Ncdor Sales Tax

The North Carolina Department of Revenue (NCDOR) plays a crucial role in the state's economic landscape, particularly when it comes to managing and enforcing sales tax regulations. With a comprehensive understanding of the sales tax system, the NCDOR ensures fair and effective taxation practices for businesses and consumers alike. This article delves into the intricacies of NCDOR sales tax, exploring its significance, processes, and impact on North Carolina's economy.

Understanding NCDOR Sales Tax: An Overview

Sales tax is a vital revenue source for states, enabling them to fund essential services and infrastructure. In North Carolina, the NCDOR is responsible for administering and collecting sales and use taxes, which are integral to the state’s fiscal health. The sales tax rate in North Carolina varies depending on the location and type of goods or services being sold, and the NCDOR meticulously manages these varying rates to ensure compliance.

The NCDOR's sales tax framework is designed to be inclusive, covering a broad range of transactions. It applies to the sale of tangible personal property, certain services, and even digital products. This comprehensive approach ensures that businesses, regardless of their industry or scale, contribute to the state's revenue stream. Moreover, the NCDOR's regulations extend beyond traditional brick-and-mortar stores, encompassing online retailers and e-commerce platforms, reflecting the evolving nature of the retail landscape.

For businesses, understanding and adhering to NCDOR sales tax regulations is imperative. The NCDOR provides comprehensive resources and guidelines to assist businesses in navigating the sales tax landscape. From registration and filing requirements to tax rate determination and remittance processes, the NCDOR offers a wealth of information to ensure businesses operate in compliance with state tax laws.

Key Aspects of NCDOR Sales Tax Registration

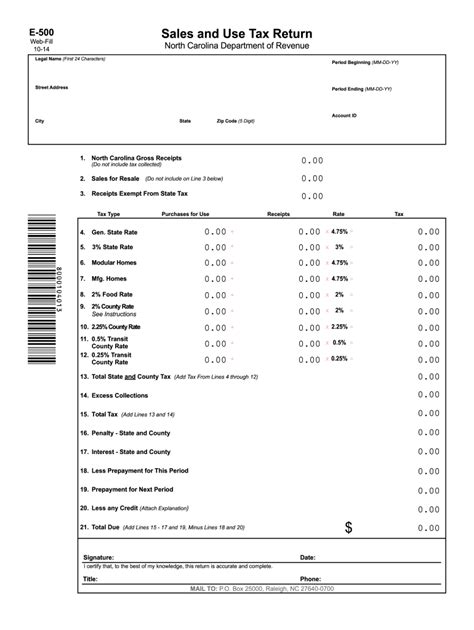

Sales tax registration with the NCDOR is a mandatory step for businesses operating within North Carolina. The process involves submitting an application that details the nature of the business, its location(s), and the products or services it offers. The NCDOR reviews these applications to assign the appropriate tax rates and ensure the business is set up correctly within the state’s tax system.

Once registered, businesses receive a unique identification number, which is used for all future tax-related communications with the NCDOR. This number is crucial for filing sales tax returns and ensuring accurate reporting. The NCDOR provides an online platform for businesses to manage their tax obligations, offering a user-friendly interface for filing returns, making payments, and accessing relevant resources.

| Registration Requirement | Details |

|---|---|

| Entity Type | Sole proprietorships, partnerships, corporations, and LLCs must register. |

| Location | Businesses with a physical presence in NC, including warehouses, offices, or stores, must register. |

| Sales Threshold | Businesses with annual sales exceeding $300,000 must register, regardless of location. |

| Online Sales | Online retailers must register if they exceed the sales threshold or have a physical presence in NC. |

The NCDOR offers a streamlined registration process, often completed within a few business days. However, businesses with complex structures or those operating in multiple jurisdictions may require additional time and documentation to ensure accurate registration.

