Arkansas Sales Tax Auto

Welcome to a comprehensive exploration of the Arkansas Sales Tax, specifically focusing on the unique aspects of automotive purchases. In this article, we will delve into the intricacies of sales tax regulations in Arkansas, offering a detailed guide for consumers and businesses alike. From the basic tax rates to the specific considerations for buying a vehicle, we aim to provide an expert analysis that covers all the bases.

Arkansas, like many other states, imposes a sales tax on various goods and services, including automotive purchases. However, understanding the nuances of this tax can be crucial for making informed financial decisions. Whether you're a resident looking to buy a new car or a business owner navigating the complexities of tax compliance, this guide will equip you with the knowledge needed to navigate the Arkansas sales tax landscape.

Understanding Arkansas Sales Tax

Arkansas sales tax is a consumption tax levied on the sale of goods and certain services. It is an essential revenue source for the state, contributing to various public services and infrastructure development. The tax is applied at the point of sale and is typically included in the final price paid by the consumer.

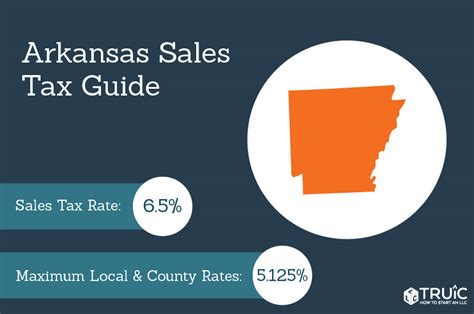

The standard sales tax rate in Arkansas is 6.5%, which is applied statewide. However, it's important to note that local jurisdictions, such as cities and counties, can impose additional sales taxes, resulting in a higher overall tax rate. These local taxes can vary significantly, leading to differences in tax rates across the state.

For instance, in the city of Little Rock, the total sales tax rate stands at 9.25%, comprising the state's base rate of 6.5% and an additional local tax of 2.75%. On the other hand, a rural county like Baxter might have a lower combined rate of 8.25%, reflecting a more modest local tax component.

It's crucial for businesses to stay updated on these local variations to ensure accurate tax calculations and compliance. Similarly, consumers can benefit from this knowledge when comparing prices and planning their purchases, especially for significant purchases like vehicles.

Taxable Items and Exemptions

In Arkansas, the sales tax generally applies to the sale of tangible personal property and certain services. This includes a wide range of items, from groceries and clothing to electronics and automobiles. However, there are specific exemptions and special provisions that can impact the taxability of certain items.

One notable exemption is for food items, which are not subject to sales tax in Arkansas. This exemption extends to both prepared foods and grocery items, providing a significant benefit for consumers' daily needs. However, it's important to note that certain food items, such as soft drinks and snacks, may be subject to a gross receipts tax instead.

Additionally, there are exemptions for certain services, such as medical services and prescription drugs. These exemptions aim to reduce the financial burden on essential healthcare services and medications.

| Taxable Items | Exemptions |

|---|---|

| Clothing | Food |

| Electronics | Medical Services |

| Automotive Parts | Prescription Drugs |

| Vehicles | Educational Materials |

Sales Tax for Automotive Purchases

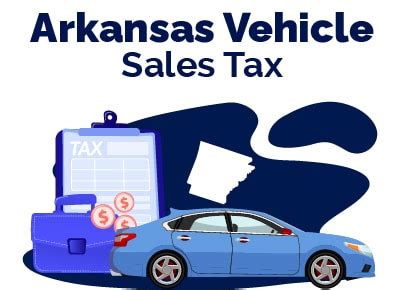

When it comes to buying a vehicle in Arkansas, the sales tax implications can be particularly significant. Whether you’re purchasing a new car, truck, or motorcycle, understanding the tax calculations and requirements is essential to avoid any surprises.

Tax Calculation for Vehicles

The sales tax for automotive purchases in Arkansas is calculated based on the purchase price of the vehicle, including any additional fees and options. This means that the tax due is directly proportional to the cost of the vehicle, making it a substantial consideration for buyers.

For instance, if you purchase a new car for $30,000 in Little Rock, you would be subject to a sales tax of $2,775 (9.25% of $30,000). This tax amount is added to the purchase price, resulting in a total cost of $32,775 for the vehicle.

It's important to note that the sales tax calculation can become more complex when dealing with trade-ins or lease buyouts. In such cases, the tax is typically calculated based on the net purchase price, which takes into account the value of the trade-in or the remaining lease balance.

Vehicle Registration and Title Fees

In addition to sales tax, automotive purchases in Arkansas are subject to various registration and title fees. These fees are typically paid at the time of vehicle registration and can vary based on the type and value of the vehicle.

For instance, the title fee in Arkansas is $14, regardless of the vehicle's value. However, the registration fee can range from $16 to $36, depending on the weight of the vehicle. Heavier vehicles, such as trucks and SUVs, may incur higher registration fees.

