What Changes Are Coming to the New Mexico Tax Rate?

The shifting landscape of taxation in New Mexico is akin to navigating a complex maze that evolves with each turn. As state policymakers juggle revenue needs with economic growth ambitions, the upcoming changes to the New Mexico tax rate serve as a pivotal compass, guiding both residents and businesses through these transformations. To fully grasp these developments, it’s helpful to view the state’s tax policy as a living organism—constantly adapting, influenced by fiscal pressures, political priorities, and economic realities. This analogy not only clarifies the mechanics behind tax rate modifications but also illuminates their broader implications on the state's economy, social programs, and individual taxpayers.

Understanding the Foundations of New Mexico’s Tax System

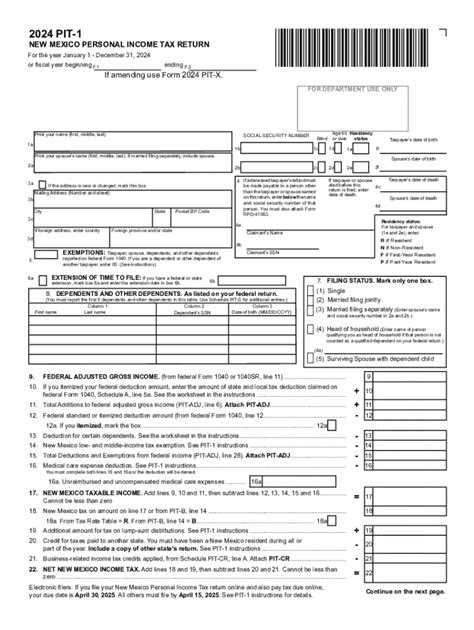

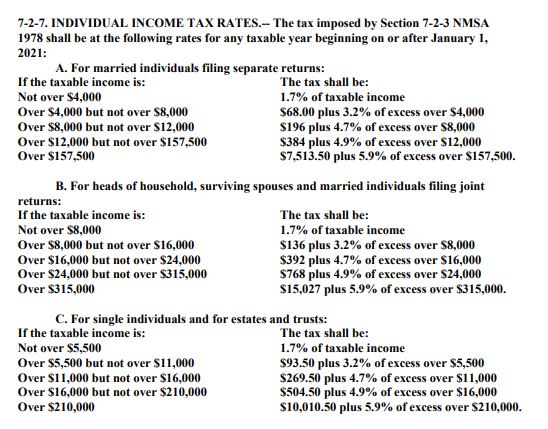

Before delving into the upcoming changes, it is essential to establish a clear understanding of New Mexico’s existing tax framework. Historically, the state has relied on a blend of income, gross receipts, and corporate taxes to fund its operations. Among these, the personal income tax has been a primary revenue source, with progressive rates designed to ensure that higher earners contribute proportionally more. Meanwhile, sales and gross receipt taxes provide a significant stream of revenue generated from consumer spending. This multifaceted system has functioned as a dynamic engine—much like a well-oiled machine—adjusted over decades to meet shifting fiscal demands and economic trends.

The Evolution of Tax Policy: From Past to Present

Tax policy evolution in New Mexico bears resemblance to a garden’s growth cycle. Initially, the state maintained relatively low rates to attract new residents and businesses. Over time, as public services expanded and economic challenges emerged—such as funding education, healthcare, and infrastructure—the state incrementally increased its tax thresholds and rates. Notably, in recent years, discussions surrounding tax cuts versus increases have reflected broader political debates, mirroring the delicate balance required in tending a garden—where too much fertilization can hinder growth, while too little can stunt development.

The 2019 Tax Reform Legislation: A Turning Point

One of the most significant shifts occurred in 2019, when New Mexico enacted broad tax reform measures intended to simplify the system and address disparities. The reform included lowering certain income tax rates and broadening the tax base, with a focus on reducing regressivity. It acted as a pruning process—removing some of the overgrowth that complicated compliance and fairness—aiming to stimulate economic activity while maintaining fiscal sustainability. Understanding this historical context is key to predicting future modifications and their justifications.

| Relevant Category | Substantive Data |

|---|---|

| State Income Tax Rates (Pre-Reform) | Progressed from 1.7% to 4.9% over multiple brackets |

| 2019 Tax Reform Impact | Lowered top rate from 4.9% to 4.9% (flattened), widened brackets, increased standard deduction |

| Current Budget Shortfall | Approximately $1.2 billion projected deficit for FY 2024 based on recent fiscal reports |

Projected Changes to the New Mexico Tax Rate: What’s on the Horizon?

As state legislators convene amid mounting financial pressures, predictions suggest a series of strategic modifications targeting the existing tax structure. These changes are comparable to a chef altering a recipe—adding ingredients to enhance flavor, removing elements that spoil the dish, and adjusting proportions to suit the desired outcome. Key proposals include increases in income tax brackets for high earners, tightening of exemptions, and potential adjustments to sales tax thresholds. Each modification reflects an attempt to recalibrate the state’s fiscal balance amid evolving economic realities.