Sales Tax Collection and Remittance: Best Practices

Collecting and remitting sales tax accurately is a critical aspect of a business’s financial operations. The NCDOR provides clear guidelines on how businesses should calculate and collect sales tax from customers. This includes understanding the tax rates applicable to different jurisdictions within North Carolina and ensuring these rates are correctly applied to transactions.

For businesses, the key to effective sales tax management lies in integration. Integrating sales tax calculation into the point-of-sale system or e-commerce platform ensures accurate tax collection at the time of sale. This approach minimizes the risk of errors and simplifies the process for both the business and its customers.

When it comes to remitting sales tax, businesses must adhere to the NCDOR's filing deadlines. Typically, sales tax returns are due quarterly, with specific due dates depending on the business's tax year. Late filing can result in penalties and interest charges, so staying organized and maintaining a calendar of important tax dates is essential.

| Filing Frequency | Due Dates |

|---|---|

| Quarterly | March 20, June 20, September 20, and December 20 |

| Monthly | 20th of the following month for the previous month's sales |

The NCDOR provides a secure online portal for businesses to file their sales tax returns and make payments. This platform offers real-time transaction tracking, allowing businesses to monitor their tax obligations and ensure timely compliance.

NCDOR Sales Tax: Compliance and Enforcement

Ensuring compliance with sales tax regulations is a critical aspect of the NCDOR’s role. The department employs various strategies to promote compliance, educate businesses, and enforce tax laws when necessary.

Education and Outreach Initiatives

The NCDOR understands that compliance begins with understanding. To this end, the department invests in robust education and outreach programs to ensure businesses and consumers are aware of their tax obligations. These initiatives include:

- Seminars and workshops: The NCDOR conducts educational sessions across the state, providing businesses with in-depth knowledge of sales tax regulations and best practices.

- Online resources: The NCDOR's website is a treasure trove of information, offering comprehensive guides, FAQs, and tutorials on sales tax compliance.

- Social media engagement: Utilizing platforms like Twitter and LinkedIn, the NCDOR shares timely updates, reminders, and relevant news to keep businesses informed.

By investing in education, the NCDOR empowers businesses to make informed decisions and avoid unintentional non-compliance, which can lead to costly penalties.

Audit and Enforcement Procedures

While education is a key strategy, the NCDOR also employs rigorous audit and enforcement procedures to ensure compliance. These procedures include:

- Random audits: The NCDOR conducts random audits of businesses to verify compliance with sales tax regulations. These audits can be comprehensive, examining a business's sales records, tax returns, and accounting practices.

- Specific industry audits: In certain industries where sales tax evasion is more prevalent, the NCDOR may conduct targeted audits to ensure compliance.

- Enforcement actions: In cases of non-compliance, the NCDOR may take enforcement actions, which can include penalties, interest charges, and, in severe cases, legal proceedings.

The NCDOR's audit and enforcement procedures are designed to be fair and transparent. Businesses are given the opportunity to respond and correct any non-compliance issues, and the NCDOR provides clear guidelines on the audit process and potential outcomes.

Impact of NCDOR Sales Tax on the Economy

The NCDOR’s sales tax regulations have a significant impact on North Carolina’s economy. By ensuring fair and effective taxation, the NCDOR contributes to the state’s fiscal health, enabling the funding of essential services and infrastructure projects.

Revenue Generation and Fiscal Health

Sales tax is a primary revenue source for the state, and the NCDOR’s efficient management of this tax stream ensures a steady flow of funds into the state’s coffers. This revenue is crucial for funding various government services, including education, healthcare, infrastructure development, and public safety.

By collecting and distributing sales tax revenue effectively, the NCDOR plays a pivotal role in maintaining the state's fiscal health. This, in turn, attracts investment, fosters economic growth, and creates a positive business environment, benefiting both businesses and consumers.

