Pay Oc Property Tax

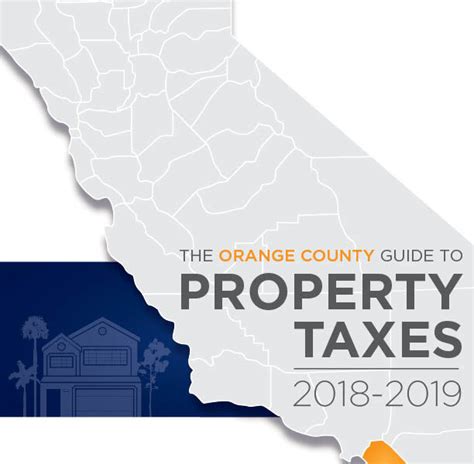

Paying property taxes is an essential part of homeownership, and it's a process that can sometimes feel daunting, especially for those new to the process. This comprehensive guide will walk you through the steps to pay your OC property tax efficiently and provide valuable insights to ensure a smooth experience.

Understanding OC Property Taxes

Before delving into the payment process, it's crucial to grasp the fundamentals of Orange County's property tax system. In OC, property taxes are a significant source of revenue for local governments, which use these funds to maintain infrastructure, provide essential services, and support public schools.

The Orange County Tax Collector is responsible for assessing and collecting property taxes. These taxes are calculated based on the assessed value of your property and the tax rate set by various taxing authorities, including the county, cities, and special districts.

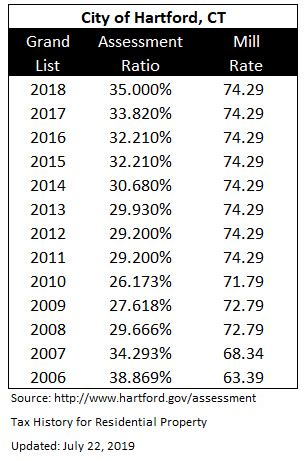

Tax Rates and Assessments

The tax rate in OC is typically a combination of several rates, each representing a different taxing authority. For instance, the rate might include a countywide rate, a city rate, and rates for special districts like fire protection or flood control districts. These rates are usually expressed as a percentage of the assessed value of your property.

The assessed value of your property is determined by the Orange County Assessor's Office. They conduct regular assessments to ensure property values are up-to-date. The assessed value can be influenced by factors such as recent sales of similar properties, improvements made to the property, and general market conditions.

| Taxing Authority | Tax Rate |

|---|---|

| Countywide | 1.00% |

| City of Orange | 0.75% |

| Special Districts (Fire Protection) | 0.50% |

| Total Tax Rate | 2.25% |

Steps to Pay OC Property Tax

Now that we have a clearer understanding of OC property taxes, let's dive into the payment process. Here's a step-by-step guide to help you navigate the process seamlessly.

Step 1: Obtain Your Property Tax Bill

The first step in paying your OC property tax is to obtain your property tax bill, also known as the Secure Tax Bill. This bill provides detailed information about your property's assessed value, the calculated tax amount, and the due dates for payment.

You can receive your tax bill in several ways:

- By Mail: The Orange County Tax Collector typically mails tax bills to property owners. Ensure your mailing address is up-to-date with the tax collector's office to receive your bill promptly.

- Online Access: You can also access your tax bill online through the Orange County Tax Collector's Secure Bill Payment Portal. This portal provides a secure way to view and manage your tax information.

Step 2: Review Your Bill

Once you have your property tax bill, take the time to review it carefully. Ensure that the information on the bill, including your property address, assessed value, and calculated tax amount, is accurate.

Look for any changes in the assessed value of your property. If you disagree with the assessed value or believe there might be an error, you can file an appeal with the Orange County Assessment Appeals Board. The deadline for appeals is typically around mid-year, so it's important to act promptly if you have concerns.

Step 3: Choose Your Payment Method

The Orange County Tax Collector offers several convenient payment methods to suit your preferences and needs:

- Online Payment: The most common and efficient method is to make your payment online through the Secure Bill Payment Portal. This method allows you to pay securely using a credit card, debit card, or electronic check. You can also set up automatic payments for future tax bills.

- Mail-In Payment: If you prefer a more traditional approach, you can mail your payment to the Orange County Tax Collector's office. Ensure you include your tax bill stub and make the payment using a check or money order. Send your payment to the address provided on your tax bill.

- In-Person Payment: For those who prefer face-to-face transactions, you can visit the Orange County Tax Collector's office and make your payment in person. They accept cash, checks, money orders, and credit/debit cards for in-person payments.

Step 4: Make Your Payment

Choose the payment method that suits you best and follow the instructions provided by the Orange County Tax Collector. Ensure that you make your payment before the due date to avoid late fees and penalties.

If you're paying online, keep your confirmation number or payment receipt for your records. For mail-in or in-person payments, ensure that you receive a receipt or some form of confirmation that your payment has been received and processed.

Important Dates and Deadlines

Being aware of the key dates and deadlines related to OC property taxes is crucial to avoid late payments and potential penalties.

Tax Bill Issuance and Due Dates

The Orange County Tax Collector typically issues property tax bills twice a year, with two installments due on the following dates:

- First Installment: Typically due in November. The exact date may vary slightly each year, so it's essential to check your tax bill for the specific due date.

- Second Installment: Generally due in February of the following year. Again, the exact date can vary, so refer to your tax bill for the accurate due date.

It's important to note that if you miss the due date for either installment, a 10% penalty will be applied. Additionally, if the second installment is not paid by May 7, the property becomes subject to tax default proceedings.

Late Payment Penalties

To encourage timely payments, the Orange County Tax Collector imposes penalties for late payments. Here's an overview of the penalty structure:

- First 60 Days: If you pay within the first 60 days after the due date, a 10% penalty is applied.

- After 60 Days: If the payment is made after the initial 60-day grace period, an additional 10% penalty is added, resulting in a total penalty of 20%.

- Delinquent Taxes: If taxes remain unpaid after May 7, the property becomes subject to tax default proceedings, and additional penalties and costs may apply.

Frequently Asked Questions

Can I pay my OC property tax in installments?

+Yes, the Orange County Tax Collector offers the option to pay your property tax in two installments. The first installment is typically due in November, and the second in February. This allows for more manageable payments throughout the year.

What happens if I miss the property tax payment deadline?

+If you miss the property tax payment deadline, a 10% penalty is applied to your tax bill. Additionally, if the second installment is not paid by May 7, the property becomes subject to tax default proceedings, which may lead to further penalties and costs.

Can I appeal my property's assessed value?

+Yes, if you believe your property's assessed value is incorrect, you can file an appeal with the Orange County Assessment Appeals Board. The deadline for appeals is typically mid-year, so it's important to act promptly if you have concerns about your property's assessed value.

How can I ensure my property tax bill is accurate?

+To ensure your property tax bill is accurate, carefully review it when you receive it. Check for any errors in your property address, assessed value, or calculated tax amount. If you notice any discrepancies, contact the Orange County Tax Collector's office for assistance.

Paying your OC property tax is a vital responsibility of homeownership, but with the right knowledge and tools, it can be a straightforward process. By understanding the tax rates, assessment process, and payment options, you can navigate the OC property tax system with confidence. Remember to stay organized, keep track of important dates, and take advantage of the convenient payment methods offered by the Orange County Tax Collector.

If you have further questions or need assistance, the Orange County Tax Collector’s office is ready to help. Their website provides a wealth of information, and their staff is available to guide you through any challenges you may encounter. With a clear understanding of the process and a timely approach, paying your OC property tax can be a smooth and stress-free experience.