Spokane Sales Tax

Welcome to the comprehensive guide on the Spokane Sales Tax, an essential topic for both local businesses and consumers alike. Understanding the intricacies of sales tax is crucial for ensuring compliance and making informed financial decisions. In this expert-led article, we will delve into the specifics of Spokane's sales tax, covering its rates, exemptions, and unique aspects. By the end of this article, you'll have a thorough understanding of how sales tax operates in Spokane, empowering you to navigate the local market with confidence.

Unraveling the Spokane Sales Tax Landscape

Spokane, a vibrant city nestled in the heart of Washington state, boasts a unique sales tax structure that impacts both residents and businesses. The sales tax in Spokane is a combination of state, county, and municipal taxes, each contributing to the overall tax rate applicable to various goods and services. Let’s explore the layers of this tax system to gain a comprehensive understanding.

State Sales Tax: The Foundation

The state of Washington imposes a 6.5% sales tax rate on most retail transactions. This foundational rate forms the basis of the sales tax landscape in Spokane and across the state. However, it’s important to note that Washington is one of the few states without a general sales tax on groceries, making essential food items more affordable for residents.

| Tax Type | Rate |

|---|---|

| State Sales Tax | 6.5% |

The state sales tax is applicable to a wide range of goods, including electronics, clothing, and household items. However, certain categories, such as prescription medications and medical devices, are exempt from this tax, offering relief to individuals with specific healthcare needs.

County Sales Tax: A Local Twist

Spokane County adds an additional layer to the sales tax structure with a 0.4% county sales tax. This supplementary tax is crucial for funding local initiatives and infrastructure projects within the county. It ensures that residents contribute to the development and maintenance of their community, creating a sense of collective responsibility.

| Tax Type | Rate |

|---|---|

| County Sales Tax | 0.4% |

While the county sales tax may seem small, its impact is significant. It allows Spokane County to address local needs and priorities, whether it's improving roads, supporting public transportation, or investing in community programs. This localized tax structure empowers residents to directly influence the development of their neighborhood.

Municipal Sales Tax: City-Specific Considerations

Spokane City, the vibrant urban center of Spokane County, imposes its own 0.5% municipal sales tax. This city-specific tax is a critical revenue stream for the city government, enabling it to fund essential services and initiatives that enhance the quality of life for its residents.

| Tax Type | Rate |

|---|---|

| Municipal Sales Tax | 0.5% |

The municipal sales tax in Spokane City contributes to a range of vital projects, from maintaining public parks and recreational facilities to supporting local law enforcement and emergency services. It ensures that the city remains a thriving and safe place to live, work, and visit.

A Collaborative Effort: Combined Rates and Exemptions

The sales tax structure in Spokane is a collaborative effort between the state, county, and city governments. When combined, these taxes result in a 7.4% sales tax rate for most goods and services within the city limits. However, it’s important to note that certain items, such as non-prepared food and certain clothing items, are exempt from the municipal sales tax, providing some relief to consumers.

| Tax Type | Rate |

|---|---|

| Combined Sales Tax (State + County + City) | 7.4% |

This collaborative approach to sales taxation ensures that the revenue generated benefits the community at large. It allows for a more equitable distribution of resources, with the state, county, and city each playing a role in providing essential services and infrastructure to the residents of Spokane.

Sales Tax Exemptions: Navigating the Exceptions

While the sales tax in Spokane applies to a wide range of goods and services, there are specific categories that are exempt from taxation. These exemptions are crucial for both consumers and businesses, as they provide financial relief and clarity in certain situations. Let’s explore some of the key exemptions in the Spokane sales tax landscape.

Groceries and Food: Essential Items Tax-Free

One of the most notable exemptions in the Spokane sales tax system is the absence of tax on groceries and certain food items. This exemption is a significant relief for residents, as it makes essential items more affordable and reduces the overall tax burden on households. Whether it’s a trip to the local grocery store or a visit to a farmer’s market, residents can enjoy tax-free purchases of food items, including fresh produce, dairy products, and staple foods.

| Category | Exemption Status |

|---|---|

| Groceries | Tax-Free |

| Prepared Food | Taxable |

However, it's important to note that prepared food, such as meals from restaurants or takeout services, is subject to sales tax. This distinction ensures that businesses in the food industry contribute to the local tax base while providing consumers with a clear understanding of their tax obligations.

