Ri Tax Refund Status

For Rhode Island residents, navigating the process of tracking the status of their tax refunds can be a complex journey. This guide aims to provide a comprehensive understanding of the steps involved in checking the progress of your RI tax refund and offers insights into the factors that influence refund timing. By delving into the specifics of the process, we hope to equip taxpayers with the knowledge they need to confidently monitor the status of their refunds and make informed decisions.

Understanding the RI Tax Refund Process

The journey of a tax refund in Rhode Island begins with the submission of your tax return. Once your return is filed, the Rhode Island Division of Taxation commences a meticulous review process to ensure accuracy and compliance with state tax regulations. This initial review stage can vary in duration, depending on the complexity of your return and the volume of submissions the division is handling at the time.

During this review, the Division of Taxation scrutinizes the information provided on your tax return, verifying the accuracy of your income, deductions, and credits. This process is vital to ensure that all taxpayers are treated fairly and that the state's revenue is collected and distributed appropriately.

Once the review is complete and your return is deemed accurate, the Division of Taxation proceeds to the refund processing stage. Here, they calculate the amount of your refund, taking into account any taxes paid in excess of your actual tax liability. This process involves complex calculations and may require additional time if there are adjustments or discrepancies that need to be addressed.

The timing of your refund is influenced by several factors, including the method of filing (electronic vs. paper returns), the complexity of your tax situation, and the overall volume of tax returns being processed by the Division of Taxation. Electronic returns are typically processed more quickly, as they can be reviewed and calculated automatically, whereas paper returns require manual data entry and review, which can take longer.

Factors Affecting RI Tax Refund Timing

The speed at where your tax refund is processed can be influenced by a variety of factors, some of which are outlined below:

- Filing Method: As mentioned, electronic filing generally results in quicker refund processing compared to paper returns.

- Return Complexity: Simple tax returns with straightforward income and deductions are typically processed faster than those with complex financial situations, multiple sources of income, or extensive deductions.

- Volume of Returns: The overall number of tax returns being processed by the Division of Taxation can impact the speed of your refund. During peak tax season, when a large volume of returns are being submitted, processing times may be longer.

- Refund Amount: In some cases, larger refund amounts may require additional review, which can prolong the processing time.

It's important to note that while these factors can influence the timing of your refund, the Division of Taxation strives to process returns as quickly and efficiently as possible while maintaining the integrity of the tax system. They understand the importance of timely refunds for taxpayers and work diligently to ensure that refunds are issued as promptly as circumstances allow.