Proposed Increases in Top Income Tax Brackets

The most prominent proposal involves escalating the top-tier income tax rate from 4.9% to possibly around 6.0%. This policy shift aims to generate additional revenue from the wealthiest residents, who represent a relatively small segment but contribute significantly to state coffers—akin to an orchard owner harvesting a higher percentage during surplus seasons. Data from fiscal analyses indicate that such a move could raise an estimated $250 million annually, providing crucial funds for public education, healthcare, and infrastructure projects.

| Relevant Category | Substantive Data |

|---|---|

| Projected Revenue Increase | Approximately $250 million annually from top income earners |

| Number of taxpayers affected | Estimated 3,000 filers with income above $150,000 |

| Implementation Timeline | Potential legislative approval in the upcoming session, effective FY 2025 |

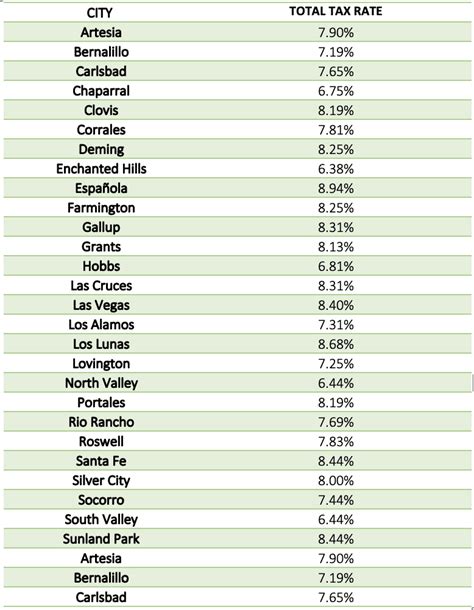

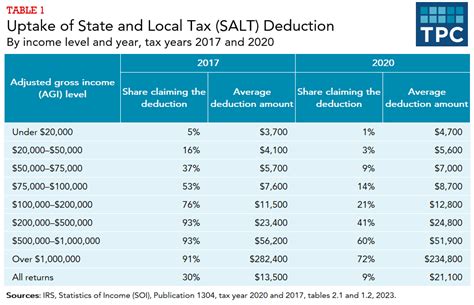

Sales and Gross Receipts Tax Adjustments

Alongside income tax revisions, authorities are considering a recalibration of sales and gross receipts taxes. This could involve narrowing exemptions for certain goods or services, pushing the overall sales tax rate slightly upward—similar to a gardener fertilizing specific parts of a garden that have seen less growth. For example, expanding the taxable base for digital services or luxury items could increase revenues without broad-based rate hikes, which sometimes face political resistance. The challenge here is balancing revenue growth with maintaining affordability for consumers, akin to watering a garden enough to promote growth without drowning the plants.

| Relevant Category | Substantive Data |

|---|---|

| Potential Increase in Sales Tax Rate | From 7.5% to up to 8.0%, depending on exemptions |

| Estimated Additional Revenue | Approximately $150 million annually |

| Impacted Sectors | Digital services, luxury retail, certain business-to-business transactions |

Potential Challenges and Counterarguments

Despite the clear fiscal needs, these proposed tax increases face several hurdles—much like a gardener contends with pests or unexpected droughts. Political opposition from business associations and taxpayer advocacy groups may argue that higher taxes will stifle economic growth, discourage investment, or lead to tax flight. Conversely, others emphasize the moral and social imperatives for equitable funding of public goods. Balancing these competing interests demands nuanced strategies, transparency, and ongoing dialogue—similar to a gardener integrating various pest-control methods to sustain a healthy ecosystem.

Economic Impact Analysis

Empirical research suggests that while incremental tax hikes can increase revenue in the short term, excessive or poorly structured increases risk economic stagnation or migration, much like over-fertilizing can harm a garden instead of helping it flourish. Studies indicate that New Mexico’s GDP could experience slight deceleration with significant rate hikes, but carefully calibrated changes—targeting only the highest earners and certain consumption sectors—may preserve economic vitality while bolstering fiscal health.

Key Points

- Tax policy shifts aim to balance revenue needs with economic competitiveness, much like a gardener balancing pruning and fertilizing.

- Increases in top income brackets and strategic sales tax adjustments are primary focus areas.

- Projected revenue gains support public services but must be managed to avoid economic downsides.

- Stakeholder engagement and transparent policymaking are crucial for successful implementation.

- The fiscal landscape remains fluid, requiring continuous adaptation—akin to seasonal garden management.

Strategic Considerations and Long-term Outlook

The upcoming modifications reflect a broader strategy—like setting a garden on a sustainable growth cycle. Policymakers must consider factors such as economic resilience, demographic shifts, and the long-term sustainability of revenue streams. Incorporating comprehensive data analytics and predictive modeling can help forecast impacts and optimize tax structures. For instance, employing scenario analysis—evaluating effects of various rate adjustments—can inform balanced decision-making. This approach echoes a gardener’s use of weather forecasts and soil tests before applying treatment to ensure optimal plant health.

Conclusion: Navigating the Fiscal Garden of New Mexico

Changes to the New Mexico tax rate are not isolated adjustments but part of an intricate ecosystem—each decision influencing the state’s economic health and social fabric. Like a gardener tending to diverse plantings, policymakers must weigh short-term gains against long-term sustainability, balancing fairness with growth. As the state moves toward these proposed reforms, staying informed and adaptable will be vital, much like navigating a garden through various seasons—always aiming to cultivate a prosperous, equitable landscape for all residents.

What specific changes are expected in New Mexico’s tax rates?

+The primary anticipated changes include increasing the top income tax rate from 4.9% to approximately 6%, alongside potential adjustments to sales and gross receipts taxes, possibly raising the rate from 7.5% to 8%. These modifications aim to enhance revenue streams from high earners and certain consumption sectors.

How will these changes impact different taxpayers?

+Higher income earners may see increased tax liabilities, while middle and lower-income residents could experience minimal direct impact unless sales tax rates rise significantly. The goal is to target those with greater ability to contribute, similar to selective pruning in a well-maintained garden, ensuring overall vitality without overburdening less able contributors.

What are the risks of raising taxes in New Mexico?

+The key risks include potential economic slowdown, reduced investment, and migration of high earners seeking more favorable tax environments elsewhere. However, balanced, carefully targeted increases—like gentle watering of specific garden areas—can mitigate these risks while supporting essential public services.