Marin County Tax Collector

Welcome to the comprehensive guide on the Marin County Tax Collector, a vital role in the local government that handles a wide range of financial responsibilities and plays a crucial role in the management of public funds. This article will delve into the functions, services, and impact of the Marin County Tax Collector's office, offering an in-depth analysis for those seeking to understand the financial operations of this Californian county.

Understanding the Role of the Marin County Tax Collector

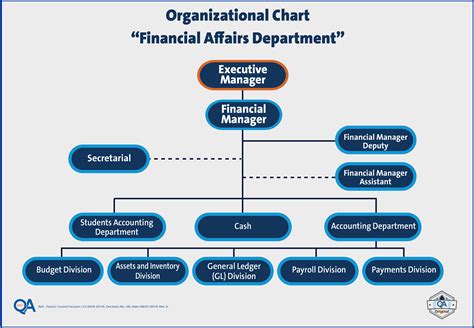

The Marin County Tax Collector is an elected official responsible for the efficient and effective collection of various taxes and fees within the county. This office serves as the financial gateway, ensuring that the county’s revenue streams are managed transparently and accurately. The scope of their work encompasses a diverse range of tax-related tasks, making them a key player in the local government’s financial landscape.

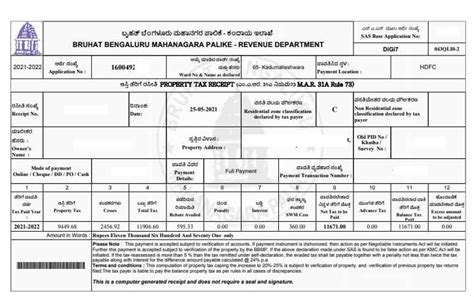

One of the primary responsibilities of the Marin County Tax Collector is the assessment and collection of property taxes. These taxes are levied on real estate properties within the county, forming a significant portion of the county's revenue. The tax collector's office is responsible for determining the assessed value of each property, applying the appropriate tax rate, and issuing tax bills to property owners. This process requires a high level of accuracy and timely execution to ensure the county's financial stability.

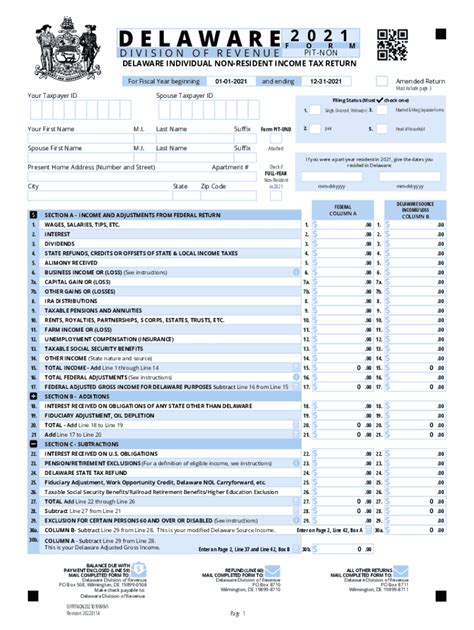

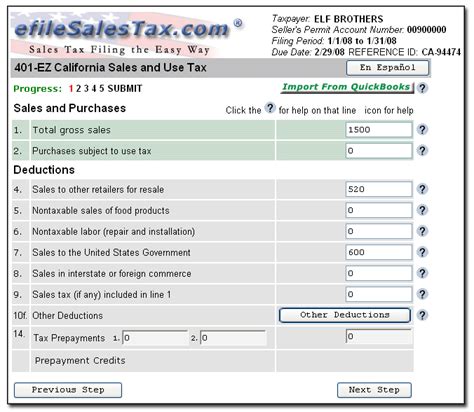

In addition to property taxes, the Marin County Tax Collector also oversees the collection of various other taxes and fees. This includes business taxes, vehicle registration fees, and special assessments for specific services or improvements. Each of these revenue streams contributes to the overall financial health of the county and requires meticulous management to ensure compliance and accuracy.

Services Offered by the Marin County Tax Collector

The Marin County Tax Collector’s office provides a range of services to both residents and businesses. These services are designed to facilitate the payment of taxes and fees, offer assistance with tax-related inquiries, and ensure a transparent and efficient financial system.

- Tax Payment Options: The tax collector's office offers a variety of payment methods, including online payment portals, in-person payments at designated locations, and payment by mail. This flexibility ensures that taxpayers can choose the most convenient method for them.

- Tax Assessment Information: Residents and property owners can access detailed information about their tax assessments through the tax collector's website or by visiting the office. This includes property values, tax rates, and any applicable exemptions or deductions.