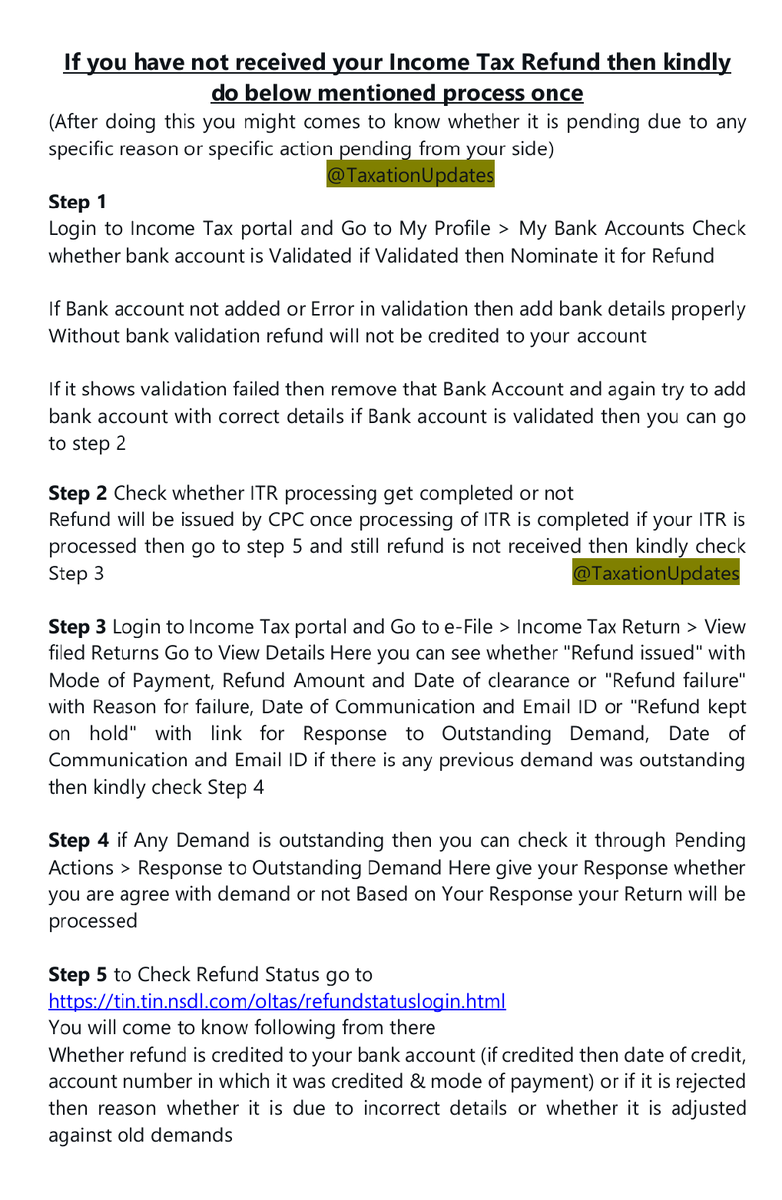

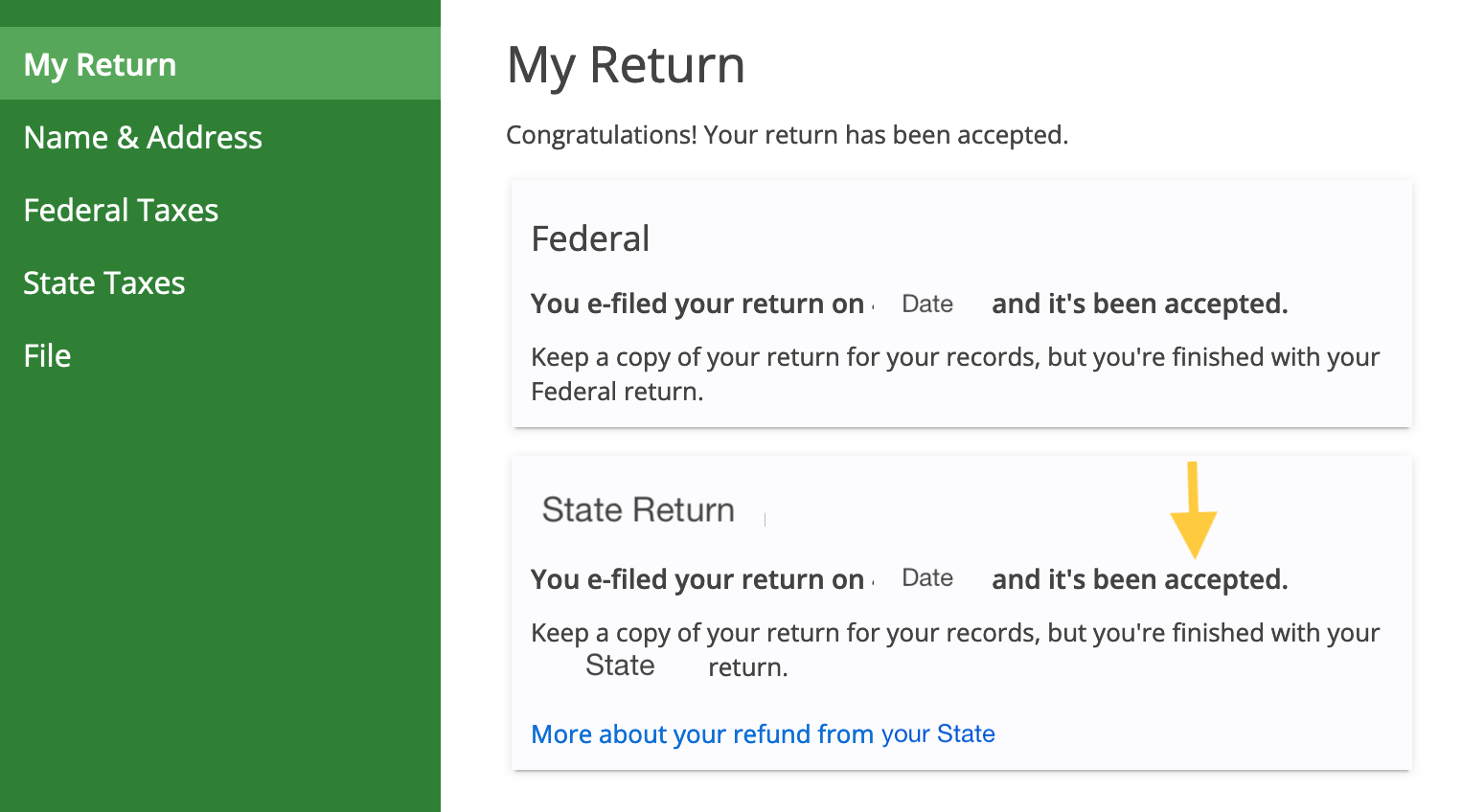

Checking Your RI Tax Refund Status

To check the status of your RI tax refund, the Rhode Island Division of Taxation offers several convenient options. These options provide taxpayers with real-time updates on the progress of their refund and help alleviate some of the uncertainty that often accompanies the refund process.

Online Refund Status Check

The most efficient way to check your refund status is by using the online refund status tool provided by the Rhode Island Division of Taxation. This tool is accessible through the division’s official website and offers a quick and secure way to track the progress of your refund.

To use this tool, you will need to provide some basic information, such as your Social Security Number, filing status, and the exact amount of your refund as shown on your return. This information is used to verify your identity and ensure that the refund status information is provided securely and accurately.

Once you have entered the required information, the online tool will display the current status of your refund. This status may indicate whether your return is still being processed, whether it has been approved and is awaiting payment, or if there are any issues or delays with your refund.

The online refund status tool is updated regularly, providing you with the most up-to-date information available. It is an invaluable resource for taxpayers, allowing them to stay informed and make any necessary adjustments to their financial plans while awaiting their refund.

Telephone Refund Inquiry

For those who prefer a more personal approach, the Rhode Island Division of Taxation also offers a telephone refund inquiry service. Taxpayers can call the division’s dedicated refund hotline to speak with a customer service representative who can provide information on the status of their refund.

When calling the hotline, be prepared to provide the same basic information as required for the online status check, including your Social Security Number, filing status, and the exact amount of your refund. This information helps the representative locate your refund status quickly and accurately.

