S.c. Sales Tax

Welcome to this comprehensive guide on the intricacies of Sales and Use Tax, commonly known as S.c. Sales Tax, in the United States. This complex tax system plays a crucial role in state and local revenue generation, impacting businesses and consumers alike. As we delve into this topic, we'll uncover the nuances, regulations, and strategies to navigate this essential aspect of commerce.

Understanding Sales and Use Tax

Sales and Use Tax, or S.c. Sales Tax, is a consumption tax levied on the sale of goods and services. It’s a vital source of revenue for state and local governments, with each state having its own unique set of rules and regulations. This tax is typically imposed at the point of sale and is collected by the seller, who then remits it to the appropriate tax authority.

The tax rate varies widely across states, with some states imposing a single rate while others have a multi-tiered system, applying different rates to different types of goods or services. Additionally, local jurisdictions within a state often have the authority to levy their own sales taxes, creating a complex web of tax rates and regulations.

For businesses, especially those operating across multiple states, managing S.c. Sales Tax obligations can be a daunting task. They must stay compliant with a multitude of tax laws, calculate and collect the correct tax amounts, and remit them accurately and timely. Failure to do so can result in costly penalties and legal consequences.

Key Components of S.c. Sales Tax

- Sales Tax Rate: The percentage of the sale price that is charged as tax. This rate can vary significantly, with some states having rates as low as 4% and others as high as 10% or more.

- Taxable Items: Not all goods and services are subject to sales tax. States typically have a list of exempt items, such as certain groceries, prescription drugs, and non-prepared food.

- Tax Collection and Remittance: Businesses are responsible for collecting the tax from customers and remitting it to the state. This process involves accurate record-keeping and regular reporting to tax authorities.

- Registration and Licensing: To collect and remit sales tax, businesses must obtain the necessary licenses and registrations from each state and local jurisdiction they operate in.

Compliance and Strategies for Businesses

Ensuring compliance with S.c. Sales Tax regulations is a complex and ongoing process for businesses. Here are some key strategies and considerations:

Sales Tax Registration

Every business selling taxable goods or services must register with the appropriate state and local tax authorities. This registration process varies by state and often involves providing detailed information about the business, its location(s), and the nature of its sales.

| State | Registration Requirements |

|---|---|

| California | Online registration, providing business details, and obtaining a Seller's Permit. |

| Texas | Completion of the Combined Application for Tax Permits, including Sales and Use Tax. |

| New York | Registering through the New York State Department of Taxation and Finance, with specific requirements for online sellers. |

Tax Rate Determination

Determining the correct tax rate is crucial. Businesses must consider not only the state sales tax rate but also any applicable local or municipal taxes. This can be a complex task, especially for businesses with multiple locations or online sales.

To ensure accuracy, businesses often utilize tax rate lookup tools or work with tax professionals who specialize in sales tax. These experts can provide guidance on the latest tax rate changes and help businesses avoid undercharging or overcharging customers.

Sales Tax Calculation and Collection

Calculating sales tax accurately involves applying the correct rate to the taxable portion of a sale. This process can be automated through the use of sales tax software, which integrates with a business’s accounting and e-commerce systems.

Once calculated, the sales tax is collected from the customer at the point of sale. This can be done through various methods, including adding the tax to the purchase price or displaying it separately on the receipt.

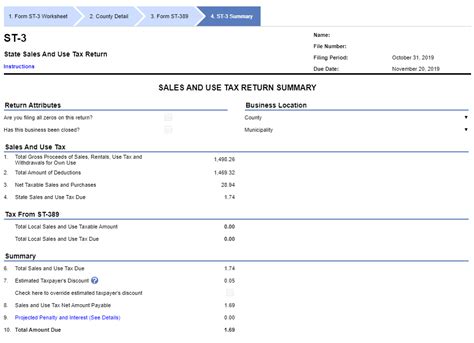

Remittance and Reporting

Remitting the collected sales tax to the appropriate tax authority is a critical responsibility for businesses. This involves regular reporting, typically on a monthly or quarterly basis, and submitting the tax payments along with the necessary documentation.

