Iowa Vehicle Sales Tax

The Iowa Vehicle Sales Tax is a crucial aspect of the state's revenue generation and automotive industry regulations. It is a tax levied on the purchase of vehicles, including cars, trucks, motorcycles, and other motorized vehicles. This tax plays a significant role in the state's financial framework and impacts both residents and businesses alike. Understanding the intricacies of the Iowa Vehicle Sales Tax is essential for anyone involved in the automotive industry or planning to purchase a vehicle in the state.

Understanding the Iowa Vehicle Sales Tax

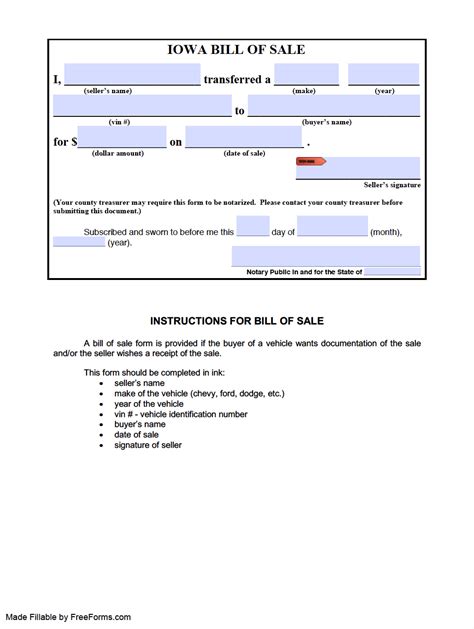

The Iowa Vehicle Sales Tax is a state-level tax imposed on the retail sale or lease of motor vehicles. It is calculated as a percentage of the vehicle's purchase price and is collected by the Iowa Department of Revenue. This tax is separate from other fees and taxes, such as the title fee and registration fee, which are also required when purchasing a vehicle.

The primary purpose of the Iowa Vehicle Sales Tax is to generate revenue for the state, which is then allocated to various public services and infrastructure projects. It ensures that the costs associated with maintaining roads, bridges, and other transportation networks are shared by those who benefit from them. Additionally, the tax contributes to the state's general fund, supporting education, healthcare, and other essential services.

Iowa's Vehicle Sales Tax is a consumption tax, meaning it is based on the actual purchase price of the vehicle. This tax is applicable to both new and used vehicles, whether purchased from a dealership or a private seller. The tax rate, however, can vary depending on several factors, including the type of vehicle, its weight, and the location of the sale.

Tax Rate and Calculation

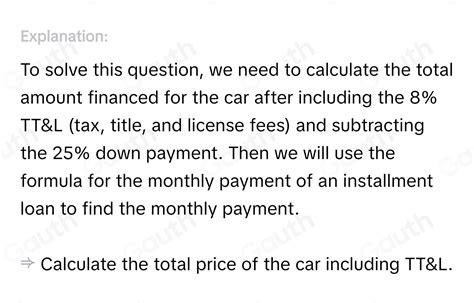

As of my last update in January 2023, the Iowa Vehicle Sales Tax rate stands at 5% of the vehicle's purchase price. This rate is uniform across the state and applies to all vehicle sales. However, it is important to note that additional local option sales taxes may be added to the state tax rate, depending on the county in which the vehicle is purchased.

To calculate the Vehicle Sales Tax, you need to multiply the purchase price of the vehicle by the applicable tax rate. For instance, if you purchase a car for $25,000, the Vehicle Sales Tax would be calculated as follows:

| Purchase Price | Tax Rate | Vehicle Sales Tax |

|---|---|---|

| $25,000 | 5% | $1,250 |

In this example, the buyer would need to pay an additional $1,250 in Vehicle Sales Tax on top of the purchase price.

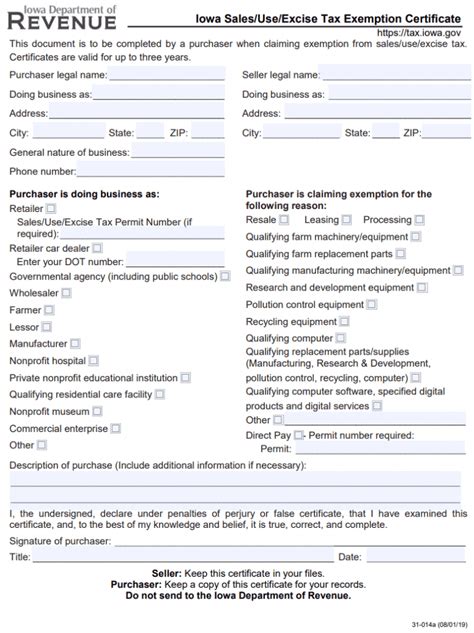

Exemptions and Special Considerations

While the Iowa Vehicle Sales Tax applies to most vehicle purchases, there are certain exemptions and special cases to be aware of:

- Trade-Ins: If you trade in your old vehicle as part of the purchase, the sales tax is calculated based on the difference between the trade-in value and the purchase price of the new vehicle.

- Military Personnel: Active-duty military personnel stationed in Iowa are exempt from paying the Vehicle Sales Tax if they are not legal residents of the state.

- Vehicles for Disabled Individuals: Vehicles specifically modified for disabled individuals may be eligible for a tax exemption. This includes vehicles with specialized equipment or modifications to accommodate the disability.

- Farm Vehicles: Certain farm vehicles used exclusively for agricultural purposes may be exempt from the Vehicle Sales Tax. However, specific criteria and restrictions apply.

Impact on Automotive Industry and Consumers

The Iowa Vehicle Sales Tax has a significant influence on both the automotive industry and consumers. For dealerships and automotive businesses, the tax is a key consideration when setting vehicle prices and structuring sales strategies. It affects their bottom line and can impact their profitability.

