New Market Tax Credits

The world of real estate and economic development is often intertwined with complex financial tools and incentives, aimed at fostering growth and regeneration in communities. One such powerful mechanism is the New Markets Tax Credit (NMTC) program, a federal initiative that has become a game-changer for underserved and low-income communities across the United States.

In this comprehensive guide, we delve into the intricacies of the NMTC program, exploring its origins, impact, and the transformative potential it holds for communities in need. By understanding the mechanics and real-world applications of this innovative tax credit, we can appreciate its role in shaping a more equitable and prosperous future.

Understanding the New Markets Tax Credit Program

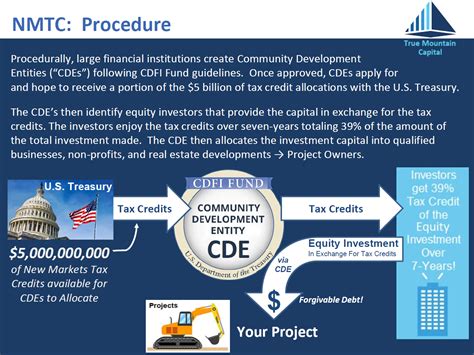

The New Markets Tax Credit program was introduced as part of the Community Renewal Tax Relief Act of 2000, a federal legislation aimed at stimulating economic growth and development in distressed communities. Administered by the Community Development Financial Institutions (CDFI) Fund within the U.S. Department of the Treasury, the NMTC program has since become a cornerstone of community development efforts nationwide.

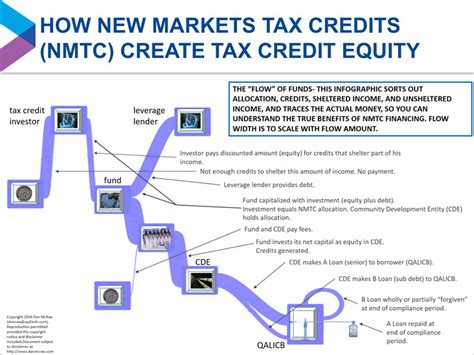

At its core, the NMTC program offers a powerful incentive to encourage private investment in low-income communities. It does so by providing a tax credit to investors who commit capital to qualified community development entities (CDEs) for investment in these targeted areas. This tax credit mechanism has proven to be a highly effective tool for channeling private capital into projects that might otherwise struggle to secure traditional financing.

Key Characteristics of the NMTC Program

- Tax Credit Allocation: The NMTC program allocates tax credits to CDEs, which are then responsible for investing these credits in qualified projects within designated low-income communities. These credits are typically allocated through a competitive application process, with a focus on projects that create jobs, provide essential services, and spur economic growth.

- Qualified Projects: NMTC-eligible projects encompass a wide range of initiatives, including business development, real estate rehabilitation, infrastructure improvements, and community facilities. The flexibility of the program allows for a diverse array of projects to be funded, from healthcare centers and schools to manufacturing facilities and affordable housing developments.

- Community Impact: The primary goal of the NMTC program is to drive economic development and create positive, lasting impacts in underserved communities. By leveraging private investment, the program aims to generate jobs, improve access to vital services, and stimulate overall economic activity, thereby fostering community growth and empowerment.

Real-World Applications and Success Stories

The New Markets Tax Credit program has been instrumental in facilitating transformative projects across the country, each with its own unique story of community uplift and development. From revitalizing downtown areas to providing critical healthcare services, the NMTC program has proven its ability to catalyze change on a local level.

Case Study: Revitalizing a Historic Neighborhood

In the heart of a once-thriving urban center, the NMTC program played a pivotal role in the rehabilitation of a historic neighborhood that had fallen into disrepair. The project, led by a community-based CDE, focused on revitalizing the area’s infrastructure, renovating historic buildings, and attracting new businesses. With NMTC financing, the CDE was able to leverage private investment to create a vibrant, mixed-use development that now serves as a cultural hub for the community.

Key Outcomes:

- Job Creation: The project generated over 200 new jobs, primarily for local residents, offering much-needed employment opportunities.

- Economic Impact: The development's success has spurred additional investment in the area, leading to a thriving local economy with diverse business offerings.

- Community Engagement: The project fostered a sense of pride and ownership among residents, with many involved in the planning and implementation stages.

Empowering Healthcare Access in Rural Communities

In remote, rural areas where access to healthcare is limited, the NMTC program has been a lifeline for communities in need. A CDE focused on healthcare development used NMTC financing to construct and equip a state-of-the-art medical facility, providing much-needed primary care, specialty services, and emergency care to an underserved population.

Impact Highlights:

- Healthcare Equity: The new facility significantly improved access to quality healthcare, reducing the burden on residents who previously had to travel long distances for medical treatment.

- Economic Benefits: The project created employment opportunities for local residents and attracted additional healthcare professionals to the area, further enhancing the community's healthcare infrastructure.

- Community Well-Being: With improved healthcare access, the community experienced a boost in overall well-being, leading to better health outcomes and a more resilient population.

Technical Specifications and Performance Analysis

The NMTC program's success is not just a matter of storytelling; it is underpinned by robust technical specifications and performance metrics that demonstrate its effectiveness.