The customer service representative will be able to provide you with an update on the progress of your refund and answer any general questions you may have about the refund process. However, due to the high volume of calls during peak tax season, you may experience longer wait times when using this method.

It's important to note that the telephone refund inquiry service is primarily intended for general inquiries and status updates. If your refund is delayed or there are issues with your return, the representative may not have the authority to resolve these issues over the phone. In such cases, you may be directed to speak with a tax specialist or provided with further instructions on how to proceed.

Common Issues and Delays with RI Tax Refunds

While the Rhode Island Division of Taxation works diligently to process tax refunds as quickly as possible, there are occasions when refunds may be delayed or held up. Understanding these potential issues can help taxpayers anticipate and address any problems that may arise.

Return Errors and Discrepancies

One of the most common causes of refund delays is errors or discrepancies on the tax return. These errors can range from simple mistakes, such as incorrect Social Security Numbers or math errors, to more complex issues like missing or incorrect documentation.

When the Division of Taxation identifies an error or discrepancy on a tax return, they may need to contact the taxpayer for additional information or documentation. This process can significantly delay the refund, as it requires manual intervention and communication between the taxpayer and the division.

To avoid delays due to errors, it is crucial to review your tax return carefully before submitting it. Double-check all personal information, income figures, and deductions to ensure accuracy. If you are unsure about any aspect of your return, consider seeking professional assistance or using tax preparation software that can help identify and correct potential errors.