Businesses must also keep detailed records of their sales transactions, including the tax collected, to ensure they can provide accurate reports and respond to any audits or inquiries from tax authorities.

Impact on Consumers

While S.c. Sales Tax is a business responsibility, it directly affects consumers as well. The tax adds to the cost of goods and services, influencing purchasing decisions and consumer behavior.

Tax Inclusion vs. Exclusion

When making a purchase, consumers may encounter sales tax displayed as a separate line item on their receipt or included in the advertised price. This distinction, known as tax-inclusive vs. tax-exclusive pricing, can impact how consumers perceive the cost of an item.

Tax-inclusive pricing includes the sales tax in the advertised price, providing a more straightforward understanding of the total cost. Tax-exclusive pricing, on the other hand, requires consumers to calculate the tax separately, which can make price comparisons more complex.

Online Shopping and Sales Tax

With the rise of e-commerce, online shopping has become a significant aspect of consumer behavior. The treatment of sales tax for online purchases can vary, depending on the seller’s location, the buyer’s location, and the nature of the goods being sold.

In many cases, online sellers are required to collect and remit sales tax based on the buyer's shipping address. This means that consumers may encounter varying sales tax rates depending on where they live and where the seller is located.

Challenges and Future Implications

The landscape of S.c. Sales Tax is constantly evolving, presenting both challenges and opportunities for businesses and consumers.

Economic Impact and Revenue Generation

Sales tax is a significant source of revenue for state and local governments, funding essential services and infrastructure. However, the economic impact of sales tax can be complex, with debates around its fairness and efficiency.

Critics argue that sales tax disproportionately affects lower-income individuals, as they tend to spend a larger portion of their income on taxable goods. This has led to discussions about the need for tax reform and alternative revenue streams.

Technological Advances and E-Commerce

The rise of e-commerce has brought new challenges and opportunities for sales tax. Online sellers must navigate a complex web of state and local tax laws, often requiring specialized software and expertise to ensure compliance.

Additionally, the growth of online marketplaces and third-party sellers has further complicated sales tax collection. States are increasingly focusing on these platforms to ensure that sales tax is collected and remitted accurately, even for small-scale sellers.

Tax Policy and Reform

The complexity and variability of sales tax rates and regulations have led to calls for tax reform. Some states have considered simplifying their tax structures or implementing a uniform sales tax rate across the board.

Furthermore, discussions around the introduction of a national sales tax or a value-added tax (VAT) have gained traction, with proponents arguing for a more streamlined and efficient tax system.

Conclusion

S.c. Sales Tax is a critical component of the U.S. tax system, playing a significant role in state and local revenue generation. For businesses, compliance with sales tax regulations is essential, requiring careful planning, accurate record-keeping, and the use of specialized tools and expertise.

As the landscape of sales tax continues to evolve, staying informed and adapting to changing regulations is crucial. Whether it's navigating the complexities of online sales tax or keeping up with tax policy reforms, businesses and consumers alike must stay vigilant to ensure compliance and make informed decisions.

How often do businesses need to remit sales tax payments to tax authorities?

+The frequency of sales tax payments can vary by state and the size of the business. Typically, businesses remit sales tax on a monthly or quarterly basis. Larger businesses with significant sales volumes may be required to remit more frequently, such as weekly or bi-weekly.

Are there any exceptions to sales tax collection for certain types of businesses or transactions?

+Yes, there are various exceptions and exemptions to sales tax collection. These can include sales to government entities, non-profit organizations, or sales of certain types of goods, such as prescription drugs or educational materials. It’s crucial for businesses to understand the specific exemptions that apply to their industry and location.

What happens if a business fails to collect and remit sales tax accurately?

+Failing to collect and remit sales tax accurately can result in significant penalties and interest charges. In some cases, businesses may also face legal consequences, including fines or even criminal charges for tax evasion. It’s essential for businesses to maintain accurate records and seek professional advice to ensure compliance.