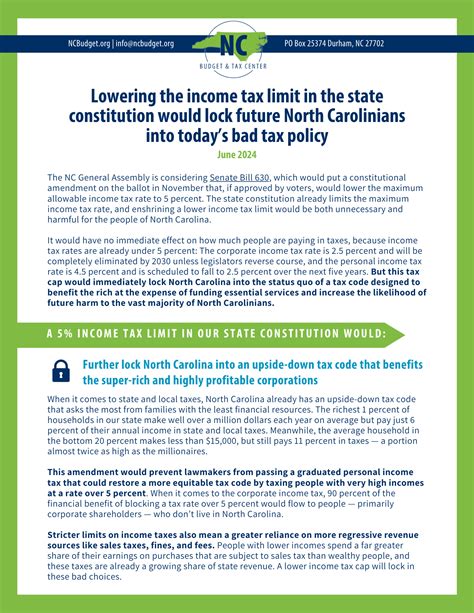

Equitable Taxation and Economic Development

The NCDOR’s sales tax framework is designed to be equitable, ensuring that all businesses, regardless of size or industry, contribute fairly to the state’s revenue. This approach promotes a level playing field, preventing larger businesses from gaining an unfair advantage over smaller ones.

Moreover, the NCDOR's efforts in educating businesses and enforcing compliance contribute to a culture of responsible tax practices. This fosters trust in the tax system and encourages businesses to invest and expand within the state, driving economic development and job creation.

Future Trends and Innovations

As the retail landscape continues to evolve, the NCDOR is adapting its sales tax regulations to keep pace with changing business models. This includes addressing the rise of e-commerce and the challenges it presents for tax collection and compliance.

The NCDOR is exploring innovative solutions, such as improved data analytics and enhanced online platforms, to streamline sales tax processes and enhance compliance. By staying ahead of the curve, the NCDOR ensures that North Carolina's sales tax system remains efficient, effective, and responsive to the needs of businesses and consumers.

Conclusion: NCDOR’s Vital Role in North Carolina’s Economy

The North Carolina Department of Revenue’s management of sales tax is a complex yet critical aspect of the state’s economic landscape. By understanding and adhering to NCDOR sales tax regulations, businesses contribute to the state’s fiscal health and ensure a fair and thriving business environment.

As North Carolina continues to evolve and grow, the NCDOR's role in managing sales tax will remain integral to the state's success. By providing clear guidelines, offering educational resources, and enforcing compliance, the NCDOR ensures that sales tax remains a stable and reliable revenue source, driving economic prosperity for all North Carolinians.

Frequently Asked Questions

What is the current sales tax rate in North Carolina?

+

The state sales tax rate in North Carolina is 4.75%. However, this rate can vary depending on the location, as counties and cities may impose additional sales taxes. It’s essential to check the specific sales tax rate for your location to ensure accurate compliance.

How often do businesses need to file sales tax returns with the NCDOR?

+

The frequency of filing sales tax returns depends on the business’s sales volume. Generally, businesses with sales exceeding $300,000 annually must file quarterly. However, businesses with lower sales may be required to file monthly or annually. It’s best to consult the NCDOR’s guidelines for specific requirements.

What happens if a business fails to register for sales tax with the NCDOR?

+

Failing to register for sales tax with the NCDOR can result in significant penalties and interest charges. Additionally, the business may be held liable for back taxes, which can accrue over time. It’s crucial to register promptly to avoid these financial burdens.

How can businesses stay updated with the latest NCDOR sales tax regulations and changes?

+

Businesses can stay informed by regularly visiting the NCDOR’s website, which provides the latest updates and news. Additionally, subscribing to the NCDOR’s email notifications and following their social media channels can ensure timely access to critical information.

What resources does the NCDOR offer to assist businesses with sales tax compliance?

+

The NCDOR offers a wealth of resources, including comprehensive guides, tutorials, and FAQs on their website. They also provide an online platform for easy registration, filing, and payment of sales taxes. Additionally, the NCDOR conducts seminars and workshops to educate businesses on sales tax compliance.