Amend Tax Return Turbotax

Amending a tax return is a crucial process that ensures taxpayers can rectify errors or make necessary adjustments to their previously filed tax forms. While the idea of amending a tax return might seem daunting, platforms like TurboTax offer accessible and user-friendly tools to streamline this process. In this comprehensive guide, we will delve into the world of amending tax returns using TurboTax, providing an expert analysis of the steps involved, best practices, and potential benefits.

Understanding the Need to Amend Tax Returns

There are various scenarios that might prompt taxpayers to amend their tax returns. Some common reasons include discovering mathematical errors, forgetting to claim eligible deductions or credits, or receiving corrected tax documents after the initial filing. Additionally, life events such as marriage, divorce, or changes in income can necessitate an amended return. In such cases, TurboTax provides a straightforward solution to rectify these issues.

The TurboTax Advantage for Amending Tax Returns

TurboTax, a trusted name in tax preparation software, offers an intuitive platform that guides users through the process of amending their tax returns. With its user-friendly interface and step-by-step instructions, TurboTax simplifies what could otherwise be a complex and time-consuming task. Here’s a detailed breakdown of the advantages of using TurboTax for amending tax returns:

1. Error Identification and Rectification

TurboTax employs advanced algorithms to identify potential errors or discrepancies in your tax return. It cross-references your information with tax regulations and guidelines, alerting you to any issues that may have been overlooked during the initial filing. By catching these errors early, you can avoid potential penalties and ensure accurate reporting.

For instance, let's say you realized you forgot to include a charitable donation in your initial tax return. TurboTax's amendment process would guide you through adding this deduction, recalculating your tax liability, and generating the necessary forms to submit to the IRS.

2. Comprehensive Deduction and Credit Analysis

One of the most valuable aspects of using TurboTax for amendments is its ability to analyze your financial situation and suggest eligible deductions and credits you might have missed. Whether it’s maximizing retirement contributions, claiming education expenses, or taking advantage of tax credits for dependents, TurboTax ensures you don’t leave any potential savings on the table.

Consider a scenario where you recently purchased a new home and were unaware of the various tax benefits associated with homeownership. TurboTax's amendment tool would guide you through claiming deductions for mortgage interest, property taxes, and even energy-efficient improvements, potentially resulting in significant tax savings.

3. Streamlined Form Generation and Submission

Amending a tax return often involves completing and submitting specific IRS forms. TurboTax takes care of this process, automatically generating the necessary forms based on your amendments. It ensures accuracy and completeness, reducing the risk of errors that could delay your refund or result in further complications.

If you need to amend your tax return to correct an error in your filing status or claim additional credits, TurboTax will guide you through the process of completing Form 1040X, the amended U.S. Individual Income Tax Return. This form is crucial for rectifying mistakes and ensuring your tax obligations are met accurately.

4. Expert Support and Guidance

TurboTax offers expert support throughout the amendment process. Their team of tax professionals is available to provide guidance and answer any questions you may have. Whether it’s understanding complex tax regulations or interpreting specific IRS guidelines, TurboTax ensures you have the support you need to navigate the amendment process with confidence.

For instance, if you're unsure about the implications of a particular life event on your tax return, such as a change in marital status or a new business venture, TurboTax's experts can provide tailored advice to ensure your amended return is accurate and compliant with tax laws.

5. Data Security and Privacy

When dealing with sensitive financial information, data security is of utmost importance. TurboTax employs robust security measures to protect your personal and financial data. Their encryption protocols ensure that your information remains confidential throughout the amendment process, giving you peace of mind.

TurboTax's commitment to data security is evident in their multi-factor authentication systems and encryption technologies. These measures safeguard your data from unauthorized access, ensuring that your amended tax return is filed securely and your personal information remains protected.