Clothing and Apparel: Selective Exemptions

The sales tax exemptions in Spokane also extend to certain clothing items. Specifically, clothing and footwear costing less than $100 per item are exempt from municipal sales tax. This exemption provides a financial benefit to consumers, especially those on a budget, as it reduces the overall cost of essential clothing items.

| Category | Exemption Status |

|---|---|

| Clothing (under $100) | Municipal Sales Tax Exempt |

| Clothing (over $100) | Municipal Sales Tax Applicable |

By exempting lower-priced clothing items, the sales tax system in Spokane acknowledges the basic needs of its residents and ensures that essential apparel remains accessible to a wider range of income levels. This selective exemption is a thoughtful approach to balancing the needs of consumers and the revenue requirements of the city.

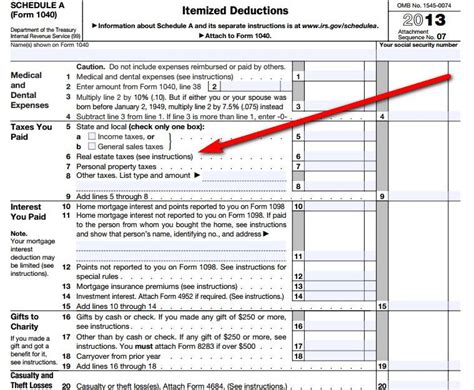

Prescription Medications and Medical Devices: Healthcare Relief

Spokane’s sales tax structure demonstrates a commitment to supporting healthcare by exempting prescription medications and medical devices from state sales tax. This exemption is particularly beneficial for individuals with specific healthcare needs, as it reduces the financial burden associated with essential medications and medical equipment. By removing the sales tax on these items, Spokane ensures that access to healthcare is more affordable and equitable for its residents.

| Category | Exemption Status |

|---|---|

| Prescription Medications | State Sales Tax Exempt |

| Medical Devices | State Sales Tax Exempt |

This exemption not only provides financial relief to individuals but also encourages a healthier community. By reducing the cost of essential healthcare items, Spokane promotes better access to medical care and supports the overall well-being of its residents.

Navigating Sales Tax for Businesses: Compliance and Strategies

For businesses operating in Spokane, understanding and complying with the sales tax regulations is essential for maintaining a healthy relationship with the local government and ensuring financial stability. Let’s explore some key considerations and strategies for businesses to navigate the sales tax landscape effectively.

Registration and Remittance: The Legal Requirements

All businesses in Spokane that engage in taxable sales are required to register with the Washington State Department of Revenue. This registration process ensures that businesses are officially recognized as tax collectors and are held accountable for accurately calculating and remitting sales taxes to the appropriate authorities.

Businesses must obtain a Business License and a Sales Tax Permit to legally operate and collect sales tax. These licenses and permits serve as a form of identification and authorization, allowing businesses to conduct their operations within the legal framework of the state and city.

Once registered, businesses are responsible for calculating the applicable sales tax on each transaction and remitting these taxes to the Department of Revenue on a regular basis. The frequency of remittance can vary based on the business's sales volume and turnover, with options for monthly, quarterly, or annual filings.

Accurate Calculation: A Key to Compliance

Accurate calculation of sales tax is a critical aspect of compliance for businesses in Spokane. With a combined sales tax rate of 7.4%, it’s essential for businesses to have a clear understanding of the applicable rates and exemptions to ensure they are charging the correct amount of tax on each transaction.

Businesses can utilize sales tax calculation tools and software to streamline this process and reduce the risk of errors. These tools take into account the various tax rates and exemptions, providing a precise calculation for each sale. By investing in accurate sales tax calculation methods, businesses can avoid undercharging or overcharging customers, maintaining a positive relationship with their clientele.

Record-Keeping and Audits: Ensuring Transparency

Maintaining detailed and accurate records of sales transactions is a fundamental aspect of sales tax compliance for businesses in Spokane. These records serve as a vital tool for tax authorities during audits, allowing them to verify the accuracy of sales tax calculations and remittances.

Businesses should keep records of all sales, including the date, amount, and applicable sales tax rate for each transaction. These records should also indicate whether any exemptions were applied and the reasons for those exemptions. By maintaining thorough records, businesses can demonstrate their commitment to transparency and compliance, reducing the likelihood of penalties or legal issues.

Regular internal audits can also help businesses identify any discrepancies or errors in their sales tax calculations. By catching these issues early, businesses can make the necessary corrections and ensure ongoing compliance with sales tax regulations.