Technical Details:

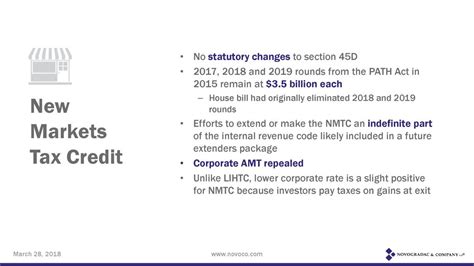

- Tax Credit Structure: NMTCs are offered as a 39% credit over a seven-year period, with 5% of the credit available in the first year and the remaining 34% allocated equally over the subsequent six years. This structure provides a steady stream of tax benefits to investors, encouraging long-term commitment to community development.

- Allocation Process: The CDFI Fund allocates NMTCs through a competitive process, considering factors such as community need, project impact, and the CDE’s track record. This process ensures that tax credits are directed to projects with the greatest potential for positive social and economic outcomes.

- Investment Requirements: To qualify for NMTC financing, projects must be located in designated low-income communities, as defined by the CDFI Fund’s guidelines. Additionally, projects must meet specific eligibility criteria, such as creating jobs, generating economic activity, or providing essential community services.

Performance Metrics:

| Metric | Impact |

|---|---|

| Job Creation | The NMTC program has facilitated the creation of over 1 million jobs since its inception, offering employment opportunities in underserved communities. |

| Investment Mobilized | As of 2022, the program has mobilized over $100 billion in private investment, demonstrating its success in attracting capital to low-income areas. |

| Community Facilities | NMTC-funded projects have resulted in the development of over 1,500 community facilities, including healthcare centers, schools, and community centers. |

| Real Estate Development | The program has supported the rehabilitation and construction of over 25,000 affordable housing units and countless commercial properties, revitalizing distressed neighborhoods. |

Future Implications and Ongoing Impact

As the NMTC program continues to evolve and adapt, its future implications hold great promise for communities across the United States. The program’s success has not gone unnoticed, and its impact has sparked conversations around further expanding and enhancing its reach.

Expanding Eligibility Criteria

One key area of focus for the future of the NMTC program is the potential expansion of eligibility criteria. Currently, projects must be located in designated low-income communities to qualify for NMTC financing. However, there is growing recognition that the program could be further optimized to support a wider range of initiatives, including those focused on environmental sustainability, renewable energy development, and community resilience.

By broadening the scope of eligible projects, the NMTC program could play a pivotal role in addressing some of the most pressing challenges facing communities today. For instance, investing in renewable energy infrastructure and sustainable development projects could not only drive economic growth but also contribute to a more resilient and environmentally conscious future.

Enhanced Collaboration and Partnerships

The NMTC program’s success is often a result of strong collaboration between community development entities, investors, and local stakeholders. As the program continues to gain traction, fostering deeper partnerships and collaborative initiatives will be essential for maximizing its impact.

One promising avenue for enhanced collaboration is the integration of NMTC financing with other community development programs and initiatives. By combining the NMTC program with other federal, state, and local incentives, community developers can access a more comprehensive suite of tools to tackle complex challenges. For example, combining NMTC financing with historic tax credits or brownfield redevelopment incentives could unlock new opportunities for revitalizing historic buildings and remediating contaminated sites, leading to more holistic community redevelopment efforts.

Addressing Equity and Inclusion

While the NMTC program has been a powerful force for economic development in underserved communities, ensuring that its benefits are equitably distributed remains a key focus. As the program continues to evolve, a concerted effort to address issues of equity and inclusion will be essential.

This includes actively engaging with and empowering local community leaders and residents in the planning and implementation of NMTC-funded projects. By involving community members in decision-making processes and ensuring their voices are heard, the program can better align with the unique needs and aspirations of each community it serves. Additionally, promoting diverse and inclusive hiring practices in NMTC-supported projects can help ensure that the benefits of economic development are shared by all members of the community.

Conclusion

The New Markets Tax Credit program is a testament to the power of innovative financial mechanisms in driving positive change. By harnessing the potential of private investment and directing it towards underserved communities, the NMTC program has become a catalyst for economic growth, job creation, and community empowerment.

As we look to the future, the ongoing success and evolution of the NMTC program will be instrumental in shaping a more equitable and prosperous society. By expanding eligibility criteria, fostering collaborative initiatives, and prioritizing equity and inclusion, the program can continue to make a profound impact on communities in need, paving the way for a brighter and more resilient future.

How are New Markets Tax Credits allocated, and who is eligible to receive them?

+

NMTCs are allocated through a competitive application process, with the Community Development Financial Institutions (CDFI) Fund considering factors such as community need, project impact, and the CDE’s track record. To be eligible, projects must be located in designated low-income communities and meet specific criteria, including job creation, economic activity generation, or provision of essential community services.

What types of projects are eligible for New Markets Tax Credit financing?

+

NMTC-eligible projects include a wide range of initiatives, such as business development, real estate rehabilitation, infrastructure improvements, and community facilities. This flexibility allows for projects like healthcare centers, schools, manufacturing facilities, and affordable housing developments to be funded.

How has the New Markets Tax Credit program impacted communities across the United States?

+

The NMTC program has facilitated transformative projects, including urban revitalization, rural healthcare access, and economic development. It has created over 1 million jobs, mobilized over $100 billion in private investment, and supported the development of essential community facilities and affordable housing units.

What are the future prospects and ongoing impact of the New Markets Tax Credit program?

+

The future of the NMTC program involves expanding eligibility criteria to include initiatives like environmental sustainability and renewable energy development. Enhanced collaboration and partnerships will also play a crucial role in maximizing its impact, while addressing equity and inclusion remains a key focus to ensure benefits are equitably distributed.