Canadian Taxes Vs Us Taxes

Welcome to a comprehensive exploration of the intriguing world of Canadian and US tax systems. As an expert in international taxation, I aim to guide you through the complexities and nuances of these two distinct systems, shedding light on their similarities, differences, and the unique challenges they present to individuals and businesses alike.

Unraveling the Complexity: Canadian Taxes vs. US Taxes

The tax systems of Canada and the United States, while sharing some common principles, are structured uniquely, reflecting the economic, social, and political landscapes of each country. Understanding these systems is essential for individuals and businesses with cross-border interests, as well as for those seeking to optimize their tax strategies.

The Canadian Tax Landscape

Canada's tax system is a complex interplay of federal, provincial, and territorial jurisdictions. At the federal level, the Canada Revenue Agency (CRA) administers a wide range of taxes, including income tax, sales tax, and payroll deductions. Provincial and territorial governments also levy their own taxes, such as the Provincial Sales Tax (PST) and the Harmonized Sales Tax (HST), creating a layered tax structure.

For individual taxpayers, the Canadian tax system offers a progressive income tax rate, with higher rates applied to higher income brackets. The Basic Personal Amount is a key feature, providing a tax-free threshold for personal income. Additionally, Canada offers a robust system of tax credits and deductions, including the Working Income Tax Benefit and the Canada Child Benefit, aimed at supporting low- to middle-income families.

| Tax Type | Description |

|---|---|

| Income Tax | Federal and provincial income tax, with progressive rates. |

| Sales Tax | HST or PST applied to goods and services. |

| Capital Gains Tax | 50% inclusion rate on capital gains. |

| Corporate Tax | Varies by province, with federal rates around 15%. |

On the business front, Canada offers a competitive corporate tax rate, which varies by province but averages around 15%. The country also boasts a robust system of tax incentives, such as the Scientific Research and Experimental Development (SR&ED) Tax Incentive Program, aimed at fostering innovation and technological advancement.

The US Tax Landscape

In contrast, the US tax system is characterized by its federal structure, with a single set of tax laws and regulations administered by the Internal Revenue Service (IRS). The US tax code is notoriously complex, with numerous provisions, deductions, and credits, making it a challenging landscape for taxpayers and tax professionals alike.

For individuals, the US tax system operates on a progressive income tax scale, with higher tax rates for higher income levels. The Standard Deduction and Personal Exemptions are key features, allowing taxpayers to reduce their taxable income. The US also offers a wide array of tax credits, such as the Child Tax Credit and the Earned Income Tax Credit, to support low- and moderate-income households.

| Tax Type | Description |

|---|---|

| Income Tax | Federal income tax with progressive rates, varying by state. |

| Sales Tax | Varies by state and locality, with some states having no sales tax. |

| Capital Gains Tax | Long-term capital gains taxed at a lower rate. |

| Corporate Tax | Federal corporate tax rate of 21%. |

In the business realm, the US offers a competitive corporate tax rate of 21% at the federal level, which was significantly reduced under the Tax Cuts and Jobs Act of 2017. Additionally, the US provides a range of tax incentives, such as the Research and Development Tax Credit, to encourage innovation and business growth.

Comparative Analysis: Canadian vs. US Tax Systems

Income Tax

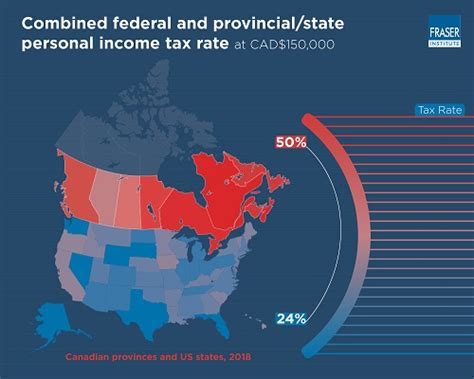

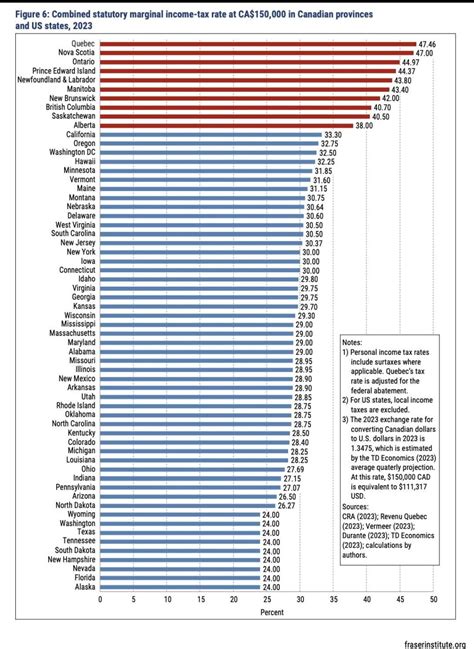

Both Canada and the US have progressive income tax systems, with tax rates increasing as income rises. However, the tax brackets and rates differ between the two countries. Canada has a more straightforward system with fewer brackets, while the US has a more complex structure with varying state-level taxes.

For example, in Canada, the federal income tax rates for 2023 range from 15% for the lowest bracket to 33% for the highest income earners. In contrast, the US has seven federal tax brackets, ranging from 10% to 37%, with additional state and local taxes adding to the complexity.

Sales Tax

Sales tax is a notable difference between the two countries. Canada has a harmonized sales tax (HST) or provincial sales tax (PST), which is applied at the point of sale and varies by province. The HST combines the federal goods and services tax (GST) with the provincial sales tax.

