How Do I Find My Real Estate Taxes

Determining your real estate taxes is a crucial aspect of property ownership, as these taxes contribute to the overall financial obligations associated with owning a home or commercial property. In this comprehensive guide, we will delve into the process of calculating real estate taxes, exploring the factors that influence these assessments and providing you with the tools to navigate this essential aspect of property ownership with confidence.

Understanding Real Estate Taxes

Real estate taxes, also known as property taxes, are a significant financial responsibility for property owners. These taxes are levied by local governments and are typically based on the assessed value of your property. Understanding how real estate taxes work is essential for effective financial planning and for ensuring compliance with local tax regulations.

The primary purpose of real estate taxes is to fund various public services and infrastructure within a community. These taxes contribute to the maintenance and improvement of local schools, roads, emergency services, and other essential public facilities. As a property owner, your real estate taxes play a vital role in supporting the development and well-being of your community.

Factors Influencing Real Estate Tax Assessments

The assessment of real estate taxes involves several key factors that determine the amount you will owe to local authorities. Here are some of the primary considerations:

Property Value

The most significant factor in real estate tax assessments is the value of your property. Local governments typically employ professional assessors who evaluate properties to determine their fair market value. This value is then used as the basis for calculating your tax liability.

| Property Type | Assessment Value |

|---|---|

| Residential Home | $500,000 |

| Commercial Building | $2,000,000 |

| Vacant Land | $150,000 |

It's important to note that property values can fluctuate over time due to market conditions, improvements made to the property, or changes in the surrounding area. Regular reassessments by local authorities ensure that tax assessments remain accurate and fair.

Tax Rates

The tax rate applied to your property’s assessed value is set by local governments and can vary significantly from one area to another. Tax rates are typically expressed as a percentage and are used to calculate the actual tax amount owed.

| Location | Tax Rate (%) |

|---|---|

| City A | 1.5% |

| Suburb B | 1.2% |

| Rural Area C | 0.8% |

Tax rates can be influenced by factors such as the need for additional revenue to fund specific projects or services, changes in local government budgets, or shifts in the local economy. It's essential to stay informed about tax rate changes in your area to accurately estimate your real estate tax obligations.

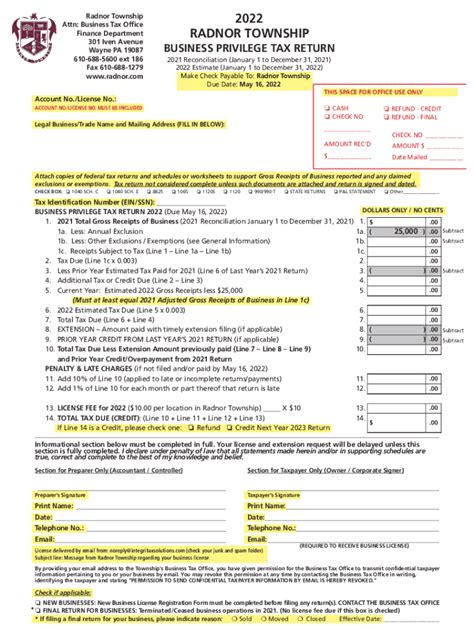

Exemptions and Deductions

Many jurisdictions offer exemptions and deductions that can reduce your real estate tax liability. These incentives are designed to provide relief to specific groups of taxpayers or to promote certain behaviors. Common exemptions and deductions include:

- Homestead Exemption: This exemption is often available to homeowners who use their property as their primary residence. It can significantly reduce the taxable value of your home, resulting in lower real estate taxes.

- Senior Citizen Discount: Some areas provide tax discounts or exemptions for senior citizens, helping them manage the financial burden of property ownership in their later years.

- Veteran Benefits: Veterans may be eligible for real estate tax exemptions or reduced rates as a way to recognize and support their service to the country.

- Green Energy Incentives: Properties with energy-efficient improvements or renewable energy systems may qualify for tax credits or deductions, encouraging environmentally friendly practices.

It's crucial to research the specific exemptions and deductions available in your area and ensure you meet the eligibility criteria to take advantage of these benefits.

