Uncover the True Phantom Tax Meaning and How It Affects Your Finances

In the intricate web of modern taxation, few terms evoke as much confusion and speculation among taxpayers as the "phantom tax." Often cloaked in technical jargon and misunderstood legislation, the true nature and impact of this phenomenon remain elusive to many. Envision a scenario where individuals and corporations brace for tax liabilities that seemingly appear out of nowhere, eroding their financial stability and strategic planning. Such circumstances underscore the importance of demystifying the "phantom tax"—a concept that, despite its pervasive presence, often operates behind the scenes, influencing personal and corporate finances in profound ways.

Deciphering the Phantom Tax: A Deep Dive into Its Meaning and Origins

The “phantom tax” refers to a tax liability that arises without an explicit sale, distribution, or cash event prompting it. Unlike typical tax obligations triggered by income, capital gains, or tangible transactions, phantom taxes manifest through mechanisms like unrealized gains, deemed distributions, or complex financial arrangements. At its core, the concept leverages the recognition of income or gains that haven’t been physically realized but are nevertheless taxed, creating a hidden burden that can catch taxpayers unawares.

Historically, the roots of the phantom tax trace back to evolving tax laws designed to prevent tax avoidance and ensure comprehensive revenue collection. Notably, certain provisions within the U.S. tax code, such as the Internal Revenue Code §83, address the taxation of property transferred for services or compensation, often leading to taxable events even absent actual cash flow. Additionally, the advent of financial instruments like mutual funds, hedge funds, and estate planning vehicles has amplified opportunities for unrealized gains to trigger tax liabilities, further entrenching the phenomenon as a significant fiscal concern.

Understanding the intricate interplay of these legislative mechanisms requires a nuanced grasp of tax policy and financial engineering. The underlying principle is straightforward: the government seeks to tax accrued economic benefits to maintain equity and prevent tax deferral abuse. However, the complexity of modern financial products and estate strategies often results in taxpayers facing tax bills for gains they haven’t yet realized—hence, the term “phantom.”

The Mechanics of the Phantom Tax in Contemporary Financial Contexts

In contemporary finance, the phantom tax manifests most prominently within the framework of passive income, investment appreciation, and estate planning. For instance, mutual funds, which often distribute capital gains annually, can generate taxable income for unitholders even if they haven’t sold any shares. This distribution, though not realized by the investor personally, produces a tax event, subsequently affecting cash flow and investment strategies.

Unrealized Gains and Deemed Dispositions

One of the core pathways to phantom taxation involves unrealized gains—appreciation in asset value not yet realized through sale or transfer. Tax regimes in many jurisdictions, including the U.S. and Canada, incorporate provisions where certain “deemed dispositions” occur—events where assets are considered sold for tax purposes, even without an actual transaction. An example is the deemed sale of appreciated property upon death or transfer, which can trigger estate taxes or capital gains, effectively taxing growth that hasn’t been liquidated.

| Relevant Category | Substantive Data |

|---|---|

| Capital Gains Taxation | Unrealized gains on assets such as stocks, real estate, or mutual funds are taxed upon deemed sale events, often accelerating tax liability beyond the actual liquidation point. |

| Estate and Gift Tax | Transfers at death can trigger valuation-based taxation where assets appreciated during lifetime are taxed based on their fair market value, producing phantom liabilities for heirs. |

| Specific Instruments | Derivatives, partnerships, and complex financial instruments often result in income recognition without cash realization, compounding phantom tax issues. |

How Phantom Taxes Impact Personal Finances and Wealth Preservation

Dealing with phantom tax liabilities isn’t merely an academic exercise—they carry tangible consequences for everyday investors, retirees, and high-net-worth individuals. These impacts are multifaceted, affecting how assets are held, when liquidity is needed, and how intergenerational wealth transfer strategies are shaped.

Liquidity Challenges and Cash Flow Management

Perhaps the most immediate concern relates to liquidity. An individual may find themselves with a significant tax bill due to unrealized gains, necessitating the sale of assets—potentially at inopportune times—to satisfy these obligations. For retirees, this can mean sacrificing future growth to cover tax liabilities, disrupting long-term income sustainability.

