Nm Tax Revenue

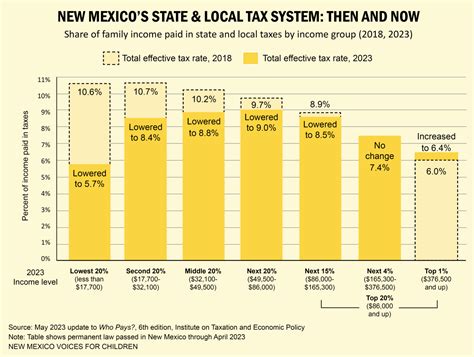

New Mexico's tax revenue landscape is an intriguing subject, especially given the state's unique economic structure and diverse revenue streams. As we delve into this topic, we will uncover the intricacies of New Mexico's tax system, exploring its various components, historical trends, and future implications. This analysis will provide valuable insights for economists, policymakers, and citizens alike, offering a comprehensive understanding of the state's financial dynamics.

Understanding New Mexico’s Tax Revenue Structure

New Mexico’s tax revenue system is a complex network of various taxes, each playing a significant role in contributing to the state’s overall financial health. The primary sources of tax revenue can be categorized as follows:

- Gross Receipts Tax (GRT): One of the state's major revenue generators, GRT is a value-added tax levied on the sale of goods and services. It is a broad-based tax, covering most transactions, and is a key contributor to New Mexico's tax revenue. In the fiscal year 2022, GRT accounted for over $2.6 billion in revenue.

- Individual Income Tax: New Mexico imposes a progressive income tax on its residents, with rates ranging from 1.7% to 4.9%. This tax is a substantial source of revenue, especially given the state's diverse population and varying income levels. In 2021, individual income tax contributed approximately $1.4 billion to the state's coffers.

- Corporate Income Tax: Businesses operating in New Mexico are subject to a corporate income tax, which is calculated based on their net income. While the tax rate is relatively low at 4.8%, it still generates a considerable amount of revenue. In the 2021 fiscal year, corporate income tax contributed over $170 million.

- Severance Taxes: New Mexico's rich mineral resources, particularly oil and natural gas, are subject to severance taxes. These taxes are levied on the value of the resources extracted and are a significant source of revenue for the state. In 2021, severance taxes generated over $1.1 billion, making it one of the most substantial contributors to the state's budget.

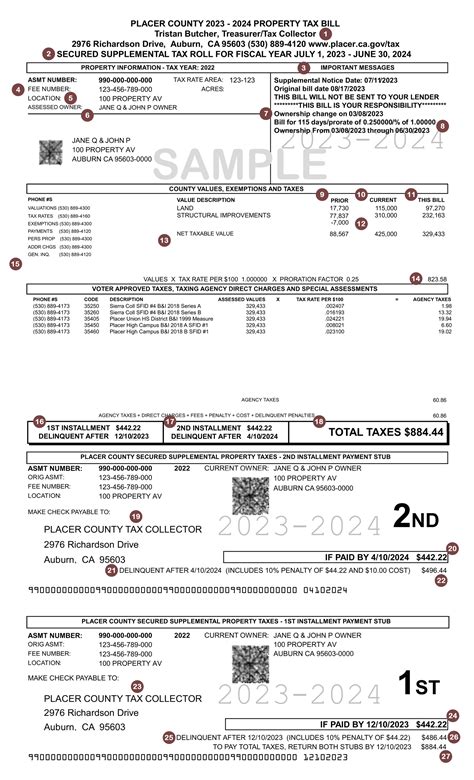

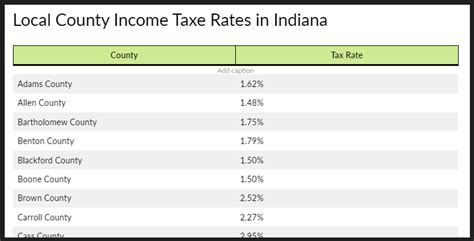

- Property Taxes: While property taxes are primarily a local revenue source, a portion is distributed to the state. The tax rate varies across counties, but the state-wide average effective property tax rate is approximately 1.17%. In 2020, property taxes contributed over $400 million to the state's general fund.

These five primary tax sources form the backbone of New Mexico's tax revenue system, each playing a unique role in contributing to the state's financial stability and economic growth.

Historical Trends and Performance Analysis

Over the years, New Mexico’s tax revenue has shown a dynamic pattern, influenced by various economic factors and policy changes. Let’s examine some key trends and performance indicators:

| Fiscal Year | Total Tax Revenue (in billions) | Growth Rate (%) |

|---|---|---|

| 2015 | $5.8 | N/A |

| 2016 | $6.3 | 8.6 |

| 2017 | $6.6 | 4.8 |

| 2018 | $6.9 | 4.5 |

| 2019 | $7.1 | 2.9 |

| 2020 | $6.7 | -5.6 |

| 2021 | $7.4 | 10.4 |

| 2022 | $7.9 | 6.7 |

The table above provides a snapshot of New Mexico's tax revenue over the last few years. It is evident that the state's tax revenue has been relatively stable, with minor fluctuations due to economic cycles and policy changes. The significant drop in 2020 can be attributed to the economic impact of the COVID-19 pandemic, while the subsequent growth in 2021 and 2022 indicates a strong economic recovery.

