Arkansas State Income Tax

Arkansas, nestled in the southern region of the United States, is known for its rich cultural heritage, diverse landscapes, and a tax system that plays a pivotal role in shaping its economic landscape. In this comprehensive exploration, we delve into the intricacies of Arkansas State Income Tax, uncovering the rates, brackets, deductions, and credits that define the financial obligations of its residents.

Understanding Arkansas State Income Tax

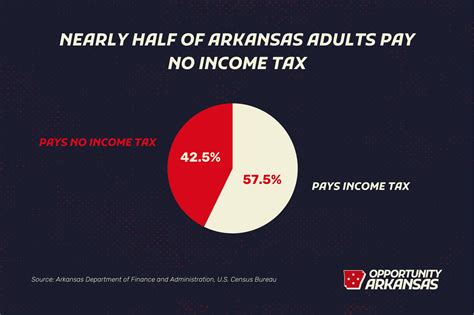

Arkansas imposes a progressive income tax system, meaning that the tax rate increases as your income rises. This approach aims to ensure that higher-income earners contribute a larger proportion of their income to the state’s revenue. As of my last update in January 2023, Arkansas operates with five income tax brackets, each corresponding to a specific range of taxable income and its respective tax rate.

Tax Brackets and Rates

The Arkansas state income tax brackets are as follows:

| Tax Bracket | Tax Rate |

|---|---|

| 0 - $2,500 | 1.0% |

| $2,501 - $4,000 | 2.0% |

| $4,001 - $7,000 | 3.0% |

| $7,001 - $10,000 | 4.0% |

| Over $10,000 | 6.0% |

These brackets are subject to adjustments annually to account for inflation and economic changes. It's important for taxpayers to refer to the most recent guidelines issued by the Arkansas Department of Finance and Administration for accurate and up-to-date information.

Taxable Income and Filing Status

Arkansas defines taxable income as the total income earned by a resident less any allowable deductions and exemptions. The state recognizes the federal filing statuses, including Single, Married Filing Jointly, Married Filing Separately, Head of Household, and Qualifying Widow(er) with Dependent Child.

The choice of filing status can significantly impact the tax liability and potential deductions available to taxpayers. For instance, married couples filing jointly often benefit from a lower overall tax rate compared to filing separately.

Deductions and Credits in Arkansas

Arkansas offers a range of deductions and credits to alleviate the tax burden on its residents. These incentives encourage economic growth, support specific industries, and provide relief to individuals and families facing unique financial circumstances.

Standard Deductions

All Arkansas taxpayers are entitled to claim a standard deduction, which reduces the taxable income. The standard deduction amounts are adjusted annually and vary based on the taxpayer’s filing status. As of my last update, the standard deductions were:

| Filing Status | Standard Deduction |

|---|---|

| Single | $3,500 |

| Married Filing Jointly | $7,000 |

| Head of Household | $5,250 |

These standard deductions help simplify the tax filing process and ensure that a basic level of income remains tax-free.

Itemized Deductions

In addition to the standard deduction, Arkansas residents can claim itemized deductions for various expenses. These deductions include medical and dental expenses, state and local taxes paid, charitable contributions, mortgage interest, and certain business-related costs. By itemizing, taxpayers can potentially lower their taxable income and, consequently, their tax liability.

Tax Credits

Arkansas offers several tax credits to promote specific initiatives and support vulnerable populations. These credits can reduce the amount of tax owed dollar-for-dollar, making them highly valuable to eligible taxpayers.

- Low-Income Credit: Aimed at assisting low-income individuals and families, this credit provides a reduction in tax liability based on income level and household size.

- Earned Income Tax Credit (EITC): The EITC is a federal credit that Arkansas recognizes. It provides a tax credit for working individuals and families with low to moderate income, boosting their financial stability.

- Child and Dependent Care Credit: This credit helps offset the costs of childcare, making it easier for working parents to manage their financial responsibilities.

- Education Credits: Arkansas offers credits for educational expenses, encouraging residents to pursue higher education and skill development.

Tax Filing and Payment

Arkansas residents are required to file their state income tax returns annually, typically by April 15th, mirroring the federal deadline. Taxpayers have the option to file electronically or by mail, with electronic filing often being the faster and more efficient route.