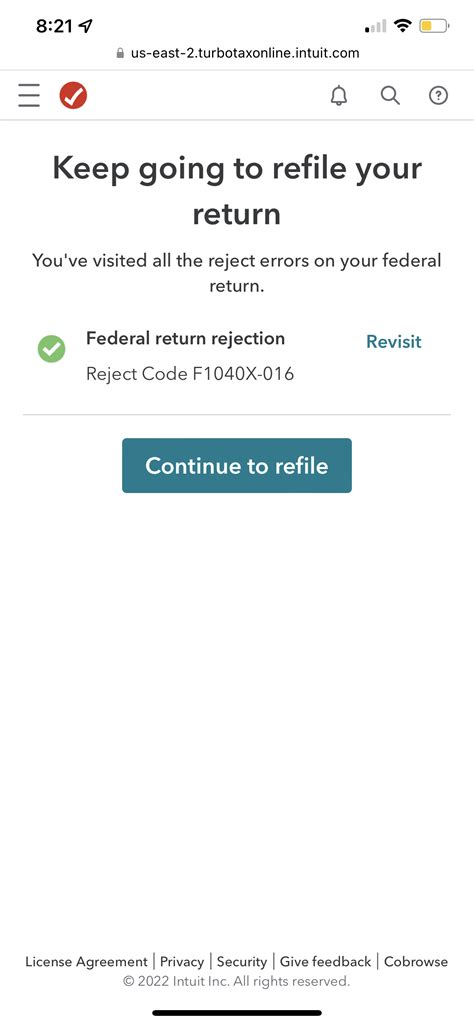

Step-by-Step Guide: Amending Your Tax Return with TurboTax

Now that we’ve explored the benefits of using TurboTax for amending tax returns, let’s delve into a detailed, step-by-step guide to help you navigate this process with ease.

1. Access Your Previous Tax Return

To initiate the amendment process, you’ll need to access your previous tax return. If you filed your taxes using TurboTax, this step is straightforward. Simply log in to your TurboTax account and navigate to the “Previous Years” section. Here, you’ll find a list of your previously filed tax returns.

Select the tax year you wish to amend, and TurboTax will provide you with a summary of your original return. This summary serves as a starting point for identifying any errors or adjustments needed.

2. Identify Errors or Adjustments

Carefully review your original tax return summary. Look for any discrepancies, missed deductions, or credits that you may have overlooked during the initial filing. TurboTax’s comprehensive review tools can assist in this process by highlighting potential issues and providing suggestions for improvements.

For example, if you realized you forgot to claim a dependent child or missed out on claiming the Earned Income Tax Credit, TurboTax will prompt you to make the necessary adjustments.

3. Make Amendments and Recalculate

Once you’ve identified the errors or adjustments needed, it’s time to make the necessary changes. TurboTax provides an intuitive interface that guides you through the amendment process. You can add, remove, or modify entries, ensuring your amended return is accurate and reflects your true financial situation.

As you make amendments, TurboTax automatically recalculates your tax liability, providing real-time updates on your potential refund or balance due. This feature ensures you have a clear understanding of the financial implications of your amendments before submitting your return.

4. Review and Verify

After making the necessary amendments, it’s crucial to review your updated tax return for accuracy. Double-check all entries, calculations, and forms to ensure they align with your financial records. TurboTax provides a comprehensive review tool that highlights any potential issues, allowing you to address them before submission.

During the review process, pay close attention to the following:

- Ensure all relevant forms are completed and attached.

- Verify that your personal information, including name, address, and Social Security number, is accurate.

- Check for any missing or incorrect entries that may impact your tax liability.

- Review the recalculated tax amounts and ensure they align with your expectations.

5. Submit Your Amended Return

Once you’ve thoroughly reviewed and verified your amended tax return, it’s time to submit it to the IRS. TurboTax simplifies this process by guiding you through the necessary steps. It ensures your return is filed accurately and securely, providing you with a confirmation once the submission is complete.

Depending on your specific circumstances, you may need to mail a paper copy of your amended return along with any supporting documentation. TurboTax provides clear instructions on how to prepare and mail your return, ensuring a smooth and hassle-free submission process.

Expert Tips and Best Practices for Amending Tax Returns

While TurboTax simplifies the amendment process, there are additional tips and best practices to consider to ensure a successful and efficient outcome. Here are some expert recommendations:

1. Gather All Relevant Documentation

Before beginning the amendment process, ensure you have all the necessary documentation readily available. This includes tax forms, receipts, and any other supporting documents related to your financial transactions. Having these documents organized and accessible will streamline the amendment process and reduce the risk of errors.

2. Understand the Impact of Amendments

Amending your tax return can have financial implications. It’s essential to understand how your amendments will affect your tax liability and potential refund. TurboTax provides real-time calculations, but it’s beneficial to have a general understanding of the tax laws and regulations surrounding your specific amendments.

3. Stay Informed About Tax Changes

Tax laws and regulations are subject to change annually. Stay informed about any updates or modifications that may impact your tax situation. TurboTax provides regular updates to its software, ensuring you have access to the latest tax information and guidelines. By staying informed, you can make informed decisions when amending your tax return.

4. Seek Professional Advice for Complex Situations

While TurboTax is a powerful tool, complex tax situations may require professional guidance. If you have unique circumstances, such as business income, investment gains, or international transactions, consider consulting a tax professional. They can provide personalized advice and ensure your amended return is compliant with complex tax regulations.

5. Maintain Accurate Records

Accurate record-keeping is crucial when it comes to tax matters. Maintain organized records of your financial transactions, receipts, and tax documents. This practice simplifies the amendment process and provides a reference point for future tax years. Consider using digital tools or tax software like TurboTax to store and manage your financial records securely.

