Property Tax Andrew Cuomo

In the state of New York, property taxes have long been a topic of discussion and a significant financial consideration for homeowners and businesses alike. Former Governor Andrew Cuomo's administration played a pivotal role in shaping the landscape of property taxation in the state. This article delves into the intricate world of property taxes under Cuomo's leadership, exploring the key policies, initiatives, and their impact on New Yorkers.

The Cuomo Legacy: A Comprehensive Overview of Property Tax Policies

Governor Andrew Cuomo’s tenure from 2011 to 2021 saw several notable changes in the realm of property taxation. His administration aimed to address the concerns of taxpayers while maintaining a balanced approach to revenue generation. Here’s a detailed exploration of his key initiatives and their implications.

The Property Tax Cap: A Landmark Reform

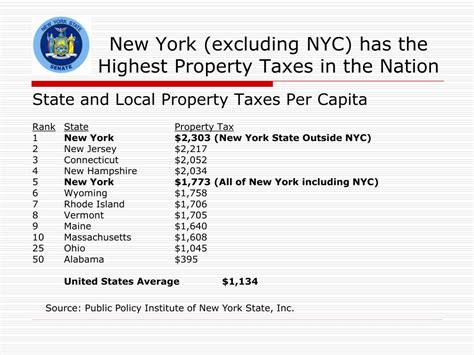

One of the most significant achievements of the Cuomo administration in the property tax realm was the implementation of the Property Tax Cap in 2011. This reform, enshrined in law, limited the annual increase in property taxes to a maximum of 2% or the rate of inflation, whichever was lower. The cap aimed to provide relief to taxpayers by curbing excessive tax hikes and promoting budgetary stability for local governments.

The impact of the Property Tax Cap was twofold. For homeowners, it offered a measure of predictability and control over their annual tax obligations. No longer were sudden and steep tax increases a constant concern. Local governments, on the other hand, had to carefully manage their budgets, ensuring that essential services were maintained while staying within the tax cap constraints.

| Year | Maximum Tax Increase |

|---|---|

| 2012 | 2% |

| 2013 | 2% |

| 2014 | 1.6% |

| 2015 | 1.5% |

| ... | ... |

| 2021 | 2% |

School Tax Relief (STAR): Expanding Tax Breaks

Governor Cuomo recognized the strain that property taxes placed on New Yorkers, especially those with school-aged children. In an effort to alleviate this burden, his administration expanded the School Tax Relief (STAR) program. STAR offered significant tax exemptions to homeowners, reducing their property tax obligations.

Under Cuomo's leadership, the STAR program saw an increase in the income eligibility threshold, allowing more middle-class families to qualify for tax breaks. Additionally, the administration introduced the STAR Credit program, which provided a direct credit to eligible homeowners, further reducing their tax liability.

| STAR Program | Tax Relief |

|---|---|

| Basic STAR | $3,050 exemption for primary residents |

| Enhanced STAR | $6,100 exemption for senior citizens |

| STAR Credit | Direct credit of up to $300 for eligible homeowners |

Assessing the Impact: A Mixed Bag

The Cuomo administration’s property tax policies had a mixed reception. While the Property Tax Cap and expanded STAR programs provided much-needed relief to taxpayers, they also presented challenges. Local governments, particularly those in areas with high property values, struggled to maintain essential services without significant revenue increases.

The Property Tax Cap, in particular, led to innovative approaches in revenue generation. Some localities explored alternative sources of funding, such as sales taxes and user fees, to make up for the lost property tax revenue. Others had to make difficult decisions regarding budget cuts and service reductions.

The Future of Property Taxation: Lessons from Cuomo

Governor Cuomo’s tenure left a lasting impact on New York’s property tax landscape. His initiatives, while well-intentioned, highlighted the delicate balance between taxpayer relief and the financial sustainability of local governments.

As the state moves forward, policymakers must carefully consider the long-term implications of property tax policies. The success of initiatives like the Property Tax Cap and STAR programs lies in their ability to strike a balance between providing tax relief and ensuring that local governments can continue to deliver essential services. Striking this balance will be crucial in shaping the future of property taxation in New York.

What is the current status of the Property Tax Cap in New York?

+The Property Tax Cap remains in effect as of 2023. However, there have been discussions and proposals to modify or repeal the cap, especially in response to the financial challenges faced by local governments.

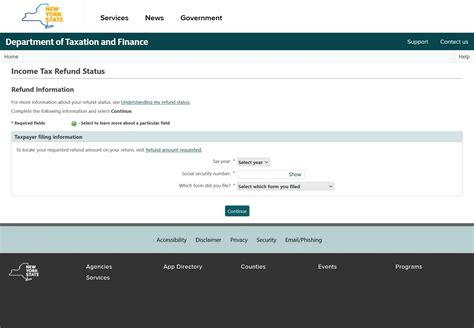

How can homeowners determine their eligibility for STAR programs?

+Homeowners can check their eligibility for STAR programs by reviewing their income and property value. The New York State Department of Taxation and Finance provides resources and guidelines to help homeowners determine their eligibility and apply for the appropriate STAR program.

Are there any alternatives to the Property Tax Cap being considered?

+Yes, there have been proposals to replace the Property Tax Cap with a circuit breaker system. This alternative approach would provide tax relief to homeowners based on their income and property tax burden, rather than a blanket cap on tax increases.

How has the Property Tax Cap affected local governments’ revenue streams?

+The Property Tax Cap has had a significant impact on local governments’ revenue streams, particularly in high-value property areas. Many localities have had to explore alternative funding sources and make difficult decisions regarding budget allocations to maintain essential services.

Are there any potential drawbacks to expanding tax relief programs like STAR?

+While expanding tax relief programs can provide significant benefits to homeowners, it may also lead to a reduction in funding for education and other critical services. Policymakers must carefully weigh the trade-offs to ensure a sustainable balance.