What Is Valorem Tax

Valorem Tax, also known as value tax or valuation tax, is a unique and innovative approach to taxation that has gained attention for its potential to promote economic fairness and efficiency. Unlike traditional tax systems that rely on income, consumption, or assets, Valorem Tax focuses on the concept of "value" as the basis for taxation.

In this expert-level article, we delve into the intricacies of Valorem Tax, exploring its definition, principles, and potential impact on economies and individuals. By examining real-world examples and analyzing its implications, we aim to provide a comprehensive understanding of this alternative taxation model.

Understanding Valorem Tax: A New Paradigm

Valorem Tax is a progressive tax system that assesses individuals or entities based on the value they create or capture within an economy. It challenges the conventional notion of taxing income or wealth by proposing a more nuanced approach: taxing the value generated through economic activities.

The concept of Valorem Tax can be traced back to the works of economists such as Henry George, who advocated for a "single tax" on land value. However, modern interpretations of Valorem Tax extend beyond land value and encompass a broader range of economic activities.

At its core, Valorem Tax aims to address several key issues associated with traditional tax systems:

- Inequality: By taxing value creation, Valorem Tax seeks to reduce income inequality by ensuring that those who benefit the most from economic growth contribute proportionally.

- Economic Efficiency: It encourages productive activities by taxing value rather than distorting market incentives through complex tax codes.

- Environmental Sustainability: Some variants of Valorem Tax incorporate environmental considerations, taxing activities that harm the environment and promoting sustainable practices.

The Mechanics of Valorem Tax

Implementing Valorem Tax requires a sophisticated valuation framework. Here’s a simplified breakdown of how it might work:

Step 1: Identifying Value Creation

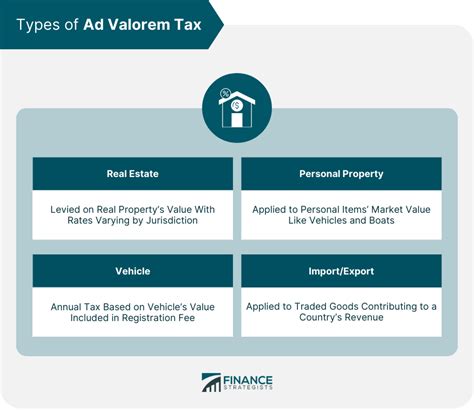

Valorem Tax begins by identifying the activities or assets that create or capture value. This can include traditional sources of income such as wages, investments, and business profits, but also extends to other forms of value creation, such as intellectual property, natural resources, and network effects.

Step 2: Assessing Value

The next step involves assessing the value created or captured. This can be done through various methods, including market-based valuations, cost-benefit analyses, or expert assessments. The goal is to determine the economic value generated by the activity or asset in question.

Step 3: Tax Calculation

Once the value is assessed, a progressive tax rate is applied. The tax rate can vary based on the type of value created or the individual’s overall contribution to value creation. For instance, higher tax rates may be applied to activities with a greater social impact or to individuals with higher value-creation potential.

For example, consider a technology startup that develops an innovative software platform. The value created by this startup can be assessed based on the market value of its software, the number of users it serves, and the potential for future growth. The Valorem Tax rate applied to this startup would depend on its specific circumstances and the overall value it generates.

Real-World Applications and Examples

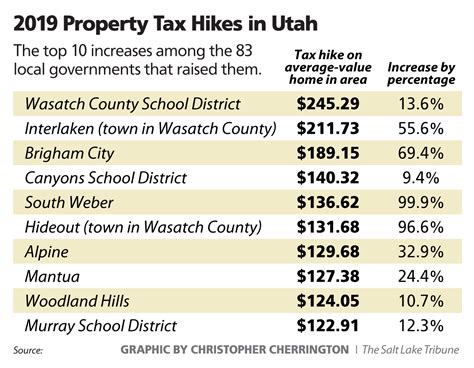

While Valorem Tax is still an emerging concept, some jurisdictions have implemented similar value-based taxation systems:

Land Value Taxation

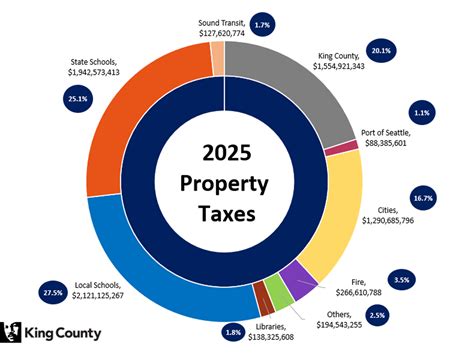

Several cities and regions around the world have adopted land value taxation, which is a direct descendant of Henry George’s single-tax idea. This system taxes the value of land based on its location and potential for development. By doing so, it discourages land speculation and encourages efficient land use.

