Douglas County Property Taxes

When it comes to property ownership, understanding the tax landscape is crucial. Property taxes are an essential revenue source for local governments, funding vital services and infrastructure. In Douglas County, Nevada, property taxes are an integral part of the local economy and community well-being. This article aims to delve into the intricacies of Douglas County property taxes, exploring the assessment process, tax rates, exemptions, and more, providing a comprehensive guide for property owners and prospective buyers.

Understanding Douglas County Property Taxes

Douglas County, nestled in the scenic Sierra Nevada mountains, is renowned for its picturesque landscapes, outdoor adventures, and vibrant communities. The county’s property tax system is a critical component of its financial infrastructure, supporting essential services such as schools, public safety, and infrastructure development. As a property owner or prospective buyer, gaining insights into the tax landscape is vital to making informed decisions.

The property tax system in Douglas County operates under the auspices of the Douglas County Assessor's Office. This office is responsible for assessing the value of all taxable properties within the county, ensuring fairness and accuracy in the taxation process. Property taxes are calculated based on the assessed value of a property and the applicable tax rate, which is set by the county commissioners.

Assessment Process: Determining Property Values

The Douglas County Assessor’s Office employs a systematic approach to assess property values. The assessment process involves analyzing various factors, including:

- Market Value: The assessor considers the current market conditions and the property’s potential selling price to determine its market value.

- Replacement Cost: This involves estimating the cost of rebuilding the property, taking into account factors like construction costs and depreciation.

- Income Approach: For income-generating properties, the assessor analyzes the property’s potential rental income to determine its value.

- Sales Comparison: By comparing the property to similar properties that have recently sold, the assessor can establish a fair value.

Once the assessment is complete, property owners receive a notice of assessed value, which serves as the basis for calculating their property taxes.

| Assessment Year | Average Assessment Increase |

|---|---|

| 2022 | 3.2% |

| 2021 | 2.8% |

| 2020 | 4.1% |

Tax Rates and Calculations

Property taxes in Douglas County are calculated using a straightforward formula. The assessed value of the property is multiplied by the applicable tax rate, which is expressed as a percentage. The resulting amount is the property’s annual tax liability.

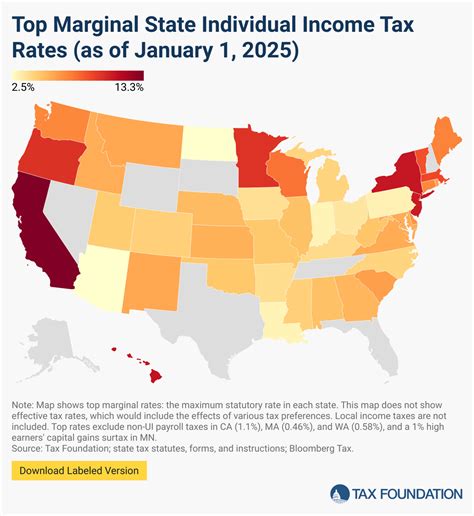

The tax rate in Douglas County is determined by the county commissioners and can vary depending on the property's location and usage. The rate typically consists of two components:

- Base Rate: This is a fixed rate applied to all properties within the county.

- Supplemental Rate: Supplemental rates may be applied to specific areas or types of properties to fund special initiatives or services.

For instance, in 2022, the base rate in Douglas County was set at 3.56% for residential properties and 3.78% for commercial properties. Additionally, there were supplemental rates for various districts, ranging from 0.08% to 0.44%.

| Property Type | Base Tax Rate | Supplemental Rates |

|---|---|---|

| Residential | 3.56% | 0.08% - 0.44% |

| Commercial | 3.78% | 0.08% - 0.44% |

Exemptions and Reductions

Douglas County offers various exemptions and reductions to eligible property owners, helping to alleviate the financial burden of property taxes. These exemptions can significantly reduce the taxable value of a property, resulting in lower tax bills.