Potential Benefits of Amending Your Tax Return

Amending your tax return using TurboTax offers several potential benefits. Here’s a breakdown of the advantages you can expect:

1. Accuracy and Compliance

By amending your tax return, you ensure accuracy and compliance with tax regulations. Correcting errors and claiming eligible deductions or credits reduces the risk of audits and penalties. TurboTax’s comprehensive review process and expert support further enhance the accuracy of your amended return.

2. Maximizing Tax Refunds

Amending your tax return can lead to a larger refund or a reduced tax liability. By identifying missed deductions or credits, you can maximize your tax savings. TurboTax’s deduction and credit analysis tools ensure you don’t leave any potential savings opportunities on the table.

3. Resolving Discrepancies

Amending your tax return allows you to address any discrepancies or errors in your original filing. Whether it’s correcting mathematical mistakes, updating personal information, or rectifying mistakes in tax calculations, TurboTax provides a straightforward solution to resolve these issues.

4. Peace of Mind

Knowing that your tax return is accurate and compliant with tax laws provides peace of mind. By using TurboTax to amend your return, you can trust that your financial obligations are met accurately. This peace of mind allows you to focus on your financial goals and future planning without the burden of tax-related worries.

5. Enhanced Financial Planning

Amending your tax return provides an opportunity to reassess your financial situation and make informed decisions for the future. By understanding your tax obligations and potential savings, you can develop a more comprehensive financial plan. TurboTax’s expert guidance and analysis tools can assist in this process, helping you optimize your financial strategies.

Future Implications and Tax Strategies

Amending your tax return is not only about rectifying past errors but also about learning from them and implementing strategies for future tax planning. Here’s a look at some future implications and tax strategies to consider:

1. Tax Planning for the Upcoming Year

Use the insights gained from amending your tax return to develop a proactive tax planning strategy for the upcoming year. Analyze the deductions and credits you claimed and identify areas where you can maximize your tax savings. TurboTax’s tax planning tools can assist in this process, providing personalized recommendations based on your financial situation.

2. Long-Term Financial Goals

Amending your tax return can be a catalyst for evaluating your long-term financial goals. Consider how your tax obligations and savings impact your overall financial plan. Use TurboTax’s financial planning tools to assess your retirement savings, investment strategies, and other financial goals, ensuring they align with your tax situation.

3. Business Tax Strategies

If you own a business, amending your tax return can provide valuable insights into your business tax strategies. Analyze the deductions and credits you claimed for your business and explore ways to optimize your tax obligations. TurboTax’s business tax tools can assist in this process, offering tailored recommendations to reduce your business tax liability.

4. Tax Compliance and Audits

Amending your tax return demonstrates a commitment to tax compliance. By addressing errors and rectifying mistakes, you reduce the risk of audits and potential penalties. TurboTax’s expert support and comprehensive review process ensure your amended return is accurate and compliant, minimizing the chances of attracting unnecessary attention from tax authorities.

5. Estate and Inheritance Planning

Amending your tax return can also impact your estate and inheritance planning. Evaluate the tax implications of your financial decisions and consider how they affect your estate. TurboTax’s estate planning tools can assist in this process, providing guidance on strategies to minimize tax obligations and ensure a smooth transition of your assets.

Conclusion

Amending your tax return using TurboTax is a straightforward and beneficial process. By following the step-by-step guide and implementing expert tips, you can ensure accuracy, maximize tax savings, and achieve peace of mind. Remember, staying informed, seeking professional advice when needed, and maintaining accurate records are key to successful tax management.

With TurboTax, you have a trusted partner in navigating the complexities of tax amendments. Embrace the power of this software to rectify errors, optimize your tax situation, and plan for a financially secure future.

Can I amend my tax return if I used a different tax preparation software initially?

+Absolutely! TurboTax’s amendment process is designed to accommodate tax returns prepared using different software. You can easily import your previous tax return data into TurboTax, making the amendment process seamless.

How long does it take to amend a tax return using TurboTax?

+The time it takes to amend a tax return depends on the complexity of your situation. Simple amendments can be completed within a few hours, while more complex cases may require additional time. TurboTax provides a clear timeline and guides you through the process efficiently.

Are there any fees associated with amending a tax return using TurboTax?

+TurboTax offers various pricing plans for amending tax returns. The cost depends on the complexity of your return and the specific features you require. It’s best to review the pricing options on their website to choose the plan that suits your needs.

Can I amend my tax return if I filed it manually without using any software?

+Yes, you can still amend your tax return manually filed. TurboTax provides the necessary forms and guidance to complete the amendment process. You’ll need to gather your original tax return and supporting documents to make the necessary corrections.

What happens if I discover an error after amending my tax return with TurboTax?

+If you identify an error after amending your tax return, you can simply log back into your TurboTax account and make the necessary corrections. TurboTax allows you to update your amended return as needed, ensuring accuracy throughout the process.