Orange County Nc Tax Records

Orange County, located in the vibrant heart of North Carolina, is renowned for its vibrant communities, thriving economy, and rich history. As one of the most sought-after regions in the state, it attracts residents and businesses alike with its diverse attractions and robust growth. Amidst this thriving landscape, understanding Orange County's tax records becomes essential for both residents and businesses.

Delving into Orange County's tax records reveals a dynamic and progressive system that plays a pivotal role in shaping the county's future. These records encompass a wide range of information, from property assessments to tax rates, providing a comprehensive overview of the county's financial landscape. In this article, we will explore the intricacies of Orange County's tax records, offering an in-depth analysis of their significance, the processes involved, and their impact on the community.

Understanding Orange County Tax Records

Orange County's tax records are an essential component of the local government's financial framework. These records are meticulously maintained by the Orange County Tax Office, which acts as the custodian of all tax-related information for the county. The tax office ensures the accuracy and integrity of these records, making them a reliable source of information for taxpayers, investors, and policymakers.

The tax records in Orange County cover a wide array of data points, providing a comprehensive view of the county's tax landscape. Here's a breakdown of the key components typically found in these records:

- Property Tax Records: Property taxes are a significant source of revenue for Orange County. The tax records include detailed information on property assessments, including the assessed value of each property, the applicable tax rates, and the calculated tax amounts. These records are vital for property owners to understand their tax obligations and for the county to manage its revenue stream effectively.

- Business Tax Records: Orange County's thriving business community generates substantial tax revenue. The tax records include details on business licenses, permits, and taxes. This information is crucial for businesses to comply with tax regulations and for the county to monitor and support economic growth.

- Vehicle Tax Records: Vehicle taxes are another important revenue stream for the county. The tax records include information on vehicle registration, license plate fees, and any applicable taxes based on vehicle value or usage. These records ensure compliance and provide insights into the county's transportation-related revenue.

- Personal Property Tax Records: Beyond real estate and vehicles, Orange County also assesses taxes on personal property. These records include details on the valuation and taxation of items like boats, aircraft, and other tangible assets. This ensures a comprehensive tax system that captures all taxable assets within the county.

- Special Assessment Records: In certain cases, Orange County may impose special assessments on properties for specific purposes, such as infrastructure improvements or community development projects. These records detail the assessment process, the affected properties, and the distribution of funds, ensuring transparency and accountability.

Accessing Orange County Tax Records

Accessing Orange County's tax records is a straightforward process designed to provide transparency and convenience for taxpayers and stakeholders. The Orange County Tax Office offers several avenues for accessing these records, ensuring that the information is readily available to those who need it.

The primary method of accessing tax records is through the Orange County Tax Office's official website. The website features a user-friendly interface that allows users to search for tax records based on various criteria, such as property address, owner's name, or account number. This online portal provides real-time access to the latest tax information, making it a valuable resource for taxpayers and property owners.

Additionally, the Orange County Tax Office maintains a physical office where taxpayers can visit to access tax records and seek assistance. The office staff is well-equipped to provide guidance and answer queries related to tax records, ensuring a personalized experience for those who prefer in-person interaction.

For those seeking a more comprehensive understanding of the county's tax landscape, the Orange County Tax Office also offers annual reports and statistical summaries. These reports provide aggregated data on tax collections, assessments, and other relevant financial information, offering valuable insights into the county's fiscal health and tax trends.

The Role of Technology in Tax Record Management

In recent years, Orange County has embraced technological advancements to enhance its tax record management system. The implementation of modern technology has brought about significant improvements in efficiency, accuracy, and accessibility.

One of the key technological advancements is the adoption of a centralized database system. This system integrates all tax-related data, including property records, tax assessments, and payment history, into a single platform. This integration streamlines the record-keeping process, reduces the risk of errors, and enables faster access to information for both taxpayers and tax officials.

Additionally, Orange County has implemented online payment systems, allowing taxpayers to make tax payments electronically. This not only provides convenience but also reduces the administrative burden on taxpayers and the tax office. Online payment systems also facilitate the tracking of payments, ensuring timely revenue collection for the county.

