Jersey City Taxes

Welcome to this comprehensive guide on Jersey City taxes, where we delve into the intricacies of the taxation system in this vibrant urban center. As one of the most densely populated cities in the United States, Jersey City boasts a diverse population and a thriving economy, making its tax landscape an intriguing subject for exploration. In this article, we will navigate through the various tax structures, rates, and regulations that shape the financial landscape of Jersey City, offering valuable insights for residents, businesses, and those considering relocation.

Understanding the Tax Landscape of Jersey City

Jersey City’s tax system is a complex interplay of local, state, and federal regulations, each with its own set of rules and rates. From property taxes to income taxes and sales taxes, understanding these components is essential for making informed financial decisions.

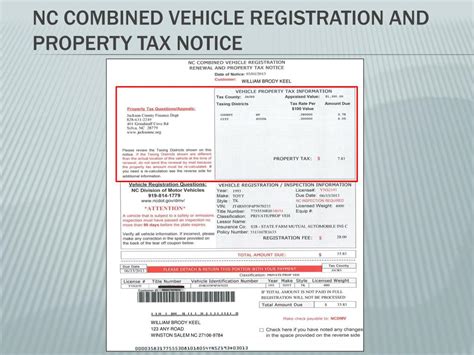

Property Taxes: A Significant Component

Property taxes are a substantial part of the tax burden for residents and businesses in Jersey City. With one of the highest property tax rates in the nation, it is crucial to delve into the specifics of this tax structure. The city’s property tax rate is influenced by various factors, including the assessed value of the property, the budget needs of local governments, and the distribution of tax revenue among different municipalities.

| Tax Rate Category | Rate (%) |

|---|---|

| Residential Property Tax | 2.65 |

| Commercial Property Tax | 3.10 |

| Industrial Property Tax | 3.35 |

Jersey City’s property tax system is administered by the Jersey City Tax Assessor’s Office, which is responsible for assessing the value of properties and ensuring fair and equitable taxation. Property owners can access their tax assessment information online, making the process more transparent and convenient.

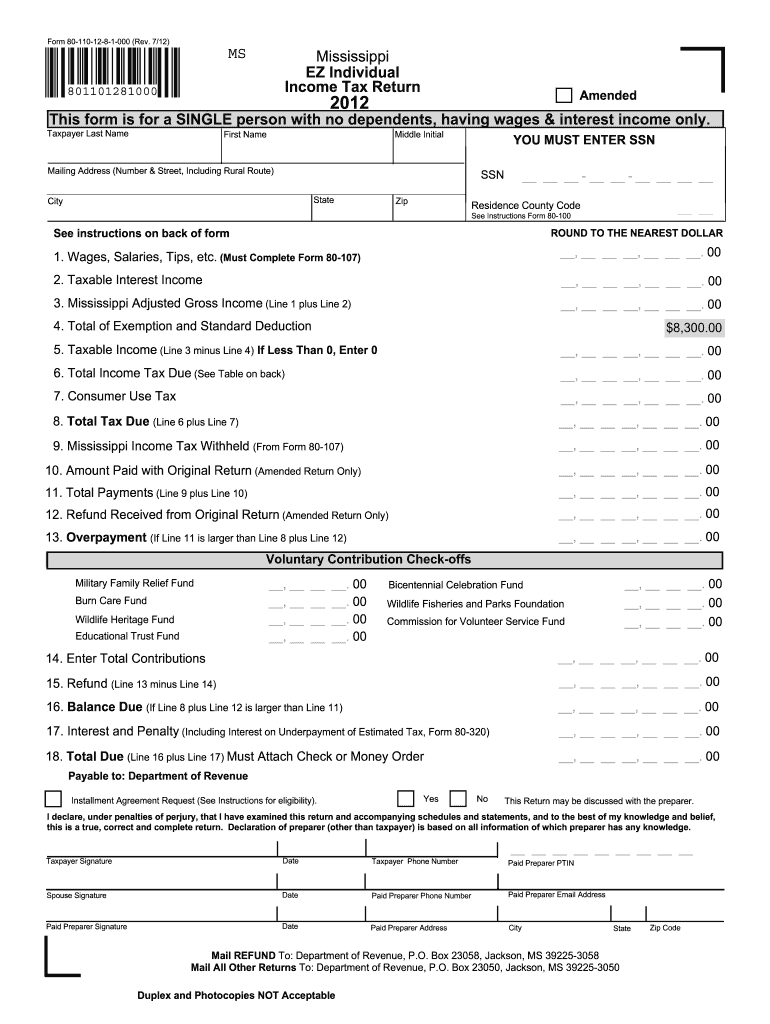

Income Taxes: Navigating the Local and State Landscape

Jersey City residents and businesses also navigate the complexities of income taxes. The city’s income tax structure is influenced by both local and state regulations, creating a unique tax environment.

