Capital Gains Tax On Homes

The concept of capital gains tax on homes, often referred to as "capital gains tax on real estate" or "capital gains tax on primary residences," is an important aspect of financial planning and homeownership. It is a tax levied on the profit made from the sale of an asset, such as a home, and it can significantly impact the financial outcomes of homeowners. Understanding this tax, its implications, and strategies to mitigate its effects is crucial for anyone considering buying or selling a home.

Understanding Capital Gains Tax on Homes

Capital gains tax is a tax on the profit or gain made from the sale of an asset. When it comes to homes, this tax applies to the difference between the purchase price and the selling price, minus any eligible expenses and deductions. The profit made on the sale of a home is considered a capital gain, and this gain is subject to tax.

The specific rules and regulations regarding capital gains tax on homes can vary significantly based on geographical location and the legal framework of the country or region. In many jurisdictions, the tax treatment of capital gains from home sales is different from that of other assets, offering homeowners certain advantages and considerations.

Capital Gains Tax Exemptions and Benefits

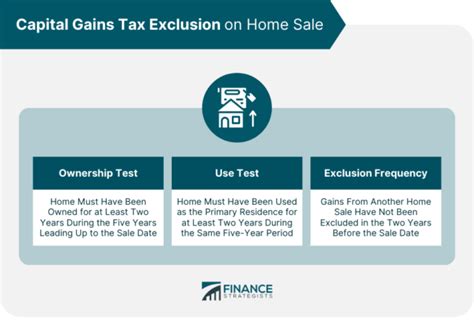

One of the most significant aspects of capital gains tax on homes is the potential for tax exemptions or benefits. Many countries offer a primary residence exemption, which means that the capital gains from the sale of a primary residence are exempt from taxation up to a certain amount or under specific conditions. This exemption aims to encourage homeownership and provide financial stability to homeowners.

For instance, in the United States, individuals can exclude up to $250,000 of capital gains from the sale of their primary residence if they have owned and used the home as their main residence for at least two of the five years before the sale. For married couples filing jointly, this exclusion doubles to $500,000. This exclusion is a significant benefit and can result in substantial tax savings for homeowners.

| Country/Region | Primary Residence Exemption |

|---|---|

| United States | $250,000 for individuals, $500,000 for married couples |

| Canada | No capital gains tax on the sale of a primary residence |

| United Kingdom | No capital gains tax on the first £12,300 of gain from the sale of a primary residence |

| Australia | No capital gains tax if the home has been owned and used as a primary residence for at least 6 months |

Calculating Capital Gains on Home Sales

Calculating capital gains on the sale of a home involves a few key steps. First, determine the adjusted basis of the property, which is typically the purchase price plus any improvements or additions made to the property. Then, subtract the adjusted basis from the selling price of the property to find the capital gain.

For example, if a homeowner purchased a property for $300,000 and made improvements worth $50,000, the adjusted basis would be $350,000. If the property is sold for $450,000, the capital gain would be $100,000 ($450,000 - $350,000). This gain is then subject to capital gains tax, with the tax rate depending on the homeowner's tax bracket and the holding period of the property.

Strategies to Manage Capital Gains Tax on Homes

Homeowners and prospective homebuyers have several strategies at their disposal to manage and minimize the impact of capital gains tax on home sales. These strategies can help optimize financial outcomes and ensure compliance with tax regulations.

Utilizing Tax Exemptions and Benefits

As mentioned earlier, understanding and leveraging tax exemptions and benefits is a crucial strategy. Homeowners should be aware of the specific exemptions available in their region and ensure they meet the requirements to claim these benefits. For example, in the United States, homeowners can take advantage of the primary residence exemption by ensuring they meet the ownership and residency periods.

Timing of Home Sales

The timing of a home sale can significantly impact the capital gains tax liability. Homeowners can strategically time their sales to take advantage of favorable tax rates or exemptions. For instance, selling a home after meeting the ownership and residency requirements for the primary residence exemption can result in significant tax savings.

Additionally, homeowners can consider the tax rates applicable to their income bracket and the holding period of the property. Short-term capital gains (properties held for less than a year) are generally taxed at a higher rate than long-term capital gains (properties held for more than a year). Therefore, homeowners might benefit from holding onto a property for a longer period to qualify for more favorable tax rates.

