfortable lifestyle while keeping more of their savings intact.