From a consumer perspective, the Vehicle Sales Tax adds to the overall cost of purchasing a vehicle. Buyers need to factor in this additional expense when budgeting for a new or used car. However, it's important to note that the tax is a necessary contribution to the state's infrastructure and public services, ensuring that roads and transportation networks are well-maintained.

Comparison with Other States

When compared to other states, Iowa's Vehicle Sales Tax rate of 5% is relatively moderate. Some states have higher tax rates, while others have lower or even no sales tax on vehicle purchases. This can make Iowa an attractive option for vehicle buyers, especially those residing in neighboring states with higher tax rates.

However, it's essential to consider the overall tax landscape when comparing states. Other taxes, such as income tax and property tax, can also significantly impact an individual's or business's financial situation. Therefore, a comprehensive analysis of the tax structure is necessary when making decisions related to vehicle purchases or business operations.

Compliance and Enforcement

Ensuring compliance with the Iowa Vehicle Sales Tax is crucial for both businesses and individuals. The Iowa Department of Revenue has strict guidelines and regulations in place to enforce tax collection and prevent tax evasion.

For dealerships and automotive businesses, proper record-keeping and tax reporting are essential. They must accurately calculate and remit the Vehicle Sales Tax on every sale. Failure to comply can result in penalties, fines, and legal consequences.

Individuals purchasing vehicles also have a responsibility to pay the appropriate tax. When buying a vehicle from a private seller, it is the buyer's responsibility to calculate and pay the tax at the time of registration. The Iowa Department of Revenue provides resources and guidance to help individuals understand their tax obligations.

Audit and Enforcement Actions

The Iowa Department of Revenue regularly conducts audits and enforcement actions to ensure compliance with the Vehicle Sales Tax regulations. These audits can be random or targeted, depending on various factors such as sales volume, previous compliance history, and risk assessment.

During an audit, the Department of Revenue examines a business's or individual's tax records, sales receipts, and other relevant documents to verify the accuracy of tax calculations and payments. If discrepancies are found, the taxpayer may be required to pay additional taxes, interest, and penalties.

Enforcement actions can also lead to criminal charges in cases of intentional tax evasion or fraud. It is crucial for all parties involved in vehicle sales to understand and comply with the tax laws to avoid legal consequences.

Future Outlook and Potential Changes

The Iowa Vehicle Sales Tax, like many other state taxes, is subject to potential changes and updates. These changes can be influenced by various factors, including economic conditions, legislative decisions, and public opinion.

As of now, there are no significant proposed changes to the Vehicle Sales Tax rate or structure. However, it is essential to stay informed about any upcoming tax reforms or legislative actions that could impact the tax landscape in Iowa.

The state's revenue needs and economic climate can drive changes in tax policies. For instance, during economic downturns, states may consider increasing tax rates to generate additional revenue. On the other hand, economic growth and budget surpluses can lead to tax rate reductions or other incentives to stimulate the economy.

Potential Benefits and Drawbacks

Any changes to the Iowa Vehicle Sales Tax could have both positive and negative impacts. Increasing the tax rate could generate more revenue for the state, allowing for improved public services and infrastructure. However, it may also make vehicle purchases more expensive for consumers and potentially impact the automotive industry's profitability.

On the other hand, reducing the tax rate or implementing tax incentives could make Iowa more attractive for vehicle buyers and businesses. It could stimulate economic growth and encourage investment in the state's automotive sector. However, it may also result in a reduction of revenue for the state, impacting its ability to fund essential services.

Conclusion

The Iowa Vehicle Sales Tax is a vital component of the state's revenue system and has a significant impact on the automotive industry and consumers. Understanding the tax rate, calculation methods, and exemptions is essential for anyone involved in vehicle sales or purchases in Iowa.

While the current tax rate of 5% is relatively moderate, it is subject to change based on various economic and legislative factors. It is important for all parties to stay updated on any potential tax reforms and their potential impacts. By staying informed and compliant with the tax regulations, businesses and individuals can contribute to the state's financial stability while also ensuring a smooth and legal vehicle purchasing process.

FAQ

What happens if I don’t pay the Iowa Vehicle Sales Tax when purchasing a vehicle?

+Failing to pay the Iowa Vehicle Sales Tax can result in significant penalties and legal consequences. The Iowa Department of Revenue may impose fines, interest charges, and even criminal charges for tax evasion. It is crucial to comply with the tax regulations to avoid these issues.

Are there any ways to reduce or avoid the Iowa Vehicle Sales Tax?

+There are limited ways to reduce or avoid the Iowa Vehicle Sales Tax. The primary exemptions include military personnel, disabled individuals, and farm vehicles used exclusively for agricultural purposes. However, these exemptions have specific criteria, and it is important to consult with a tax professional to understand your eligibility.

How often does the Iowa Vehicle Sales Tax rate change, and what factors influence these changes?

+The Iowa Vehicle Sales Tax rate can change based on legislative decisions and economic factors. Typically, tax rate changes are proposed and implemented through legislative actions. Economic downturns or budget constraints may lead to increased tax rates, while economic growth and surpluses can result in tax rate reductions.

Can I deduct the Iowa Vehicle Sales Tax from my federal income taxes?

+No, the Iowa Vehicle Sales Tax is not deductible from federal income taxes. State and local sales taxes are generally not deductible for federal income tax purposes. However, it is important to consult with a tax professional for personalized advice based on your specific circumstances.

Are there any online resources or tools to help calculate the Iowa Vehicle Sales Tax?

+Yes, the Iowa Department of Revenue provides online resources and calculators to help individuals and businesses calculate the Vehicle Sales Tax accurately. These tools consider the vehicle’s purchase price, applicable tax rate, and any local option sales taxes. You can find these resources on the Department’s official website.