Calculating Real Estate Taxes

Calculating your real estate taxes involves a straightforward formula: Property Value x Tax Rate = Real Estate Taxes. Let’s break down the steps to determine your tax liability:

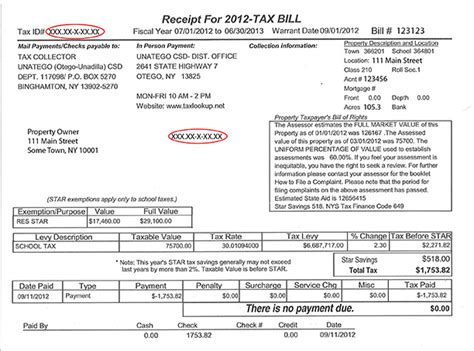

Step 1: Determine Your Property’s Assessed Value

The first step is to obtain the assessed value of your property. This information is typically available from your local tax assessor’s office or through an online property search tool provided by your municipality. The assessed value represents the estimated fair market value of your property and is used as the basis for tax calculations.

Step 2: Find Your Local Tax Rate

Next, you’ll need to determine the tax rate applicable to your property. Tax rates can vary not only between different jurisdictions but also within the same area based on the type of property and its location. Contact your local tax assessor’s office or visit their website to find the current tax rate for your property.

Step 3: Apply the Tax Rate to Your Property’s Value

Once you have both the assessed value of your property and the applicable tax rate, you can calculate your real estate taxes using the formula mentioned earlier. Multiply your property’s assessed value by the tax rate to determine your annual tax liability.

For example, if your property has an assessed value of $500,000 and the tax rate is 1.5%, your real estate taxes would be calculated as follows:

$500,000 x 0.015 = $7,500

In this case, your annual real estate tax liability would be $7,500.

Step 4: Consider Exemptions and Deductions

After calculating your initial tax liability, take into account any applicable exemptions or deductions that may reduce your tax burden. Research the specific exemptions available in your area and determine if you meet the criteria to qualify. Apply these reductions to your calculated tax amount to arrive at your final real estate tax obligation.

Staying Informed and Managing Your Real Estate Taxes

Keeping up-to-date with changes in tax assessments, rates, and exemptions is essential for effective financial planning and avoiding surprises. Here are some tips to help you manage your real estate taxes effectively:

- Stay Informed: Regularly check with your local tax assessor's office or visit their website to stay informed about any changes in tax assessments, rates, or exemptions. Sign up for email alerts or follow their social media accounts to receive updates.

- Understand Assessment Notices: When you receive a property assessment notice, carefully review it to ensure the information is accurate. If you disagree with the assessed value, you may have the right to appeal the assessment.

- Consider Professional Assistance: If you find the process of calculating real estate taxes complex or if you have a large or unique property, consider seeking assistance from a tax professional or real estate advisor. They can provide expert guidance and ensure your taxes are calculated accurately.

- Explore Payment Options: Many jurisdictions offer flexible payment plans or options for paying your real estate taxes. Explore these options to find a payment schedule that works best for your financial situation.

Future Implications and Considerations

Understanding real estate taxes and staying informed about changes in assessments and rates is crucial for effective financial planning and ensuring compliance with local regulations. As a property owner, being aware of your tax obligations and staying up-to-date with relevant information empowers you to make informed decisions and manage your financial responsibilities effectively.

Additionally, staying informed about tax exemptions and deductions can provide opportunities to reduce your tax burden. By taking advantage of available incentives, you can potentially lower your real estate tax liability and improve your overall financial situation. It's important to research and understand the specific exemptions and deductions applicable to your area and ensure you meet the eligibility criteria.

As real estate markets and local economies evolve, tax assessments and rates may undergo adjustments. Staying engaged with local government initiatives and proposed changes can help you anticipate potential impacts on your real estate taxes. Being proactive and staying informed enables you to plan and budget accordingly, ensuring a more stable financial outlook for your property ownership.

How often are real estate tax assessments conducted?

+Real estate tax assessments are typically conducted annually or biennially, depending on the jurisdiction. Local governments schedule assessment periods to ensure accurate and up-to-date tax calculations.

Can I appeal my property’s assessed value?

+Yes, if you believe your property’s assessed value is inaccurate, you have the right to appeal the assessment. The process varies by jurisdiction, but typically involves submitting an appeal to the local tax assessor’s office and providing supporting evidence to justify a lower valuation.

What happens if I don’t pay my real estate taxes on time?

+Failure to pay real estate taxes on time can result in penalties, interest charges, and potentially the loss of your property through a tax sale or foreclosure. It’s crucial to prioritize timely tax payments to avoid these consequences.