Home Improvement and Expense Deductions

Making improvements to a property can increase its value and, consequently, the capital gains upon sale. However, these improvements can also be used to reduce the taxable gain. Homeowners can deduct the cost of certain improvements from the selling price, thus reducing the capital gain and the associated tax liability.

For example, if a homeowner spends $20,000 on home improvements, this amount can be deducted from the selling price, reducing the capital gain and the tax owed. It's important to keep detailed records of these expenses and consult with a tax professional to ensure compliance and maximize deductions.

Rollover Relief and Tax-Deferred Exchanges

In some jurisdictions, homeowners can take advantage of rollover relief or tax-deferred exchanges. These strategies allow homeowners to reinvest the proceeds from the sale of a property into another property without triggering an immediate capital gains tax liability. This strategy is particularly useful for those who want to upgrade or downsize their homes without incurring a significant tax burden.

Case Study: Real-World Application

Let’s consider a case study to illustrate the practical application of capital gains tax on homes. Imagine a homeowner, John, who purchased a property in 2010 for 200,000. Over the years, John made several improvements to the property, including a kitchen renovation (25,000) and a new roof (15,000). In 2023, John decides to sell the property for 400,000.

To calculate the capital gain, we first determine the adjusted basis. The adjusted basis is $200,000 (purchase price) + $25,000 (kitchen renovation) + $15,000 (new roof) = $240,000. Subtracting the adjusted basis from the selling price, we find that John's capital gain is $60,000 ($400,000 - $240,000). This gain is subject to capital gains tax.

However, John has owned and used the property as his primary residence for more than two years. Therefore, he can take advantage of the primary residence exemption in the United States, which allows him to exclude up to $250,000 of capital gains from taxation. As a result, John's tax liability on the sale of his home is significantly reduced, thanks to this exemption.

Future Implications and Considerations

The landscape of capital gains tax on homes is subject to change and can be influenced by various factors, including economic conditions, government policies, and tax reforms. It is essential for homeowners and prospective buyers to stay informed about these changes and their potential impact.

Additionally, the rise of remote work and the changing nature of employment have led to an increase in second home ownership and investment properties. This trend can complicate the calculation of capital gains, as these properties may not qualify for the same tax benefits as primary residences. Homeowners and investors should carefully consider the tax implications of owning multiple properties and consult with tax professionals to ensure compliance.

As the housing market continues to evolve, with trends such as sustainable and energy-efficient homes gaining popularity, the tax treatment of these properties may also evolve. Governments may introduce incentives or tax breaks to encourage the adoption of eco-friendly practices, which could further impact the capital gains tax landscape.

What is the primary residence exemption, and how does it work?

+The primary residence exemption is a tax benefit that allows homeowners to exclude a certain amount of capital gains from the sale of their primary residence from taxation. In the United States, individuals can exclude up to 250,000, and married couples filing jointly can exclude up to 500,000. This exemption is subject to ownership and residency requirements.

Are there any other tax benefits for homeowners aside from the primary residence exemption?

+Yes, there are other tax benefits for homeowners. These can include deductions for mortgage interest, property taxes, and certain home improvements. Additionally, some countries offer incentives for energy-efficient homes or tax breaks for specific types of properties, such as historic homes.

How do I calculate capital gains on the sale of my home?

+To calculate capital gains, you need to determine the adjusted basis of your property, which is typically the purchase price plus any improvements. Then, subtract the adjusted basis from the selling price. The resulting amount is the capital gain, which is subject to tax.

What is the difference between short-term and long-term capital gains on home sales?

+Short-term capital gains refer to the profit made from the sale of a property held for less than a year, while long-term capital gains refer to the profit made from the sale of a property held for more than a year. Short-term capital gains are generally taxed at a higher rate than long-term capital gains.

Can I defer capital gains tax on the sale of my home?

+Yes, in some jurisdictions, you can defer capital gains tax through rollover relief or tax-deferred exchanges. These strategies allow you to reinvest the proceeds from the sale of a property into another property without triggering an immediate tax liability. However, these strategies come with specific requirements and conditions.