Strategies for Success: Minimizing Sales Tax Impact

While sales tax is an essential revenue stream for the government, businesses can implement strategies to minimize its impact on their operations and bottom line. Here are some effective strategies for businesses to consider:

- Exemption Awareness: Stay informed about the sales tax exemptions applicable to your industry and products. By understanding these exemptions, you can pass on the savings to your customers, making your business more competitive and attractive to consumers.

- Pricing Strategies: Consider adjusting your pricing strategies to absorb some of the sales tax. While this may reduce your profit margin on each transaction, it can make your products more affordable for customers and encourage higher sales volumes.

- Online Sales: If your business operates online, explore the possibility of shipping goods to locations with lower sales tax rates. This strategy can help reduce the overall tax burden on your business and provide a competitive advantage in the e-commerce space.

- Tax Software Integration: Invest in robust sales tax calculation and compliance software. These tools can automate much of the sales tax calculation process, reducing the risk of errors and saving valuable time and resources for your business.

Sales Tax and E-Commerce: A Unique Challenge

The rise of e-commerce has presented unique challenges and considerations for sales tax regulations, particularly in the context of online sales across state lines. With the ability to reach customers beyond physical boundaries, businesses now face the complex task of determining sales tax obligations in various jurisdictions. Let’s explore the intricacies of sales tax in the e-commerce landscape, specifically focusing on the impact on businesses operating in Spokane.

Nexus and Sales Tax Obligations

In the e-commerce realm, the concept of nexus becomes crucial for determining a business’s sales tax obligations. Nexus refers to a business’s connection or presence in a particular state, which triggers the requirement to collect and remit sales tax for transactions within that state. For businesses in Spokane, understanding their nexus and the nexus of their customers is essential for compliance.

If a Spokane-based business has customers in other states, it's important to determine whether they have a nexus in those states. Factors such as having employees, warehouses, or even affiliates in those states can establish a nexus, requiring the business to collect and remit sales tax for transactions with customers in those jurisdictions. This can add complexity to the sales tax calculation process, as businesses may need to consider multiple tax rates and regulations.

Economic Nexus and Remote Sellers

The concept of economic nexus has further expanded the sales tax obligations for remote sellers, including many e-commerce businesses. Economic nexus is a threshold-based approach, where a business is required to collect and remit sales tax if its sales or transactions in a state exceed a certain threshold, regardless of whether the business has a physical presence in that state.

For businesses in Spokane, understanding the economic nexus thresholds in other states is crucial. If their online sales exceed these thresholds, they may be required to register, collect, and remit sales tax in those states. This requirement ensures that businesses contribute to the tax base of the states where they have significant economic activity, even without a physical presence.

Simplifying E-Commerce Sales Tax: Solutions and Strategies

Navigating the complex world of e-commerce sales tax can be daunting, but there are solutions and strategies available to simplify the process for businesses in Spokane and beyond.

- Sales Tax Automation: Utilizing sales tax automation software can greatly streamline the process of calculating, collecting, and remitting sales tax for e-commerce businesses. These tools can integrate with your e-commerce platform, automatically calculating the applicable sales tax based on the customer's location and other relevant factors.

- Marketplace Facilitator Laws: In some states, including Washington, marketplace facilitator laws have been implemented. These laws require online marketplaces, such as Amazon or eBay, to collect and remit sales tax on behalf of third-party sellers. By leveraging these platforms, businesses can offload some of the sales tax compliance responsibilities, simplifying their tax obligations.

- Tax Consulting Services: Engaging the services of tax consultants or accountants with expertise in e-commerce sales tax can provide valuable guidance and support. These professionals can help businesses navigate the complex landscape of sales tax regulations, ensuring compliance and minimizing tax liabilities.

- Regular Updates and Training: Staying updated on the latest sales tax regulations and changes is crucial for e-commerce businesses. Regular training sessions and workshops can help businesses and their employees stay informed, ensuring that sales tax obligations are accurately met.

The Future of Sales Tax in Spokane: Trends and Predictions

As we look ahead, it’s essential to consider the future of sales tax in Spokane and the potential trends and changes that may impact businesses and consumers alike. Let’s explore some key factors that could shape the sales tax landscape in the years to come.

Potential Rate Changes: A Balancing Act

One of the most significant factors that could influence the future of sales tax in Spokane is the possibility of rate changes. While the current sales tax rate of 7.4% is relatively stable, there may be pressures to adjust this rate in the future to meet