- Tax Assistance Programs: The office also provides support for taxpayers who may be facing financial hardships. This can include programs for tax relief, payment plans, or assistance with understanding complex tax regulations.

- Business Tax Registration: Businesses operating within Marin County are required to register with the tax collector's office and pay applicable business taxes. The office provides guidance and resources to help businesses navigate the registration process and comply with tax regulations.

- Vehicle Registration and Title Transfers: The tax collector's office is responsible for processing vehicle registration and title transfers. This includes issuing registration stickers, processing title transfers, and collecting the associated fees.

These services are integral to the smooth operation of the county's financial system, ensuring that taxpayers have the necessary tools and resources to meet their tax obligations efficiently.

Performance Analysis and Impact on the Community

The Marin County Tax Collector’s office has a significant impact on the local community and economy. Their efficient management of tax revenues directly influences the county’s ability to fund essential services and infrastructure projects. A well-run tax collection system ensures that the county can maintain its financial stability, support local businesses, and provide quality public services.

Over the years, the tax collector's office has implemented various initiatives to improve its performance and service delivery. These include the adoption of modern technologies for online tax payments and assessments, streamlining of processes to reduce wait times, and the implementation of community outreach programs to educate taxpayers about their rights and responsibilities.

Additionally, the tax collector's office plays a crucial role in promoting financial transparency and accountability. By providing accessible information about tax assessments, budgets, and revenue allocations, they enable the public to understand how their tax dollars are being utilized. This transparency fosters trust between the government and the community, encouraging civic engagement and participation.

| Fiscal Year | Total Revenue Collected (in millions) | Collection Efficiency |

|---|---|---|

| 2021-2022 | $425.6 | 98.5% |

| 2020-2021 | $412.3 | 97.8% |

| 2019-2020 | $401.2 | 98.2% |

The table above highlights the tax collector's office's performance over the past three fiscal years, demonstrating their consistent efficiency in revenue collection. The high collection efficiency rates indicate a well-functioning system, ensuring that the county receives the majority of its expected tax revenues.

Future Implications and Ongoing Initiatives

Looking ahead, the Marin County Tax Collector’s office is focused on several key initiatives to enhance its services and adapt to evolving financial landscapes.

- Digital Transformation: The office is committed to further digitizing its services, aiming to make tax-related processes even more convenient and accessible for taxpayers. This includes expanding online payment options, improving the user experience of their website, and exploring blockchain technologies for secure and transparent record-keeping.

- Community Engagement: Continuing their community outreach efforts, the tax collector's office plans to host more educational workshops and town hall meetings. These initiatives aim to bridge the gap between the government and taxpayers, fostering a deeper understanding of tax responsibilities and the importance of timely payments.

- Environmental Sustainability: In line with the county's sustainability goals, the tax collector's office is exploring ways to reduce its environmental footprint. This includes transitioning to paperless systems where possible, promoting electronic tax records, and implementing energy-efficient practices in their operations.

By embracing these initiatives, the Marin County Tax Collector's office aims to stay at the forefront of financial management, ensuring efficient revenue collection and effective service delivery for the benefit of the entire community.

Conclusion

The role of the Marin County Tax Collector is multifaceted, encompassing revenue collection, financial management, and community engagement. Their work is integral to the county’s financial health, ensuring that essential services are funded and that taxpayers receive the support they need. As the county continues to evolve, the tax collector’s office remains dedicated to adapting its strategies and services to meet the changing needs of the community.

What are the office hours of the Marin County Tax Collector’s office?

+

The Marin County Tax Collector’s office is open from 8:30 AM to 4:30 PM, Monday through Friday, excluding holidays. They also offer extended hours during tax season to accommodate taxpayers.

How can I pay my property taxes in Marin County?

+

You can pay your property taxes online through the Marin County Tax Collector’s website, by mail, or in person at the tax collector’s office. They also offer a convenient drop box for after-hours payments.

What happens if I don’t pay my taxes on time in Marin County?

+

Late payments are subject to penalties and interest. The Marin County Tax Collector’s office sends reminder notices and can assist with payment plans for taxpayers facing financial difficulties.

How can I obtain a tax certificate for my property in Marin County?

+

You can request a tax certificate by contacting the Marin County Tax Collector’s office. They can provide detailed information about your property’s tax history and current status.

Does the Marin County Tax Collector offer any tax relief programs?

+

Yes, the office offers several tax relief programs, including the Homeowner and Renter’s Assistance Program and the Senior Citizen Exemption Program. These programs provide financial relief to eligible taxpayers.