Ny Income Tax Refund

In the bustling city of New York, where the concrete jungle meets ambitious individuals, the topic of income tax refunds takes on a whole new dimension. For residents of the Empire State, understanding the ins and outs of tax refunds is crucial, especially when navigating the complexities of one of the most tax-intensive states in the nation. This comprehensive guide aims to unravel the intricacies of the New York Income Tax Refund, offering an expert analysis of the process, timelines, and strategies to maximize your refund.

The Anatomy of a New York Income Tax Refund

A New York income tax refund is a reimbursement of state income taxes paid by residents or businesses during the previous tax year. It occurs when the total taxes paid exceed the amount owed based on the taxpayer's income, deductions, and credits. The process is overseen by the New York State Department of Taxation and Finance, which issues refunds to eligible taxpayers.

The state's progressive tax system means that higher-income earners face steeper tax rates, which can lead to larger refunds for those who have overpaid. However, the process is not without its complexities, and understanding the various components is essential for maximizing your refund.

Taxable Income and Deductions

New York's taxable income is calculated by subtracting allowable deductions from your total income. These deductions can include standard deductions, personal exemptions, and various itemized deductions such as mortgage interest, state and local taxes, and charitable contributions. The more deductions you qualify for, the lower your taxable income, which can lead to a larger refund.

| Deduction Category | Maximum Amount |

|---|---|

| Standard Deduction (Single Filers) | $2,375 |

| Standard Deduction (Married Filing Jointly) | $4,750 |

| Mortgage Interest Deduction | Varies based on loan amount |

| State and Local Taxes Deduction | Up to $10,000 |

It's important to note that New York allows for the deduction of certain expenses not allowed at the federal level, such as public transportation expenses and home office expenses for those working remotely. These unique deductions can significantly impact your taxable income and, subsequently, your refund.

Tax Credits and Their Impact

Tax credits play a significant role in reducing your tax liability and increasing your potential refund. New York offers a range of tax credits, including the Child and Dependent Care Credit, Child Tax Credit, and the Earned Income Tax Credit (EITC). These credits can be substantial, especially for low- and middle-income taxpayers.

The EITC, for instance, is a refundable credit that can result in a larger refund than the taxes you paid. It's designed to benefit working individuals and families with low to moderate income, providing a significant boost to their financial well-being.

| Credit Type | Maximum Amount |

|---|---|

| Child and Dependent Care Credit | Up to $600 per qualifying child |

| Child Tax Credit | Up to $2,000 per qualifying child |

| Earned Income Tax Credit (EITC) | Varies based on income and number of qualifying children |

Understanding Tax Rates and Brackets

New York has a progressive tax system with six income tax brackets ranging from 4% to 8.82%. The tax rate increases as your income rises, which means that higher earners will pay a larger portion of their income in taxes. However, this progressive system also means that taxpayers in lower brackets may be eligible for larger refunds.

| Tax Bracket | Tax Rate |

|---|---|

| $0 - $8,500 | 4% |

| $8,500 - $11,850 | 4.5% |

| $11,850 - $23,050 | 6.5% |

| $23,050 - $161,550 | 6.5% |

| $161,550 - $2,150,000 | 6.85% |

| Over $2,150,000 | 8.82% |

Understanding which bracket you fall into and how your deductions and credits affect your taxable income can be crucial in optimizing your refund.

The Process of Claiming Your New York Income Tax Refund

Claiming your New York income tax refund involves several steps, from preparing your tax return to receiving your refund. Let's delve into each stage to ensure a smooth and efficient process.

Step 1: Gather Your Documents

Before you begin preparing your tax return, gather all the necessary documents. This includes W-2 forms from your employer(s), 1099 forms for any additional income, and documentation for deductions and credits you plan to claim. If you're self-employed, you'll need to collect business-related receipts and records.

It's essential to keep organized records, as the accuracy of your return depends on the information you provide. Double-check that all your documents are up-to-date and complete before moving on to the next step.

Step 2: Prepare Your Tax Return

The next step is to prepare your tax return. You can do this manually using tax forms and instructions provided by the New York State Department of Taxation and Finance, or you can use tax preparation software, which can simplify the process and reduce the risk of errors. If you're comfortable with tax laws and regulations, you can prepare your return yourself; otherwise, consider hiring a tax professional.

When preparing your return, pay close attention to the various deductions and credits you're eligible for. Make sure to claim all applicable deductions and credits to minimize your tax liability and maximize your refund.

Step 3: File Your Tax Return

Once your tax return is complete, it's time to file it. You can file your return electronically through the New York State e-file system, which is the fastest and most secure way to file. Alternatively, you can mail your return to the address specified by the Department of Taxation and Finance.