On the local level, Jersey City imposes a 3% income tax on residents and businesses operating within its borders. This tax applies to various forms of income, including wages, salaries, commissions, and net profits from business activities. Non-residents working in Jersey City are also subject to this tax, adding an extra layer of complexity.

At the state level, New Jersey has a progressive income tax system with marginal tax rates ranging from 1.4% to 10.75%. This means that as income increases, so does the tax rate. The state’s income tax brackets and rates are adjusted annually, reflecting the changing economic landscape.

For businesses, Jersey City offers a range of tax incentives and programs aimed at promoting economic growth and job creation. These initiatives can significantly impact the tax obligations of businesses, making them an essential consideration for entrepreneurs and investors.

Sales and Use Taxes: Consumer Considerations

Jersey City, like the rest of New Jersey, imposes a sales and use tax on the sale of tangible personal property and certain services. The current sales tax rate in the city is 6.625%, which includes the state’s base rate of 6.625% and a local tax rate of 0%. This tax is applied to most retail sales, with certain exemptions and special provisions for specific goods and services.

For online retailers, Jersey City’s sales tax obligations extend to remote sellers. The city has implemented a Marketplace Facilitator Law, requiring online marketplaces and remote sellers to collect and remit sales tax on behalf of their third-party sellers. This law ensures a level playing field for local businesses and promotes fair competition.

In addition to sales tax, Jersey City also imposes a use tax on the storage, use, or consumption of tangible personal property purchased from out-of-state retailers. This tax is designed to prevent tax evasion and ensure a fair tax burden for all consumers, regardless of where they make their purchases.

Tax Strategies and Considerations for Residents and Businesses

Navigating the tax landscape of Jersey City requires a strategic approach. For residents, understanding the implications of property taxes, income taxes, and sales taxes is essential for effective financial planning. Utilizing tax deductions, credits, and abatements can significantly reduce tax obligations, making it crucial to stay informed about available options.

Businesses, on the other hand, face a unique set of tax considerations. From choosing the right business structure to optimizing tax incentives, there are numerous strategies to minimize tax liabilities. Staying abreast of local and state tax regulations, as well as utilizing professional tax advice, is crucial for businesses operating in Jersey City.

Case Study: Tax Implications for a Growing Business

Consider the example of TechGenius Inc., a software development firm based in Jersey City. As the company experienced rapid growth, its tax obligations became a critical consideration. By working closely with tax professionals, TechGenius was able to navigate the city’s tax landscape strategically.

The company utilized tax incentives offered by the city and state, such as the Grow New Jersey Assistance Program, which provided significant tax credits for creating new jobs and investing in the community. Additionally, TechGenius optimized its tax obligations by carefully selecting its business structure, opting for an S-Corporation, which offered tax advantages for small businesses.

Through strategic tax planning, TechGenius not only minimized its tax liabilities but also contributed to the local economy, creating jobs and driving economic growth. This case study highlights the importance of understanding the tax landscape and leveraging available resources to achieve financial success.

Conclusion: A Complex but Navigable Tax Landscape

Jersey City’s tax system is a multifaceted and dynamic entity, influenced by a multitude of factors. From property taxes to income taxes and sales taxes, each component has its own set of regulations and rates. While the city’s tax landscape may appear complex, with the right knowledge and strategies, residents and businesses can effectively navigate these waters.

This guide has provided a comprehensive overview of Jersey City taxes, offering valuable insights and considerations for those living, working, or investing in the city. By staying informed and utilizing the available resources, individuals and businesses can make informed financial decisions, ensuring their prosperity in this vibrant urban center.

What is the current property tax rate in Jersey City?

+

The current property tax rate in Jersey City is 2.65% for residential properties, 3.10% for commercial properties, and 3.35% for industrial properties.

Are there any tax incentives or abatements available for businesses in Jersey City?

+

Yes, Jersey City offers a range of tax incentives and programs to promote economic growth. These include the Grow New Jersey Assistance Program, which provides tax credits for job creation and investment.

How does the sales tax rate in Jersey City compare to other cities in New Jersey?

+

The sales tax rate in Jersey City is 6.625%, which is the standard rate for New Jersey. However, some municipalities may have additional local taxes, so it’s important to check the specific rate for each city.

Are there any tax deductions or credits available for Jersey City residents?

+

Yes, Jersey City residents may be eligible for various tax deductions and credits, such as the Homestead Rebate Program, which provides a rebate on property taxes for eligible homeowners.

How can businesses optimize their tax obligations in Jersey City?

+

Businesses can optimize their tax obligations by staying informed about local and state tax regulations, utilizing tax incentives and abatements, and seeking professional tax advice to ensure compliance and minimize liabilities.