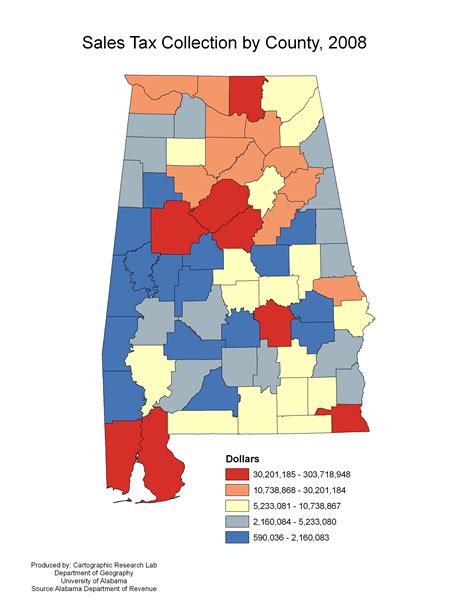

The use of Geographic Information Systems (GIS) has also revolutionized the way Orange County manages its tax records. GIS technology enables the creation of interactive maps that integrate property information, tax data, and geographic features. This visualization tool enhances the understanding of the county's tax landscape, aids in property valuation, and provides a powerful tool for planning and analysis.

Impact of Tax Records on the Community

Orange County's tax records have a profound impact on the community, shaping its economic landscape and influencing various aspects of daily life. The revenue generated through taxes plays a crucial role in funding essential services, infrastructure development, and community initiatives.

One of the primary benefits of efficient tax record management is the ability to allocate resources effectively. The data derived from tax records allows the county to identify areas with higher tax contributions, enabling targeted investments in infrastructure and services. This ensures that the tax revenue is distributed equitably, benefiting all segments of the community.

Moreover, accurate tax records contribute to a fair and transparent tax system. By ensuring that all taxable entities are accounted for and assessed accurately, the county can maintain a level playing field for businesses and property owners. This fosters a sense of trust and fairness within the community, encouraging compliance and fostering economic growth.

Tax records also play a vital role in economic development initiatives. By analyzing tax data, the county can identify trends, assess the impact of tax incentives, and make informed decisions to attract businesses and investments. This data-driven approach ensures that economic development strategies are well-informed and tailored to the unique needs of Orange County.

The Future of Orange County Tax Records

As Orange County continues to thrive and evolve, the future of its tax records looks promising. With ongoing technological advancements and a commitment to transparency, the county is well-positioned to enhance its tax record management system further.

One of the key areas of focus for the future is the integration of artificial intelligence (AI) and machine learning algorithms. These technologies can automate certain aspects of tax record management, such as data analysis and assessment processes. By leveraging AI, the county can improve accuracy, reduce manual errors, and enhance the overall efficiency of its tax system.

Additionally, the continued development of user-friendly online platforms will play a crucial role in the future of tax record access. By investing in intuitive interfaces and seamless integration with other county services, Orange County can provide a seamless experience for taxpayers, making tax-related tasks more accessible and convenient.

Furthermore, the county can explore the potential of blockchain technology to secure and validate tax records. Blockchain's decentralized and immutable nature can enhance data integrity, reduce fraud risks, and provide a transparent audit trail for tax transactions. This innovative approach could revolutionize the way Orange County manages its tax records, ensuring trust and security.

In conclusion, Orange County's tax records are a vital component of its financial framework, shaping the county's economic landscape and community well-being. Through a comprehensive understanding of these records, taxpayers, businesses, and policymakers can make informed decisions that contribute to the county's growth and prosperity. As technology continues to advance, Orange County is poised to embrace innovative solutions, ensuring a robust and transparent tax record management system for the future.

How often are Orange County tax records updated?

+Orange County tax records are typically updated on an annual basis, with the tax office conducting assessments and updates at regular intervals. This ensures that the records reflect the most current information on property values, tax rates, and other relevant data.

Can I access Orange County tax records online?

+Yes, Orange County provides an online platform through its official website, allowing taxpayers and stakeholders to access tax records conveniently. Users can search for records based on various criteria, making the process efficient and user-friendly.

What information is included in Orange County’s property tax records?

+Orange County’s property tax records include detailed information such as the assessed value of the property, applicable tax rates, calculated tax amounts, and payment history. These records provide a comprehensive overview of a property’s tax obligations and contributions.

How does Orange County ensure the accuracy of its tax records?

+Orange County employs a rigorous process to ensure the accuracy of its tax records. This includes regular audits, cross-referencing data with other government agencies, and implementing quality control measures. The county also encourages taxpayers to report any discrepancies or errors to facilitate timely corrections.

Can I dispute my property tax assessment in Orange County?

+Yes, Orange County provides a process for taxpayers to dispute their property tax assessments. Taxpayers can file an appeal with the Orange County Tax Office, presenting evidence and arguments to support their case. The county has a dedicated appeals process to ensure a fair and transparent resolution.