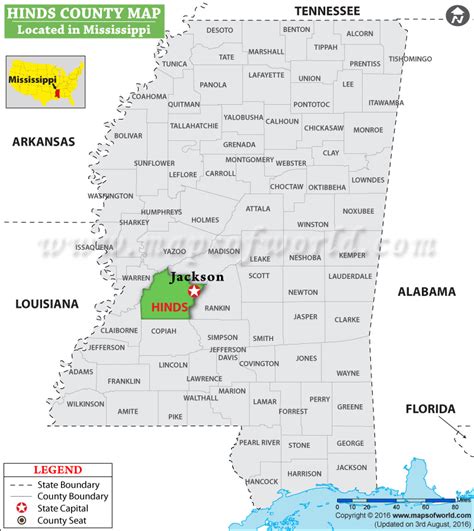

Hinds County Ms Tax Collector

In the heart of Mississippi, the role of the Hinds County Tax Collector is a pivotal position within the county's administration, responsible for managing and overseeing a multitude of critical tasks related to property and vehicle taxation, license plates, and more. This office, led by a dedicated team, plays a vital role in ensuring the efficient functioning of local government and the provision of essential services to residents.

The Role and Responsibilities of the Hinds County Tax Collector

The Hinds County Tax Collector is a key figure in the county’s fiscal landscape, charged with a comprehensive set of duties that contribute significantly to the local economy and governance.

Property Tax Assessment and Collection

One of the primary responsibilities of the Hinds County Tax Collector is the assessment and collection of property taxes. This process involves evaluating the value of properties within the county and ensuring that the appropriate taxes are levied and collected. The office maintains accurate records of property ownership and ensures that all residents meet their tax obligations in a timely manner.

| Property Tax Rates in Hinds County | 2023 Rates (per $100 of Assessed Value) |

|---|---|

| County General Fund | $44.48 |

| School District | $69.73 |

| City/Town Taxes | Varies by Municipality |

Vehicle Registration and License Plates

The Tax Collector’s office also manages vehicle registration and the issuance of license plates. Residents must register their vehicles annually and pay the corresponding fees to maintain valid registration and receive their license plates. This process not only ensures compliance with state regulations but also provides a steady stream of revenue for the county.

| Vehicle Registration Fees in Hinds County | 2023 Fees |

|---|---|

| Standard Passenger Vehicle (under 4,500 lbs) | $23.00 |

| Light Truck or SUV (4,500-6,000 lbs) | $28.00 |

| Motorcycle | $12.00 |

| Electric/Hybrid Vehicles | $38.00 |

Other Tax-Related Services

Beyond property and vehicle taxes, the Hinds County Tax Collector offers a range of other tax-related services, including the collection of taxes on personal property, business taxes, and special assessments. The office also provides assistance with tax exemptions and refunds, helping residents navigate the complex world of taxation.

Online Services and Modernization

Recognizing the importance of digital transformation, the Hinds County Tax Collector’s office has embraced online services to enhance efficiency and convenience for taxpayers.

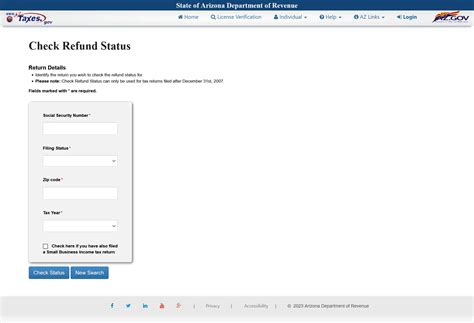

Online Payment Portal

Residents can now pay their property and vehicle taxes online through a secure payment portal. This service offers the flexibility to pay taxes anytime, anywhere, and provides real-time confirmation of payment. The portal also allows taxpayers to view their account history and manage their tax obligations digitally.

E-Filing for Business Taxes

The office has introduced e-filing for business taxes, enabling businesses to file their tax returns electronically. This system streamlines the tax filing process, reducing paperwork and increasing accuracy. It also allows for faster processing times, ensuring that businesses receive their tax refunds or are able to resolve any issues promptly.

Community Engagement and Outreach

The Hinds County Tax Collector understands the importance of community engagement and actively works to foster a positive relationship with residents. Through various outreach programs and initiatives, the office aims to educate taxpayers about their rights and responsibilities, ensuring a fair and transparent taxation system.

Taxpayer Assistance Programs

Recognizing that some residents may face financial difficulties, the Tax Collector’s office has implemented assistance programs. These programs offer support to qualifying individuals and families, providing options for tax deferrals, payment plans, or even tax exemptions in certain circumstances. The office works closely with social service agencies to ensure that vulnerable residents are not unfairly burdened by tax obligations.

Educational Workshops

To promote financial literacy and awareness about taxation, the office conducts regular educational workshops. These workshops cover a range of topics, from understanding property tax assessments to navigating the vehicle registration process. By empowering residents with knowledge, the Tax Collector’s office aims to build a more informed and engaged community.

Future Prospects and Technological Innovations

Looking ahead, the Hinds County Tax Collector’s office is committed to continuous improvement and innovation. As technology advances, the office plans to integrate new systems and processes to further streamline tax administration.

Implementing Blockchain Technology

The office is exploring the potential of blockchain technology to enhance the security and transparency of tax records. By utilizing a distributed ledger system, the Tax Collector’s office could improve data integrity, reduce the risk of fraud, and increase efficiency in record-keeping and tax processing.

Artificial Intelligence for Tax Assessment

To improve the accuracy and fairness of property tax assessments, the office is considering the use of artificial intelligence (AI). AI algorithms could analyze a wealth of data, including property characteristics, market trends, and sales history, to provide more precise valuations. This would not only ensure fairness but also reduce the administrative burden on the office.

Conclusion

The Hinds County Tax Collector plays a vital role in the county’s administration, managing a diverse range of responsibilities with efficiency and integrity. Through a combination of traditional methods and modern innovations, the office strives to provide excellent service to residents while ensuring the county’s financial stability. As the county continues to evolve, the Tax Collector’s office remains committed to staying at the forefront of technological advancements, ensuring a bright future for Hinds County and its residents.

How can I pay my property taxes in Hinds County?

+You can pay your property taxes in Hinds County through the online payment portal, by mail, or in person at the Tax Collector’s office. The online payment portal is the most convenient method, offering 24⁄7 access and real-time confirmation of payment.

What are the vehicle registration requirements in Hinds County?

+To register your vehicle in Hinds County, you need to provide proof of insurance, a valid driver’s license, and the title or registration from your previous state (if applicable). You will also need to pay the registration fee and any applicable taxes. The Tax Collector’s office can guide you through the entire process.

Are there any tax exemptions available for senior citizens in Hinds County?

+Yes, senior citizens in Hinds County may be eligible for tax exemptions. The Homestead Exemption, for instance, reduces the taxable value of a homeowner’s property, which can result in lower property taxes. To qualify, homeowners must be at least 65 years old and meet certain income requirements. It’s best to consult with the Tax Collector’s office to understand your eligibility and the application process.