It's important to file your return accurately and on time to avoid penalties and interest. The due date for filing your New York State income tax return is typically aligned with the federal deadline, which is usually April 15th of the following year.

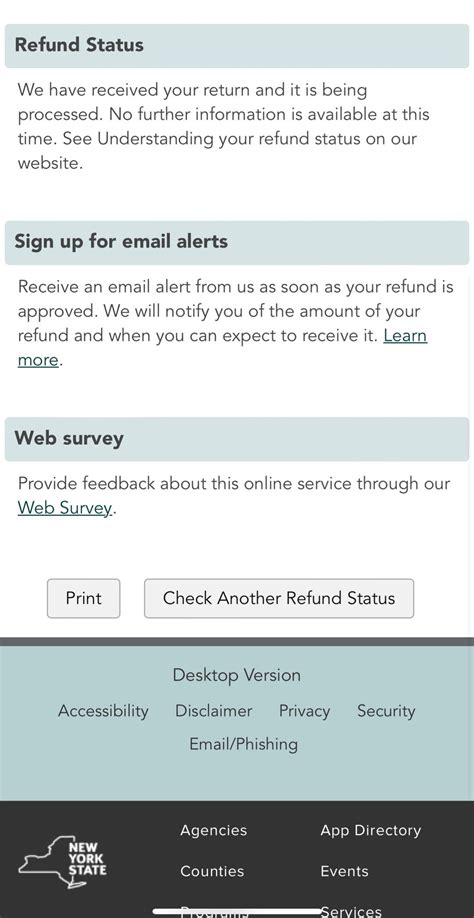

Step 4: Track Your Refund

After filing your return, you can track the status of your refund through the New York State Refund Hotline or online through the Where's My Refund tool on the Department's website. This tool provides up-to-date information on the status of your refund, including whether it has been processed and when you can expect to receive it.

It's important to note that refund processing times can vary depending on several factors, including the method of filing and the complexity of your return. Generally, electronic returns are processed faster than paper returns.

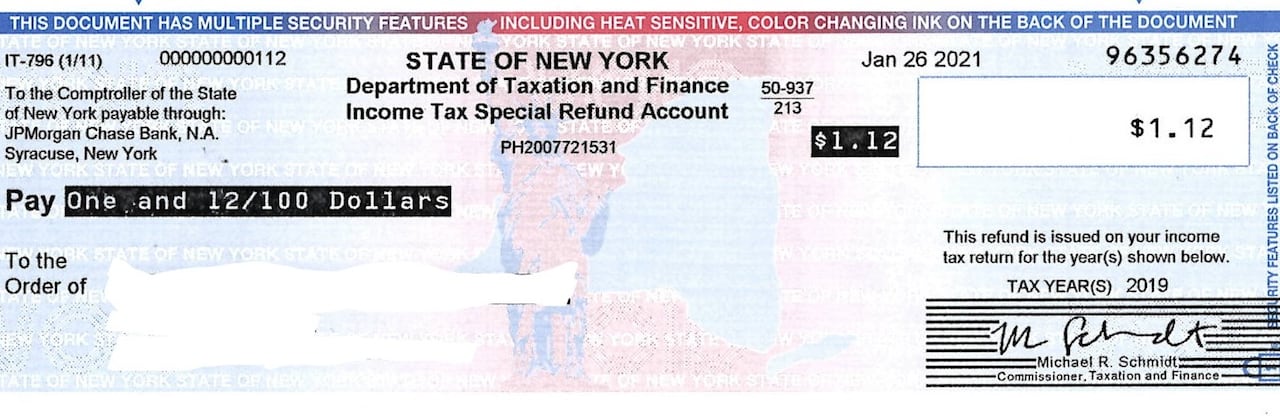

Step 5: Receive Your Refund

Once your refund has been approved and processed, you'll receive it via your chosen method of payment. You can opt for direct deposit, which is the fastest way to receive your refund, or you can have it mailed to you as a check.

It's crucial to keep an eye on your bank account or mailbox to ensure you receive your refund promptly. If you encounter any issues or delays, contact the New York State Department of Taxation and Finance for assistance.

Maximizing Your New York Income Tax Refund

Maximizing your New York income tax refund requires a strategic approach. By taking advantage of deductions, credits, and other tax-saving strategies, you can potentially increase the amount of your refund. Here are some expert tips to help you get the most out of your refund.

Explore Deductions and Credits

As mentioned earlier, deductions and credits can significantly impact your taxable income and, consequently, your refund. Make sure you're aware of all the deductions and credits you're eligible for and claim them on your tax return. Some common deductions and credits include:

- Standard or itemized deductions

- Mortgage interest deduction

- State and local taxes deduction

- Charitable contributions

- Child and dependent care credit

- Child tax credit

- Education credits (e.g., American Opportunity Tax Credit)

- Retirement savings deductions

Consult a tax professional or use reputable tax software to ensure you're taking advantage of all applicable deductions and credits.