Financial Transaction Taxes

Financial transaction taxes, often referred to as “Tobin taxes,” are a form of Valorem Tax applied to financial transactions. These taxes are designed to reduce excessive speculation in financial markets and generate revenue from the value created by financial institutions. Some countries, like France and Belgium, have implemented such taxes with varying degrees of success.

Carbon Pricing and Environmental Taxes

Environmental taxes, such as carbon pricing mechanisms, can be considered a form of Valorem Tax when they aim to internalize the external costs of pollution and environmental damage. By taxing activities that generate carbon emissions, these taxes encourage a transition to cleaner and more sustainable practices.

Advantages and Challenges of Valorem Tax

Valorem Tax presents several advantages and potential benefits, including:

- Promoting Economic Fairness: By taxing value creation, Valorem Tax can help reduce income inequality and ensure that those who benefit from economic growth contribute accordingly.

- Encouraging Productive Activities: Taxing value creation may incentivize individuals and businesses to engage in activities that generate real economic value, rather than focusing solely on tax avoidance strategies.

- Environmental Sustainability: Valorem Tax can be tailored to promote sustainable practices by taxing activities that harm the environment, thus encouraging a shift towards greener alternatives.

- Simplifying Tax Codes: A single tax based on value could potentially simplify the complex web of taxes and deductions in traditional systems, making tax compliance easier and reducing administrative burdens.

However, Valorem Tax also faces several challenges and considerations:

- Valuation Complexity: Assessing the value created by various activities and assets can be complex and subjective, requiring sophisticated valuation methods and expertise.

- Transition Challenges: Shifting from traditional tax systems to Valorem Tax may be politically and administratively challenging, especially when existing tax structures are deeply ingrained.

- International Coordination: In a globalized economy, coordinating Valorem Tax across jurisdictions is crucial to prevent tax avoidance and ensure a level playing field for businesses operating internationally.

The Future of Valorem Tax

As economies evolve and face new challenges, the concept of Valorem Tax may become increasingly relevant. Here are some potential future implications and considerations:

Digital Economy and Intangible Assets

The rise of the digital economy and the increasing importance of intangible assets present unique challenges for taxation. Valorem Tax could be a potential solution to tax the value created by digital platforms, software, and other intangible assets, ensuring that the benefits of the digital economy are shared fairly.

Sustainable Development Goals

The United Nations’ Sustainable Development Goals (SDGs) aim to address global challenges such as poverty, inequality, and environmental sustainability. Valorem Tax, with its focus on value creation and environmental considerations, could play a role in financing and achieving these goals.

Tax Reform and Innovation

As governments seek to reform tax systems to meet changing economic realities, Valorem Tax may emerge as a viable alternative or complement to existing tax structures. It offers an opportunity to rethink taxation and align it with the principles of fairness, efficiency, and sustainability.

Conclusion: A New Perspective on Taxation

Valorem Tax presents a bold and innovative approach to taxation, challenging the status quo and offering a potential path towards a more equitable and sustainable economy. While it may not be a one-size-fits-all solution, its principles and potential applications are worth exploring and debating.

As economists, policymakers, and citizens continue to grapple with the complexities of taxation, Valorem Tax provides a fresh perspective that could shape the future of economic policy and social welfare.

What are the key advantages of Valorem Tax over traditional tax systems?

+

Valorem Tax offers several advantages, including promoting economic fairness by taxing value creation, encouraging productive activities, and potentially addressing environmental concerns. It also simplifies tax codes and reduces the administrative burden on taxpayers.

How is Valorem Tax different from a wealth tax or income tax?

+

Valorem Tax differs from wealth and income taxes by focusing on the value created or captured rather than existing wealth or income. It aims to tax the potential for economic growth and the benefits derived from economic activities.

Can Valorem Tax be applied globally, or is it more suitable for specific jurisdictions?

+

Valorem Tax can be adapted to different jurisdictions, but its successful implementation requires careful consideration of local economic conditions and political feasibility. International coordination is crucial to prevent tax avoidance and ensure a level playing field.

What are the potential challenges in assessing the value created by various activities and assets under Valorem Tax?

+

Assessing value can be complex and subjective, requiring advanced valuation techniques and expertise. The challenge lies in developing a robust and consistent valuation framework that accounts for the diverse nature of value creation across different sectors and activities.

How might Valorem Tax impact the digital economy and the taxation of tech giants like Google, Facebook, and Amazon?

+

Valorem Tax could provide a more nuanced approach to taxing the digital economy by focusing on the value created by these tech giants. It may help address concerns about tax avoidance and ensure that these companies contribute fairly to the economies they operate in.