Tax Margin 2016

In the realm of financial analysis and investment strategies, understanding tax margins is crucial for making informed decisions. This comprehensive article aims to delve into the intricacies of Tax Margin 2016, a key financial metric that provides valuable insights into a company's profitability and tax obligations.

The tax margin is a critical indicator that sheds light on a company's ability to manage its tax liabilities and generate profits. It offers a snapshot of a company's financial health and its efficiency in tax management. In this analysis, we will explore the significance of Tax Margin 2016, its calculation, and how it influences investment decisions.

Understanding Tax Margin 2016

Tax Margin 2016 represents the financial performance of a company during the fiscal year 2016, specifically focusing on its tax obligations and profitability. It is a measure of the company's success in generating profits while effectively managing its tax liabilities.

The tax margin is calculated by dividing the company's tax expense by its revenue for the given period. This ratio provides a percentage that indicates the proportion of revenue that is utilized to cover tax obligations. The formula can be expressed as:

Tax Margin = (Tax Expense / Revenue) * 100

A lower tax margin indicates that a larger portion of the company's revenue is available for reinvestment, growth, and shareholder returns. Conversely, a higher tax margin suggests that a significant portion of revenue is allocated towards tax payments, potentially impacting the company's financial flexibility.

Key Factors Influencing Tax Margin

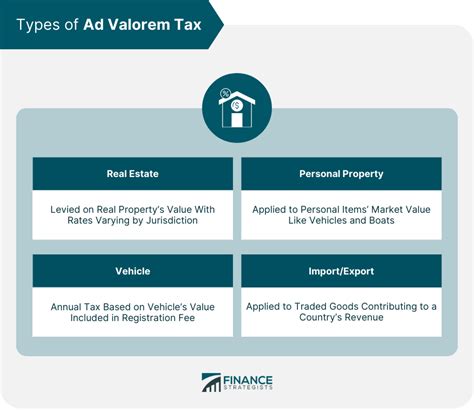

Several factors contribute to the tax margin and its variability. These include:

- Tax Rates: Changes in tax rates, both at the federal and state levels, can significantly impact a company's tax obligations. Higher tax rates may lead to increased tax expenses, affecting the tax margin.

- Industry-Specific Tax Considerations: Different industries have unique tax structures and regulations. For instance, certain sectors may benefit from tax incentives or face higher tax burdens, influencing their tax margins.

- Corporate Tax Strategies: Companies employ various tax planning strategies to optimize their tax liabilities. These strategies, such as tax credits, deductions, and deferrals, can impact the tax margin and overall financial performance.

- Economic Conditions: Economic factors, including GDP growth, inflation, and consumer spending, can influence a company's revenue and, consequently, its tax obligations. Economic downturns may lead to decreased revenue and a higher tax burden relative to income.

Analyzing Tax Margin 2016: A Case Study

To illustrate the significance of Tax Margin 2016, let's consider a hypothetical case study of a leading technology company, TechCorp International.

TechCorp International, a global technology giant, experienced a remarkable financial performance in 2016. The company's revenue for the fiscal year amounted to $10 billion, a significant increase from the previous year. However, the company's tax obligations were substantial, with a tax expense of $2.8 billion.

Using the tax margin calculation, we can determine TechCorp International's tax margin for 2016:

Tax Margin = ($2.8 billion / $10 billion) * 100 = 28%

This tax margin of 28% indicates that TechCorp International allocated nearly one-third of its revenue towards tax payments. While this is a significant proportion, it is important to analyze the context and compare it to industry peers and historical data.

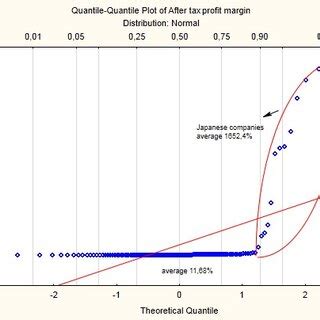

Industry Comparison

In the technology sector, tax margins can vary widely due to the diverse nature of businesses and tax regulations. TechCorp International's tax margin of 28% is slightly higher than the industry average of 25% for 2016. This suggests that the company's tax obligations may be slightly higher than its competitors, potentially impacting its financial flexibility.