On the other hand, the US has a more varied sales tax system, with some states having no sales tax at all. State sales taxes typically range from 4% to 7%, but some states also have local sales taxes, resulting in a complex patchwork of rates.

Capital Gains Tax

Canada and the US approach capital gains tax differently. In Canada, 50% of capital gains are included in taxable income, meaning that only half of the gain is taxed. The capital gains inclusion rate is a significant advantage for Canadian taxpayers.

In the US, long-term capital gains (held for over a year) are taxed at a lower rate than ordinary income, providing an incentive for long-term investment. However, the US also has a more complex set of rules for determining capital gains, including the treatment of collectibles and the tax treatment of certain assets.

Corporate Tax

Corporate tax rates vary significantly between Canada and the US. In Canada, the federal corporate tax rate is 15%, but it can vary by province, with some provinces offering lower rates to attract businesses. The US, on the other hand, has a federal corporate tax rate of 21%, which was reduced from 35% in 2017.

Both countries offer various tax incentives and deductions for businesses, but the specifics can differ greatly. For instance, Canada's Scientific Research and Experimental Development (SR&ED) program provides tax incentives for research and development activities, while the US offers the Research and Development Tax Credit, which can be a significant benefit for innovative businesses.

Challenges and Considerations for Cross-Border Taxation

For individuals and businesses with interests in both Canada and the US, navigating the complex web of tax regulations can be a significant challenge. Key considerations include:

- Residency and Citizenship: Understanding the tax implications of residency and citizenship in both countries is crucial. Double taxation can occur if not properly managed.

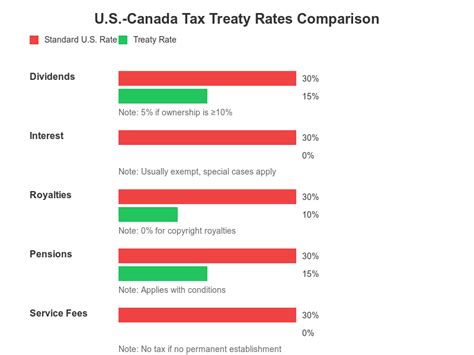

- Tax Treaties: Canada and the US have a tax treaty in place to avoid double taxation, but the treaty's provisions can be complex and require careful interpretation.

- Reporting Requirements: Each country has its own set of reporting requirements, such as the Foreign Account Tax Compliance Act (FATCA) in the US and the Common Reporting Standard (CRS) in Canada.

- Transfer Pricing: For businesses with cross-border transactions, transfer pricing rules can be a significant challenge, requiring careful documentation and valuation.

Strategies for Effective Tax Management

Effective tax management in a cross-border context requires a strategic approach. Here are some key strategies to consider:

- Seek Professional Advice: Engaging the services of a cross-border tax specialist or a firm with expertise in both Canadian and US taxation can provide invaluable guidance.

- Understand the Tax Treaties: Familiarize yourself with the Canada-US tax treaty and its implications for your specific situation.

- Optimize Tax Planning: Explore opportunities for tax optimization, such as utilizing tax credits, deductions, and incentives available in both countries.

- Maintain Proper Documentation: Ensure that all financial records and transactions are properly documented and compliant with the regulations of both countries.

Future Outlook and Potential Reforms

The tax landscapes of Canada and the US are subject to ongoing changes and reforms, driven by economic, political, and social factors. Here are some potential future developments to watch:

Canadian Tax Reforms

- Simplification of Tax System: Efforts to simplify the Canadian tax system, such as reducing the number of tax brackets and streamlining tax regulations, could make compliance easier for taxpayers.

- Enhanced Tax Incentives: The Canadian government may continue to promote innovation and economic growth by enhancing tax incentives for research, development, and investment.

- Digital Taxation: With the rise of the digital economy, Canada may need to address the taxation of digital services and e-commerce, similar to the EU's Digital Services Tax.

US Tax Reforms

- Tax Code Overhaul: There have been calls for a comprehensive reform of the US tax code to simplify the system and reduce complexity. Such a reform could have significant implications for taxpayers and businesses.

- International Tax Reform: The US may continue to focus on international tax reform, particularly in response to the global digital economy and the rise of digital giants.

- Tax Incentives for Innovation: The US could enhance its tax incentives for research and development to encourage innovation and technological advancement.

Conclusion

The Canadian and US tax systems, while distinct, share common goals of raising revenue for government operations and promoting economic growth. However, the approaches taken by each country, as well as the complexities of their respective tax codes, create unique challenges for taxpayers and businesses.

As an expert in international taxation, I hope this comprehensive guide has provided valuable insights into the Canadian and US tax systems. For those navigating the complexities of cross-border taxation, understanding these systems and seeking expert guidance is essential to ensuring compliance and optimizing tax strategies.

What is the main difference between Canadian and US income tax rates?

+Canada has a simpler structure with fewer tax brackets, while the US has a more complex system with varying state-level taxes.

How do sales taxes differ between Canada and the US?

+Canada has a harmonized sales tax (HST) or provincial sales tax (PST), while the US has a more varied system with some states having no sales tax.

What is the capital gains tax rate in Canada and the US?

+Canada taxes 50% of capital gains, while the US taxes long-term capital gains at a lower rate than ordinary income.

How do corporate tax rates compare in Canada and the US?

+Canada has a federal corporate tax rate of 15%, while the US has a rate of 21%.