Marriage Tax Penalty

The concept of a marriage tax penalty has sparked considerable interest and debate among couples, tax experts, and policymakers alike. It refers to the potential financial disadvantage that some married couples may face when filing their taxes jointly compared to when they were single or filing separately. This penalty, though not always straightforward, can significantly impact a couple's tax liability and financial planning. Understanding its intricacies is crucial for couples to optimize their tax strategies and make informed decisions.

Unraveling the Marriage Tax Penalty

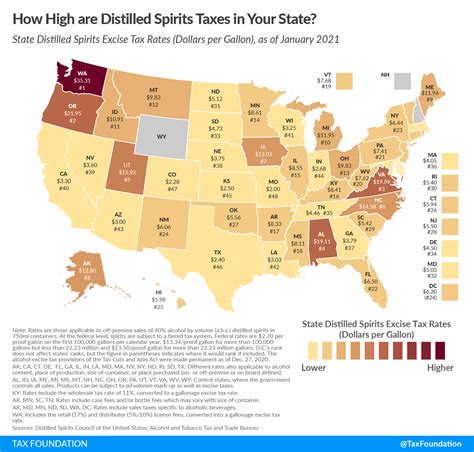

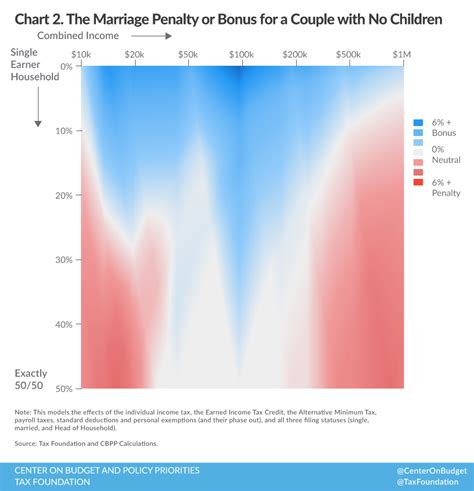

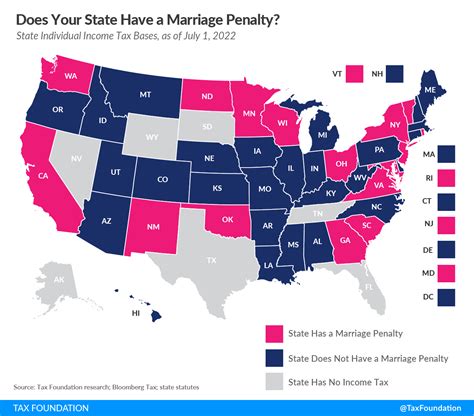

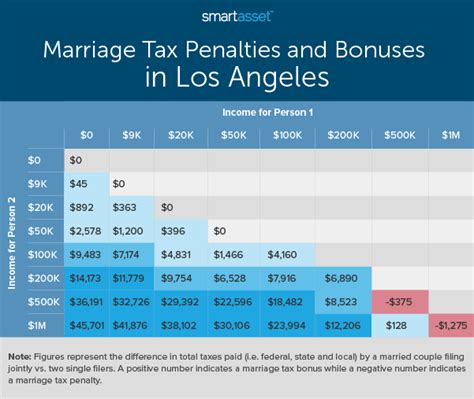

At its core, the marriage tax penalty arises from the progressive nature of the U.S. tax system, which imposes higher tax rates as income increases. When two individuals with disparate incomes marry and file jointly, their combined income may push them into a higher tax bracket, resulting in a higher tax bill than they would have incurred as single filers. This penalty is not a uniform phenomenon; its impact varies based on a multitude of factors, including the couple’s income levels, deductions, credits, and the specific tax laws in their state.

The marriage tax penalty is not a new concept. It has been a subject of debate and legislative reform for decades. The Tax Reform Act of 1986 aimed to address this issue by introducing a more uniform tax structure. However, the complexity of the tax code and the myriad of factors influencing tax liability have made it challenging to completely eradicate this penalty.