Furthermore, a deeper analysis reveals that the Gross Receipts Tax has consistently been the largest contributor to the state's tax revenue, followed by individual income tax and severance taxes. The state's diverse economy, with its strong focus on the energy sector and growing service industries, plays a vital role in shaping these trends.

Future Implications and Policy Considerations

Looking ahead, New Mexico’s tax revenue landscape is poised for several significant changes and developments. These potential shifts are influenced by a combination of economic factors, demographic trends, and policy decisions.

Economic Factors and Growth Projections

The state’s economic growth is expected to continue, driven by a resilient energy sector, a burgeoning tech industry, and a robust tourism sector. These sectors are likely to contribute significantly to the state’s tax revenue in the coming years. According to a recent report by the New Mexico Taxation and Revenue Department, the state’s economy is projected to grow at an average annual rate of 2.7% over the next decade, which will likely translate into increased tax revenue.

However, the state's economy is also vulnerable to external factors, such as fluctuations in global energy prices and shifts in federal policies. These factors can significantly impact the state's tax revenue, especially given the heavy reliance on the energy sector.

Demographic Shifts and Tax Base Expansion

New Mexico’s population is projected to grow at a steady pace, with an increasing number of younger residents. This demographic shift can have a positive impact on the state’s tax revenue, as younger individuals are typically more mobile and engaged in the workforce. As the population grows and diversifies, the state can expect an expansion of its tax base, particularly in the form of individual income tax and property taxes.

Policy Decisions and Revenue Optimization

Policy decisions at the state level will play a crucial role in shaping New Mexico’s tax revenue landscape. The state government has been actively exploring ways to optimize its tax system, with a focus on streamlining processes, enhancing compliance, and exploring new revenue streams. One notable initiative is the proposed reform of the Gross Receipts Tax, which aims to simplify the tax structure and reduce compliance burdens while maintaining a stable revenue stream.

Additionally, the state is also considering expanding its tax base by introducing new taxes or modifying existing ones. For instance, there have been discussions around the introduction of a digital services tax, which could capture revenue from the growing tech sector. Such initiatives, if implemented effectively, could significantly enhance New Mexico's tax revenue potential.

Potential Challenges and Mitigation Strategies

Despite the optimistic projections, New Mexico’s tax revenue landscape is not without challenges. The state faces several potential hurdles, including the risk of economic downturns, the impact of climate change on its energy sector, and the need to balance revenue generation with tax fairness and simplicity.

To mitigate these challenges, the state can consider a multi-pronged approach. This could include diversifying its economy further, investing in renewable energy sources to reduce its reliance on traditional energy sectors, and implementing robust tax administration measures to ensure efficient revenue collection. Additionally, the state can explore innovative financing mechanisms, such as public-private partnerships, to fund critical infrastructure projects without placing excessive burdens on taxpayers.

Conclusion

New Mexico’s tax revenue landscape is a complex and dynamic arena, shaped by a unique blend of economic factors, demographic trends, and policy decisions. As we’ve explored, the state’s tax system is a critical component of its financial health, contributing significantly to its economic growth and development. By understanding the current landscape, historical trends, and future implications, stakeholders can make informed decisions to ensure the state’s financial stability and prosperity.

How does New Mexico’s tax revenue compare to other states?

+New Mexico’s tax revenue is relatively lower compared to many other states. In 2021, it ranked 43rd in terms of total tax revenue per capita, with an average of 3,437 per person. This is significantly lower than the national average of 4,625 per person. However, it’s important to note that New Mexico’s economy and tax structure are unique, and direct comparisons may not always be indicative of the state’s financial health.

What are the key challenges facing New Mexico’s tax system?

+New Mexico’s tax system faces several challenges, including a heavy reliance on a few key sectors (particularly the energy sector), which makes the state vulnerable to economic downturns. Additionally, the state’s tax structure is relatively complex, which can lead to compliance issues and administrative burdens. The state also faces challenges in ensuring tax fairness, given its diverse population and varying income levels.

How has New Mexico’s tax revenue been impacted by the COVID-19 pandemic?

+The COVID-19 pandemic had a significant impact on New Mexico’s tax revenue. In 2020, the state experienced a sharp decline in revenue, primarily due to economic shutdowns and reduced economic activity. However, the state’s revenue has since rebounded, with a strong growth rate in 2021 and 2022, indicating a resilient recovery.