Additional Medicare Tax

The Additional Medicare Tax, often referred to as the AMT, is a supplementary tax levied on certain high-income individuals in the United States to help fund the Medicare program. This tax is a critical component of the healthcare system, ensuring that those with higher earnings contribute proportionally more to sustain the essential healthcare services provided by Medicare.

As healthcare costs continue to rise, understanding the Additional Medicare Tax is crucial for both taxpayers and healthcare professionals. This article aims to provide an in-depth exploration of the AMT, its purpose, calculation, implications, and its role in shaping the future of healthcare financing.

Understanding the Additional Medicare Tax

The Additional Medicare Tax is an income-based levy that was introduced as part of the Health Care and Education Reconciliation Act of 2010. Its primary objective is to address the growing financial demands on the Medicare program, particularly with an aging population and escalating healthcare expenses.

Unlike the standard Medicare tax, which is typically deducted from payroll and applies to earned income up to a certain threshold, the AMT targets individuals with higher incomes. It aims to ensure that those who can afford to contribute more to the healthcare system do so, thereby spreading the financial burden more equitably.

The AMT is a 0.9% surtax applied to a portion of an individual's earnings. It is designed to impact only a specific income bracket, leaving most taxpayers unaffected. However, for those with substantial earnings, the AMT can significantly increase their overall tax liability.

Who Pays the Additional Medicare Tax?

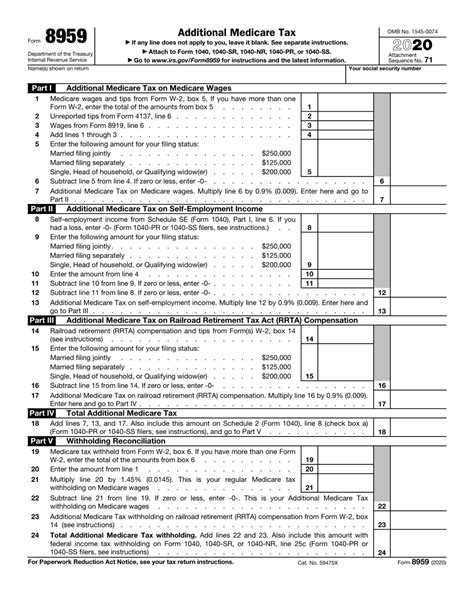

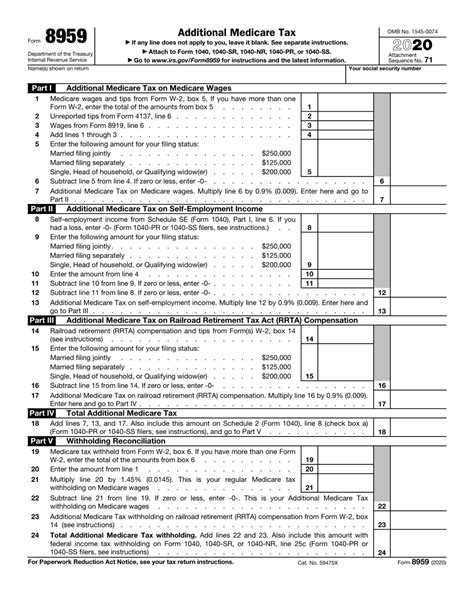

The AMT is applicable to individuals whose modified adjusted gross income (MAGI) exceeds certain thresholds. These thresholds are adjusted annually to account for inflation. For tax year 2023, the thresholds are as follows:

| Filing Status | Threshold Amount |

|---|---|

| Single or Head of Household | $200,000 |

| Married Filing Jointly | $250,000 |

| Married Filing Separately | $125,000 |

It's important to note that the AMT is a self-employment tax for individuals who work for themselves. Self-employed individuals must calculate their AMT liability separately from their regular income tax obligations.

Calculation of the Additional Medicare Tax

The calculation of the AMT involves several steps. First, the taxpayer’s modified adjusted gross income (MAGI) is determined. This is the income used to assess eligibility for the AMT and is calculated by adding back certain deductions and exclusions to the adjusted gross income.

Once the MAGI is established, it is compared to the applicable threshold for the taxpayer's filing status. If the MAGI exceeds the threshold, the AMT applies. The tax is then calculated as follows:

- For single filers and heads of household: 0.9% of the amount over $200,000.

- For married filing jointly: 0.9% of the amount over $250,000.

- For married filing separately: 0.9% of the amount over $125,000.

It's worth mentioning that the AMT is not calculated on the entire income but only on the portion that exceeds the threshold. This means that not all of an individual's income is subject to the AMT, which is a critical distinction from the regular income tax.