The Mechanics of the Marriage Tax Penalty

To understand the penalty, one must delve into the intricacies of the tax system. When couples file their taxes jointly, their incomes are combined and taxed at the higher-earning spouse’s marginal tax rate. This means that even if the lower-earning spouse has little or no income, the couple’s tax rate is determined by the higher income. In contrast, when individuals file separately, each spouse’s income is taxed at their respective marginal rate, potentially resulting in a lower overall tax burden.

| Filing Status | Marginal Tax Rate |

|---|---|

| Married Filing Jointly | Up to $197,900: 10% $197,900 - $441,450: 12% $441,450 - $518,400: 22% $518,400 - $628,300: 24% $628,300 - $736,950: 32% $736,950 - $1,710,500: 35% Over $1,710,500: 37% |

| Married Filing Separately | Up to $98,950: 10% $98,950 - $220,725: 12% $220,725 - $309,150: 22% $309,150 - $364,200: 24% $364,200 - $368,850: 32% $368,850 - $855,250: 35% Over $855,250: 37% |

For instance, consider a hypothetical couple where one spouse earns $100,000 and the other $50,000. If they were to file separately, each would be taxed at their respective marginal rates, resulting in a combined tax liability of approximately $22,000. However, when filing jointly, their combined income of $150,000 would push them into a higher tax bracket, potentially resulting in a tax bill of $24,000 or more, thus incurring a marriage tax penalty.

Real-World Impact and Mitigation Strategies

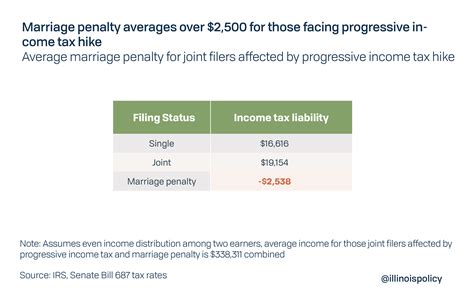

The marriage tax penalty is not a theoretical concept; it has real-world implications for countless couples. A 2021 study by the National Bureau of Economic Research estimated that about 1 in 5 married couples face a marriage tax penalty, with the average penalty amounting to $1,500 per year. This penalty can significantly impact a couple’s financial planning, especially for those with tight budgets or specific savings goals.

To mitigate this penalty, couples can employ various strategies. One approach is to consider filing as "married filing separately" if the income disparity is substantial. This option may reduce the tax burden, especially if one spouse has significantly higher income or deductions. However, this strategy may not be beneficial for all couples, as it can limit access to certain tax benefits and credits that are only available to joint filers.

Maximizing Deductions and Credits

Another effective strategy is to maximize deductions and credits. Couples can strategically allocate deductions, such as mortgage interest, state and local taxes, and charitable contributions, to reduce their taxable income. Additionally, taking advantage of tax credits, like the Child Tax Credit or the Earned Income Tax Credit, can further lower their tax liability. By carefully managing these deductions and credits, couples can often minimize or eliminate the marriage tax penalty.

For example, let's consider a couple where one spouse has significant student loan interest payments. By allocating this deduction to their tax return, they can reduce their taxable income and potentially avoid the higher tax bracket, thus minimizing the marriage tax penalty.

The Future of Marriage Tax Reform

The issue of the marriage tax penalty has not gone unnoticed by policymakers. In recent years, there have been efforts to reform the tax system to address this penalty. The Tax Cuts and Jobs Act of 2017, for instance, made significant changes to the tax code, including expanding tax brackets and increasing standard deductions. While these changes aimed to simplify the tax system and reduce the marriage tax penalty, the penalty still persists for certain income levels.

Looking forward, the future of marriage tax reform remains uncertain. Some policymakers advocate for a complete overhaul of the tax system, proposing a flat tax or a consumption-based tax system, which could eliminate the marriage tax penalty altogether. However, such drastic reforms face significant political and logistical challenges.

In the meantime, couples can stay informed about tax law changes and consult with tax professionals to ensure they are optimizing their tax strategies. Staying abreast of tax reforms and understanding the potential impact on their specific financial situation is crucial for effective tax planning.

Conclusion: Navigating the Complexities

The marriage tax penalty is a complex issue that requires careful consideration and strategic planning. While it can present a financial challenge for some couples, understanding the mechanics of the tax system and employing effective mitigation strategies can help minimize its impact. As the tax landscape continues to evolve, staying informed and proactive in tax planning is key to optimizing one’s financial position.

How can I calculate the marriage tax penalty for my situation?

+

To calculate the marriage tax penalty, you’ll need to determine your tax liability as a married couple filing jointly and compare it to your combined tax liability as single filers. This calculation can be complex, so it’s often best done with the help of a tax professional or tax software.

Are there any states where the marriage tax penalty doesn’t exist?

+

Yes, some states, like California, have a separate tax system that doesn’t recognize federal tax brackets. As a result, the marriage tax penalty is less of an issue in these states. However, it’s important to note that this doesn’t eliminate all tax complexities for married couples.

Can I change my filing status to avoid the marriage tax penalty?

+

Changing your filing status can be a strategy to mitigate the marriage tax penalty. However, it’s important to consider the potential loss of certain tax benefits that are only available to joint filers. It’s recommended to consult with a tax professional to determine the best filing status for your specific situation.