King County Washington Property Tax

Welcome to an in-depth exploration of the King County Washington Property Tax, a vital aspect of the region's financial ecosystem. This article aims to demystify the property tax system in King County, offering a comprehensive guide for homeowners, investors, and anyone interested in understanding this essential aspect of local government finance.

Understanding King County Property Tax

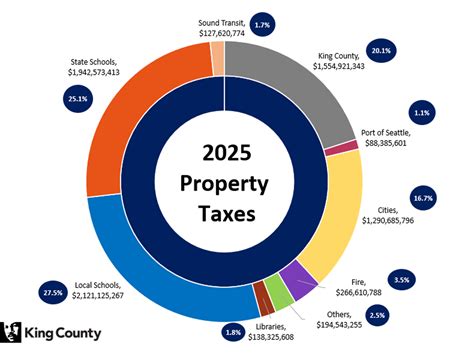

King County, home to Seattle and numerous other vibrant communities, operates a robust property tax system to fund essential services like schools, public safety, transportation, and more. The property tax is a crucial revenue source, ensuring the county can deliver vital services to its residents.

Property tax in King County is based on the assessed value of real estate properties, including homes, commercial buildings, and land. The tax is levied annually and is calculated as a percentage of the assessed value, with the exact rate varying based on the property's location and its classification.

The assessment process involves evaluating the property's market value, considering factors like location, size, improvements, and recent sales of comparable properties. This process is conducted by the King County Assessor's Office, an independent agency responsible for maintaining accurate property assessments.

Property Tax Rates in King County

The property tax rate in King County is determined by the various taxing districts a property falls within. These districts include the county itself, cities, school districts, and special purpose districts like fire or water districts. Each of these districts sets its tax rate, resulting in a combined rate for each property.

| Taxing District | Tax Rate (per $1,000 assessed value) |

|---|---|

| King County | $6.25 |

| City of Seattle | $8.34 |

| Issaquah School District | $3.57 |

| Snoqualmie Fire District | $2.75 |

| Total Combined Rate | $21.03 |

In the above example, a property located within these districts would be subject to a total property tax rate of $21.03 per $1,000 of assessed value. This rate is applied to the property's assessed value to calculate the annual tax liability.

Property Tax Exemptions and Discounts

King County offers various exemptions and discounts to certain property owners, reducing their tax liability. These include:

- Homestead Exemption: Provides a reduction in the assessed value for homeowners who use the property as their primary residence.

- Senior Exemption: Offers a partial or full exemption for homeowners aged 61 or older, based on income and other criteria.

- Veterans' Exemption: Provides a reduction in assessed value for veterans with service-connected disabilities.

- Conservation Easement Discount: Grants a discount for properties subject to a conservation easement, preserving the land for environmental or agricultural purposes.

These exemptions and discounts can significantly reduce the property tax burden for eligible homeowners.

The Assessment Process

The King County Assessor’s Office conducts annual assessments to determine the market value of properties. This process involves physical inspections, analysis of recent sales, and consideration of other relevant factors.

Property owners can appeal their assessed value if they believe it is inaccurate or unfair. The appeal process is detailed on the Assessor's Office website and typically involves a review by an independent hearing board.

Property Tax Payment and Due Dates

Property taxes in King County are due twice a year, typically in April and October. The taxes are billed by the King County Treasurer’s Office, and payments can be made online, by mail, or in person.

Late payments incur penalties and interest, and in extreme cases, the property may be subject to a tax foreclosure sale.

The Impact of Property Taxes on King County Residents

Property taxes play a critical role in funding the infrastructure and services that make King County a desirable place to live and work. These taxes contribute to the county’s robust education system, efficient public transportation, and well-maintained parks and recreation areas.

However, the property tax system also has its challenges. Rising property values can lead to higher tax bills, impacting homeowners' budgets. Additionally, the complexity of the system, with multiple taxing districts and varying rates, can make it challenging for property owners to understand their tax liability.

Frequently Asked Questions (FAQ)

How are property tax rates determined in King County?

+

Property tax rates in King County are set by the various taxing districts a property falls within. These districts, such as the county, cities, and school districts, each determine their tax rate, which is then combined to create the overall rate for each property.

What are some common property tax exemptions and discounts available in King County?

+

King County offers a range of exemptions and discounts, including the Homestead Exemption for primary residences, Senior Exemption for homeowners aged 61 and above, Veterans’ Exemption for disabled veterans, and Conservation Easement Discount for properties subject to conservation easements.

How can I appeal my property’s assessed value in King County?

+

Property owners can appeal their assessed value if they believe it is inaccurate or unfair. The process involves submitting an appeal to the King County Assessor’s Office, typically within a specified timeframe, and presenting evidence to support the appeal. The appeal is then reviewed by an independent hearing board.

What happens if I don’t pay my property taxes in King County?

+

Late payment of property taxes in King County incurs penalties and interest. If the taxes remain unpaid, the property may be subject to a tax foreclosure sale, where the property is sold to satisfy the tax debt.

How do property taxes contribute to the development and maintenance of King County’s infrastructure and services?

+

Property taxes are a significant source of revenue for King County, funding essential services such as education, public safety, transportation, and infrastructure maintenance. These taxes enable the county to provide high-quality services and contribute to the overall well-being and development of the community.