Homestead Exemption

The Homestead Exemption is one of the most widely utilized tax benefits in Douglas County. This exemption reduces the taxable value of a primary residence by a specified amount, currently set at $350,000. To qualify, property owners must:

- Own and occupy the property as their primary residence.

- Have owned the property for at least one year.

- Apply for the exemption annually.

The Homestead Exemption can provide substantial savings, especially for homeowners with higher-valued properties.

Veterans’ Exemption

Douglas County honors its veterans by offering a tax exemption specifically for eligible military veterans. This exemption reduces the taxable value of a veteran’s primary residence by a certain amount, depending on their level of disability.

To qualify, veterans must:

- Be honorably discharged.

- Own and occupy the property as their primary residence.

- Have a service-connected disability rating of at least 10%.

Senior Citizen Exemption

Douglas County also provides tax relief for senior citizens. The Senior Citizen Exemption reduces the taxable value of a senior's primary residence by a specified amount, currently set at $150,000. To be eligible, seniors must:

- Be at least 65 years old.

- Have owned and occupied the property for at least five years.

- Meet certain income requirements.

Other Exemptions and Reductions

In addition to the above, Douglas County offers various other exemptions and reductions, including:

- Disabled Persons' Exemption: For individuals with disabilities, this exemption can reduce the taxable value of their primary residence.

- Manufactured Home Exemption: This exemption applies to manufactured homes and reduces their taxable value.

- Low-Income Senior Citizen Reduction: Seniors with limited incomes may qualify for a reduction in their property taxes.

Payment Options and Deadlines

Property owners in Douglas County have several options for paying their property taxes. The most common method is to pay the full amount by the deadline, which is typically in early November. However, for those who prefer to pay in installments, the county offers a convenient payment plan.

The installment plan allows property owners to divide their tax liability into two or four equal payments, with due dates spread throughout the year. This option can provide greater flexibility for managing finances.

| Payment Method | Due Dates |

|---|---|

| Full Payment | November 1st |

| Installment Plan (2 Payments) | November 1st and March 1st |

| Installment Plan (4 Payments) | November 1st, February 1st, May 1st, and August 1st |

Appealing Property Assessments

If a property owner believes that their property has been over-assessed, they have the right to appeal the assessment. The appeal process in Douglas County is designed to be fair and transparent, providing property owners with an opportunity to present their case.

To initiate an appeal, property owners must submit a written request to the Douglas County Assessor's Office within a specified timeframe, typically 60 days after receiving the assessment notice. The request should include supporting documentation, such as recent sales data or appraisals, to justify the appeal.

The Assessor's Office will review the appeal and make a determination. If the appeal is successful, the property's assessed value may be adjusted, resulting in a lower tax bill.

Conclusion: Navigating Douglas County Property Taxes

Understanding the intricacies of Douglas County property taxes is essential for property owners and prospective buyers. The assessment process, tax rates, exemptions, and payment options all play a crucial role in managing property tax liabilities. By staying informed and taking advantage of available exemptions, property owners can ensure they are paying their fair share while supporting the community’s vital services.

For more information on Douglas County property taxes, the Assessor's Office provides comprehensive resources and guidance. Additionally, local real estate professionals and tax consultants can offer valuable insights and assistance in navigating the tax landscape.

How often are property values reassessed in Douglas County?

+Property values in Douglas County are reassessed every odd-numbered year, ensuring that assessments remain current and accurate.

Can I appeal my property assessment if I disagree with the value?

+Absolutely! If you believe your property has been over-assessed, you have the right to appeal. The Assessor’s Office provides a clear process for appealing assessments, allowing you to present your case.

Are there any special tax incentives for green or energy-efficient properties in Douglas County?

+Yes, Douglas County offers a Green Building Incentive Program, which provides tax incentives for properties that meet certain energy-efficient standards. This program promotes sustainable development and rewards property owners for their environmentally conscious choices.

What happens if I miss the property tax payment deadline?

+Missing the payment deadline can result in penalties and interest charges. It’s important to stay organized and make timely payments to avoid additional costs.