Historical Analysis

Examining TechCorp International's tax margin over several years provides valuable insights. In 2015, the company's tax margin was 26%, indicating a slight increase in 2016. This could be attributed to various factors, including changes in tax rates, economic conditions, or the company's tax planning strategies.

| Year | Revenue ($) | Tax Expense ($) | Tax Margin (%) |

|---|---|---|---|

| 2016 | 10,000,000,000 | 2,800,000,000 | 28 |

| 2015 | 8,500,000,000 | 2,200,000,000 | 26 |

Implications for Investors

Understanding Tax Margin 2016 is crucial for investors as it provides insights into a company's financial health and potential risks. Here are some key implications:

- Profitability: A high tax margin may indicate that a significant portion of revenue is being directed towards tax payments, potentially limiting the company's ability to reinvest in growth initiatives or distribute dividends to shareholders.

- Financial Flexibility: A lower tax margin suggests that the company has more financial flexibility to invest in research and development, expand its operations, or pursue strategic acquisitions. This can be attractive to investors seeking growth opportunities.

- Tax Risk: A sudden increase in tax rates or changes in tax regulations can significantly impact a company's tax margin. Investors should consider the potential risks associated with tax policy changes and their impact on the company's financial performance.

- Tax Planning Strategies: Companies with effective tax planning strategies may have lower tax margins, indicating their ability to optimize tax obligations. Investors can assess the company's tax efficiency and its potential for long-term profitability.

Considerations for Tax-Efficient Investing

When evaluating investments based on tax margins, investors should consider the following:

- Industry Analysis: Compare tax margins within the industry to identify companies with competitive tax strategies and efficient tax management.

- Historical Trends: Analyze tax margins over several years to understand the company's historical performance and its ability to manage tax obligations effectively.

- Tax Policy Changes: Stay informed about potential changes in tax regulations that may impact the company's tax obligations and, consequently, its tax margin.

- Risk Assessment: Assess the potential risks associated with a high tax margin, such as limited financial flexibility or the impact of future tax policy changes.

Future Outlook and Tax Strategies

As we look ahead, the tax landscape continues to evolve, and companies must adapt their tax strategies to remain competitive. Here are some key considerations for the future:

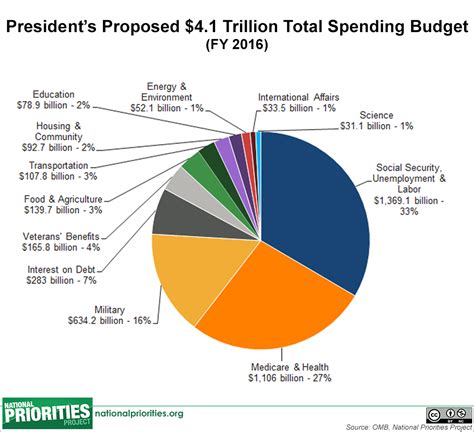

- Tax Reform: Tax reforms, such as the Tax Cuts and Jobs Act in the United States, have significantly impacted corporate tax obligations. Companies must navigate these changes and optimize their tax structures accordingly.

- International Tax Considerations: With global operations, companies must navigate complex international tax regulations. Effective tax planning and compliance are essential to minimize tax obligations and maximize profitability.

- Tax Technology: Advances in technology, such as tax automation and data analytics, offer opportunities for companies to streamline their tax processes and improve tax efficiency. Investing in tax technology can lead to significant cost savings and improved tax management.

Staying Competitive in a Changing Tax Environment

In today's dynamic tax landscape, companies must stay agile and adapt their tax strategies. By leveraging technology, optimizing tax structures, and staying informed about tax reforms, companies can maintain a competitive edge and improve their tax margins.

As investors, staying informed about tax policies, industry trends, and company-specific tax strategies is crucial for making strategic investment decisions. Tax Margin 2016 provides a snapshot of a company's financial performance and tax management during a critical period, offering valuable insights for investors and analysts alike.

How is Tax Margin calculated, and what does it represent?

+Tax Margin is calculated by dividing a company’s tax expense by its revenue for a specific period. It represents the percentage of revenue allocated towards tax obligations, providing insights into a company’s tax efficiency and financial health.

What factors can influence a company’s tax margin?

+Several factors can impact tax margins, including tax rates, industry-specific regulations, corporate tax strategies, and economic conditions. These factors can vary significantly, affecting a company’s tax obligations and overall financial performance.

Why is Tax Margin important for investors?

+Tax Margin provides investors with valuable insights into a company’s financial health and potential risks. It helps assess a company’s profitability, financial flexibility, and tax efficiency, allowing investors to make informed decisions about potential investments.

How can investors analyze Tax Margin for investment purposes?

+Investors should compare tax margins within an industry, analyze historical trends, and consider potential tax policy changes. A comprehensive assessment of tax margins alongside other financial metrics is essential for making well-informed investment decisions.