For those who owe taxes, the payment can be made alongside the filing or through a payment plan arrangement with the state. Arkansas offers various payment options, including direct debit, credit card, and electronic funds transfer.

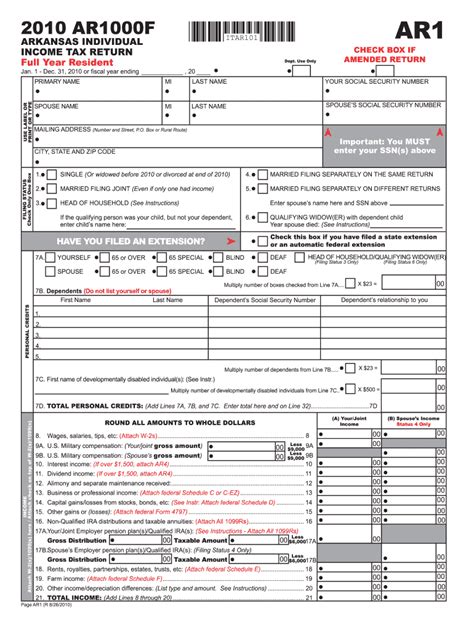

Tax Forms and Requirements

The primary tax form used in Arkansas is Form AR1000, the Arkansas Individual Income Tax Return. This form collects essential information about the taxpayer’s income, deductions, credits, and tax liability. Other forms, such as Schedule 1 and Schedule 2, are used to report additional income, deductions, and credits that don’t fit on the primary form.

Taxpayers are required to provide accurate and complete information on their tax returns, including W-2 forms from employers, 1099 forms for self-employment income, and documentation for any deductions or credits claimed.

Tax Compliance and Enforcement

The Arkansas Department of Finance and Administration is responsible for tax compliance and enforcement within the state. They ensure that taxpayers are adhering to the tax laws and regulations, and they have the authority to audit tax returns, assess penalties for non-compliance, and pursue legal action in cases of tax evasion.

Arkansas takes tax compliance seriously, and taxpayers are encouraged to seek professional advice if they have any doubts or questions about their tax obligations.

Tax Amnesty Programs

From time to time, Arkansas may offer tax amnesty programs to encourage voluntary compliance and provide a fresh start for taxpayers who have fallen behind on their tax obligations. These programs typically waive penalties and interest for taxpayers who come forward and pay their outstanding taxes.

Tax amnesty programs are a way for the state to recover lost revenue and provide a pathway for taxpayers to resolve their tax issues without facing further legal consequences.

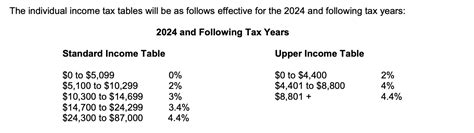

The Future of Arkansas State Income Tax

Arkansas, like many states, is continuously evaluating its tax policies to ensure they remain fair, competitive, and supportive of economic growth. The state’s tax system is subject to legislative changes, economic shifts, and societal needs, making it a dynamic and evolving aspect of Arkansas’s governance.

Looking ahead, Arkansas may consider adjustments to its tax brackets, deductions, and credits to adapt to changing economic conditions and demographic shifts. Additionally, the state may explore initiatives to simplify the tax code, making it more accessible and understandable for taxpayers.

In conclusion, Arkansas State Income Tax is a crucial component of the state's fiscal framework, shaping the economic landscape and influencing the financial well-being of its residents. By understanding the tax rates, brackets, deductions, and credits, individuals can navigate the tax system with confidence and ensure they're fulfilling their obligations while maximizing the benefits available to them.

What is the current Arkansas state income tax rate for 2023?

+As of my last update in January 2023, the Arkansas state income tax rates range from 1.0% to 6.0%, depending on the taxable income bracket.

Are there any deductions or credits available for Arkansas taxpayers?

+Yes, Arkansas offers standard deductions based on filing status, and residents can also claim itemized deductions for various expenses. Additionally, the state provides tax credits for low-income individuals, education, childcare, and more.

When is the deadline for filing Arkansas state income taxes?

+The deadline for filing Arkansas state income taxes typically aligns with the federal deadline, which is usually April 15th of each year. However, it’s always advisable to check for any updates or extensions announced by the state.