Estate Planning and Intergenerational Wealth Transfer

In estate planning, the phantom tax can complicate inheritance strategies. Appreciated assets transferred upon death often trigger capital gains taxes based on fair market value, even if the heirs do not sell the assets immediately. This phenomenon can erode estate value and challenge heirs’ liquidity management, prompting the adoption of sophisticated planning techniques like step-up basis adjustments or charitable trusts to mitigate these effects.

| Impact Area | Specific Implication |

|---|---|

| Tax Burden Timing | Liabilities can become due before assets are liquidated, creating cash flow strains. |

| Asset Liquidity | Forced sales for tax payments may lock in gains or losses at suboptimal moments. |

| Complexity of Planning | Need for advanced estate and tax strategies to minimize phantom liabilities and preserve wealth. |

The Strategic Approaches to Mitigate Phantom Tax Effects

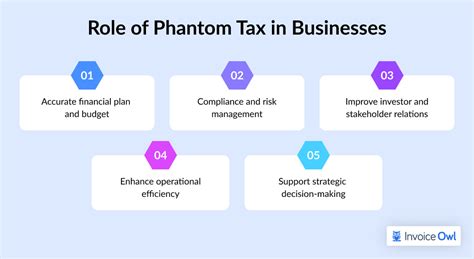

Thoughtful planning is paramount to minimizing the impact of phantom taxes. Investors and estate planners alike leverage a variety of methods, blending legislative understanding with innovative financial strategies.

Tax Deferral and Investment Choice Optimization

Opting for tax-advantaged accounts such as Roth IRAs or 401(k)s in the U.S. can sidestep immediate recognition of gains. Similarly, choosing investments with tax-efficient profiles, like index funds or municipal bonds, can help control taxable events. Utilizing entities like partnerships or LLCs allows for strategic allocation of income and gains, often deferring tax consequences.

Estate Planning Techniques

Employing different estate planning devices—such as grantor retained annuity trusts (GRATs), charitable gift annuities, or life insurance funding—can soften the blow of inherited phantom liabilities. Step-up in basis provisions in certain jurisdictions reset the valuation of assets upon inheritance, significantly reducing unrealized gains subject to taxation.

| Planning Strategy | Key Benefit |

|---|---|

| Tax-Deferred Accounts | Postpones tax recognition of gains, allowing for growth within the account. |

| Step-Up Basis | Revalues assets at the date of inheritance, often reducing exposure to capital gains taxes. |

| Donor Strategies | Using charitable donations or trusts to transfer wealth efficiently and limit phantom liabilities. |

Legal and Policy Considerations Surrounding the Phantom Tax

The landscape of phantom taxation is shaped by ongoing legislative debates and policy reforms. Governments seek to balance revenue needs against economic growth and fairness, often leading to shifts in how unrealized gains and deemed dispositions are taxed.

Recent proposals have aimed to introduce or expand wealth taxes, capital gains at death, or more stringent controls on estate transfers—each with implications for phantom tax exposure. Jurisdictions like the United States continue to refine rules around valuation, basis adjustments, and exceptions, fostering an environment where tax professionals must stay vigilant and adaptable.

Key Points

- Legislative Amendments: Policy reforms can either mitigate or exacerbate phantom tax liabilities.

- Policy Shifts: Ongoing debates influence estate tax laws, capital gains treatments, and income recognition rules.

- Legal Strategies: Staying abreast of legal updates is essential for minimizing unexpected liabilities.

- Financial Planning: Dynamic estate and investment strategies remain crucial amid evolving policy landscapes.

- Impacts on Wealth Accumulation: Effective management of phantom tax exposure directly affects net worth growth over generations.

What exactly is a phantom tax, and how does it differ from regular income tax?

+The phantom tax is a tax liability on unrealized gains or deemed dispositions of assets, meaning taxes owed without actual cash received from a sale or profit realization. Unlike regular income tax, which applies to cash or actual transfers, phantom taxes recognize economic gains that haven’t been liquidated.

Can phantom taxes be avoided legally?

+While completely avoiding phantom taxes isn’t always feasible due to legislative frameworks, strategic planning—such as utilizing tax-efficient accounts, adjusting estate structures, and timing asset transfers—can significantly mitigate their impact. Consulting with tax professionals can help craft tailored strategies.

How does the phantom tax affect high-net-worth individuals?

+High-net-worth individuals often face considerable phantom liabilities due to substantial unrealized gains in investments or estate assets. This can lead to liquidity challenges, forced asset sales, and increased estate tax exposure, emphasizing the need for advanced planning techniques.

Are there legislative measures to limit phantom tax liabilities?

+Legislative proposals periodically aim to address or curb phantom tax issues—ranging from changes in basis step-up laws to modifications of deemed disposition rules. Monitoring policy developments and adapting estate plans accordingly is key to managing future liabilities.