Identity Verification and Fraud Prevention

With the increasing prevalence of identity theft and tax fraud, the Rhode Island Division of Taxation has implemented rigorous identity verification processes to protect taxpayers and ensure the integrity of the tax system.

In some cases, the division may require additional identity verification steps, such as providing a copy of your photo ID or completing a separate identity verification form. While these measures are necessary to prevent fraud and protect your refund, they can also lead to delays in processing your return and issuing your refund.

To expedite the identity verification process, it is important to respond promptly to any requests for additional information or documentation. Keep a close eye on your mail and email, and be prepared to provide the required documentation as soon as possible. By doing so, you can help minimize delays and ensure a smoother refund process.

Tips for a Smooth RI Tax Refund Experience

Navigating the tax refund process can be less stressful and more efficient by following these tips and best practices.

File Your Return Electronically

Electronic filing is not only faster and more convenient than filing a paper return, but it also reduces the risk of errors and discrepancies. When you file your return electronically, the software automatically calculates your tax liability and prepares the necessary forms, minimizing the chances of mathematical errors or incomplete information.

Additionally, electronic filing allows the Rhode Island Division of Taxation to process your return more quickly, as it can be reviewed and calculated automatically. This can result in a faster refund, allowing you to access your money sooner.

Choose Direct Deposit

When you are expecting a refund, consider opting for direct deposit instead of a paper check. Direct deposit is a more secure and efficient method of receiving your refund, as it eliminates the risk of checks being lost or stolen in the mail.

With direct deposit, your refund is electronically transferred into your bank account, typically within a few days of the refund being approved. This not only provides you with quicker access to your funds but also reduces the administrative burden on the Division of Taxation, allowing them to process refunds more efficiently.

Keep Accurate Records

Maintaining accurate and organized records is crucial throughout the tax season and beyond. Keep copies of your tax returns, supporting documentation, and any correspondence with the Rhode Island Division of Taxation in a safe and easily accessible location.

Accurate records can be invaluable if you need to reference your tax information in the future, such as when applying for a loan or resolving a tax issue. They can also help you quickly address any questions or concerns that may arise during the refund process, reducing the time and effort required to resolve potential issues.

Stay Informed

Staying informed about the latest tax news and updates can help you navigate the refund process more effectively. Keep an eye on official announcements and publications from the Rhode Island Division of Taxation, as well as reputable tax resources and news outlets.

Being aware of any changes to tax laws, refund processing procedures, or potential delays can help you anticipate and plan for any issues that may arise. It can also provide you with valuable insights into the factors that may influence the timing of your refund, allowing you to manage your finances more proactively.

| Key Takeaway | Action Item |

|---|---|

| Electronic Filing | File your tax return electronically to expedite processing and reduce errors. |

| Direct Deposit | Choose direct deposit for your refund to receive your funds faster and more securely. |

| Record Keeping | Maintain accurate and organized tax records to address any potential issues efficiently. |

| Stay Informed | Stay updated on tax news and announcements to anticipate potential delays and plan accordingly. |

How long does it typically take to receive my RI tax refund?

+The processing time for RI tax refunds can vary, but on average, it takes around 4 to 6 weeks from the date your return is received by the Division of Taxation. However, this timeframe can be influenced by factors such as the method of filing, the complexity of your return, and the overall volume of returns being processed.

What should I do if my refund is delayed or I receive a notice from the Division of Taxation?

+If your refund is delayed or you receive a notice from the Division of Taxation, it’s important to respond promptly. Carefully review the notice and gather any additional information or documentation that may be requested. Contact the Division of Taxation’s customer service or tax specialist to address any issues and resolve them as soon as possible.

Can I check the status of my RI tax refund by phone?

+Yes, you can check the status of your RI tax refund by calling the Division of Taxation’s refund hotline. Be prepared to provide your Social Security Number, filing status, and the exact amount of your refund as shown on your return. This information will help the customer service representative locate your refund status quickly.

What if I need help with a complex tax issue or have questions beyond the refund status?

+For complex tax issues or questions beyond the scope of refund status, it’s recommended to consult with a tax professional or accountant. They can provide personalized advice and guidance based on your specific circumstances and help you navigate any challenges or complexities you may encounter.