Impact and Implications

The Additional Medicare Tax has several significant implications for both taxpayers and the healthcare system. For taxpayers, it can represent a substantial increase in their tax liability, especially for those with incomes just above the threshold. These individuals may need to adjust their financial planning and strategies to account for this additional tax.

For the healthcare system, the AMT is a vital source of funding, ensuring that Medicare remains financially stable and can continue providing quality healthcare services to seniors and individuals with disabilities. The revenue generated from the AMT helps cover the rising costs of medical care, prescription drugs, and other essential healthcare services.

The Role of the Additional Medicare Tax in Healthcare Financing

The AMT plays a crucial role in shaping the future of healthcare financing in the United States. As healthcare costs continue to rise, finding sustainable funding sources is essential to maintain the quality and accessibility of healthcare services.

Addressing Healthcare Cost Inflation

Healthcare costs have been rising steadily, driven by factors such as technological advancements, an aging population, and the increasing prevalence of chronic diseases. The AMT provides a dedicated funding stream to help offset these rising costs. By targeting higher-income individuals, the tax ensures that those who can afford it contribute more to sustain the healthcare system.

Equitable Distribution of Healthcare Costs

The AMT aims to distribute the financial burden of healthcare more fairly. While the standard Medicare tax applies to a broader income range, the AMT specifically targets higher earners. This approach ensures that individuals with greater financial means contribute proportionally more to the healthcare system, creating a more equitable distribution of costs.

Funding Innovation and Research

The revenue generated from the AMT not only helps maintain existing healthcare services but also supports innovation and research. A portion of the funds goes towards developing new treatments, technologies, and medications, which can lead to improved patient outcomes and more efficient healthcare delivery.

Impact on Healthcare Accessibility

By providing a stable funding source for Medicare, the AMT indirectly contributes to improving healthcare accessibility. With sufficient funding, Medicare can continue offering essential healthcare services to its beneficiaries, ensuring that seniors and individuals with disabilities have access to the care they need.

Future Considerations and Potential Changes

As the healthcare landscape continues to evolve, so too may the Additional Medicare Tax. Here are some potential future considerations:

Adjusting Thresholds and Rates

The AMT thresholds and rates are subject to annual adjustments to account for inflation. However, future changes could involve more significant adjustments to reflect changes in the cost of living or shifts in the income distribution of the population.

Expanding the Scope of the AMT

While the AMT currently targets individuals with higher incomes, future considerations may involve expanding its scope. This could include extending the tax to other forms of income or adjusting the thresholds to capture a broader range of taxpayers.

Integration with Other Healthcare Financing Mechanisms

The AMT could potentially be integrated with other healthcare financing mechanisms, such as value-based payment models or healthcare reform initiatives. This integration could enhance the efficiency and effectiveness of healthcare financing, ensuring that resources are allocated optimally.

Conclusion

The Additional Medicare Tax is a critical component of the healthcare financing system in the United States. By targeting higher-income individuals, it ensures that those who can afford it contribute more to sustain the Medicare program. This tax plays a vital role in addressing the rising costs of healthcare, distributing the financial burden equitably, and supporting innovation and research.

As the healthcare landscape evolves, the AMT will continue to adapt, potentially undergoing changes in thresholds, rates, and scope. These adaptations will be crucial in ensuring the long-term sustainability of the healthcare system and its ability to meet the needs of an aging and increasingly diverse population.

How does the Additional Medicare Tax differ from the regular Medicare tax?

+The regular Medicare tax is deducted from payroll and applies to earned income up to a certain threshold. The Additional Medicare Tax, on the other hand, is a supplementary tax that applies to higher incomes, targeting individuals with modified adjusted gross income (MAGI) above specific thresholds.

What happens if my income exceeds the AMT threshold?

+If your income exceeds the AMT threshold, you will be subject to the 0.9% surtax on the portion of your income that exceeds the threshold. This additional tax will increase your overall tax liability for the year.

How can I calculate my potential Additional Medicare Tax liability?

+To calculate your AMT liability, you need to determine your modified adjusted gross income (MAGI) and compare it to the applicable threshold for your filing status. If your MAGI exceeds the threshold, you calculate the AMT by applying the 0.9% rate to the amount over the threshold.

Are there any strategies to reduce my Additional Medicare Tax liability?

+Reducing your AMT liability may involve tax planning strategies such as maximizing deductions and contributions to tax-advantaged accounts. Consulting with a tax professional can provide personalized advice based on your specific financial situation.