Consider Tax-Advantaged Accounts

Tax-advantaged accounts, such as Health Savings Accounts (HSAs), Flexible Spending Accounts (FSAs), and Individual Retirement Accounts (IRAs), can provide significant tax benefits. Contributions to these accounts are often deductible, and earnings grow tax-free. When it's time to withdraw funds, you may not be taxed if the money is used for qualified expenses.

For example, contributions to an HSA can be deducted from your taxable income, and funds can be used for medical expenses without being taxed. Similarly, contributions to a traditional IRA may be tax-deductible, and earnings grow tax-free until withdrawal.

Optimize Your Withholding

If you receive a large refund each year, it might be a sign that you're having too much tax withheld from your paychecks. While getting a large refund can feel like a windfall, it essentially means you're giving the government an interest-free loan throughout the year. Consider adjusting your W-4 form to reduce the amount of tax withheld, which can result in a larger paycheck each pay period and potentially a smaller refund.

On the other hand, if you owe taxes at the end of the year, you may need to increase your withholding to avoid penalties. It's a delicate balance, and consulting a tax professional can help ensure you're withholding the right amount.

Take Advantage of Tax-Free Benefits

Certain benefits, such as employee discounts and fringe benefits, are tax-free and can help reduce your taxable income. For example, if your employer provides a company car for personal use, the value of this benefit is not taxable. Other tax-free benefits may include childcare benefits, tuition reimbursement, and certain health and wellness programs.

Review your employee benefits package to identify any tax-free perks you may be eligible for. These benefits can help lower your taxable income and increase your refund.

Stay Informed About Tax Law Changes

Tax laws are subject to change, and staying informed about these changes can help you plan your finances accordingly. For instance, the Tax Cuts and Jobs Act of 2017 brought significant changes to the tax code, including an increase in the standard deduction and changes to certain credits and deductions. Staying up-to-date with these changes can help you adjust your financial strategies and maximize your refund.

The Future of New York Income Tax Refunds

The landscape of New York income tax refunds is constantly evolving, influenced by various factors such as economic conditions, legislative changes, and technological advancements. Here's a glimpse into the potential future of New York income tax refunds.

Digital Transformation

The continued advancement of technology is likely to drive further digital transformation in the tax refund process. The New York State Department of Taxation and Finance has already embraced online tools like the e-file system and Where's My Refund, making the process more efficient and secure. In the future, we can expect to see even more sophisticated digital solutions, such as real-time tax refund tracking and digital wallets for refund deposits.

Enhanced Taxpayer Services

As the state strives to improve taxpayer satisfaction, we can anticipate enhanced services and resources. This could include expanded taxpayer assistance programs, improved tax guidance materials, and more accessible methods for resolving tax-related issues. The Department may also invest in educational initiatives to help taxpayers better understand their rights and responsibilities, potentially reducing errors and disputes.

Potential Tax Law Reforms

Tax laws are subject to change, and New York is no exception. The state may consider reforms to address economic disparities, promote fairness, and simplify the tax code. These reforms could include adjustments to tax rates, brackets, and deductions, as well as the introduction of new credits or the expansion of existing ones. Additionally, the state may explore ways to reduce the tax burden on certain industries or encourage specific economic activities.

Impact of Economic Trends

Economic conditions play a significant role in the income tax refund landscape. During economic downturns, tax refunds can provide much-needed financial relief to taxpayers. Conversely, strong economic growth can lead to higher tax revenues, potentially reducing the average refund amount. The state's response to economic trends, such as through stimulus packages or tax incentives, can also influence the size and distribution of tax refunds.

Frequently Asked Questions

What is the average processing time for a New York State income tax refund?

+The average processing time for a New York State income tax refund is typically around 4 to 6 weeks from the date of filing. However, it’s important to note that processing times can vary based on several factors, including the method of filing (electronic vs. paper) and the complexity of the return.

Can I check the status of my New York State income tax refund online?

+Yes, you can check the status of your New York State income tax refund online using the “Where’s My Refund” tool on the Department of Taxation and Finance’s website. This tool provides real-time updates on the processing status of your refund.

What should I do if my New York State income tax refund is delayed or incorrect?

+If your New York State income tax refund is delayed or you believe it is incorrect, you should first verify your filing status and the processing status of your refund using the “Where’s My Refund” tool. If the tool indicates an issue with your return, you should contact the New York State Department of Taxation and Finance for assistance.

Can I file my New York State income tax return electronically?

+Yes, you can file your New York State income tax return electronically through the New York State e-file system. Electronic filing is the fastest and most secure way to file your return and receive your refund.