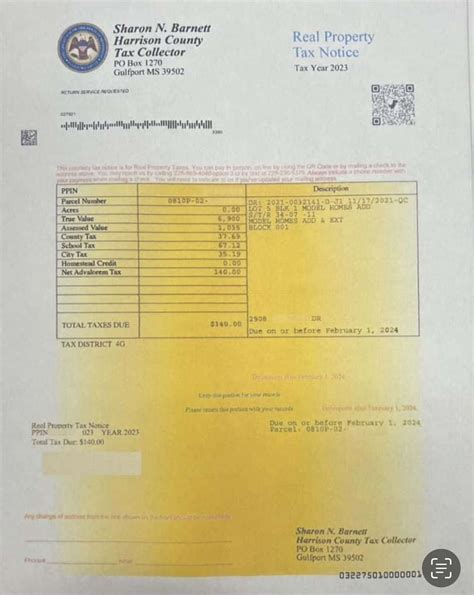

Harrison County Tax Collector

In the heart of Harrison County, Mississippi, the Harrison County Tax Collector's Office plays a pivotal role in managing the financial obligations of its residents. This government entity, with its dedicated team, ensures the smooth operation of tax collection processes, impacting the county's economy and services.

A Deep Dive into the Harrison County Tax Collector’s Operations

The Harrison County Tax Collector’s Office is a vital administrative body, overseeing various tax-related services and providing essential support to the county’s residents and businesses.

1. Tax Collection Process

The primary function of the Tax Collector’s Office is to collect taxes efficiently and effectively. This process involves:

- Property Taxes: Harrison County residents are responsible for paying property taxes annually. The Tax Collector’s Office assesses property values and sends out tax bills, providing options for online payments or traditional in-person transactions.

- Vehicle Registration and Excise Taxes: Vehicle owners must register their vehicles and pay excise taxes. The Tax Collector’s Office facilitates this process, ensuring compliance with state regulations.

- Business Taxes: Local businesses are subject to various taxes, including sales tax and business license fees. The office works closely with businesses to ensure accurate tax reporting and timely payments.

2. Online Services

In today’s digital age, the Harrison County Tax Collector’s Office has embraced technology to enhance its services. The HCTaxCollector.gov website provides a user-friendly platform for residents and businesses to access a range of online services, including:

- Tax Payment Portal: Residents can make secure online payments for property taxes, vehicle registration fees, and other taxes.

- Tax Record Lookup: Property owners can easily access their tax records, including assessment values and payment history.

- Vehicle Registration Renewal: Vehicle owners can renew their registrations online, saving time and effort.

- Business Tax Forms: Businesses can download and submit tax forms electronically, simplifying the tax filing process.

| Service | Online Availability |

|---|---|

| Property Tax Payment | 🟢 Available |

| Vehicle Registration Renewal | 🟢 Available |

| Business Tax Forms | 🟢 Available |

| Tax Record Search | 🟢 Available |

3. Customer Support and Outreach

The Tax Collector’s Office recognizes the importance of strong customer relations. It maintains a dedicated customer support team to address inquiries and provide assistance. Additionally, the office engages in community outreach programs to educate residents about tax obligations and answer common questions.

4. Impact on the Community

The efficient collection of taxes by the Harrison County Tax Collector’s Office has a direct impact on the county’s finances and, subsequently, the services it can provide. Tax revenue funds essential public services such as:

- Education: Supporting local schools and educational initiatives.

- Infrastructure: Maintaining roads, bridges, and public transportation systems.

- Public Safety: Funding law enforcement, fire departments, and emergency services.

- Healthcare: Contributing to public health programs and facilities.

5. Future Innovations

Looking ahead, the Harrison County Tax Collector’s Office is committed to staying at the forefront of technological advancements. Plans include further digitizing tax-related processes and exploring innovative payment methods to enhance convenience and security.

6. Comparative Analysis

When compared to other county tax collector offices in the region, the Harrison County Tax Collector’s Office stands out for its:

- Efficient Online Services: The comprehensive online platform has simplified tax-related tasks for residents and businesses.

- Community Engagement: The office’s proactive approach to community outreach sets it apart, fostering a better understanding of tax obligations among residents.

- Timely Revenue Collection: The office’s efficient processes contribute to timely revenue collection, ensuring the county’s financial stability.

7. Conclusion

The Harrison County Tax Collector’s Office is a key player in the county’s administrative landscape, ensuring the smooth collection of taxes and providing essential support to residents and businesses. Its dedication to technological advancement and community engagement positions it as a leading example in modern tax administration.

How can I make a tax payment to the Harrison County Tax Collector’s Office?

+You can make tax payments through the official website, HCTaxCollector.gov, which offers a secure online payment portal. Alternatively, you can visit the Tax Collector’s physical office and make payments in person.

What are the office hours for the Harrison County Tax Collector’s Office?

+The office is open from Monday to Friday, 8:00 AM to 5:00 PM. However, it’s advisable to check the official website for any holiday closures or special operating hours.

How often do I need to renew my vehicle registration in Harrison County?

+Vehicle registrations in Harrison County need to be renewed annually. You can renew online through the Tax Collector’s website or in person at the office.