Furthermore, there are additional fees for specific vehicle types, such as motorcycles, which have a motorcycle registration fee of $14, and electric vehicles, which are subject to a $100 fee for their specialized license plates.

| Fee Type | Fee Amount |

|---|---|

| Sales Tax | Varies based on purchase price and location |

| Title Fee | $14 |

| Registration Fee | $16 to $36 (varies by vehicle weight) |

| Motorcycle Registration Fee | $14 |

| Electric Vehicle Fee | $100 |

Tax Incentives and Exemptions for Automotive Purchases

While the sales tax for automotive purchases can be substantial, Arkansas does offer certain tax incentives and exemptions that can provide relief to buyers.

Military and Veteran Exemptions

Arkansas extends special considerations to military personnel and veterans when it comes to automotive sales tax. Qualified individuals can claim an exemption on the sales tax for the purchase of a new or used vehicle, provided they meet specific criteria.

To qualify for this exemption, the vehicle must be purchased within 60 days of the service member's discharge or release from active duty. Additionally, the service member must be a resident of Arkansas at the time of purchase, and the vehicle must be registered in their name.

This exemption can result in significant savings for military families, especially when purchasing higher-value vehicles.

Alternative Fuel Vehicles

Arkansas also encourages the adoption of environmentally friendly vehicles by offering tax incentives for the purchase of alternative fuel vehicles. These incentives can take the form of tax credits or exemptions, reducing the overall tax burden for buyers.

For instance, the state offers a tax credit of up to $2,500 for the purchase of an electric vehicle (EV). This credit is available for both new and used EVs, providing an incentive for consumers to transition to more sustainable transportation options.

Additionally, Arkansas has established a zero-emissions vehicle (ZEV) program, which aims to increase the number of ZEVs on the road. This program includes various incentives, such as hoV lane access and charging station infrastructure, making it more convenient for EV owners.

Sales Tax Compliance and Reporting

For businesses operating in Arkansas, sales tax compliance is a critical aspect of their financial operations. Accurate tax calculation, collection, and remittance are essential to maintain a good standing with the state and avoid penalties.

Sales Tax Registration

Businesses that sell taxable goods or services in Arkansas are required to register for a sales and use tax permit with the Arkansas Department of Finance and Administration (DFA). This permit authorizes the business to collect and remit sales tax on behalf of the state.

The registration process involves completing an application, providing business information, and selecting a tax filing frequency. The DFA offers online registration, making the process more accessible and efficient for businesses.

Tax Collection and Remittance

Once registered, businesses are responsible for collecting the appropriate sales tax from customers at the point of sale. This tax is typically included in the final price of the goods or services provided.

The collected sales tax must be remitted to the DFA on a regular basis, as determined by the business's filing frequency. Common filing frequencies include monthly, quarterly, or annually, depending on the business's tax liability and sales volume.

It's crucial for businesses to maintain accurate records of sales transactions and tax collections to ensure compliance and facilitate accurate tax reporting.

Sales Tax Filing and Reporting

Businesses in Arkansas are required to file sales tax returns with the DFA on their designated filing due dates. These returns provide a detailed account of the sales tax collected during the reporting period, including any exemptions or adjustments.

The sales tax return includes information such as total taxable sales, tax collected, and any applicable credits or deductions. Businesses must calculate the net tax due and remit this amount to the DFA along with the return.

Failure to file accurate and timely sales tax returns can result in penalties and interest charges, impacting the business's financial health and reputation.

Conclusion: Navigating Arkansas Sales Tax for Automotive Purchases

Understanding the Arkansas sales tax landscape, especially for automotive purchases, is a crucial step toward making informed financial decisions. From the basic tax rates to the specific incentives and exemptions, this guide has provided an in-depth look at the sales tax considerations in the state.

For consumers, being aware of the sales tax implications can help in budgeting and planning for vehicle purchases. Knowing the tax rates and potential exemptions can result in significant savings and a more seamless buying experience.

On the other hand, businesses operating in Arkansas must stay compliant with sales tax regulations to avoid penalties and maintain a positive relationship with the state. Accurate tax calculation, collection, and reporting are essential aspects of their financial operations.

By staying informed and proactive, both consumers and businesses can navigate the Arkansas sales tax system with confidence and ensure a positive financial outcome.

How often do I need to file sales tax returns in Arkansas?

+The frequency of sales tax filing in Arkansas depends on your business’s tax liability and sales volume. Common filing frequencies include monthly, quarterly, or annually. However, the Arkansas Department of Finance and Administration (DFA) may assign a specific filing frequency based on your business’s circumstances.

Are there any sales tax holidays in Arkansas?

+Yes, Arkansas occasionally observes sales tax holidays, during which certain items are exempt from sales tax for a limited period. These holidays typically focus on back-to-school supplies and clothing, providing a tax break for families. It’s important to stay updated on these events to take advantage of the savings.

Can I apply for a sales tax exemption for my business in Arkansas?

+Yes, Arkansas offers various sales tax exemptions for businesses, including manufacturers, agricultural producers, and certain non-profit organizations. To apply for an exemption, you’ll need to complete the appropriate forms and provide supporting documentation. The Arkansas DFA website provides detailed information on the exemption process.